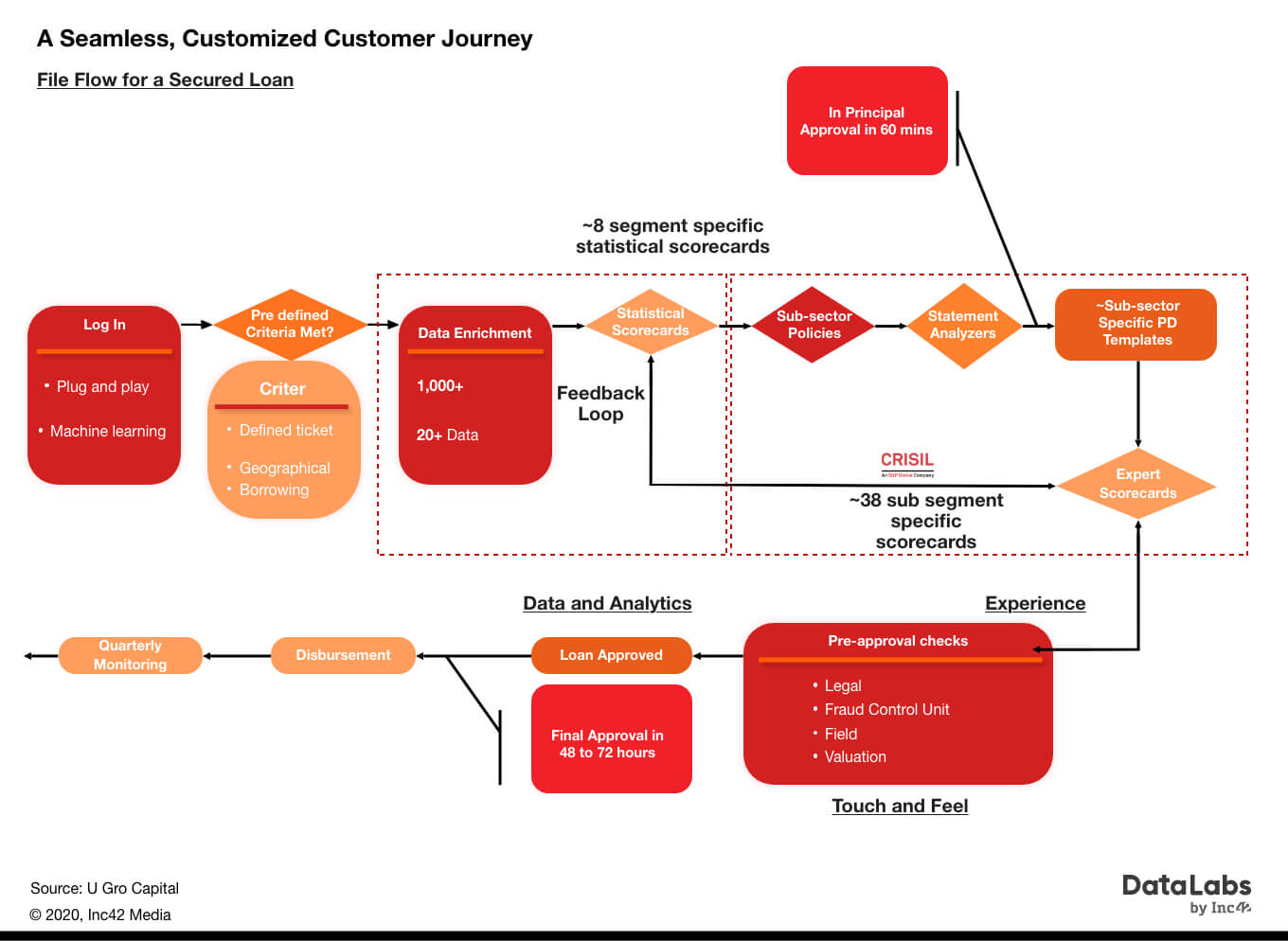

U Gro has developed proprietary SME sector-specific statistical scorecards for 8 sectors

The platform enables 60 minutes loan disbursal to SMEs of up to INR 5 Cr

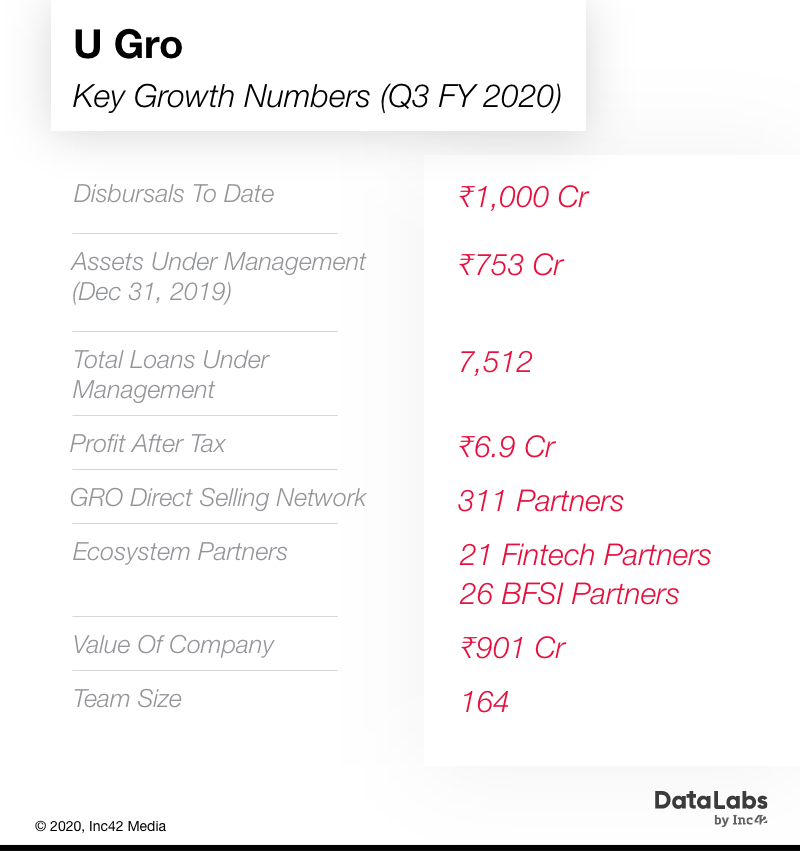

By FY24, it plans to reach more than 350 channel partners, 45 BFSI partners, 20 branches and more

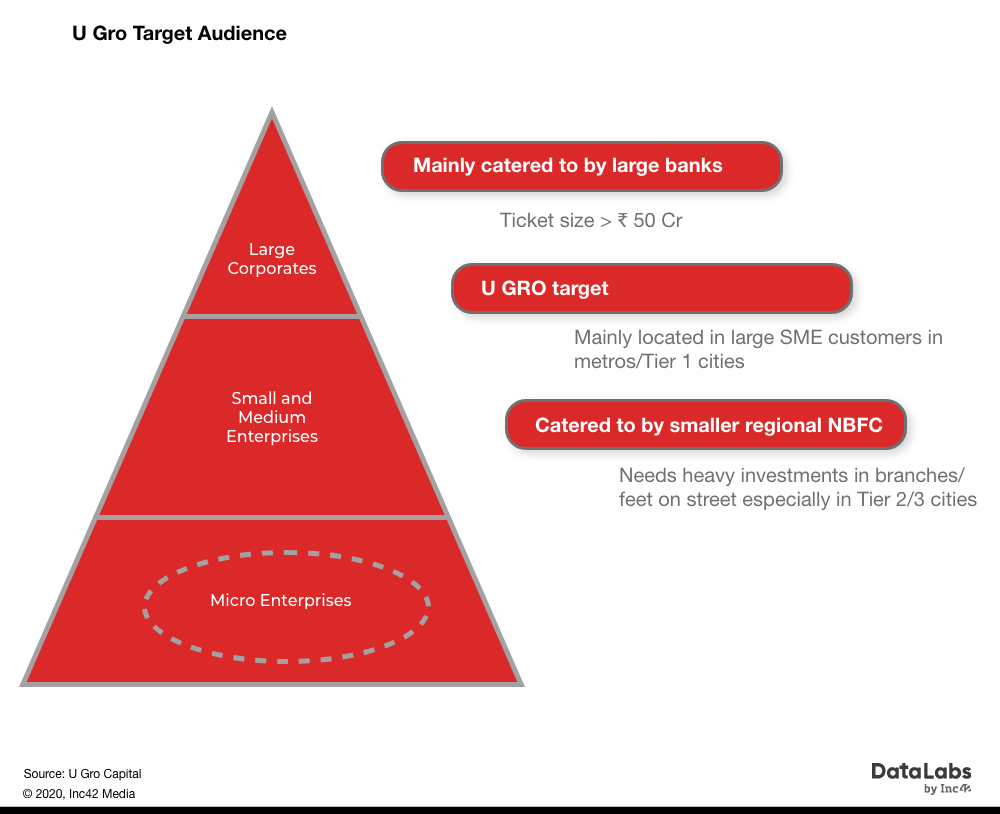

India is home to an estimated 60 Mn micro, small and medium enterprises or MSMEs, and the sector has been called the backbone of the Indian economy, thanks to its cumulative contribution to the GDP. Yet, when it comes to credit access, only 10%-12% of MSME players bank on organised sources of credit, leaving the rest to fend for themselves in the wild world of unorganised lending.

This is an opportunity that Indian MSME lending players in the digital domain are eyeing for a long time now. Players like Aye Finance, LenDenClub, NeoGrowth, InCred Finance, Capital Float among others are using their tech-enabled platform to solve the ever-growing credit gap for MSMEs, and small and medium businesses.

Together, these platforms have lent billions of dollars in loans to lakhs of MSMEs so far, but the SME lending market is far from saturated, as startups are targeting niches within the sector. Another player growing rapidly in this segment is U Gro.

Mumbai-based U Gro Capital (formerly known as Chokhani Securities) is a BSE-listed, technology-focused, small business lending platform. Founded by Shachindra Nath in July 2018, U Gro is looking to address the capital needs of small businesses by providing customised loan solutions, which it claims is a $300 Bn market that is yet to be fully tapped by lending players.

“We believe that the problem of small businesses can be solved by building deep expertise around core sectors of SMEs in India coupled with a data-centric, technology-enabled approach,” said Nath.

The company has developed proprietary tools which comprise of customised SME sector-specific statistical scorecards, underwriting insights based on deep research on the sub-sector level and put together in a highly integrated lending platform. This helps in getting an in-principle decision for the loan application within 60 minutes, Nath claimed.

U Gro has raised INR 920 Cr of equity capital from a diversified set of institutional investors and well-known family offices such as NewQuest, ADV, PAG and Samena Capital among others. The Company has already disbursed more than INR 1070 Cr across 7500+ small businesses in the first 12 months of lending operations. It counts the likes of SBI, Bank of Baroda, ICICI as partner banks. AUM stood at over INR 750 crores as of the end of 2019

Building Technology-Centric Positioning In Eight Sectors

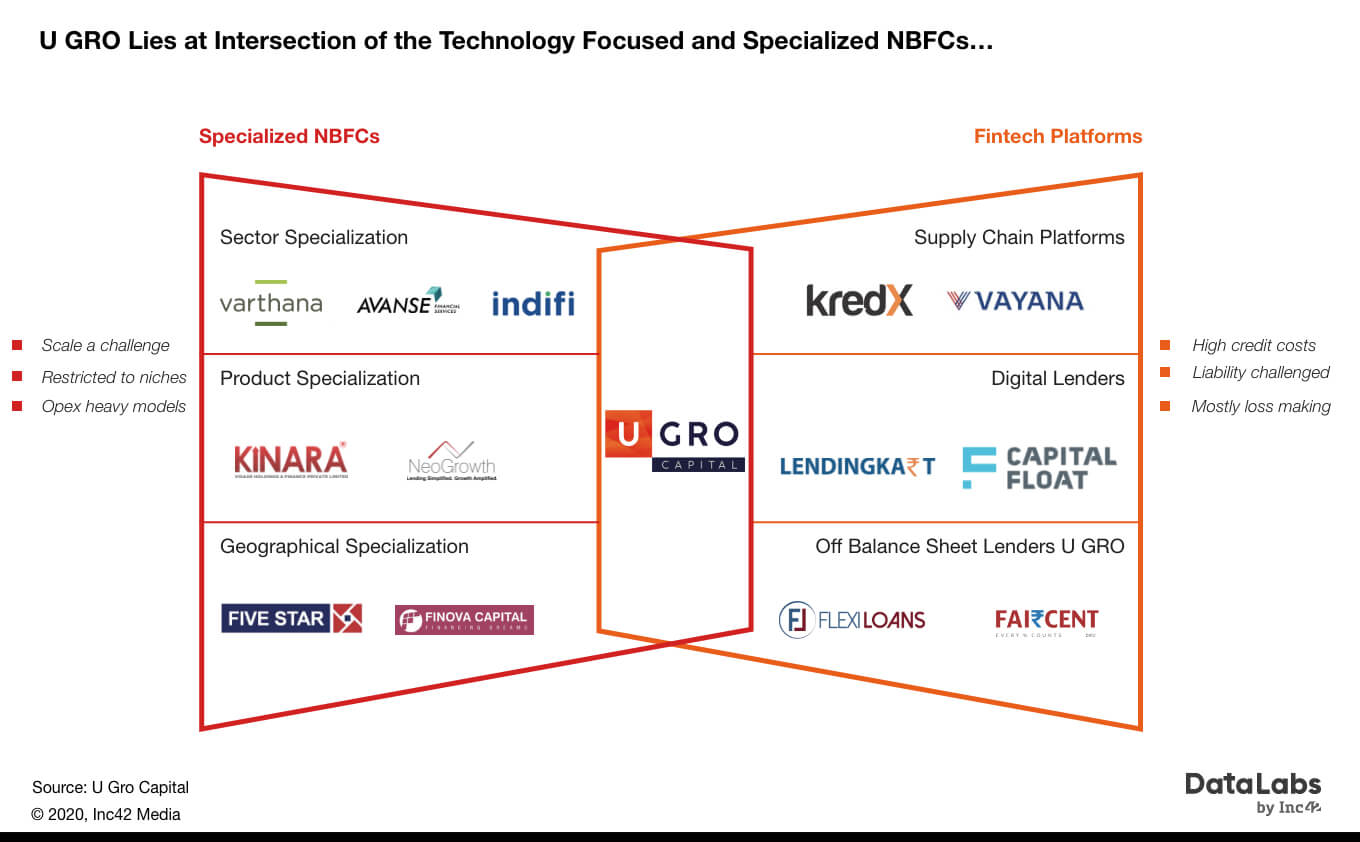

At present, the credit gap in MSME lending is catered by three entities: traditional NBFCs, banks and specialized SME lenders offering customised products and services. Among the new-age MSME lending players are fintech startups using technology in the core operations to implement better assessment and shorter turnaround time across different processes of lending, underwriting and correction.

U GRO lies at the intersection of the technology-focused and specialised NBFCs.

The company is focussed on eight sectors shortlisted on the basis of an 18-month process involving the extensive study of macro and micro-economic parameters carried out in conjunction with market experts like CRISIL.

The eight sectors shortlisted are healthcare, education, chemicals, food processing or FMCG, hospitality, electrical equipment and components, auto components, and light engineering. These sectors are further divided into 38 sub-sectors and clusters.

The company has five technology modules which figure to play key roles in the facilitation of its asset engine going forward:

- GRO Plus: Designed for traditional branch-led disbursement which has fully integrated every element of underwriting digitally (using all conventional parameters). The platform allows for GRO Partners to obtain loan approval within 60 minutes.

- GRO Direct: U GRO’s Direct Digital channel, a platform built to allow for non-intermediated loan applications from eligible SMEs. Launched in Beta in December 2019 across two subsectors, the reach of GRO-Direct will be greatly expanded upon in 2020.

- GRO Chain: an upcoming end-to-end platform for supply chain financing that will cater to ecosystem Anchors, vendor borrowers and dealer/distributor borrowers

- GRO Xstream – a tech platform for U GRO’s BFSI partners which integrates the loan origination and underwriting model with the lending mechanism of the large banks, in order to facilitate a range of transactions including co-lending, assignments and securitization.

- GRO Score: U GRO’s proprietary sector-specific statistical scorecards based on commercial bureau data and proprietary algorithms that are implemented across all loan applications

The Company is expanding the offered product base to include smaller ticket loans through the nascent direct digital and digital partnership channels, so as to provide specialised credit to a larger pool of small businesses.

U Gro’s Technology Stack

The company has adopted a digital lending platform built by Decimal Technologies to enable SMEs PAN India to get a loan disbursal of up to INR 5 Cr, in under 60 minutes.

“The standard time for any NBFC loan disbursement is a minimum of 7 days as of now, so this is an industry-first initiative. Decimal has built this tool exclusively for U GRO. It is the same fintech company that had earlier also built Kotak 811,” said Nath.

The Digital Loan Orientation System (DLOS) is based on Decimal’s in-house platform Vahana, a ‘No Code’ digital asset management platform. It helps businesses design an application, integrates it with core systems as well as APIs and creates end-to-end business solutions on a real-time basis. DLOS uses a combination of intelligence and technology by applying sector-specific statistical predictive modelling combined with data from over 25 financial and non-financial sources to understand the creditworthiness and eligibility of a customer.

Selecting Channel Partners, Locations For Growth

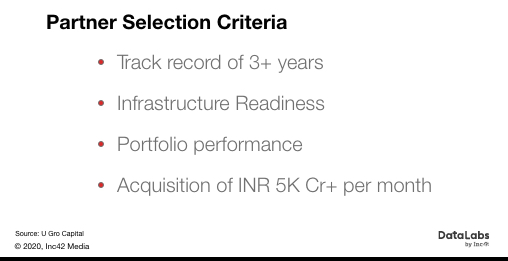

In any lending model, location and channel partners play a crucial role in building a sustainable and scalable venture. At U Gro, the locations are identified through SME cluster analysis and portfolio benchmarking. Rigorous vetting of 1,200+ partners was done to reach an initial list of 100 channel partners. Channel partners also pay an onboarding fee to be part of U Gro’s platform – a first in the industry.

The company has a dedicated growth team to build industry partnerships. “The focus is on building the ability to tap into the partners’ network of distributors, dealers, suppliers and then eventually the end customer through an ecosystem-based lending strategy,” said Nath.

Further, the company uses a risk-based pricing model which involves analysis on the basis of 8 Mn+ loan records, and 850 parameters per loan, thus eliminating 70% bad loans at the bottom 20% by statistical scorecards. Also, it has successfully launched the beta version of GRO-Direct, its proprietary direct-to-customer platform, which achieved its first disbursals through in Q3 FY 2020.

Growth Of Credit In India: An Opportunity Beyond Saturation

The overall lending market in India is expected to grow at 10-11% with NBFCs growing at 15-17% over the next five years, according to Nath. The government impetus on promoting digitalisation in the banking sector, through the grant of universal banking, payment banking and small finance banking licenses bodes well for the industry.

Further, financial inclusion measures like Jan Dhan Yojana, Pradhan Mantri Awas Yojana, India Stack, credit guarantee schemes for MSMEs among others have improved access to loans.

As highlighted by Nath, still the potential addressable credit gap at MSME level is INR 21.3 Lakh Cr, growing at the rate of 7% per annum. The primary challenge for players in the online lending segment is lack of credit history, fragmented target audience, and high cost of customer acquisition.

“Technology has created a new breed of fintech lenders in India. Digital lending is expected to increase 10-15 times by 2023, scaling up to INR 6-7 lakh crores in annual disbursements,” Nath added.

Having said this, Nath is busy expanding U Gro. By FY24, Nath plans to go on an expansion spree reaching to more than 350 channel partners, 45 BFSI partners, 20 branches and more. FY21 will also see geographical expansion through the opening of new branches.

The company achieved profitability in Q3 FY20, which is a positive portent of future financial performance. Revenue is expected to grow concurrently with loan book size, with the company confident in being able to achieve significant AUM expansion with the activation and improvement of its diversified disbursal channels. As Nath said,

“This is only the beginning of our story, and we expect to see much greater profitability as our asset engine starts reaping the benefits of the excellent partnerships we have formed. We continue to strive to build it into a platform that can provide a revolutionary non-intermediated financing option for small businesses.”

Ad-lite browsing experience

Ad-lite browsing experience