The 1% Club initially started as a member-only educational platform for financial management

The startup’s key target demography is the rising middle class of the country and anybody who is making more than 5 Lakh per annum or living in a metro or a Tier II city

The 1% Club seems well poised to capture the Indian investment market with its holistic solutions that are aimed at making the common man rich

The personal finance situation of a common middle-class Indian is tougher than ever, and this is despite the country’s economy growing by leaps and bounds. According to an April 2023 report published by PwC, around 74% of Indians are concerned about their financial situation, as opposed to 50% globally.

Further, the dilapidating situation of the financial health of Indians has resulted in 63% of Indian consumers cutting back on non-essential spending altogether, per the study.

So, who is to blame?

Well, for one, a sheer dearth of financial education is one of the most critical factors behind the current state of financial affairs of middle-class individuals in the country. Another factor worth noting is that qualified professionals are scarce in the realm of financial planning.

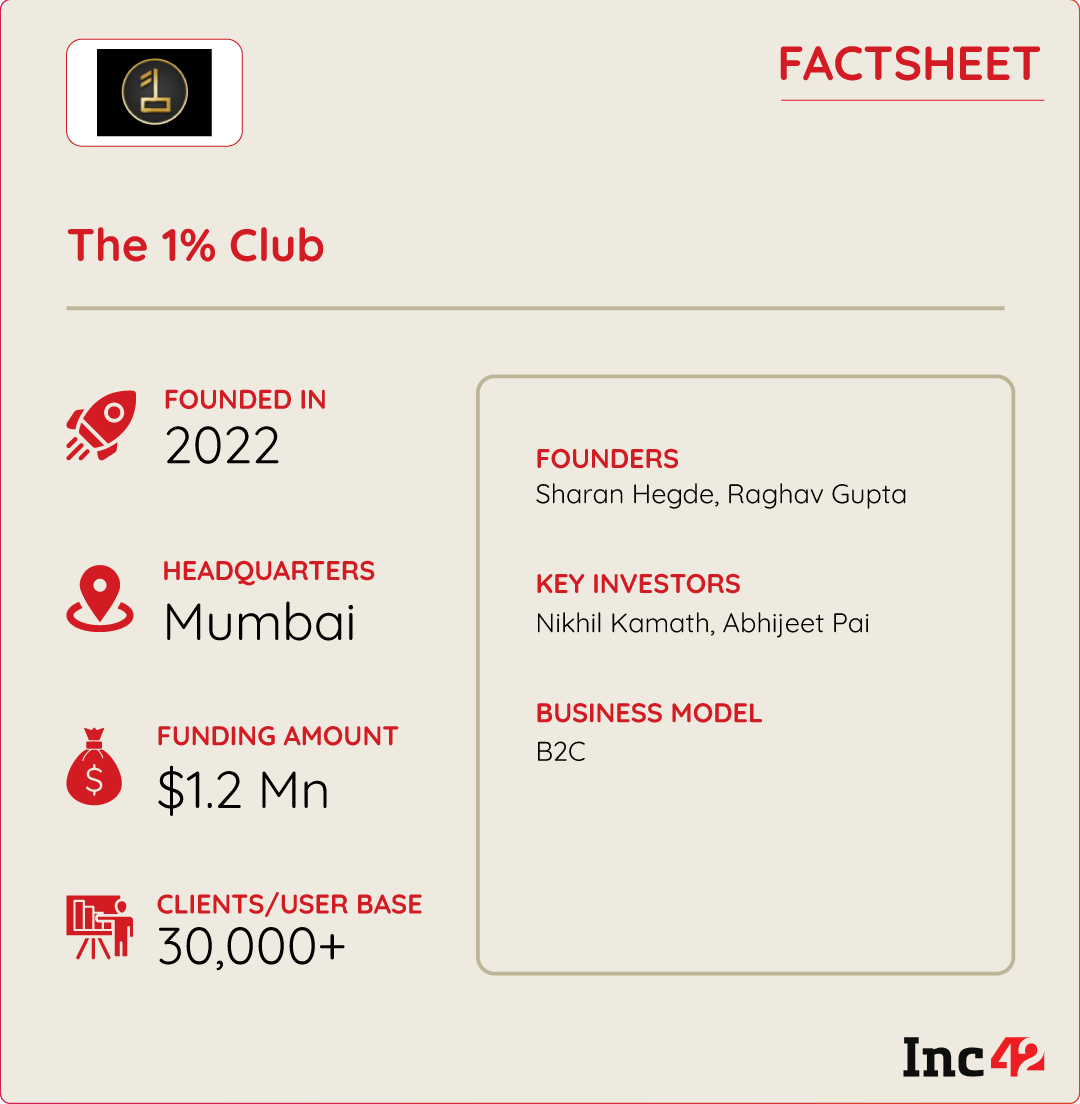

Noticing this key gap, finfluencer Sharan Hegde (aka Finance with Sharan) and Raghav Gupta (cofounder and CEO at Futurense Technology) founded The 1% Club in 2022 to help Indians become financially independent.

According to Hegde, there are merely 1,300 financial planners operating on a fixed fee model in India — and this is alarming for a country which is home to a big chunk of middle-class households and individuals.

Speaking with Inc42, Hegde said that the capacity of these professionals to assist individuals is limited, as they can only work with a select number of clients.

Further, the financial influencer said that even though there are 2 Lakh mutual fund distributors in the country, they are heavily reliant on commissions, and it has been seen that distributors prioritise their earnings over customer interest, compromising the entire investment journey of an individual.

“This is where The 1% Club comes into the picture. With our initiatives, we aim to offer cost-effective financial solutions to Indians. We have decided to take the Registered Investment Advisor (RIA) route, wherein we will collect a fee directly from the customer rather than charging a percentage of their investments. This approach will help prevent potential negative incentives for financial planners to promote high-commission products,” Hegde told Inc42.

The 1% Club initially started as a member-only educational platform for financial management. While the founders recognised that education was the basic step in guiding them, they also toiled to build a community that encouraged peer-to-peer learning and drew inspiration from the experiences of others.

“When someone talks to their CA, they don’t properly understand what they are saying, and they are not in a position to question them. This is a significant issue today. In India, financial literacy is around 24% compared to over 50% in the United States,” Gupta said.

Catering To The Aspiring Rich Class

According to Hegde, the startup’s key target demography is the rising middle class of the country and anybody who is making more than 5 Lakh per annum or living in a metro or a Tier II city.

The startup currently boasts users from over 100 cities. However, nearly 70% of its users reside in Tier I cities. The 1% Club’s user base primarily comprises the middle class or individuals who have recently begun their careers or have been employed for five to ten years but have yet to effectively manage their finances.

The ideal users of The 1% Club are the people who tend to earn a minimum annual income of 5 Lakh. However, on average, the current audience consists of around 30,000 individuals with an annual income ranging from INR 12-15 lakhs.

The 1% Club currently provides a lifetime membership for INR 16,999, the company’s sole revenue stream for now. Zerodha cofounder Nikhil Kamath-backed venture capital (VC) firm Gruhas recently invested INR 10 Cr ($1.2 Mn) in the startup.

Following the introduction of their fintech service, they anticipate additional revenue streams, with a focus on their financial planning service. The pricing structure for this service is still under consideration, potentially incorporating variations based on an individual’s net worth and income.

“We want to make middle-class Indians richer. The pathway to increased wealth narrows down to two fundamental methods: earning more income or optimising your investments. The focus currently revolves around enhancing investment strategies,” Hegde said.

While the cofounders of The 1% Club have plans to diversify into wealth-creation opportunities in the long term, they want to become the personal chief financial officers (CFOs) of as many Indian households as possible in the medium term.

Meanwhile, the founders’ ultimate mission is to revolutionise and democratise financial planning, ensuring mass availability in an industry where such solutions are scarce, and helping Indians attain financial freedom.

What’s On The Cards?

The 1% Club currently claims to have enlightened approximately 30,000 individuals with fundamental knowledge of financial planning. Now, the venture plans to foray into fintech services, provide products and launch offerings for more informed users.

The 1% Club will soon launch a personalised financial planning service for its users. This one-on-one service involves a dedicated human financial advisor, who will assess the user’s financial situation and goals to provide tailored advice on investment products, including mutual funds, government bonds, real estate, and debt funds.

Additionally, the cofounders also want to help individuals with insurance and tax planning to optimise cash flows and effective tax-saving strategies.

The 1% Club is in the advanced stages of seeking registration with the Securities and Exchange Board of India (SEBI) as a registered investment advisor (RIA) to elevate its credibility and regulatory compliance in the finance sector, the founders said.

Against the backdrop of India’s financial literacy crisis, with only 27% of adults meeting basic standards, the 1% Club enters an arena that demands a solution.

Even though competition arises from emerging startups like Piggy and MahaMoney, striving to enhance financial literacy, The 1% Club seems well poised to capture the Indian investment market with its holistic solutions aimed at making the common man rich.

Ad-lite browsing experience

Ad-lite browsing experience