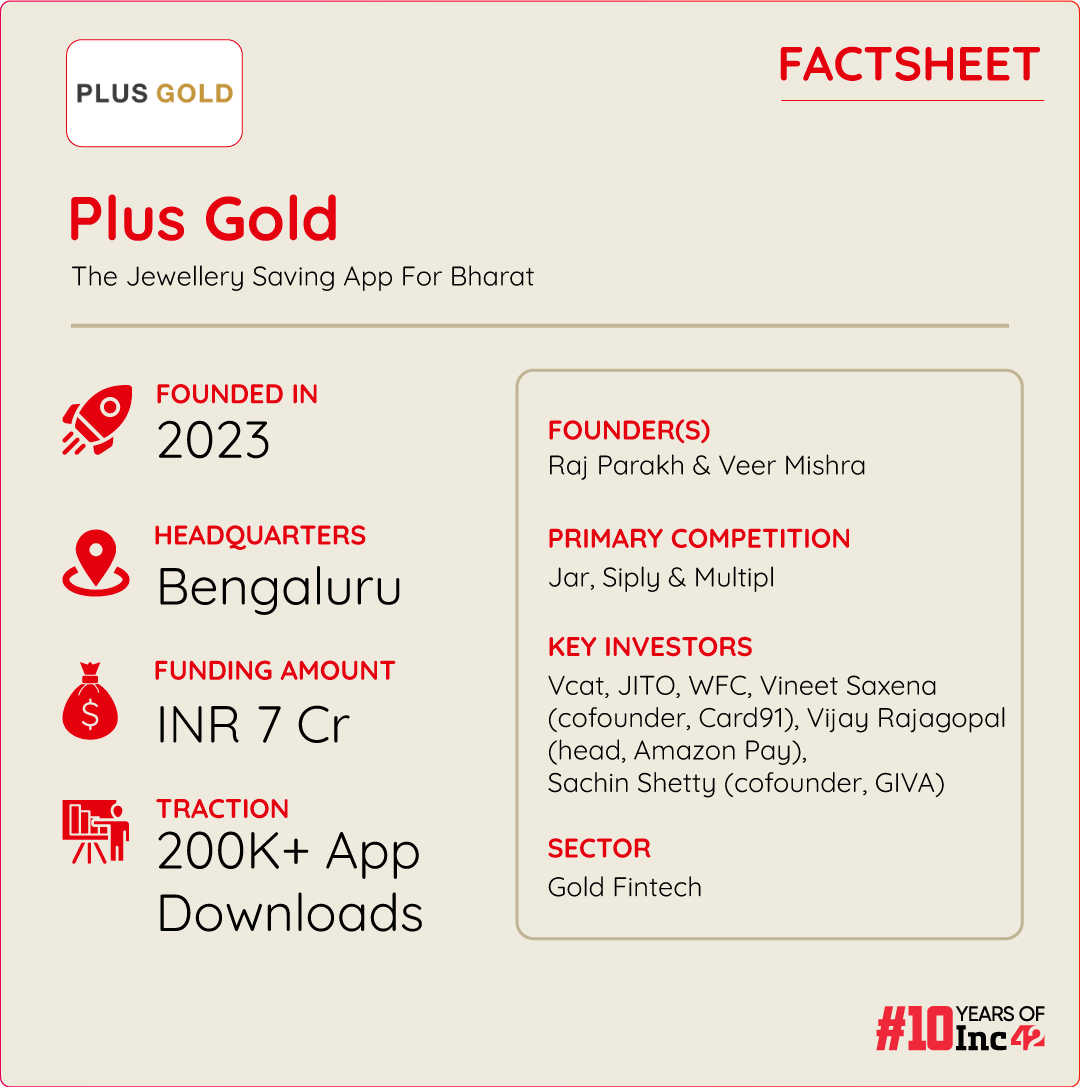

The fintech app’s 350+ jeweller partners operate in 500+ cities and have undergone stringent screening for guaranteed asset quality

Plus Gold promises an 18% net return on each purchase and also offers a gold leasing service

It recently roped in actor Sonakshi Sinha as an investor and brand ambassador

India’s affinity for gold jewellery has been well-known for ages. However, the recent spike in gold prices reduced the country’s consumption to 562.2 tonnes in 2023, a 6.39% dip from 600.6 tonnes of gold as jewellery in 2022, according to the World Gold Council. On the other hand, China raced to the top last year, consuming 630.2 tonnes of gold as jewellery.

But away from the discretionary purchase of jewellery, this precious metal is rapidly gaining traction in India as an asset class. There has been an upsurge in the consumption of bullion (bars, coins and ingots) and investments in sovereign gold bonds (SGBs) since 2022. In fact, the December quarter (Q3 FY24) saw a record rise in SGB investments, reaching 12.1 tonnes at a little over INR 7.5K Cr.

Aware of the country’s indelible link with the yellow metal, serial entrepreneurs Raj Parakh and Veer Mishra launched Plus Gold, India’s first-ever fintech platform that ensures convenient and secure gold and gold jewellery accumulation by curating and digitalising the entire process. The aim is to democratise gold investments for all, especially the 160 Mn homemakers across Bharat, with little or no exposure to active wealth creation.

Undoubtedly, Bengaluru-based Plus Gold caters to a target audience served by very few fintechs, even though India is the second-largest gold-consuming country. Besides, a 2024 survey indicates that 14% of Indian women still prefer gold as an investment option over real estate and equities.

The fintech app (available on iOS and Android) offers hassle-free gold buying online and focusses on gold purity and asset security. Its 350+ jeweller partners hailing from Mumbai, Bengaluru, Udaipur and more than 500 other cities have undergone stringent vetting before they were onboarded. They also provide exclusive discounts and enable seamless integration of physical and digital gold purchases as and when required. In essence, a buyer can retrieve digital gold in a physical form.

Users can save on the app akin to a traditional jewellery saving scheme (10+1) type. They can buy lump sum gold in one go or save in small amounts in desired frequencies like daily, weekly or monthly. Users can also earn 10% IRR (internal rate of return) per annum on their savings. Additionally, one gets up to 5% discount from the jewellers on the platform while redeeming their gold in the form of jewellery.

Plus Gold offers a gold leasing service and buyers opting for it can earn an extra 5% annual interest on their investments. The gold purchased and leased can be redeemed anytime as cash, gold coins, or jewellery.

All gold assets, physical and digital, are insured and securely stored with Augmont, a digital gold provider and the technology arm of RiddiSiddhi Bullions (RSBL). It is a key partner of Plus Gold, ensuring fair trade and transparent pricing.

The fintech startup promises an impressive 18% net return on each purchase – a typical 11% price appreciation of gold, 5% jeweller discount and 5% value addition from Plus Gold. In effect, the customers receive 1 gram of additional gold for every 10 gram of gold purchased. This is significantly higher than traditional gold savings schemes or the average stock market returns of 10% annually, often drubbed by inflation.

Jeweller partners benefit from a large customer base and hassle-free gold conversion from users’ savings. By June 2024, the startup aims to provide them with paid marketing tools to help enhance their presence on the platform. It will also introduce the sale/exchange of old gold by October-December.

By February 2025, it will run a pilot for gold loans, a market expected to reach $150 Bn globally by 2030. In India, loans against gold jewellery surged 17%, amounting to INR 1.01 Lakh Cr as of January 26, 2024. Gold loans are largely driven by the increasing adoption of fintech platforms and growing awareness of gold as an investment/monetisation option.

Plus Gold secured INR 60 Lakh at Shark Tank Season 3 and raised INR 7 Cr from a clutch of investors such as Venture Catalysts, Jain International Trade Organisation and WFC. Its revenue comes from B2B (jeweller partners) and B2C (gold shoppers) commission fees – 2% on each transaction from both buyer and seller. The platform is free for users and jewellers.

The startup has crossed more than 200K+ downloads and has recorded 400% month-over-month transaction growth since December 2023. It recently roped in actor Sonakshi Sinha as an investor and brand ambassador.

How Plus Gold Carved A Niche By Talking With 3K+ Women, Working On Three PMFs In 18 Months

Unlike precious stones like diamonds, sold by a few industry juggernauts with impeccable quality guarantees, gold has a somewhat opaque supply chain and faces issues related to karate, durability and overall quality. Essentially, the integrity of gold assets is a must-have to win the trust of people intrigued by the yellow metal. Which meant discussing the pros and cons with target customers looking to invest in a safe-haven asset class.

Parakh and Mishra, close friends for the past eight years when they started working in retail, wanted to create an app their mothers could use for hassle-free gold/jewellery savings. They started their research by speaking with more than 3K women within two months and soon realised that few fintech companies had ever targeted Indian homemakers to help them reap such financial benefits. So, the duo left their jobs to set up Plus Gold, registered as Finshakti Solutions in May 2022.

They developed the Plus Gold model as a minimum viable product (MVP) three times in 18 months to reach a viable product-market (PMF) fit and win consumer trust. The founders are unfazed by the number of pivots, saying it is the way to build a solid business foundation. Even after spending three years in the hustle, startups may not reach PMF or launch an effective go-to-market strategy because they have not pivoted in time.

But finding the right PMF at the right time was only the first step. There were challenges galore, and they needed to bring together consumers, capital and brand-building efforts to build a gold-savings ecosystem.

Coping with the lack of consumer confidence: Initially, people were cautious about an app developed for homemakers to save their money and invest in their choice of jewellery. According to the founders, the annual market for gold savings could be as big as INR 1 Lakh Cr in India. However, the trust factor wilted after several retailers either collapsed or wilfully shut down their businesses to scam customers in the absence of stringent regulations and standardised ROI across gold savings schemes.

The platform demystified the gold-buying process to change the old order and devised quality checks required for big-ticket purchases. These include physical visits to outlets, analysing customer feedback, verifying company-level information and more. Plus Gold says it only partners with brands that can provide adequate data so that vetting can be done to optimise credibility and customer satisfaction.

Building a trustworthy network fast: The startup is part of several jewellers’ associations and federations, helping it build a robust network of trust. Most new jewellers come on board based on the recommendations from existing jeweller partners or customers. The fintech has set up pan-India teams and claims to partner with a new jeweller every four hours.

“Our goal is to build and empower a 10 Mn-strong user community underpinned by a validated business model, a network of trusted jewellers and diversified revenue channels for long-term success. This ecosystem will continue to expand significantly over time,” the founders said.

Gaining value beyond funding from industry stalwarts like VCats: No surprises there when the fintech startup faced a capital crunch in the early days, given the global funding freeze and the aftermath of the Covid-19 pandemic, a worldwide health crisis significantly stalling business growth. However, Parakh and Mishra had valuable experience as entrepreneurs, and friends and former colleagues who were confident about their capabilities came to the rescue.

A chance encounter with a mutual connection also helped them raise INR 1 Cr from Venture Catalysts, an integrated incubator/accelerator helping build the startup ecosystem. Since 2016, VCats has backed more than 110 startups across sectors.

“Its trust in our vision, the strategic guidance it provided and its industry connections have been the driving force behind our rapid scaling. VCats’ support goes far beyond the quantifiable and focusses on intangibles essential for business success,” said Parakh.

When asked about funding now that investor confidence is up, the duo sounded cautious. “Given the current market landscape, we are not building Plus with a dependency on funding. But we are open to good deals that can accelerate our impact across India.”

Driving brand awareness: Plus Gold primarily relies on digital marketing to acquire users, but since its appearance on Shark Tank (Season 3), it has seen a surge in brand awareness. The startup is now revisiting and reworking its primary (digital) and secondary (offline channels including events) channels for customer acquisition.

“We raised smart capital to create our mote in our target industry. We stayed lean, went back to the market every quarter and failed fast [read pivoted] to build a robust model, thus increasing the chances of our success,” said Parakh.

Will Plus Gold Bring The Sheen Back To Gold Savings?

Historically, gold is considered a valuable asset class due to its liquidity and effectiveness in hedging against inflation and deflation. However, the physical form of this commodity, especially jewellery, holds more sentimental and social value than it does as a hard-core investment option. This scenario has changed with the rise of new capital market investment products like digital gold, sovereign gold bonds, and physical gold-backed exchange-traded funds (ETFs).

The global ‘gold rush’ receded slightly in recent years for two reasons. First, it had a low annualised return of 5% or so from 1974 through to 2022. Second, the Federal Reserve (the Fed) hiked interest rates on fixed-income instruments, making them more attractive.

But the bullion market made a strong comeback, racing to INR 67K/10g in March 2024. It may accelerate further based on geopolitical conflicts, a weakening dollar and falling interest rates on fixed-income investments at home. More importantly, the rising value of the yellow metal has sent central banks and hedge funds scurrying after the asset class once again. According to the WGC, central banks worldwide purchased a record 1081.9 tonnes of gold in 2022 and 1037.4 tonnes in 2023.

The gold rally indicates that the new crop of gold savings startups, such as Plus Gold, Jar, Siply and more, are bound to attract retail customers looking for bumper returns.

But what sets Plus Gold apart is the unique convenience of buying digital and physical gold via affordable EMIs. This not only ensures hassle-free transactions and high liquidity but also protects and increases a consumer’s portfolio value and provides access to a diverse marketplace.

In contrast, investing through legacy banks/FIs can be cumbersome. It requires a lump sum down payment equivalent to the gold value, has stringent upper limits and long lock-in periods (a minimum of five years). Moreover, returns are pretty low, an annual interest rate of 2.5% in case of sovereign gold bonds issued by the RBI.

Private jewellers offer EMI-based gold-buying schemes, but these also lack flexibility. One can only buy from a specific jeweller instead of browsing through a varied marketplace and may have to pay exorbitant prices. Also, missing a single EMI may lead to the forfeiture of the benefits accrued.

According to investment professionals, a high-value commodity like gold needs staggered buying to avoid short-term volatility. Gold gains can only boom when buyers have the much-needed flexibility to choose their timing and price. Otherwise, it will invariably turn into a lead weight in one’s portfolio.

Plus Gold and its ilk are offering small-time gold investors that rare opportunity to choose their product, price and pace. Hence, it should be a win-win for the gold savings fintech, its users and jeweller partners in the long run.

Ad-lite browsing experience

Ad-lite browsing experience