Multipl offers a personalised investment advisory to help users invest in mutual fund-style baskets and link those baskets to spending goals

Multipl’s SNBL offering is creating a new subset of the BNPL ecosystem and expanding the payment funnel to help brands

Users can choose to save for one-time spending, recurring spending and long-term wealth and savings

The majority of millennials and GenZ had their first tryst with savings in the form of the desi gullak. Whether it was saving up for the upcoming school trip or the latest Harry Potter book, a part of the pocket money first went into the pot to save for certain goals.

With increasing digitisation, spending money has become as easy as making UPI transfers and buying everything online with credit cards is the new normal. However, this comes with a fair share of problems like getting into a debt trap – a major pain point that Paddy Raghavan, Jags Raghavan and Vikas Jain noticed within their network.

The trio observed that brands offer subvention benefits to credit providers in the range of 5% to 10%. They also offer interest-free or low-interest credit to users who pay the full amount in instalments. However, would these brands also provide the subvention benefit directly to users if they were ready to pre-commit to the purchase?

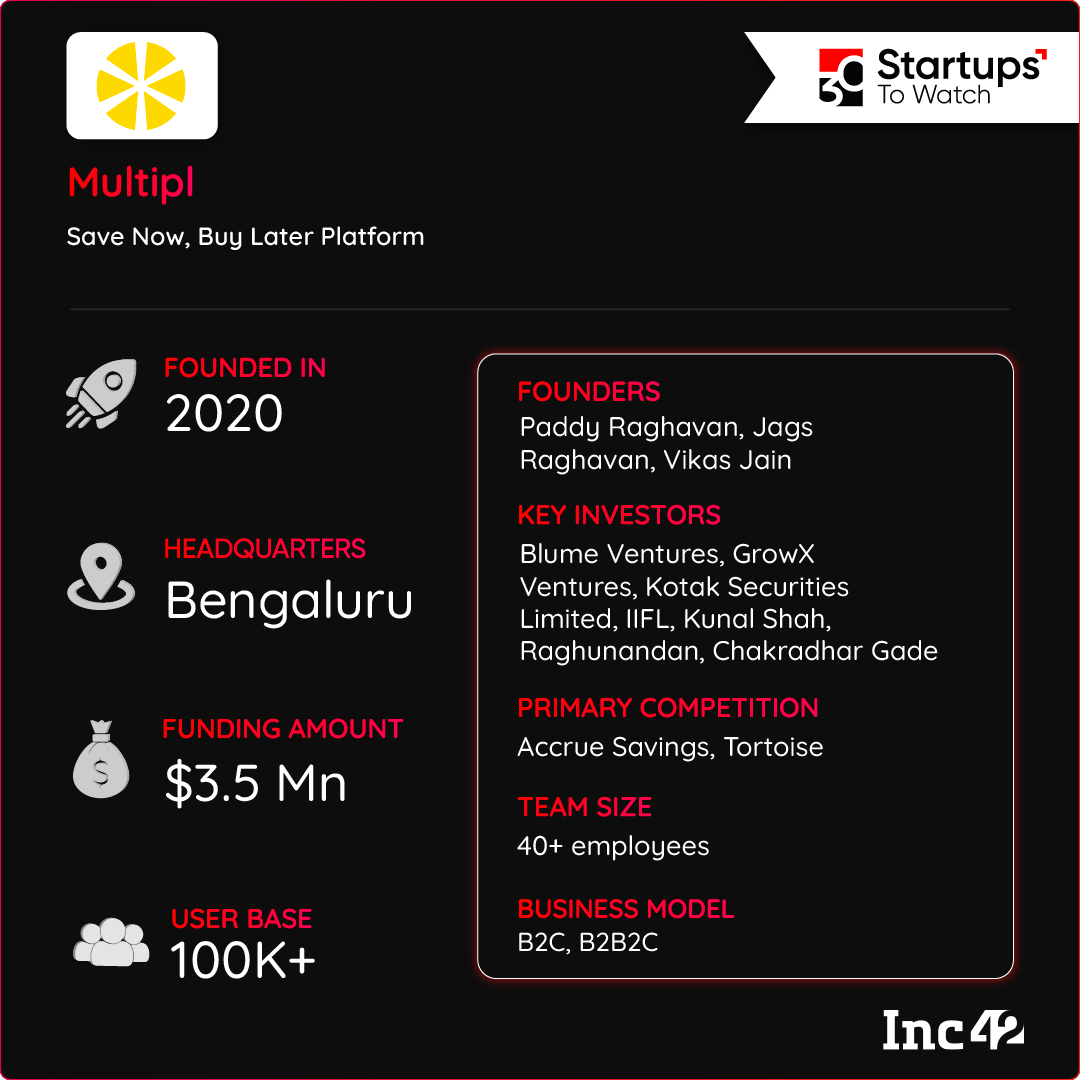

With a focus on this idea, Multipl was founded in 2020. The startup has partnered with several brands in India such as Croma, Kalyan Jewellers, Yatra, PickYourTrail, Ather Energy, Livespace, Bounce, Home Capital, Garmin, and Turtlemint to date to help its users save for their buying goals on these platforms.

An Inc42 find in ‘30 Startups To Watch – July 2022 edition’, Bengaluru-based Multipl offers a personalised investment advisory that helps users invest in mutual fund-style baskets and link those baskets to relevant lifestyle spending goals – one-time spending (such as buying a bike or car, furniture piece and more), recurring spending (school fees, insurance premiums or festival gifting), and long-term wealth generation and savings (retirement fund, tax-savers and more).

How Multipl’s Save Now, Buy Later Platform Works

From a user’s perspective, Multipl’s app is a mix of investment and ecommerce apps. As the goal-based saving phenomenon, also called the Save Now, Buy Later (SNBL) format, is increasingly gaining popularity, Multipl has launched two products – ‘Brand Saver’ and ‘Market Saver’.

With Brand Saver, the startup partners with brands and users can directly save with these brands for their future spending.

With Market Saver, users can invest their money in mutual funds (via SEBI’s registered investment advisory) to get better returns than bank fixed deposits and also added benefits from brands such as exclusive offers, that build saving habits. These mutual funds can then be linked to their shopping goals.

Multipl also houses an investment research team that allocates funds using its proprietary risk-modelling profile, built specifically for each user using a robo-advisory platform.

The startup earns revenue via its brand collaborations and makes money when users make a redemption or purchase with a partner brand.

Moreover, as a SEBI-registered investment advisor, it can also charge customers for investment advisory. However, the service is being offered free of charge currently, Raghavan said.

The target audience for the app is salaried people with an annual income of more than INR 5 Lakh. The average age of its users is 29 years.

During the conversation with Inc42, Raghavan also highlighted that users above the age of 30 generally look at SNBL instruments when planning family vacations, paying school fees for their children, and for similar reasons.

Meanwhile, those less than 27 years of age are generally looking for solo trips, gadget buying, and more. Those between the age of 27-30 years are mostly saving for their wedding.

A BNPL Competitor Or Alternate Payment Mode?

“While Buy Now, Pay Later (BNPL) offers are lucrative and encourage more shopping, they also catch people in a debt cycle. On the contrary, SNBL promotes the practice of saving money first and shopping later,” says Raghavan.

Yet, he asserted that SNBL as a concept is not replacing the BNPL ecosystem.

Reflecting on in-house research, the Multipl cofounder stated that 90% of the people who visit an online brand are window shoppers. These brands don’t have any effective mechanism to tap into this window shopper group, he said.

“With Multipl, these brands get an option to ask their window shoppers to start saving for the particular item, expanding their marketing funnel,” Raghavan said.

He added that the move has a dual benefit. “When a user signs up to save for a particular item with the brand, the consumer builds a connection with them, and it is not just buyers’ remorse.”

Ultimately, need-based buying behaviour comes into play. “If a user wants to buy the product now, and pay for it later, they will do it. But saving now, and buying later gives an option to those consumers who have decided to not fall into the debt cycle, buy at a later date, and manage their expenses accordingly,” Raghavan said.

SNBL is only creating a new subset, expanding the payment funnel for brands, he added.

The Roadmap For Multipl

With the concept of SNBL rapidly gaining popularity, there is a rise in the number of brands promoting this concept. Tortoise, Accrue Savings, Hubble Money, OmniCard, and more are among such brands.

To compete better, Multipl recently raised $3 Mn in a pre-series A round from Blume Ventures, GrowX Ventures, IIFL, and Kotak Securities Limited. It would use the funding to increase investment options on the platform and to raise awareness about the startup.

Currently, Multipl is focused on building awareness about the SNBL philosophy and preaching its benefits to its target market. The company claims to have a target addressable market of 15 Cr, growing 13% annually.

Only recently, the startup added multiple asset classes – mutual funds and digital gold, multiple brand partners, and introduced payment options via UPI. The startup claims that its number of users has grown five times to over 1 Lakh over the last six months.

Multipl’s long-term aim is to establish itself as a category leader in the SNBL space, with a user base of more than 1 Cr and assets under management of around INR 50,000 Cr.

Ad-lite browsing experience

Ad-lite browsing experience