SUMMARY

Gramophone is a full-stack intelligent farming platform that guides farmers throughout the crop cycle – offering crop input, intelligent selection, access to scientific agronomy advice, including cropping practices, and output market linkages

The agritech startup currently operates in five states - Uttar Pradesh, Madhya Pradesh, Chhattisgarh, Rajasthan and Maharashtra

Farmers can expect a 30-40% net increase in income by using Gramophone’s solutions, the startup claims

Although the share of agricultural output in the country’s overall GDP (gross domestic product) declined sharply (from 30% in 1981 to 16.5% in 2019), the sector still employs more than 42% of the national workforce. From a macroeconomic standpoint, the welfare of a large section of the population depends on agriculture. However, the ground realities point towards a deepening farm crisis.

In India, more than 70% of farmers own less than one hectare of land. Further, India’s farm yield is about 30-40% lower than that of developed countries.

There is a clear indication to improve the existing agri infrastructure and enable technology adoption to meet the demands of India’s growing population and increase farmers’ yield.

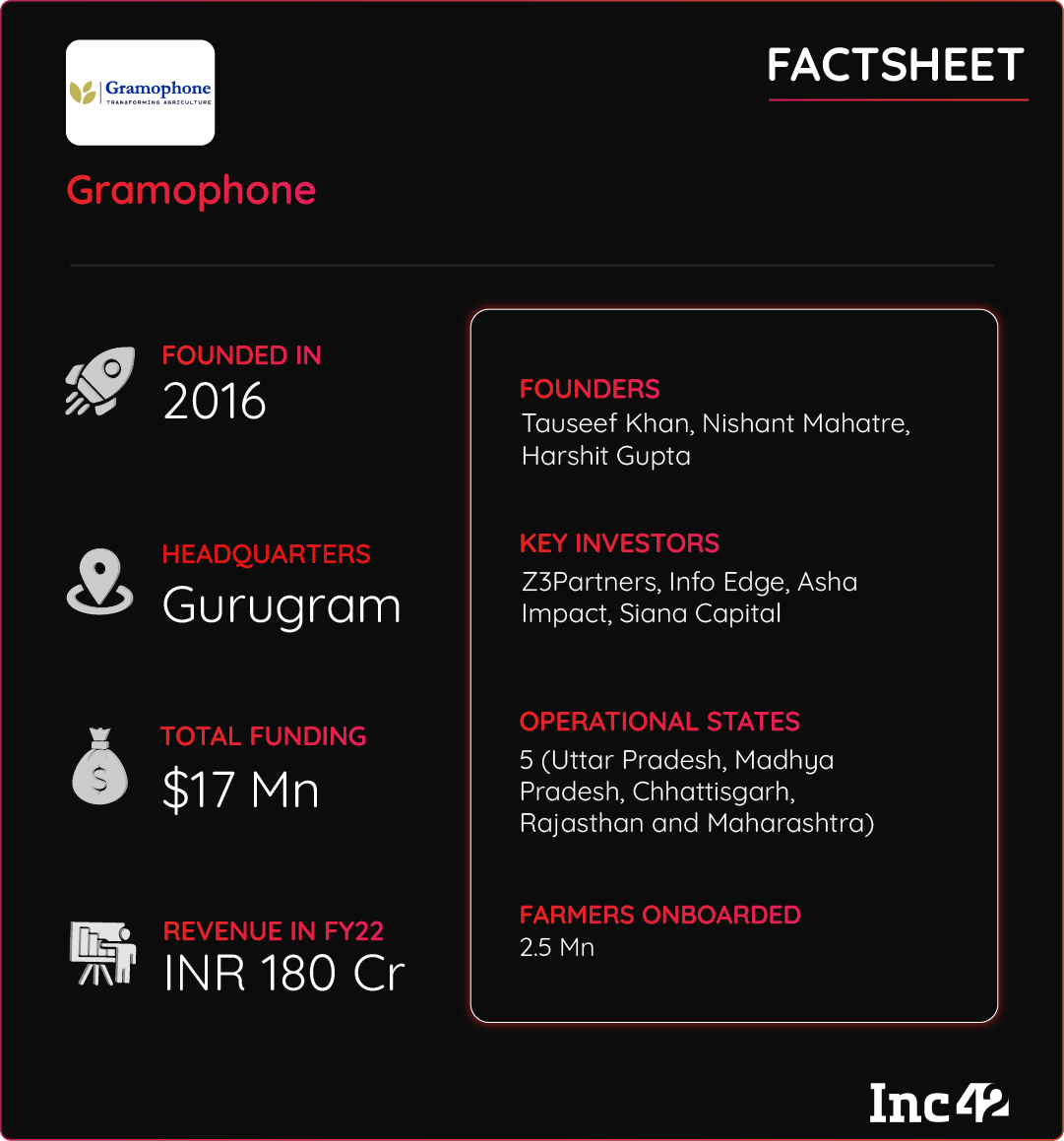

Aware of these problems, IIM Ahmedabad and IIT Kharagpur alumni Tauseef Khan and Nishant Mahatre set up agritech startup Gramophone in 2016. Khan brought his experience in consulting for the Indian agrochemical industry. Earlier, he was also an investor with Lightrock India, a VC firm that backs sustainability-focused businesses.

Mahatre brought execution experience from his stint at John Deere and the Clinton Giustra Enterprise Partnership (where he worked as a consultant). The duo was joined by Harshit Gupta to lead sales, who leveraged his experience from his stints at TAFE and OYO.

Gramophone is a full-stack intelligent farming platform that works directly with farmers and guides them throughout the crop life cycle – from seed selection and sowing to efficient use of nutrients/fertilisers to harvest management and selling.

It has also partnered with a number of companies such as Bayer, Dhanuka, PI Industries, Coromandel and Tata Rallis to provide quality seeds and agrochemicals to maximise crop yield. To enable market linkages for farm output, it has partnered with several corporate buyers and has created a network of 4,000+ traders on its platform.

The agritech startup claims to have onboarded more than 2.5 Mn farmers from Uttar Pradesh, Madhya Pradesh, Chhattisgarh, Rajasthan and Maharashtra.

It has raised close to $17 Mn to date with the business expected to grow nearly 2.5x in FY23. According to Khan, the platform clocked more than INR 180 Cr in revenue in FY22, and it is targeting INR 400-500 Cr in the current year.

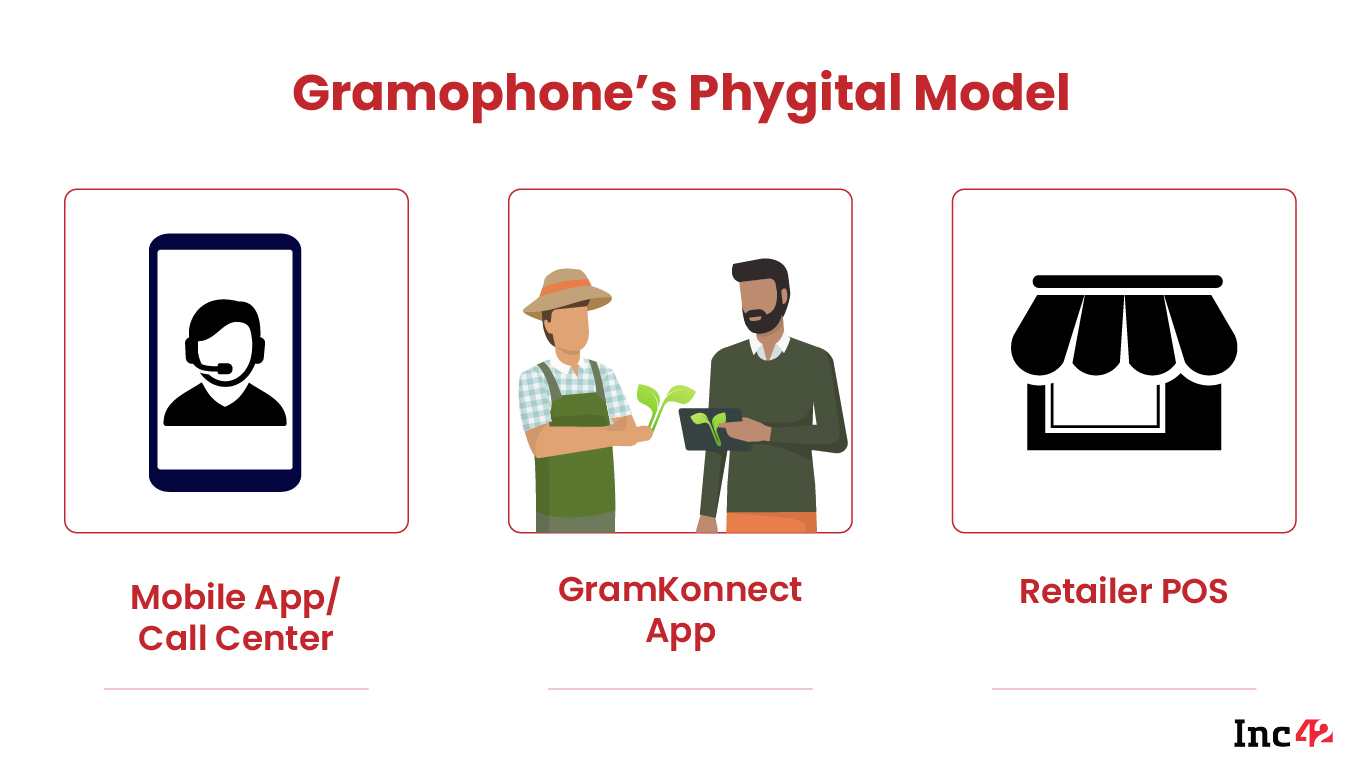

Inside Gramophone’s Phygital Network

‘India has 15+ agroclimatic zones with different soil types and weather conditions. Each crop has five-seven phases of growth lifecycles, over hundreds of known issues as well as hundreds of input product combinations for addressing those. So, a single crop can end up having millions of decision points, which is simply beyond the realm of traditional advisory,’ said Khan.

Gramophone addresses these issues with its proprietary agronomy engine that manages the entire farming lifecycle. Farmers can get personalised advisory, tailored to their geo-tagged farmland through the Gramophone mobile app. The app also offers access to high-quality crop inputs that may ordinarily be out of a farmer’s reach, the startup claimed.

However, when the startup began operations in 2016, its biggest challenge lay in changing farmers’ behaviour and in convincing them to use agronomy advice.

So the cofounders decided to create a hybrid/phygital model for better reach.

Gramophone started advertising its missed call service (along with a toll-free number) through physical banners across villages, encouraging farmers to call for free agronomy-related advice or to buy farming inputs. It has set up several physical retail stores or ‘Gram Uday’ centres (retail-cum-fulfilment centres) to offer in-person support to farmers.

Finally, it began scaling its last mile village network by partnering with local microentrepreneurs. These village representatives (VRs) are responsible for all last-mile deliveries and help with on-ground farmer assistance via the Gram Konnect App, thereby ensuring a smooth supply chain and an uninterrupted advisory flow.

Today farmers can choose from a selection of thousands of SKUs of crop inputs that can be purchased through multiple touchpoints – online through the app or its network of on-ground centres.

We have improved farmers’ yield by 30-40% by offering quality farm inputs and advisory from expert agronomists. At the same time, optimising farm inputs reduces costs by 20%. Overall, farmers can expect nearly a 50-60% net increase in their incomes by using our platform,’ said Khan.

To help farmers surpass inefficient market linkages and improve their margins, Gramophone introduced the Gram Vyapar section on its mobile app. Gram Vyapar is essentially a marketplace, connecting farmers and traders with B2B buyers.

With Gram Vyapar, farmers are able to sell their produce to a verified network of 4,000+ traders and processors listed on the platform across 100+ district mandis. On the other hand, Gramophone locks in demand from institutional customers, which is fulfilled through its farmer network built while running the input business.

Scaling Up With A Focus On Sustainability

“Our expansion playbook heavily relies on the data insights we’ve gained over the years. We target markets on a micro level. For instance, for each micro market i.e. a district, we have identified a total addressable market of $500-600 Mn for input and output business. This data is essential for growing the business sustainably,” said Khan.

Gramophone onboarded around 5K farmers by the end of 2016 and scaled to 100K users in the next year, clocking more than a 19x increase. By the end of 2021, it had over 1.3 Mn unique registrations and doubled it to nearly 2.5 Mn in less than a year, it claimed.

Currently, it operates in 60,000 villages and has onboarded more than 600 VRs across five states. Now it aims to cover 75,000 villages by the end of FY23.

Gramophone credits its expansion to its low-cost scale-up model with a focus on micro-markets. In 2021, it launched an additional channel to serve farmers through affiliated village retailers. “We are offering them a compelling value proposition i.e. access to our demand network of thousands of farmers in a region,” said Khan.

So far, it has partnered with 6,500 such retailers in its existing areas of operation as well as in adjoining districts. This has helped it scale its input business by 5x since FY21, the startup claimed.

Aiming for long-term success, it plans to focus more on the input side of the business from a revenue point of view. Since 2021, the agitech startup has launched more than 40 private labels across crop input categories. “With our private labels, we are yielding margins that are 3-4x those of third-party brands. This has a direct bearing on the economics, fueling our journey to profitability,” said Khan.

The startup claimed that its revenue grew by nearly 4x from FY21 to FY22 and reduced the Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) burn rate by nearly half to 15% which is expected to further reduce to 8% in FY23.

Since Gramophone has a good understanding of the sowing and harvesting patterns and crop needs of farmers, it has gained insights into their capital requirements as well. Hence, it rolled out its agri-fintech services in 2022 in partnership with a fintech firm and aims to scale it.

“We are developing farmers’ profiles based on farm data, alternative sources of income, past purchases and more. This has helped us develop a strong credit assessment framework to gauge farmers’ creditworthiness so that we can offer credit to a large set of people,” said Khan.

Can Agritech Transform The Way India Farms?

India is home to over 1,000+ agritech startups that are closely working with farmers and other stakeholders to modernise traditional farming through digitalisation and tech adoption.

Most of these players help farmers optimise resources and boost productivity ( Gramophone and Agrostar, to name a few), iron out supply chain inefficiencies (Ninjacart, WayCool and DeHaat) and develop agri-lending channels (Jai Kisan, CashPlow and payAgri) for capital requirements.

However, agritech penetration in India currently stands at merely 1%. But Gramophone sees it as an opportunity to grab a large market share in the near future. “We have a deep understanding of cropping patterns, farmer demographics and technology-led relationships with farmers. These components are essential for pan-India reach, scaling up and profitability,” said Khan.

The sentiment resonates with industry experts who believe that growing VC interest and government initiatives are bound to deepen the sector’s reach in the hinterland, taking agritech’s market opportunity to an estimated $25 Bn by 2025.

Consider this. According to a recent Inc42 report, there are 401 active agritech investors in India, and the sector raised $482 Mn as of H1 2022 despite a funding winter.

In September 2021, the government also announced the Digital Agriculture Mission to accelerate digital adoption and improve farmer welfare using new technologies like AI/ML, GIS, drone applications and remote sensing.

Given growing investments and government support, it will be interesting to see how the agritech sector shapes Indian agriculture and paves the way for a sustainable and profitable future.