SUMMARY

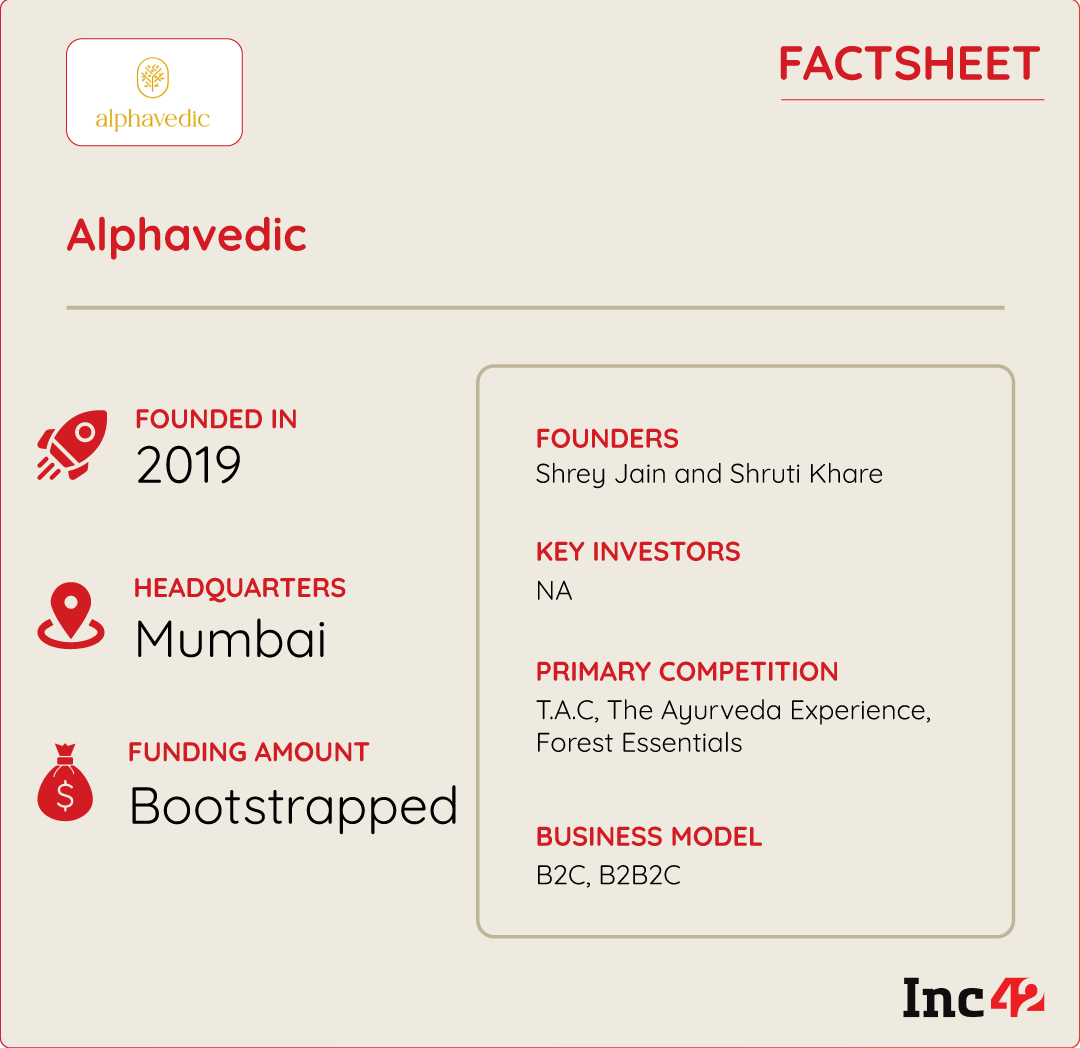

Founded in 2019 by Shrey Jain, Alphavedic is a bootstrapped D2C startup that operates in the beauty and personal care segment

The startup claims to have generated a revenue of INR 5.5 Cr in FY23. Impressively, approximately 26% of the startup’s total revenue for the year constituted gross profit

Alphavedic operates in the Indian BPC market, which is expected to reach a market size of $28 Bn by 2030, growing at a CAGR of 27% between 2022 and 2030

Often deemed the future of ecommerce, the direct-to-consumer (D2C) segment is witnessing unprecedented growth in India on the back of a spurt in demand for newer and more attractive beauty and personal care (BPC) products crowding the space.

With hundreds of BPC brands that today claim to offer natural, chemical-free or even ayurvedic products, it is but one thing that will eventually decide their respective fates — profits.

Furthermore, at a time when the BPC arena is dominated by legacy players such as Lakme, L’Oréal, and Maybelline, among others, it has become all the more imperative to shift from loss-making strategies, including high customer acquisition and marketing cost, to more sustainable business models.

According to data compiled by Inc42, only 30% of unicorns in the D2C space were barely profitable in FY22 and the remaining sat on mounting losses and rising expenses.

Bucking the loss-making and high cash burn trends, Mumbai-based Alphavedic is a profitable D2C ayurvedic beauty brand, thriving with zilch external investment.

Founded in 2019 by Shrey Jain, the bootstrapped BPC D2C brand has bet big on the B2B engagements, with a corporate gifting business model, to emerge profitable rather than solely relying on generating revenues through online and offline marketplaces.

Alphavedic is operating with the leading names such as Mamaearth, mCaffeine, Khadi Essentials, T.A.C., SUGAR, WOW Skin Science, Plum Goodness, and Nykaa to make significant strides in the Indian BPC market, which is expected to reach a market size of $28 Bn by 2030, growing at a CAGR of 27% between 2022 and 2030.

How Alphavedic Pivoted From A Healthtech Startup To A D2C Brand

Jain started Alphavedic as an ayurvedic healthtech startup to connect patients with ayurvedic doctors. However, ideas were already brewing to also make the platform a one-stop shop for different ayurvedic medicines and products later on.

Though the healthtech business initially took off, he soon realised the challenges of building and growing such a company, given that ayurvedic treatment is not mainstream. Meanwhile, Shruti Khare also joined him as a cofounder of the startup in 2019.

After pondering over the future of the business for months, Jain and Khare decided to pivot to a pure-play ayurvedic products company in 2020, marking the beginning of a profitable and scalable Alphavedic.

Starting with a haircare product, Alphavedic expanded its product line over the next two years. Jain told Inc42 that he, initially, took the help of a few influencers to unlock the startup’s first potential customer base, and, then, there was no looking back.

Once, the first few consumers recommended Alphavedic’s haircare products, Jain and his team started receiving multiple queries regarding its product portfolio. Based on customers’ requirements, Alphavedic started building its product line.

The startup, which currently has 24 stock-keeping units (SKUs), is researching on ayurvedic vitamins and supplements and plans to float them in the market in the next few months.

Alphavedic boasts a customer base of 50K individuals, of which 40% are its repeat customers.

A Sneak Peek Into Alphavedic’s Biz

Alphavedic claims to have generated a revenue of INR 5.5 Cr in FY23. Impressively, approximately 26% of the startup’s total revenue for the year constituted gross profit. Looking ahead to FY24, Alphavedic plans to generate revenues to the tune of INR 8 Cr on the back of an expanded product portfolio and a strong offline presence.

Speaking about the business strategy, Jain told Inc42 that B2B engagements helped the brand reach more customers, ensuring better returns. Notably, Alphavedic earns almost 70% of its revenue from B2B engagements.

Besides, Alphavedic has stayed away from burning hefty amounts of money on advertising and marketing.

“B2C marketing expenses by most of the D2C brands are huge, as many brands splurge a lot on influencers and social media platforms. Although we take the help of the influencers to spread the word about Alphavedic, it is all on a collaboration basis and no monetary agreements have ever been involved here,” Jain said.

As of now, the startup sells its products via its website and has a presence on marketplaces such as Amazon, Nykaa, and Flipkart. With omnichannel becoming a focus of all D2C brands, Alphavedic, too, is looking to strengthen its offline play.

Currently, Alphavedic products are available across 40 offline chains in India, including salons, resorts and hotels. Alphavedic earns 10% of its revenue from offline sales. The startup plans to grow its offline footprint to 100 such chains.

Besides being profitable, Alphavedic has also managed to have a positive cash flow. Instead of paying in advance to its contract manufacturers for its products, the startup has a flat 60-day credit agreement with its vendors. This helps the company to maintain a positive cash balance.

Bootstrapped since 2019, Alphavedic is now looking to raise $2 Mn to $2.5 Mn to accelerate its growth.

Alphavedic In The Highly Competitive D2C Space

Some of the biggest competitors of Alphavedic in the pure ayurvedic beauty brands segment are loss-making but have significantly high revenues.

A case in point is The Ayurveda Co (T.A.C), which closed its FY23 with net revenue of INR 50 Cr. Notably, the company that projects a net revenue of INR 150 Cr in FY24, is aiming to turn profitable in the next 12-18 months.

Similarly, The Ayurveda Experience expects to emerge profitable in the current financial year, despite clocking revenues to the tune of ̥INR 270 Cr in FY23.

In the broader D2C beauty space, which is led by the likes of IPO-bound Mamaearth, Plum, and mCaffeine, among others, most brands are making losses. However, there are no two thoughts about the fact that these brands have scaled significantly over the years, piggybacking on a massive capital infusion from investors.

According to Jain, in a segment saturated with a growing number of competitors, new brands entering the market will need to prioritise their unique propositions and go beyond following trends. Rather than selling everything at once, from haircare to skin and wellness products, Jain suggests going deeper into a product category with varied items to build scale.