The Singapore-headquartered company earned a total revenue of INR 600 Cr in CY20, which grew to INR 1,100 Cr in CY22. It is currently running at an annual revenue run rate of INR 1,300 Cr for the month of March 2023

According to Kadavil, one of the cofounders of FreshToHome, when going cross-border, a D2C startup must identify a brand loyalty advantage and an attractive moat irrespective of its success strategies in the host country

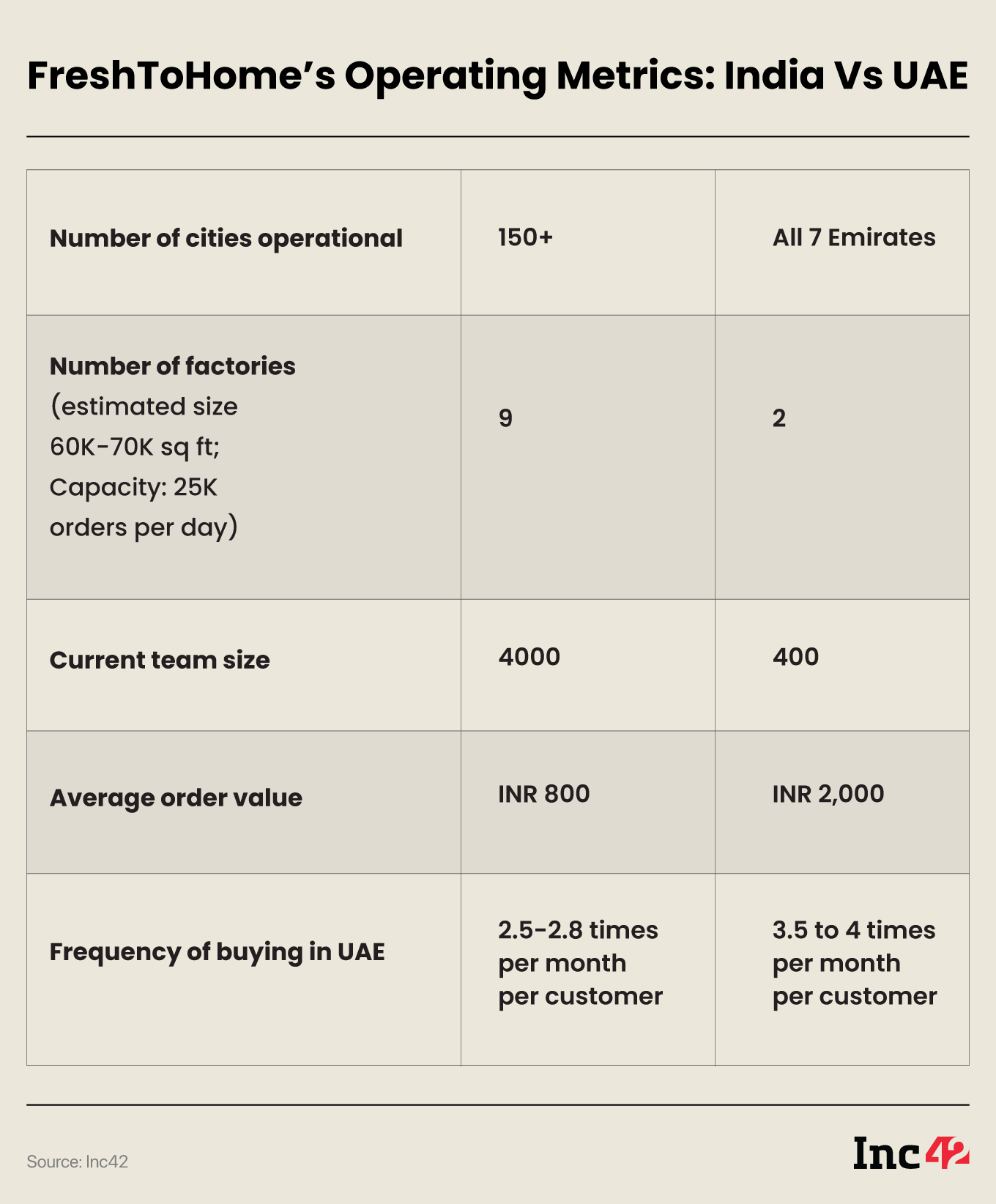

While FreshToHome has been able to position itself as a mass brand in India, keeping costs at par with competition, it has positioned itself more as a premium brand in the UAE

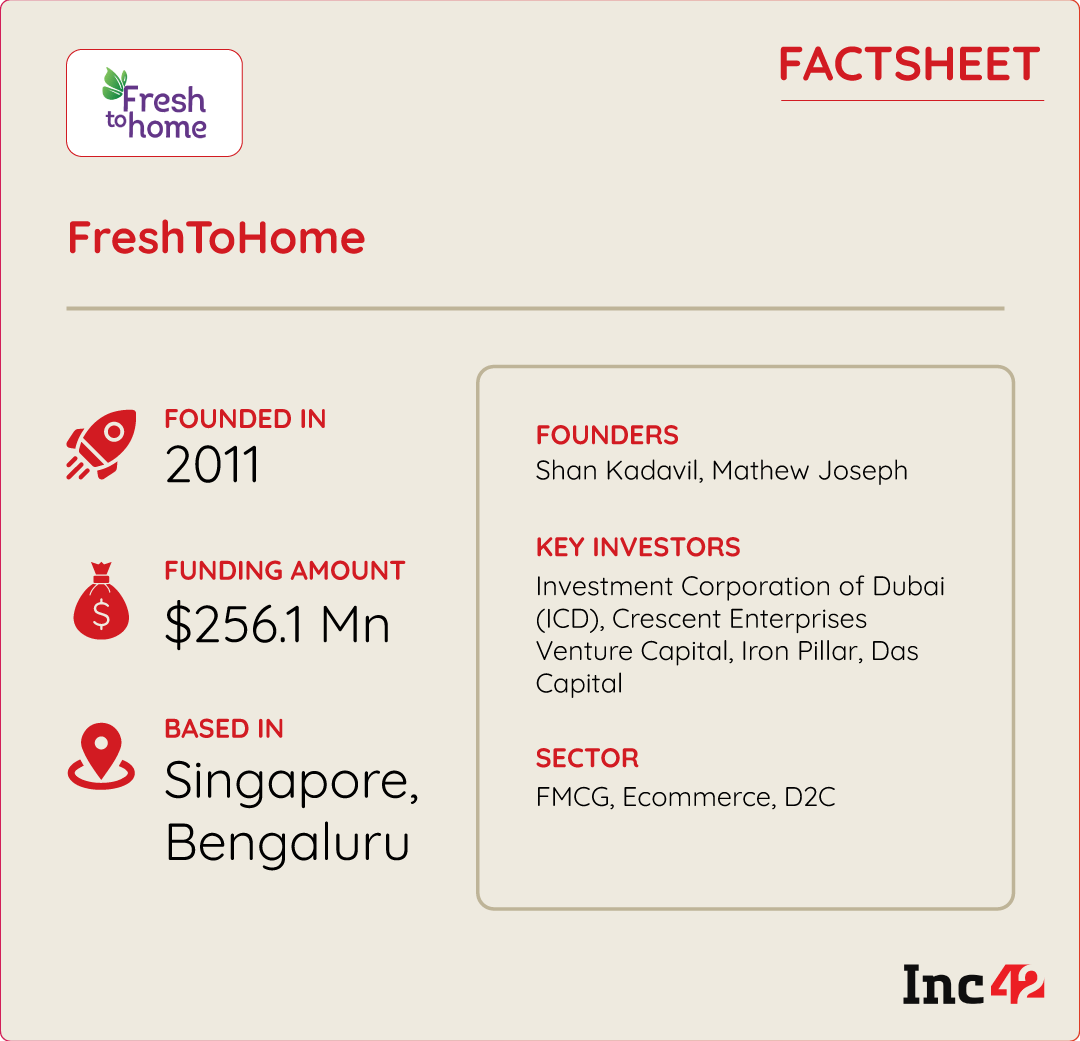

Half way through 2019, FreshToHome’s cofounders Shan Kadavil and Mathew Joseph decided to expand their D2C fresh meat and seafood brand to the UAE. However, all their projections came to a staggering halt when they realised that cracking the code to the product-market fit in the region would not be as easy as they thought.

Given that FreshToHome

“Finding the product-market fit became our biggest challenge. It became difficult to operate in GCC countries because of cultural differences and stringent regulations. We realised the hard way that how we operate in India will not work in the UAE,” Kadavil, one of the cofounders of FreshToHome, told Inc42.

Now, almost after three years of cross-border operations, the company has already expanded to all seven emirates in the UAE. The Singapore-headquartered company also saw a two-fold rise in its revenues between CY20 and CY22. It earned a total revenue of INR 600 Cr in CY20, which grew to INR 1,100 Cr in CY22. It is currently running at an annual revenue run rate of INR 1,300 Cr for the month of March 2023.

“Here, the UAE contributes 12% of our total revenues. Including the seven emirates in the UAE and the 150+ cities in India, we are currently operationally profitable at the city level (excluding our overhead costs) by 7%-8%, which is rare in our category,” Kadavil said.

The India numbers reported for the company are quite different though. As Kadavil explains, the company follows a marketplace structure like Flipkart and Amazon. This makes it difficult to portray the correct numbers in India filings, which come down to usually 4% of its total revenue.

Overall, with $104 Mn funds under their fold this year from investors such as Amazon Sambhav Venture Fund, E20 Investment, Mount Judi Ventures and Investcorp, the team is planning to enter the markets of Saudi Arabia by the end of the current financial year.

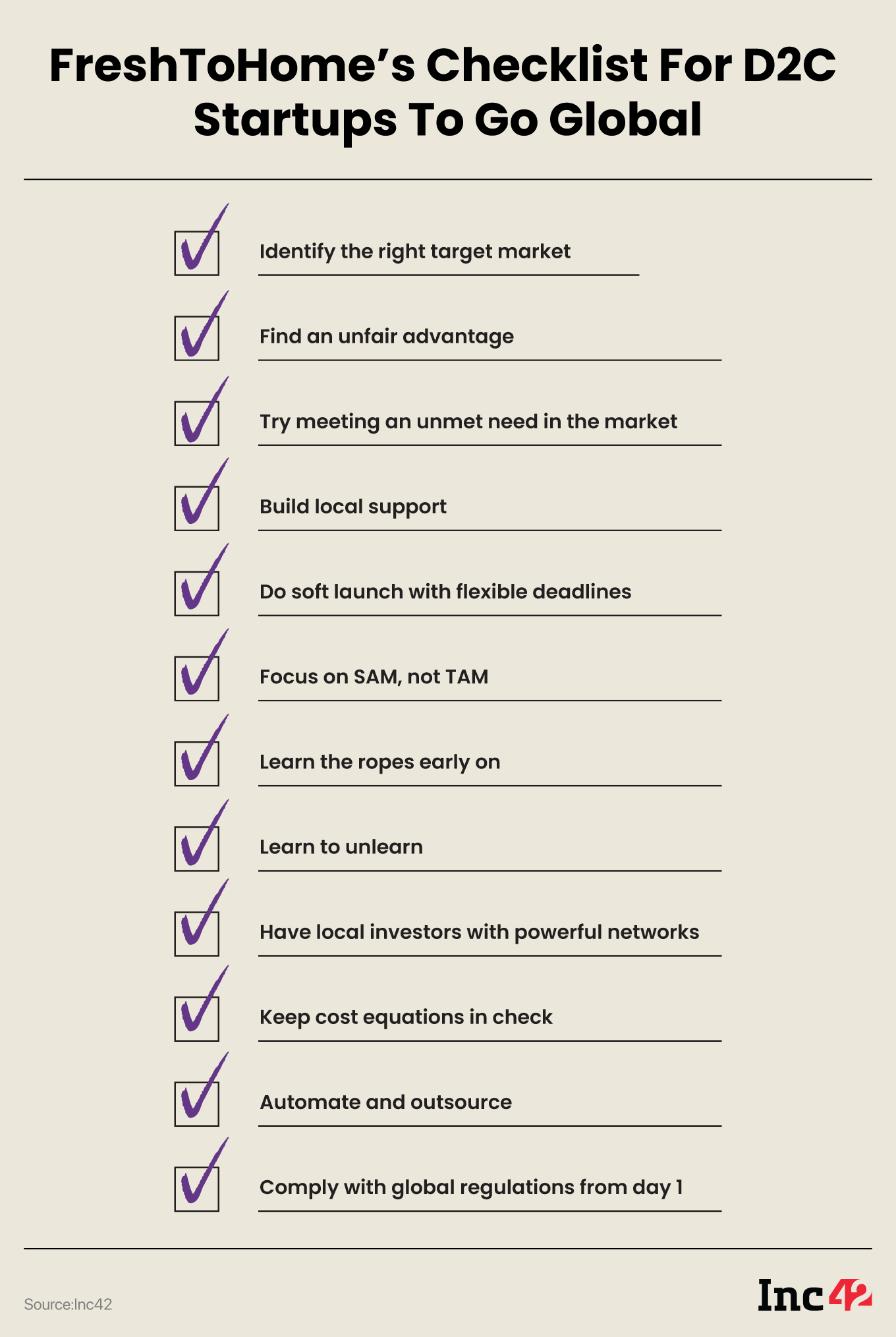

In our recent conversation with Kadavil, he shared his playbook for success in international markets and his plans for the years to come. Here’s the checklist he shared with us for D2C startups looking for global expansion.

The Right Way To Go Global

Kadavil highlighted two key focus areas for the D2C fresh meat brand when planning to go cross-border. First, they aimed to identify the right target market and build an ‘unfair’ advantage, and secondly, they wanted to understand the unmet needs of the market rather than becoming a me-too product and competing with local products.

In the case of FreshToHome, the UAE was a strategic fit because Indians account for 65% of the country’s total expat population. This worked in favour of the D2C brand as a significant percentage of Indians in the UAE may have either tried FreshToHome or heard about it from their families or friends in India.

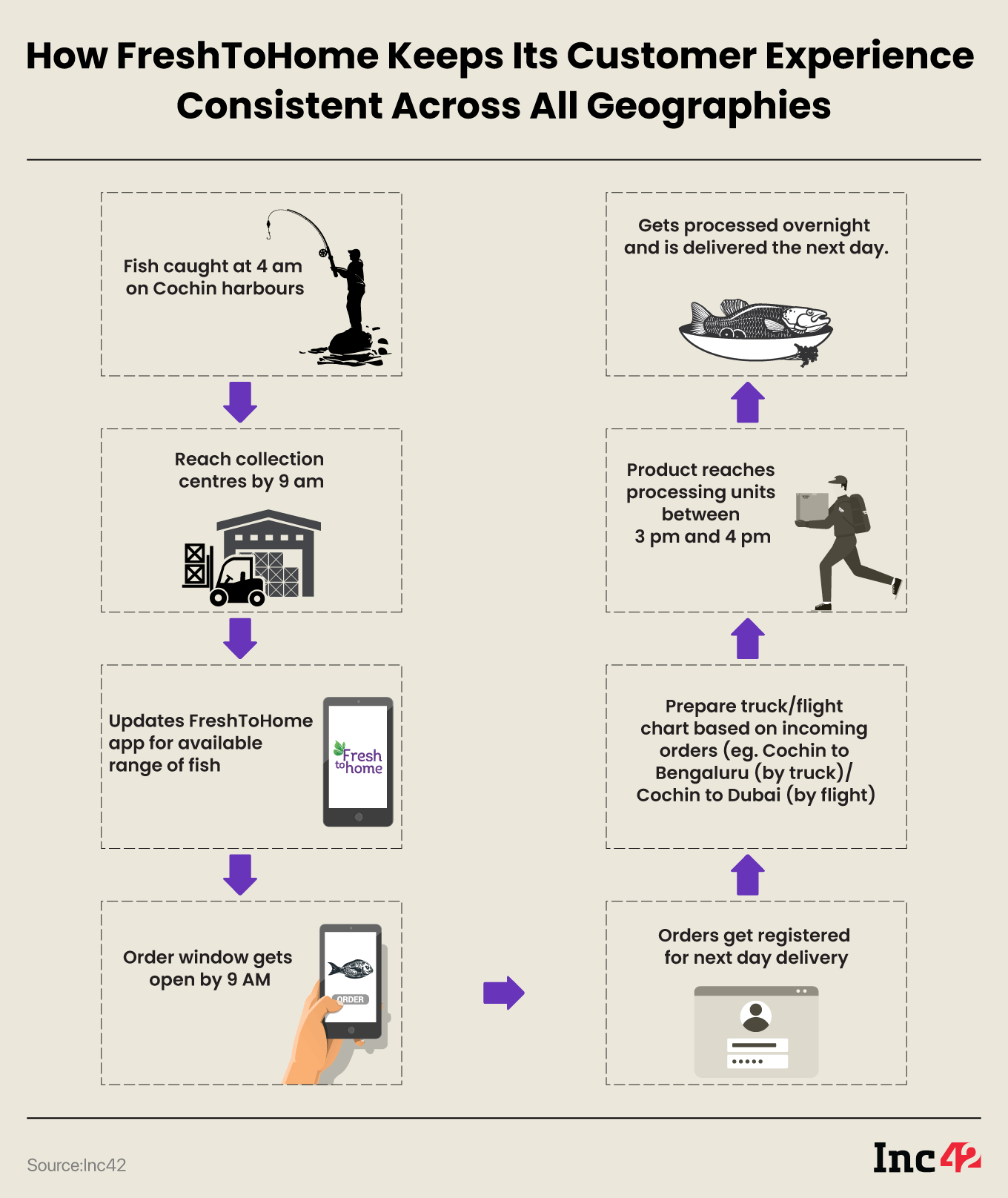

Furthermore, being operational in India since 2011, FreshToHome has an ‘unfair’ advantage with product sourcing. With a network of 3,000-4,000 fishermen and 300-400 harbours to source a wide variety of fish directly without any middleman, FreshToHome has the ability to deliver quality products at attractive prices and offer the same experience to both its Indian and international customers.

According to Kadavil, when going cross-border, a D2C startup must identify a brand loyalty advantage and an attractive moat irrespective of its success strategies in the host country. Otherwise, they will be at a disadvantage and will need to spend more on marketing to make their brand visible.

When In Rome, Do As The Romans Do

We learnt from Kadavil that cross-border markets can be very different from the domestic market, even if the demographics are similar. To succeed in a new market, a startup must understand and incorporate the local culture.

According to Kadavil, unlearning what you learned in your home country is the biggest challenge for most entrepreneurs, and they often underestimate the time it takes to do so.

“Just like we foolishly set up a three-month target to attain the product-market fit,” he said, adding that there should be two key focus areas for D2C entrepreneurs entering a new market:

- Understand the buying culture: Nearly 65% of UAE’s retail sales happen in super markets, compared to India’s 1%. That’s a very different buying culture and consumer behaviour and one needs to make sure to reach to the consumer where they are.

- Build a local support network: If a D2C founder is trying to build a cross-border business while sitting in India, it will be a chaos. In FreshToHome’s case, cofounder Mathew Joseph permanently shifted to the UAE and is now a resident there with a team of 400 people. Not only did they get the UAE government (Investment Corporation of Dubai (ICD)) as an investor in the company, but also roped in local VCs such as Crescent Enterprises Venture Capital and Iron Pillar.

“You need to have a wide network with the right people to lower the entry barriers in the foreign territory. For instance, we were one of the first companies in the UAE to get 100% FDI licence in food in this category,” Kadavil said.

Offset High Setup Cost With Premium Pricing & Automation

As of 2021, India had more than 800 D2C brands operating in the country across different categories. Considering the size of the Indian market, even the smallest of the total addressable market (TAM) offered a large serviceable addressable market (SAM) for these brands. However, the price sensitivity in the Indian markets keeps gross margins low for most companies.

While the next natural extension for many D2C brands may seem to be going cross-border, high setup costs and uncertainty in the timelines for attaining the product-market fit can trigger the cost equation.

Given the challenges, according to Kadavil, it is always prudent to take into consideration some costs before stepping into unknown territories.

- Overheads cost: Depending on which category the startup is catering to, costs related to management, salaries, and real estate can be significantly higher in many countries compared to India.

- Cost of outsourcing: Cold chain supply network and last-mile delivery can be the two key pain points in terms of cost. Although, in the UAE, cold chain supply networks are strong and ease a lot of burden for entrepreneurs.

In Kadavil’s experience it’s easier to offset these costs by positioning the brand right and automate wherever possible. For instance, the D2C meat brand outsourced cold chain network services but kept other logistics capabilities, such as automating route optimisation and hiring on-ground delivery fleet, in-house.

“In a category like ours, logistics is a metric which can severely impact your cost equation. Cost of labour is really high in the UAE compared to India, which increases reliance on automation,” Kadavil said.

However, at the same time, he also pointed out that the ability to pay in the UAE is also higher than in India, which helps offset the increased costs. For example, if the Bengaluru market is $4 Bn SAM, the entire buyer of the UAE would be of the same size.

“The population of Bengaluru is approx 130 Lakh, whereas for Dubai, its around 33+ Lakh. Thus the reduced margins in the Indian market due to price sensitivity and competition gets offset in UAE markets by its affinity towards organised retail and affordability to pay premium price, which despite being small, give us around the same serviceable market as in India,” added Kadavil.

Here are some more operating metrics that differentiate the Indian and UAE market for FreshToHome:

While FreshToHome has been able to position itself as a mass brand in India, keeping costs at par with the competition, in the UAE it has positioned itself more as a premium brand, considering the ability and affordability of the target audience to buy online.

“Essentially the profit pools you generate in the international markets are much higher than in India. Also, what I have observed is that the marketing and acquisition costs are exactly at the same level in India and in the UAE. In fact, it’s a bit expensive in India because of the competition. This is where your marketing cost across CPMs (cost per thousand) and CPCs (cost per click) in digital media go up too high,” added Kadavil.

Omnichannel: The Next Milestone In The FreshToHome Kart

FreshToHome is presently an online first brand and most of its revenue comes from online channels. However, last year, the company launched around 30 stores in Bengaluru and found that 20-25% of its new users were acquired from this channel.

The founders are now looking to expand to 100 stores across all major metros in the next 12-18 months. There are also plans to expand to another 100-200 new cities as well as explore integration with ONDC

“We already have two stores in the UAE, but we are not expanding them. The focus today is on expanding offline presence in India. The UAE is still an early market for us. We have been there only for two years effectively. There is a fairly large online growth that is happening there,” the cofounder said.

Although Kadavil didn’t share actual numbers on the expenses incurred in CY22, he did mention that last year was costlier than previous years.

“Our marketing budget is around 8%-10% of revenues, but in 2022, it shot up to 30%-40% as we roped in brand ambassadors like Ranveer Singh and Jimmy Shergill, and did some fairly large campaigns during the IPL season. But we were building our brand. And prior to that and this year, we have been continuously profitable at operating margin level and have lowered our overall cash burn,” Kadavil told Inc42.

As FreshToHome looks to expand to Saudi this year, only the CY23 financials will depict a clear picture on how much they have been able to leverage their product-market fit in the new market.

However, given the current funding environment and the debate around profitability versus growth, it is definitely worthwhile for D2C startups to explore global markets.

Edited by Shishir Parasher

Ad-lite browsing experience

Ad-lite browsing experience