Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Last weekend witnessed a glitzy startup event. In many ways, this event was like every other startup event in India — founders of “unicorn” startups dispensing gyaan to the rest of us mortals interspersed by some disinterested folks featuring in hackneyed panel discussions on done-to-death topics in front of an uninterested audience who had suddenly rediscovered the hidden joys buried deep in their smart phones.

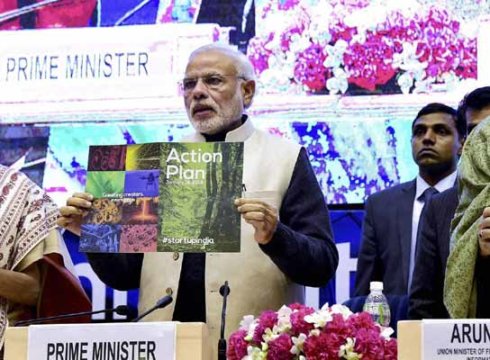

There was one difference though — the final keynote of the day was delivered by none other than the Prime Minister of the country where he drew up what was purported to be an action plan for Indian startups.

Predictably, this was followed by universal approbation and politically-correct reactions from our startup luminaries who declared this as a momentous day only marginally less important than the Second Coming.

Out of these, one quip stood out for me.

Vijay Shekhar Sharma, the founder of Paytm had this to say:

The announcements by the government were more than what a normal startup would have expected

I am not quite sure what this “normal startup” that Vijay alluded exactly is but if I were to hazard a guess, it probably means an average joe workhorse startup — one that is far from being a unicorn (like the one that Vijay himself runs) and has no rockstar founders, hedge-fund investors or nose-bleed valuations to boast of.

As it turns out, I run a company that qualifies precisely for being called a “normal startup”.

And for what it’s worth, these are my expectations around the aspects addressed in the announcements:

I Don’t Expect To Be Subject To A New “Permit Raj”

Apparently, to decide who can avail of some of the envisaged benefits, an Inter-Ministerial Board will be set up that will get to decide if a particular company is a startup or not.

As those of us who grew up in the “licence raj” pre-liberalization era will readily testify, requiring to be gated by a government-sanctioned body to avail of any benefits or privileges is the first step down a slippery road that leads to abuses and rent-seeking behaviours of all kinds.

I have no desire or inclination to run down the “permit raj” gauntlet again.

If at all, a set of gating criteria is unavoidable, they should have been simple and empirically demonstrable rather than having to depend on the whims of a board of any kind.

I Don’t Expect The Government To Become A VC Or LP That Chooses Winners

The government has announced a corpus of Rs. 10,000 crore structured as a “fund of funds” that will be disbursed over a period of four years.

I am not sure if this is a fresh initiative or the same Rs.10,000 crore fund that was announced two years back — and of which, I have heard precious little since.

In any case, I have no idea why the government feels that it needs to support the Indian startup ecosystem with direct funding. It is not as if there is a dearth of capital for startups currently — billions of dollars of VC money was invested last year and most people in the know will tell you that there is 10X more money that is waiting on the sidelines to enter the country. All of these funds are run by professional investors who have a well-informed hypothesis on why they should invest in India and specifically in chosen Indian startups.

But it is, admittedly, high-risk capital — a high-stakes game of startup roulette operating under an extreme power law (a small percentage of “winners” will end up delivering more than 90% of the returns).

This is a game that the government has no business playing. Not just because it doesn’t have the skills or risk appetite of professional investors but also because it shouldn’t be in the business of choosing winners in any form — something that yet again can leads to all kinds of rent-seeking behaviour and cronyism.

I Don’t Expect Tax Waivers Or Hand-Outs For My Startup Or My Investors

Two of the announcements made are around taxation — firstly, startups who are vetted by the Inter-Ministerial Board are exempt from paying income tax for three years and secondly, any long-term capital gains will be exempt from tax if you invest it into the government’s “fund of funds”.

I am really curious what made the government to offer tax exemption —does it feel that Indian startups are incapable of competing on their own without these kind of sops?

As far as I know, no self-respecting startup entrepreneur would expect this type of hand-out. I, for one, would have no problems with paying the stipulated taxes as mandated by the law of the land in which my startup operates.

If this is an attempt to recreate the IT-services boom which ostensibly benefited from zero tax on export income, then it is an ill-considered and retrograde move.

Tax incentives artificially mask the inadequacies of the companies who require such hand-outs and this move gives out a signal that startups are not capable of competing in a free market without this kind of government support to boost their margins and returns.

Also, as and when these incentives play out their life cycle, it leads to drastic pushbacks and normalizations that defeat the basic purpose of the original incentive.

Finally, tax incentives inevitably lead to distortions and abuse — while “good” startups require no such hand-out from the government, “bad” startups — those set up to explicitly exploit these types of schemes for nefarious purposes such as money-laundering — will prosper. A classic case of adverse selection.

As far as exemption on capital gains go, this is again an artificial inducement that is more likely to throw up bad results than good — if people invest in startups simply because they can save on their capital gain tax, it is a very bad reason to invest! Angel investing is not for all and certainly not for the faint-hearted.

I Don’t Expect The Government To Make It Easier For Folks To Startup

Under the proposed action plan, it would apparently be possible for folks to startup in a single day through a mobile app.

I am a loss to understand why this is useful or valuable and see this primarily as showboating (why a mobile app for instance?).

Is this an attempt to improve our ranking in the “ease of doing business” index?

Singapore is currently ranked one of the top-ranked countries in this index and it takes two-three weeks for you to completely set up your startup there. This is not significantly different from the time taken in India — what’s more, most of this can easily be outsourced and doesn’t really take up much of the entrepreneur’s time.

In any case, this is an activity that a startup has to go through just once in it’s lifetime — contrast this with the recurring reporting overheads that a startup has to face thereafter with assorted tax and labor departments which are far more taxing and cumbersome.

Finally, on a somewhat philosophical note, I am not quite sure why starting up should be a trivially easy operation — having some “pain” in this aspect is actually a good thing as it could filter out some of the folks who are not really cut out to be entrepreneurs in the first place! The current system is therefore a positive aspect as it is self-selecting.

I do agree that it should be easier to shut down companies but from what I understand, a bill addressing this is already pending before Parliament and the action plan doesn’t offer anything new in this regard. Also, this step is more useful to investors than to entrepreneurs themselves, so it is somewhat orthogonal to a plan that is targeted towards startups.

The Others…

Now I have been running startups for a while and so, some of the points mentioned don’t apply to me as they target newbies.

I am not convinced that the government operating startup hubs and supporting incubation centers is a step in the right direction — the bottleneck in enablers like this has never been around infrastructure but rather on having the right mentors and guides. Nothing in the announcement contours suggested that this key gap is the one that the government is cognizant of attempting to fill.

For other announcements — such as self-certified compliance and subsidized patent filings, the devil is in the details and it would be premature to judge these one way or the other today.

What I Actually Expect…

So, as a “normal startup”, what do I actually expect?

This is what I would expect:

Boost sentiment by having a predictable policy regime

A lot of startups in my peer group have re-domiciled to Singapore. Nothing that has been announced in this plan will make any of these companies to reconsider the move.

These startups have moved to Singapore primarily because global investors see India as an unpredictable place to do business. Unfortunately, these sentiments are well-founded.

Take the illustrative example of a global major that acqui-hired a small Indian startup for what was essentially a rounding error in their balance-sheet — the actual acquisition was dragged on for over a year and the amount stuck in a holding account as the acquirer was made to run from pillar to post to explain why the value of the IP acquired was fair. This global major has now sworn off acquiring any more Indian startups!

Or take the example of companies like Flipkart that have had to migrate to Singapore because the policies around FDI in ecommerce is murky and/or inimical.

Unless the government address these structural issues around business and taxation policies at a fundamental level not restricted merely to startups, the state of things is unlikely to change.

Be a proactive customer to Indian startups

Rather than being a defensive regulator, the government should consider morphing into a proactive enabler that supports Indian startups — for instance, by being a customer for the products and services offered by us. The action plan does mention a few steps in this direction but the patronage mentioned extend only to manufacturing firms who are already in line to leverage the 20% procurement mandate for PSUs and others.

Double down on building out internet connectivity infrastructure

While a large portion of the Indian populace have come online over the last few years, there are still large swathes who are not connected. If large companies like Flipkart could be created on the back of 100 million Indians online, imagine how many behemoths could emerge from 500 million Indians being online!

Epilogue

As someone who runs a normal startup in India, I already am all too aware of the myriad risks and challenges of trying to build a world-class company out of here.

But none of this fazes me.

As an Indian, this is something that I signed up for with my eyes fully open.

I see the government’s announcement as a signal that it recognizes Indian startups as an engine for innovation and non-linear growth and am grateful for this “intent”.

That said, I would love to see the policies and execution around this intent to be done on the back of substantive discussions with Indian startups and representative bodies like iSpirt.

Only then can this intent translate into something meaningful beyond a superficial fest of circle-jerking and premature declarations of victory.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.