Startup valuations are undergoing a shift from traditional reliance on financial metrics to a greater emphasis on non-financial indicators

Limited or negative revenues in startups have led to the adoption of non-financial metrics to assess market interest and potential, helping them understand scalability and sustainability

Relying heavily on these metrics has allowed startups to secure funding but has raised concerns about the long-term profitability and viability of high-profile companies, leading to the unicorn complex

Valuing a business has long been regarded as a combination of art and science, as Warren Buffett once famously stated. Traditionally, valuations relied on assessing a company’s present financial performance and projecting its future success.

Enterprise Value (EV) was commonly determined using multiples of economic metrics like EBITDA and revenue, where higher metrics and lower net debt translated to more favourable market valuations. However, the landscape of startup valuations has undergone a significant shift, due to the prevalence of limited or negative revenues associated with such companies.

This has led to non-financial metrics taking centre stage in determining startup valuations, challenging the conventional dependence on financial indicators.

The Shift To Non-Financial Metrics

While the business ecosystem continues to evolve, the traditional reliance on financial metrics for establishing valuations has shifted. Companies are now placing greater emphasis on non-financial indicators, such as the number of subscribers, conversion rates, user retention rates and probable customer lifetime value.

This is especially evident in the case of startups with minimal or negative revenues, which are increasingly relying on non-financial metrics. These metrics provide insights into user engagement, customer acquisition, and market potential, offering a holistic view of a startup’s growth prospects.

By emphasising these metrics, startups analyse and understand their ability to attract and retain customers, even if their financial performance is not yet substantial on paper. However, this change has allowed startups to project returns that may or may not materialise, potentially affecting their long-term sustainability and profitability.

Assessing Market Interest & Potential

In an increasingly competitive and fast-paced world powered by innovation, financial performance metrics only tell part of the story. Non-financial metrics allow startups to gauge market interest and potential, providing valuable insights into the scalability and sustainability of their business models.

It’s a paradigm shift that empowers startups to move beyond the confines of traditional financial metrics, enabling them to truly connect with their target audience and build long-lasting relationships. Metrics like customer acquisition cost (CAC) and customer lifetime value (CLTV) enable startups to assess the effectiveness of their marketing and sales strategies and determine if they can generate sufficient revenue from long-term customer relationships. Additionally, metrics related to user engagement and product usage patterns help startups understand the value they deliver to customers and identify areas for improvement.

Navigating A New Set Of Challenges

While non-financial metrics offer valuable insights into a startup’s growth potential, they also present challenges that have to be navigated. Startups may face difficulties in accurately measuring and predicting these metrics.

For instance, companies could promise investors that 60% of their subscribers would become customers. To back up their claims of successful conversion rates of their subscribers into paying customers, they will most likely offer free trials and heavy discounts, attracting the desired number of subscribers and driving up their valuation.

However, the crucial aspect here lies in retaining these customers, as initial sign-ups don’t always guarantee long-term loyalty. In order to achieve this, they will further offer additional incentives with expanded services and manage to retain around 40% of the initial client base.

With this achievement, they seek higher valuations, asserting that despite a reduced number of loyal customers, the value of their product has increased significantly. The argument therein is that this enhanced product value will lead to greater sales, leveraging the concept of customer lifetime value, which in turn will generate profits in the long run.

The Unicorn Complex

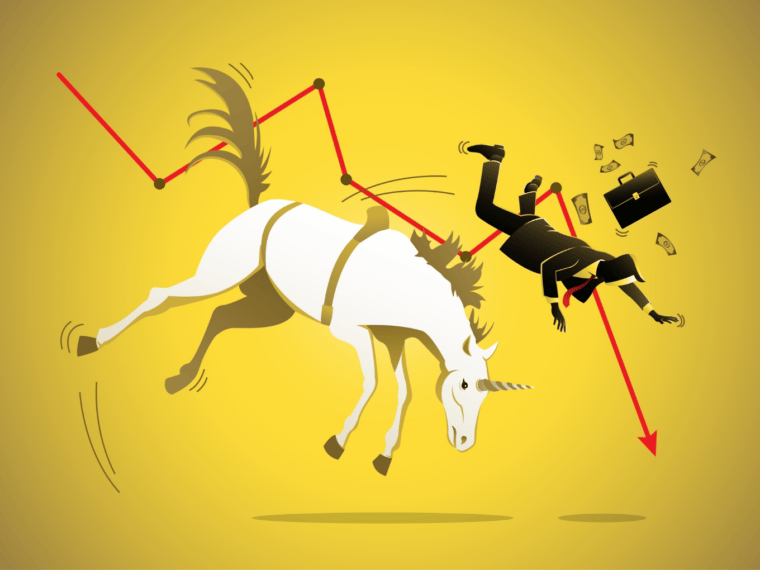

While this approach has allowed startups to secure funding, it has also led to challenges for high-profile companies that were once hailed as trailblazing unicorns.

These companies, previously considered revolutionary disruptors, have also struggled to achieve profitability or deliver on promised financial returns. Relying heavily on valuations based on non-financial metrics, which are highly variable, creates an environment where funds are obtained without a guaranteed path to sustainable financial success.

The allure of unicorn status may overshadow the reality of financial viability, raising concerns about the long-term prospects of these companies.

What The Game Of Multiples Means For Startups

Undeniably, startups must confront the intricacies of precisely measuring and forecasting metrics. It is a delicate balance that startups must master to ensure their metrics reflect the reality of their growth potential.

While non-financial metrics provide a vision of market interest and potential, financial metrics such as revenue growth, profitability, and cash flow act as the anchor of stability. It is the fusion of science and art—the financial and non-financial metrics, that unlocks a more comprehensive and accurate assessment of a startup’s value and potential.

Ad-lite browsing experience

Ad-lite browsing experience