Attero fuelled its R&D efforts in the area of Li-ion battery recycling in 2019, and in 2021, the business took off at a commercial scale

The startup’s patented technology helps it recover more than 98% of lithium carbonate, cobalt, nickel, and graphite from Li-ion batteries

Attero clocked INR 40 Cr in profit and revenues of INR 214 Cr in FY22 while it claims to have clocked a revenue to the tune of INR 300 Cr in FY23

In 2008, when the concept of waste management was still in its infancy in India, a Noida-based startup, Attero, entered the arena of recycling electronic waste (e-waste) at a time when the country was leading generators of e-waste globally.

Leveraging the booming consumer electronics products market, Attero started recovering gold, silver, aluminium, and copper from e-waste such as discarded laptops, mobile phones, televisions, and refrigerators.

Before delving deeper into the story of Attero, a Noida-based recycling startup, it is crucial to understand that the idea of recovery, recycling, and reusing metals extracted from discarded electronic devices gained serious attention in the country only in the 2000s.

Years on, the growth of the recycling sector has largely failed to budge. To put things into perspective, the country could only process 22% of the total 10.1 Lakh Tonnes of e-waste generated in 2019-20, the Central Pollution Control Board data suggests.

While the challenge of processing e-waste is yet to be fully addressed, a new source of more hazardous waste, lithium-ion (Li-ion) batteries, has started dominating the country’s landfills, and at the core of this is the increasing use of mobile phones and growing electric vehicles (EVs).

Familiar with the challenges in the field of e-waste management and the opportunities this sector holds for its stakeholders, Attero fuelled its R&D efforts in the area of Li-ion battery recycling in 2019 to make the country’s EV landscape sustainable.

In just two years, Attero’s new business vertical took off at a commercial scale, and with this, the e-waste management startup was ready to make waves in the global recycling space, which is expected to reach a market size of $23.6 Bn by 2030.

The Setting Up Of Li-ion Battery Recycling Business

Speaking with Inc42 about its journey in the Li-ion battery recycling space, Attero’s CEO and cofounder Nitin Gupta reminisced that the company soon started receiving an increasing amount of batteries as part of the e-waste sourcing stream.

“When we dug deeper into it, we realised that Li-ion battery technology is the best battery technology in the world because it’s got the highest energy density, fastest charging time and slowest discharging time. But, most importantly, close to around $100 Bn had been invested in the Li-ion battery ecosystem,” he said.

From its research, Attero realised that this creates two problems. First, as Li-ion batteries become more ubiquitous, they will grow exponentially. Given these are hazardous, they need to be recycled in an environmentally friendly manner.

“Besides, the obvious problem today is at least 50% of the cost of EVs is the cost of the batteries, out of which at least 45% is the cost of raw materials that make up the battery, which includes cobalt, lithium, nickel, graphite, manganese,” Gupta said, adding that these critical battery materials also have significant environmental, social, and governance (ESG) issues.

Due to controversies about the environmental impact of mining lithium and child labour in the cobalt mines of the Congo region, the EV ecosystem is already frowned upon by many.

Also, more than 90% of the world’s lithium gets refined in China, which is caught up in geopolitical issues with India and other nations. With a sharp focus on ESG issues, the company built its Li-ion battery recycling technology and today has a total of 38 global patents under its belt.

Amid all this, Attero has already achieved operational profitability, as it clocked INR 40 Cr in profit and revenues of INR 214 Cr in FY22. Its profit stood at INR 13 Cr and revenues at INR 114 Cr in the year-ago fiscal.

Gupta also claimed that the company is cash flow positive and growing exponentially. Attero claims to have clocked revenues to the tune of INR 300 Cr in FY23.

What’s Behind The Tech?

Today, the biggest challenge for the e-waste processing industry is to recover the maximum amount of raw material from dead batteries at minimum costs.

If we look at the global Li-ion battery recycling market today, hydrometallurgy and pyrometallurgy are the two main Li-ion battery recycling processes that companies prefer to deploy across the globe. However, both processes have certain loopholes.

While pyrometallurgy has a very low extraction rate, hydrometallurgy demands higher material costs and is a complex process. Before we move on to explaining Attero’s tech, let’s understand the entire battery recycling process in depth.

It must be noted that dead Li-ion batteries or packs are first dismantled and shredded. The shredded material is then processed to produce ‘black mass’, which consists of high amounts of different types of metals.

According to Gupta, most of the Li-ion recycling in India currently stops at the mechanical process, which is proceeding with this ‘black mass’. However, with its hydro process, Attero claims to have gone far beyond to produce pure elements from the black mass.

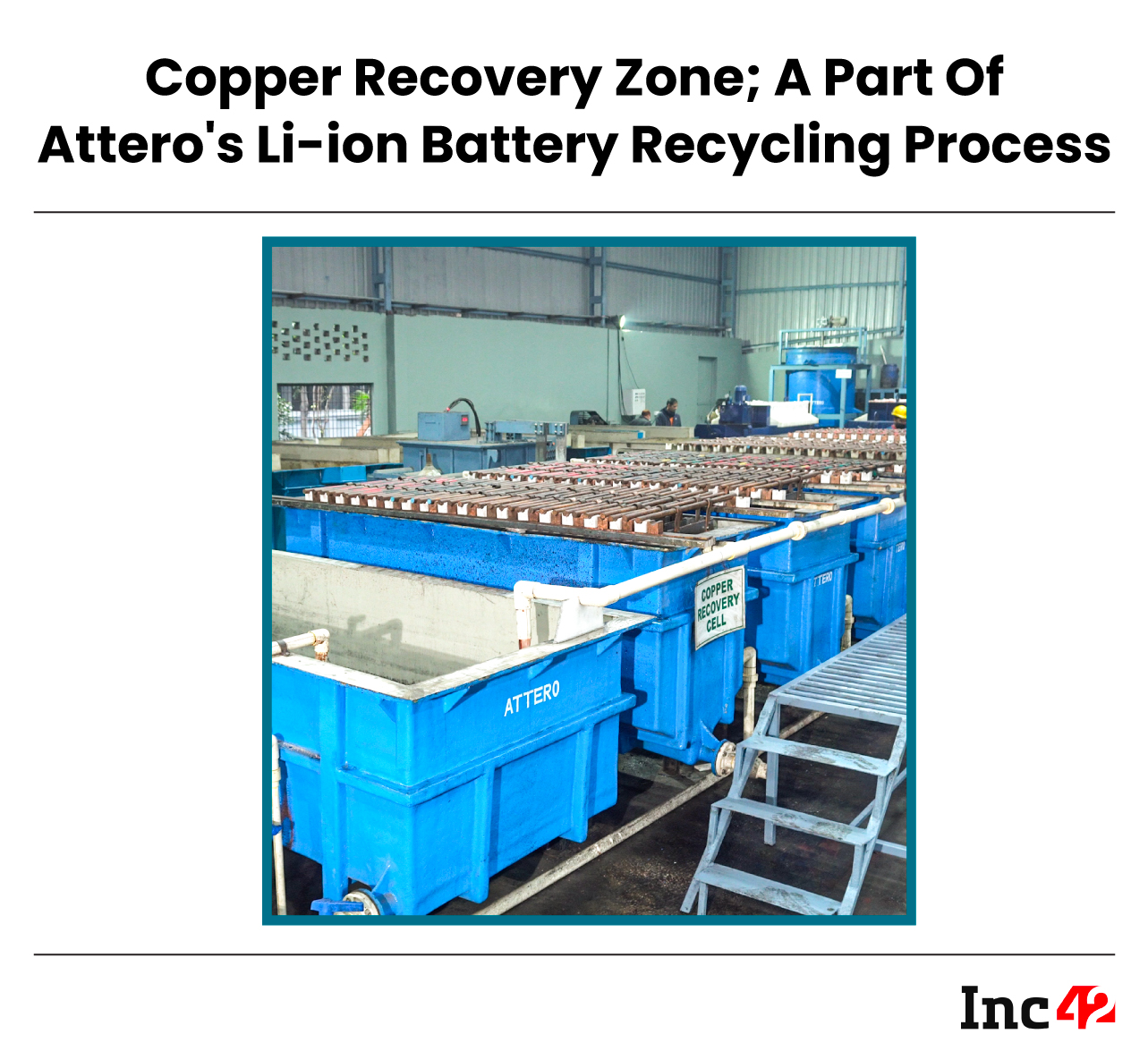

In the hydro process, the black mass is put through various chemical steps, including leaching, electrowinning, and solvent extraction.

While other global players like SungEel HiTech and US-based Li-Cycle have also adopted the hydrometallurgy process for recycling, their recovery efficiency is low at 75%-80% of cobalt, less than 50% of lithium, 75% of nickel, no graphite, according to Gupta.

However, he claimed that Attero’s patented technology helps it recover more than 98% of lithium carbonate, cobalt, nickel, and graphite from these batteries.

“In our case, the first thing that we do is leach out graphite. Now, once you do leaching of graphite, we receive two outputs – one stream of leach liquor or liquid, which is graphite-free, and another stream of precipitant, which is pure graphite,” Gupta explained.

The leach liquor that comes out is then put through a copper electrowinning system. Now, at a certain temperature, current and voltage, copper ions dissociate from the solution and get deposited on the cathode. Once again, we receive two outputs — the one that has copper and the second is a leach liquor, which is now copper-free.

Similarly, each metal is extracted separately using this methodology and then they are sold to various industries for reuse.

But when it comes to extracting Lithium, one can only precipitate 50% of lithium at normal temperatures and pressure. However, Attero claims to have broken that limit as well by using its chemical research and technology.

Besides, Attero claims that despite using the hydrometallurgy process, it has the lowest capex per tonne in the world, at $3,200 per tonne, which is at least 40% cheaper compared to others in the battery recycling space.

Gupta said that the minimum capex for a regular hydro process is $5,500 per tonne and for a pyro process, it is $10,000 per tonne.

Attero’s Billion-Dollar Dream In Recycling Business

Attero, which claims to be extremely capital-efficient, has raised a total of around $25 Mn so far from Kalaari Capital, Granite Hill Capital, and others. In FY23, 85% of its business came from e-waste recycling while Li-ion battery recycling accounted for 15% of the total business.

Attero says that it sells 99.9% pure cobalt chips, which are battery-grade. A part of it is exported while the remaining is sold in India. The company also sells lithium carbonate, which is 99.9% pure and is of pharmaceutical grade.

Notably, lithium carbonate has multiple uses across industries, including in pharmaceuticals, where it is used for the treatment of some neurological disorders.

Similarly, other extracted materials are also put back into the circular economy. Currently, the startup works with around 40 clients in India and globally.

Gupta projects his company’s revenue to touch $1 Bn in the next three years, with 70% coming from Li-ion battery recycling and 30% from e-waste.

Currently, Attero has one manufacturing facility in Uttarakhand, while plans are afoot to set up another facility in the country this year.

Besides, as part of its global expansion, the startup is setting up manufacturing facilities in Poland and Indonesia. Poland’s hub is expected to start running in 2023, while the operations in the Indonesian facility are expected to kick off next year.

The founder has plans to list Attero on the Indian bourses by 2025.

While globally, Attero competes with giants, including Umicore in Belgium, Glencore in Canada and Redwood Materials in the US, the startup is witnessing competition from the likes of Lohum, ACE Green, and Metastable Materials in India, who have also started to develop technologies to ensure maximum extractions.

However, what could solidify Attero’s footprint in the e-waste management and battery recycling spaces is its unwavering commitment to spending on R&D. With multiple global patents under its belt, the climate tech startup’s road ahead seems full of opportunities, especially when there is an increased awareness towards ESG practices.

Ad-lite browsing experience

Ad-lite browsing experience