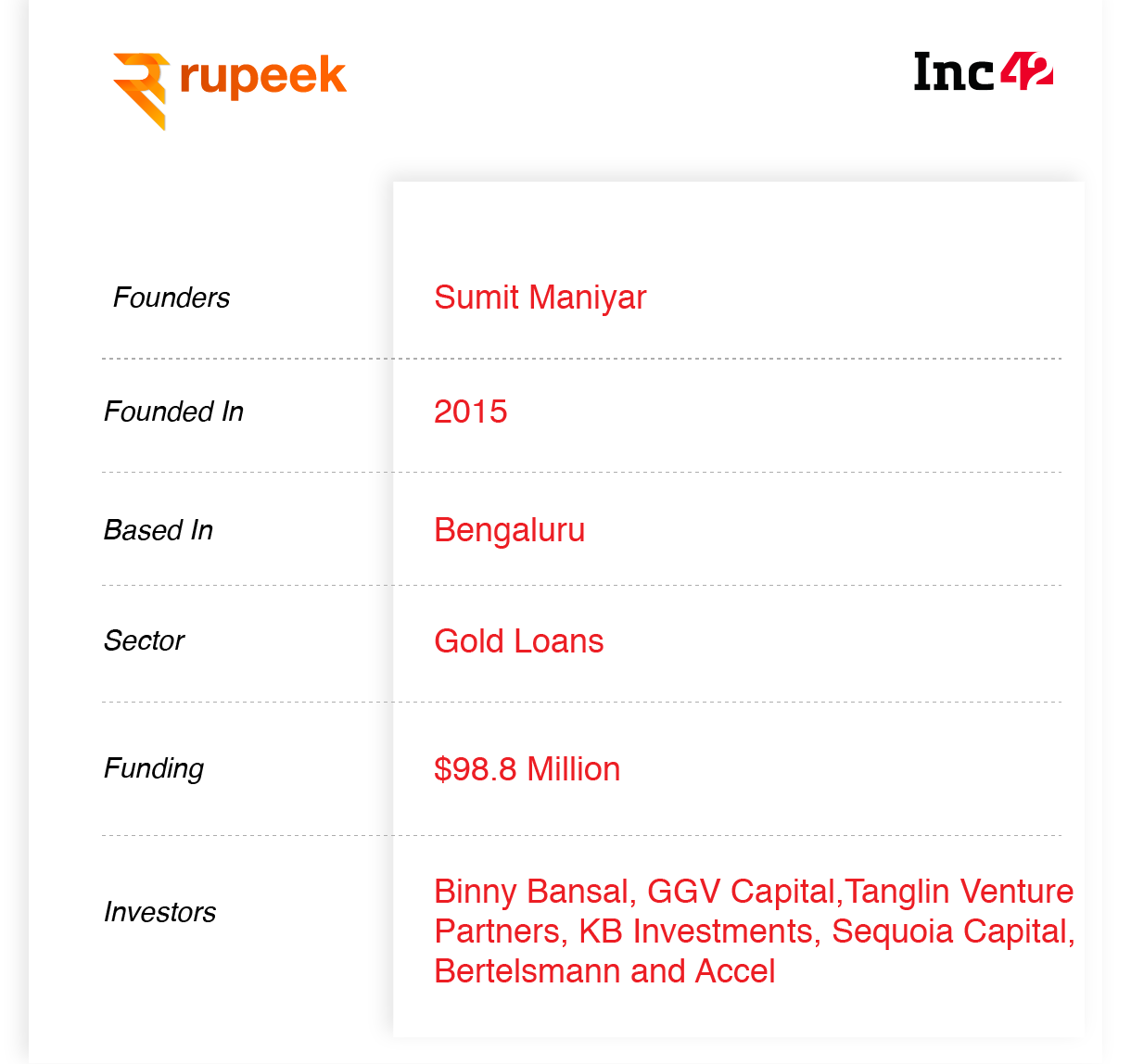

Delhi-based startup Rupeek looking to differentiate itself from other gold loans players with doorstep distribution and digital-first underwriting-to-disbursal process

With funding from other marquee investors, the startup primarily lends through banking partners with tie-ups with 15 major banks

With over INR 400 Cr worth of loans disbursed every month, the company is also working on credit solutions on the lines of a credit card backed by gold

If there is one thing that unites Indians, and Asians in general, irrespective of our million other differences, it is our love for the shiny yellow metal. According to a World Gold Council (WGC) report last month, despite the impact from Covid-19, the Indian gold market has been booming.

Globally, gold prices have skyrocketed even as demand dropped almost 30% QoQ, while India continued to account for the largest global demand along with China. And with the festive season upon us, the demand for gold is expected to skyrocket. For digital gold loan startup Rupeek and founder Sumit Maniyar, this is the right time to crack the market.

Globally, 35% to 65% household wealth is tied to physical assets, while it is 95% in India, the highest. Yet, 60%-75% credit generated globally is asset backed whereas in India only 30%-35% borrowing is collateral backed, which should be just the opposite. Plus, only 3% of the unsecured loans are from institutional sources and everything else is from unorganised sources. Unsecured credit from informal sources is costlier and crippling to the household as well as GDP. Clearly, Indians are not able to monetize our assets, believes Maniyar.

“Our goal is to be the go-to place for asset backed lending in India,” Maniyar said in describing the company’s vision.

The pitch is simple enough: Rupeek offers gold loans at the customer’s doorstep and completes the loan underwriting-to-disbursal process within 30 minutes. By cutting down on expenses with an online-only strategy, Rupeek offers gold loans at an interest starting at 0.89% per month. While Rupeek has a non-banking financial company (NBFC) licence, it primarily lends through its banking partners and not from its own book and has around 15 major banks, including both the the largest PSU and private bank, on board as lenders across various levels of integration with Rupeek, said Maniyar.

Organising The Fragmented Gold Loans Market

Valued at over $300 Mn presently, and with over INR 400 Cr worth of loans disbursed every month, Rupeek which is an online marketplace for gold loans, has raised $60 million across two rounds (first in August 2019). It’s backed by marquee investors such as Sequoia Capital, Bertelsmann, Accel Partners, GGV Capital, Tanglin Venture Partners, Korea’s KB Investments as well as Flipkart cofounder Binny Bansal.

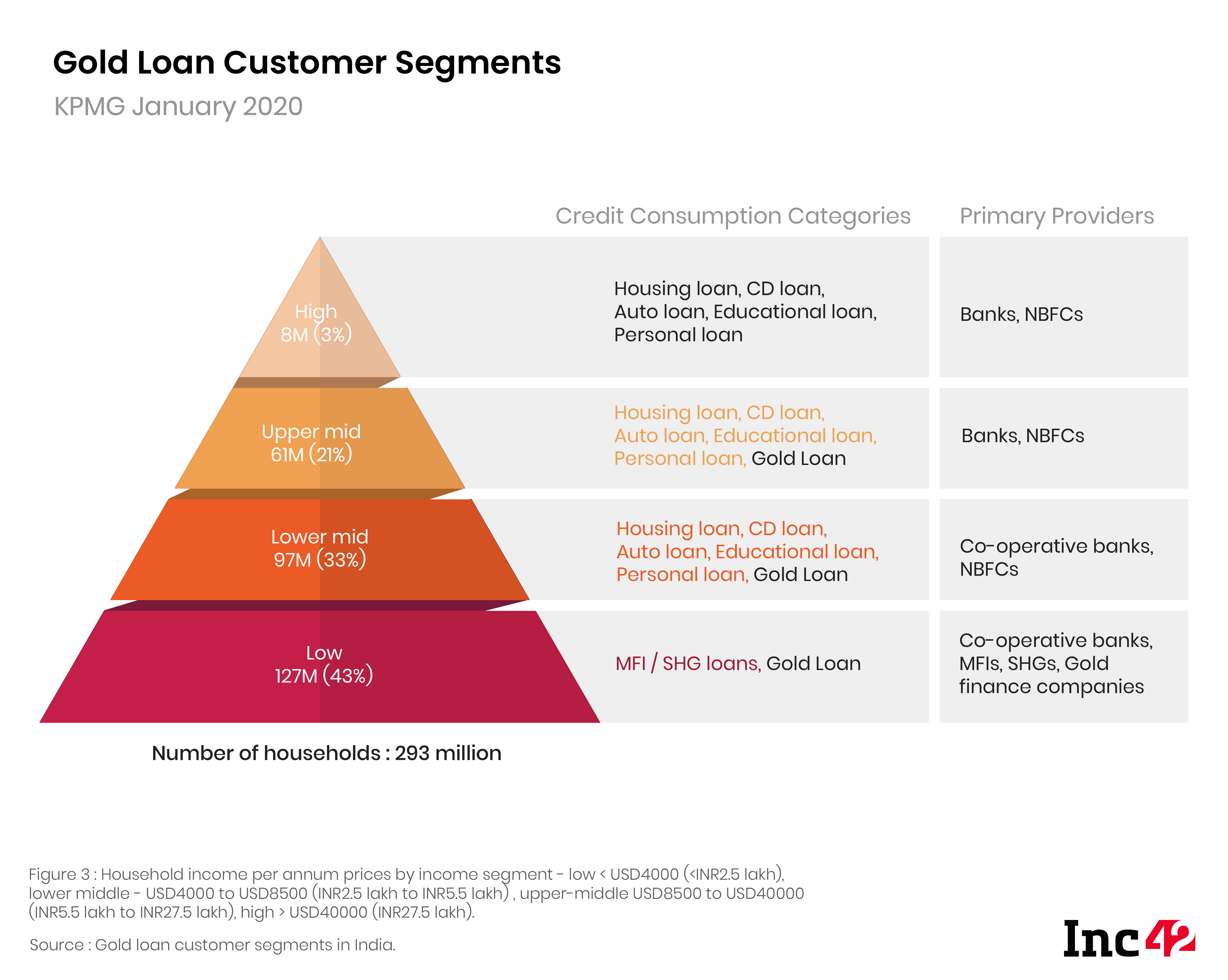

The gold-loan space in the organised market is largely dominated by traditional NBFCs such as Muthoot Finance and Manappuram Finance. Both companies primarily operate through a network of offline outlets and agents. According to a 2018 KPMG report, Muthoot and Mannapuram commanded almost 81% of the organised gold loan market.

According to Maniyar, most companies are tapping three basic models – customer acquisition models, supplier capital input model and loan distribution model.

“A product-first approach to the gold loan business helps achieve all three,” he claimed.

Also, competing directly with the existing players and NBFCs would have been folly given that the market was tilted towards retail selling.

One of Rupeek’s earliest backers, Sequoia India, had already backed Manappuram Finance between 2007 and 2010, exiting with over 4x returns. Having experienced the collateralised gold loan market, the VC firm was looking forward to Rupeek’s pitch, GV Ravishankar, managing director, Sequoia Capital India LLP told Inc42.

Ravishankar recalled that Sequoia was comforted by the fact that one of Rupeek’s initial NBFC lenders and advisors was Unnikrishnan Idicharam Veetil, a former CEO of Manappuram Finance.

Many of the existing gold loan companies were servicing customers through bulky retail networks, dealing in low value transactions servicing personal loans and small merchants seeking working capital. Maniyar pitched the fact that the retail network was better suited for attracting small ticket consumer loans and companies are spending too much to expand this footprint. But the actual profits actually came in from the larger ticket loans to merchants. Rupeek’s product saves time with a doorstep distribution and reduces the cost of acquisition. This caught Sequoia’s attention.

“He has surrounded himself with very strong “products” people from top companies. You need people who can trace out a frictionless customer experience when your business is dependent on technology,” said Ravishankar.

Looking Beyond NBFCs To Scale

A recent report by KPMG estimates that 65% of India’s $46 billion gold loan industry is dominated by informal lenders, whose interest rates can range from 25% to 50%. In many parts of India, particularly rural areas, the pawning of a woman’s ornaments is often viewed as a last recourse for families who have run out of options. Banks can charge interest rates of about 7% to 15% so people are warming up to the idea of the formal channel.

Lately, Manappuram has started offering gold-backed loans at the customer’s doorsteps via a 24-hour bank network following the pandemic. HDFC Bank is boosting the number of branches offering such loans in rural India.

When it comes to collateralised gold loans, banks typically had a disadvantage compared to NBFCs with only 75% loan to value (LTV) ratio. The LTV determines the amount a borrower can get against gold as collateral. As of August 2020, RBI has increased the LTV ratio to 90% till March 2021 in order to mitigate the Covid impact, but even in 2018, Maniyar was always clear that only banks could offer the balance sheet to scale up this business — and his early investors backed this notion.

“And after the initial banks had a good experience, he now has a large number of banks on board who understand the power of the model he has built. But there is a lot more to be done, which Sumit knows and hence he is assembling an army,” Sequoia’s Ravishankar added.

Rupeek is now working towards add-on products and asset classes in addition to the gold loan product. However, the company hasn’t formally announced any new products since June when they launched a zero contact loan product. They have in the meantime, increased their market outreach initiatives with digital and TV marketing across vernacular channels with regional celebrities as well as vernacular user interface options for the smartphone-only service.

The gold loan industry has been an unintended beneficiary of the economic uncertainty following the pandemic with banks withdrawing into a lending cave and sources of institutional loans dwindling. In the next 18 months, gold prices in the country could touch INR 65,000 per 10 grams, as per Navneet Damani, vice-president, commodities research, Motilal Oswal Financial Services.

According to a report by credit rating agency Crisil in October, Gold loan non-banking financial companies (NBFCs) are likely to see a 15-18% growth in their asset under management (AUM) this fiscal helped by demand from individuals and micro-enterprises.

“If economic growth gets postponed by a few quarters, things could start to look weaker for equities and the money chasing the market will flock towards gold. Our rupee could depreciate another 5-7 per cent. The import duty structure is going to stay at 12.5 per cent. By next Diwali, gold should be around Rs 60,000-62,000 per ten gram,” Damani was quoted as saying.

Rupeek’s first banking lender was Federal Bank which, much like the investors, came on board following Maniyar’s doorstep loan pitch.

“The responsibility of the bank starts only after pledged ornaments reach our branches concerned and properly appraised by them. So, the deep understanding of the gold loan ecosystem by Rupeek, rigorous risk mitigants put in place using the technology in the entire process and flexibility in the loan delivery mechanism offered, was convincing,” said Mohan K, senior vice president at Federal Bank and the country head for agri, micro and rural banking.

This partnership, which the bank has not replicated with any other NBFC so far, also helped Federal Bank build a reasonable gold loan portfolio in urban centres, added Mohan.

Rupeek’s New Products And Growing Team

To tap this burgeoning growth in gold prices, Rupeek roped in Japan Doshi as its head of product, engineering and data science in July, who comes with a decade of experience at tech giant Amazon India where he led payments engineering.

Earlier, Srivatsan Sridhar, ex-Mckinsey and ex-Ola had joined Rupeek as the head of new initiatives and business. Sridhar was the person behind the growth of Ola into an EBITDA-neutral entity. Anand Raj from Flipkart joined as the head of sales and operations. Raj was responsible for Flipkart’s supply chain arm Ekart and he is leading the distribution channels of Rupeek.

Last week, Hetal Faldu who has led Janalakshmi Financial Services and Varthana Financial Services in the past, joined as Rupeek’s CFO. Another new member on the team is a lending ecosystem veteran Ashish Bansal, in charge of Rupeek’s lender partnerships, who was part of Edelweiss’s Large Asset Resolution team.

In addition to top leadership, Rupeek is also expanding the engineering team aggressively and expects to reach a count of 200 from the current 140 soon, said Maniyar. And then there are the product-side developments. “The product goes through multiple security checks and audits through the entire cycle. We are covering deep supply integration with our lending partners so that we can write directly into their loan management system,” said Maniyar.

Rupeek’s USP, he believes, is that its lenders bring the diversity in size, scale and risk appetite that allows the company to target different demographics on a single platform and thereby deliver value to these lenders. “With more lenders on the platform our customer base also gets the option to chase different interest rates, overdraft limits and loan products,” said Maniyar.

The startup has been working on rolling out these products based on their proprietary data-led credit scoring system. Multiple asset classes will also help to reduce cost of distribution. In fact, Rupeek has already witnessed 50% reduction in cost of distribution since pre-Covid times. The current line of products are being built towards offering unsecured loans to repeat customers with promising credit scores.

Of the recent $60 Mn funding, $50 Mn is being allocated towards technology, brand and scale expansion initiatives across the next 12-18 months led by the team of new people on board.

Is Rupeek Looking Beyond Gold Loans?

Currently, Rupeek has established two training centres to train their field agents. The startup is focussed on improving the number of customers each field agent can cater to, helping to reduce the cost of distribution by 50% compared to pre-Covid numbers.

Rupeek currently services over 125K customers across 25 cities. But in the past 18 months, customer interest towards multi-asset loan products like mortgages, unsecured loans and vehicle financing has transformed. This is where the next set of products will come from.

According to Maniyar, Rupeek has been witnessing repeat transactions, up to once per quarter across at least 80% of its customer base with many migrating to unsecured loan classes. The proprietary analytical system weeds through 125 odd data points to build user credit scores that is helping Rupeek build new products.

At present, Rupeek is using the in-house credit score data to offer unsecured loans to their customers. Apart from expanding lender partnerships, the company is also working on credit solutions on the lines of a credit card although it isn’t ready to divulge details yet. “More frequency and stickiness based products have to come but we are looking forward to redesigning products in a way to achieve scale in the single product category first,” he added.

Ad-lite browsing experience

Ad-lite browsing experience