Although gold loan is a lifeline in a country like India, where access to formal credit is limited, 65% of the homegrown market is unorganised and unregulated

Lendingtech startup SahiBandhu wants to bring gold loans to Tier III and IV markets, as well as rural India

Powered by cutting-edge tech, its seven-point action plan streamlines operations, strengthens security measures and elevates user experience

India’s boundless love for gold is rooted in antiquity, but the value of this (primarily physical) asset class has not diminished in a digital economy. The yellow metal has been cherished through generations as a tangible indicator of family wealth, a high-value investment and a safety net in times of distress. More importantly, it is often considered a hedge against inflation. This will probably explain the massive accumulation of physical gold – an estimated $1.4 Tn worth of private stock, according to the World Gold Council.

With nearly 75% of Indian households owning gold, RBI data indicates cumulative gold holdings of more than 27K tonne out of which 5.3K tonne is pledged.

Although most Indians are reluctant to sell gold due to its sentimental value and the financial status quo attached to it, they are increasingly pledging it as short-term collateral for quick funding. This monetisation of idle gold has pushed the country’s gold loan market, with banks, NBFCs and new-age lendingtech startups eyeing a piece of the $55.5 Bn pie (as of 2022).

However, it is a different scenario for the unbanked and the underbanked beyond the metros, who mostly remain outside the purview of formal credit and cannot fund emergencies or meet working capital requirements (for agriculture and businesses). Also, 65% of the gold loan market is unorganised and pawning gold with local players/moneylenders results in 25-50% exorbitant interest rates. Moreover, such operators rarely follow valuation and pricing best practices in the absence of strict supervision in an unregulated market.

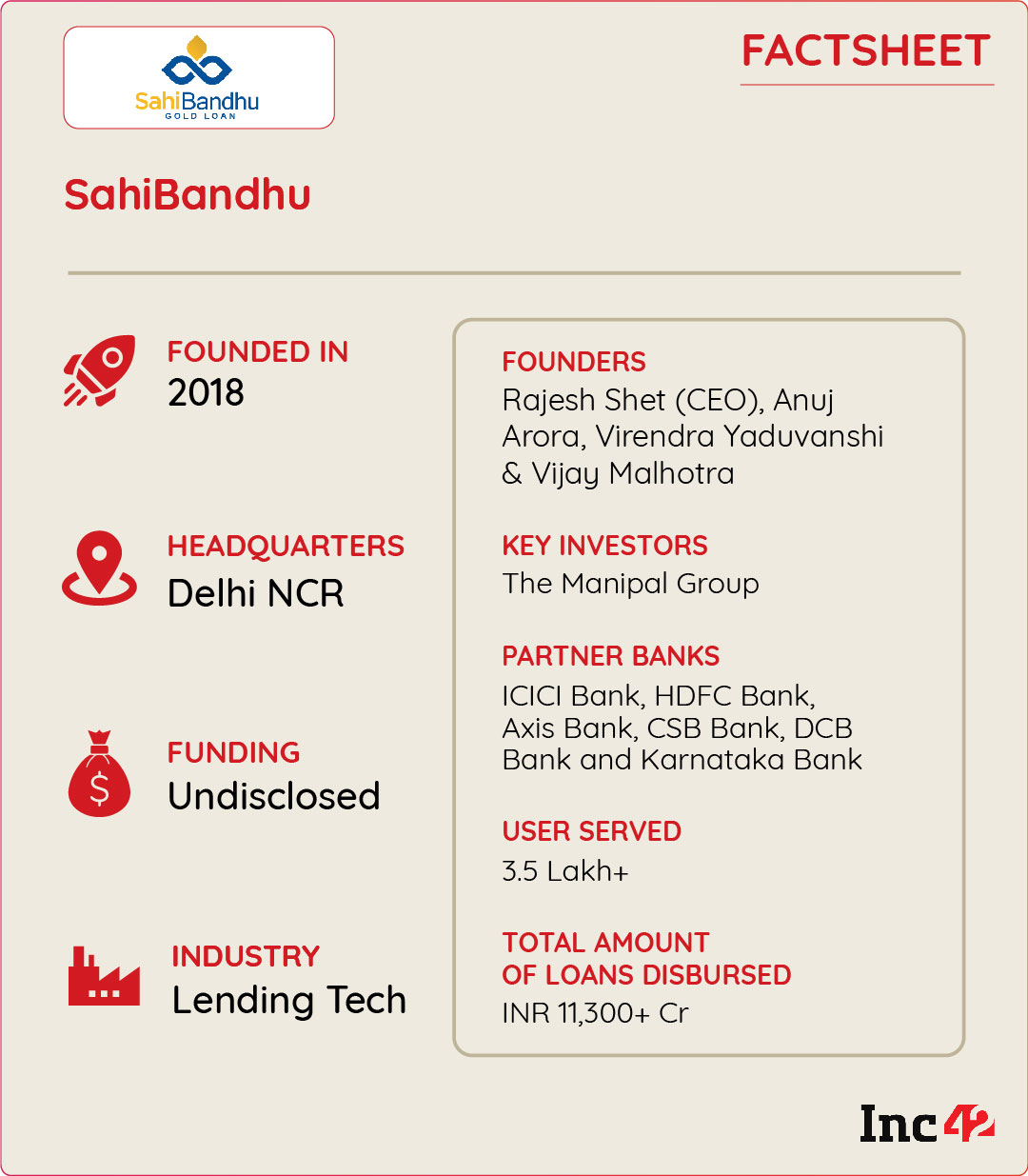

Rajesh Shet, a seasoned professional who spent 17 valuable years at the Manipal Group in various capacities, had a wealth of experience regarding this space and a clear understanding of how gold loan operations could be reworked to help underserved borrowers. Therefore, he teamed up with former Manipal colleagues Vijay Malhotra, Anuj Arora and Virendra Yaduvanshi, to launch SahiBandhu, a gold loan aggregator platform. Their mission: To make gold loans more accessible to Tier III and IV markets, as well as rural India.

The platform has carved a niche for itself, acting as a bridge between legacy banks and potential borrowers and enabling a tech-enhanced customer journey. It helps six partner banks build their gold loan portfolios sustainably and ensures a smooth credit flow for people in need with the help of a ‘phygital’ model.

SahiBandhu runs a website and a mobile app for this purpose, allowing users to come online and browse through available loans, review fully transparent terms and conditions, leverage flexible payment options and benefit from quick turnaround time (a loan is disbursed within 30 minutes of identity verification and KYC). It also offers in-branch services using a network of 6.5K physical branches (courtesy, partner banks) to ensure widespread reach and a superior customer experience, essential for building trust.

People can raise loans against 18-24 carat gold products, while the startup offers doorstep gold loans, including home assessment/valuation, collateral pickup and direct disbursement of the loan amount to one’s bank account (more on that later). One can also visit a bank of their choice and conduct the transactions there.

Incidentally, Karnataka Bank was the latest to join the SahiBandhu network. The duo teamed up in September 2023 to launch KBL-Swarna Bandhu, a doorstep gold loan service for the bank’s customers. The startup acts as a corporate business correspondent and a lending service provider, helping the bank grow its gold loan business.

Loan aggregators like SahiBandhu generate revenue through fees from gold loan providers (banks in this case) for every qualified lead. This fee can be fixed per lead or a percentage of the loan amount disbursed.

The startup claims to have served 3.5 Lakh people across 29 states, 620+ districts and 11K+ pin codes. Shet says it has disbursed INR 11.3K Cr worth of gold loans and eyes 10x growth. Shet said that SahiBandhu has been incubated by The Manipal Group.

Building Trust For Business Growth

With the consistent rise in gold prices, India’s organised gold loan market is now worth INR 6 Lakh Cr, per industry estimates. However, the market penetration is still abysmally low at 7%.

“The loan amount against gold is usually up to 75% of its current market value if quality parameters are met. It is a lifeline in a country where formal credit access can be limited, especially for rural communities. However, Indians are quite hesitant to opt for gold loans as their first choice due to the fear of gold being stolen, tampered with or the challenge of paying high-interest rates,” said Shet.

It also explains why the startup initially struggled to gain traction.

But the founders were determined to reverse this perception through ease of access to gold loans and deeper engagement with borrowers through personalised user experience. However, the foremost obstacle was the deep-seated mistrust and scepticism among potential borrowers due to their previous encounters with pawnbrokers and moneylenders.

A flexible ‘phygital’ model was developed to bridge the trust gap. Customers can either visit a physical bank and deposit their gold there or opt for at-home assessment and pickup after consulting with SahiBandhu’s financial advisors, who will guide them throughout the process. This ‘hybrid’ model appealed to the middle class, who had been hesitant until then and had never opted for gold loans.

Rural India presented a different challenge altogether. The rural populace is less tech-savvy than their urban peers and relies more on local players who promise quick payments and minimal paperwork. But the latter’s predatory lending practices, especially high-interest rates, often trap borrowers in terrifying debt cycles wherein new loans are raised to pay off old ones. This essentially leads to longer debt tenures and bigger payments.

SahiBandhu conducted several in-person outreach programmes to help rural customers understand the benefits of fully regulated gold loans and break free of this vicious cycle. It was an active collaborator helping with agricultural extension services (supply of agri inputs and services to increase crop production) and took part in rural events and fairs to engage directly with farmers. The knowledge drive was tailored to highlight the benefits of gold loan offerings for agricultural needs and emphasise flexible repayment options and competitive interest rates.

How Techvantages At Every Step Enhance Customer Journey At SahiBandhu

In tune with its tech-driven, customer-centric approach, SahiBandhu has set up a seamless, end-to-end procedure and offers both doorstep pickup and in-branch loan servicing. According to the CEO, technology is the backbone of the startup’s operations, and it uses an array of cutting-edge tech tools to streamline operations, strengthen security measures and elevate user experience. Here is a quick look at the seven-point action plan adopted by the platform.

Branch visit or home visit – it’s the customer’s choice. While branch visits happen at the sole discretion of customers, SahiBandhu’s doorstep gold loan processing is quick and efficient.

From asset assessment to loan disbursal, it’s a 30-minute journey. Doorstep loan processing starts with a simple signup using one’s mobile number and entering a few essential details (name, address proof and proof of land holding, in case of agri gold loan). After receiving an application, a SahiBandhu representative and a gold appraiser make the home visit for KYC verification and gold evaluation. Post-product assessment, the data is fed into the startup’s system so that its advanced algorithms can determine the interest rate based on real-time market trends. When the loan amount is finalised and the interest rate is freezed, the money is disbursed directly to the borrower’s bank account.

The paper trail is passé; digital documentation is in. Borrowers can conveniently submit necessary documents digitally via the app or website, eliminating cumbersome paperwork and long processing time.

Auto approval and status tracker: The superb combo speeds up things. The platform has used advanced algorithms to develop an automated loan approval system to evaluate loan applications swiftly. Additionally, borrowers can track their loan status and history on the website and the app. However, gold loans are secured (the gold serves as collateral), and their approval does not depend on CIBIL scores. Therefore, banks often grant loans even when a customer has a low credit score.

Customers can choose from three repayment options. With SahiMax, borrowers can pay the monthly interest during the loan tenure and settle the principal amount at the end. SahiDelight requires one to pay the principal sum and the interest due at the loan’s closure. SahiFlexi offers an overdraft facility, allowing borrowers to pay monthly interest on their fund usage, while the principal amount is paid at loan closure. Shet said that the lending procedure scrupulously follows all mandates and guidelines of the RBI.

Timely reminders keep repayments hassle-free. Auto alerts have been introduced to keep tabs on payment schedules. “We send automated reminders through our systems, ensuring timely notifications about upcoming payments and reducing the risk of defaults,” the CEO said.

At the core of SahiBandhu lies customer data security. The platform employs biometric security measures (fingerprints or facial recognition) to safeguard its ecosystem against unauthorised access. As for user data security, it leverages secure communication protocols and encrypts end-to-end data transmitted between user devices and financiers’ servers. Strong encryptions also exist for storing sensitive user data on servers and databases. In addition, SahiBandhu has deployed a multi-factor authentication (MFA) for additional security layers, requiring users to provide multiple forms of identification before accessing sensitive data.

The Way Forward: Greater Financial Inclusion, Better Growth

With the rise in market volatility and the looming threat of global stagflation due to the ongoing geopolitical unrest, gold has bounced back as a coveted asset class. Central banks across the globe indulged in a gold-buying spree. Even RBI joined the gold rush, putting India’s official gold reserves at No. 10 in the pecking order by September-end, per WGC data.

Although the easy availability of gold and its newfound mobility may drive the gold loan market, there is more to consider here. For instance, the RBI has mandated that other banks ensure a specific amount is lent to priority sectors like agriculture. As gold loans are prevalent in such sectors where formal credit is low and liquidity is a major issue, looking into those opportunities may pay rich dividends.

Encouraged by these developments, the likes of SahiBandhu want to double down on expanding their operations across the vast and largely untapped unorganised gold loan market. Their business motto is clear: Onboard as many customers as possible and bring them into the fold of formal credit to optimise growth. After all, the risk of incurring NPAs is pretty low in these cases.

SahiBandhu may enjoy a couple of added advantages as well. For starters, it has already established a significant presence in Tier III locations and beyond to help individuals excluded from institutional lending. Now, it is aiming to enter Tier I and II cities, which will further balloon its user base.

“We want to ensure that individuals in underserved areas have equitable access to the benefits of gold loans and other essential financial services, thereby contributing significantly to a more inclusive financial landscape nationwide,” said Shet.

Interestingly, the lending tech platform wants to leverage bank partnerships to increase its footprint in rural and remote areas. Tying up with legacy banks will not only enable the business to leverage vast branch networks but also ensure lower interest rates, posing a challenge to gold loan NBFCs, whose interest rates are always a tad higher.

Add to that the comparatively low ticket sizes of average gold loans, short tenure and the rising cases of default, and it would be pretty apparent that the NBFCs, once the leaders in this segment, may soon face tough competition from new-age fintechs banking on strategic partnerships and operational agility.

On the other hand, NBFC giants like Muthoot and Manappuram are well-established gold loan players with substantial market share. According to Statista, Muthoot Finance held a 46% share of the gold loan finance market in FY22, followed by Manappuram with a 16% market share. Additionally, they have substantial market reach and customer loyalty, essential success factors in the financial services industry.

Will it lead to a three-pronged war in the near future, with banks, NBFCs and new-age fintechs locked in a fierce battle for supremacy?

Market data does not predict so.

For one, the market is massively underpenetrated at about 7%. And it is expected to grow at a CAGR of 12.2% between 2023 and 2029 to reach $124.5 Bn. It means ample headroom for multiple players to grow, especially for those like Sahi Bandhu, who want to ensure that greater financial inclusivity remains a valuable growth trigger.

Ad-lite browsing experience

Ad-lite browsing experience