Raising funding can be a time-consuming and competitive process and may require significant effort and preparation

Once you've identified the most suitable funding sources for your startup, the next step is to navigate the fundraising journey effectively

Fundraising isn't just about raising capital; it's about building relationships, demonstrating resilience, and positioning your company for long-term success

Startup funding is the backbone of entrepreneurial ventures that fuels the growth of a business from its inception to becoming a profitable venture. Securing startup funding involves identifying and acquiring the financial resources necessary to bring your idea to market.

At every stage of your startup’s growth, funding is essential to fuel development and progress. While some founders may choose to self-fund to maintain control and avoid debt, many turn to external sources like private equity platforms, and venture capitalists for the capital needed to grow.

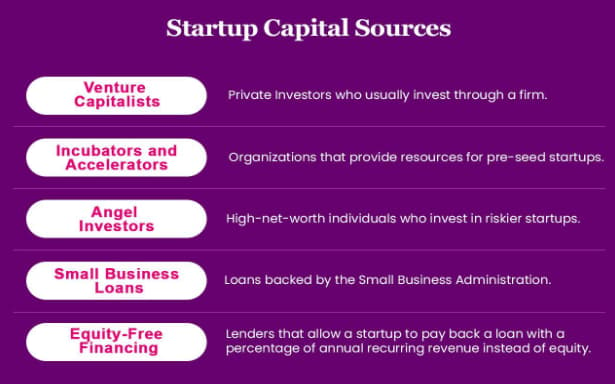

There are various sources of funding available to startups, broadly categorised into equity and debt. Equity funding includes options like bootstrapping (using the founder’s savings), angel investors, seed funding, and venture capital.

Industry experts often advise founders to start with equity funding, such as angel investors and friends & family, in the early stages and then consider debt funding once the company has a stable cash flow to cover interest payments.

How To Facilitate Fundraising For Startups?

- Bootstrapping: This is also known as self-funding, which is when the entrepreneur invests their funds into the business. This can include using personal savings, loans, or credit cards.

- Friends and family: Many entrepreneurs turn to friends and family members to help fund their startups. This can involve asking for loans or investments, often with less stringent requirements than formal investors.

- Accelerators and incubators: Accelerators and incubators are programs that provide funding, mentorship, and support to startups in exchange for equity. They often offer additional resources such as office space, legal and accounting services, and networking opportunities.

- Angel investors: Angel investors are typically high-net-worth individuals who provide early-stage funding to startups in exchange for equity in the company. They often bring experience, contacts, and expertise to the table in addition to funding.

- Venture capital: Venture capitalists are professional investors who typically provide larger amounts of funding to startups that show significant growth potential. They often take an active role in the company and may require a seat on the board of directors.

Each of these funding sources has its benefits and drawbacks, and entrepreneurs should carefully consider which type of funding is best for their particular business and stage of growth. It’s also important to note that raising funding can be a time-consuming and competitive process and may require significant effort and preparation.

How To Facilitate Fundraising Specifically For Pre-IPO companies?

Pre-IPO companies are mostly profitable and in growth or expansion mode. Investment bankers and merchant bankers play a key role in facilitating fundraising at this stage.

- Venture capitalists (VCs): VCs typically invest in growth-stage startups, starting from Series B rounds. They provide substantial funding and expertise to fuel further expansion. To get fundraising opportunities, collaborate with VCs focused on growth-stage investments that share your company’s vision and growth trajectory. Venture capitalists generally caters to tech companies.

If you are seeking funding for traditional businesses, consider exploring investments from investment bankers, merchant bankers and private equity firms that provide fundraising to tech and non-tech companies.

- Investment banking platforms: Companies planning for IPO (PreIPO) should explore Investment Banking Platforms. Investment banking platforms connect companies with private investors. Look for platforms with a wide investor base, like those with over 10,000+ investors. Seek out reputable investment banking platforms specialising in pre-IPO fundraising. These platforms offer access to a broad network of high-net-worth individuals, Family offices, and institutional investors.

- Merchant bankers: Engage experienced merchant bankers who specialise in capital market transactions. They provide valuable insights into market trends and investor sentiments. For traditional businesses, merchant bankers assist in fundraising through SME IPO or mainboard IPO. They help navigate regulatory requirements and ensure a successful offering.

- Private equity firms: Explore partnerships with private equity firms seeking opportunities in fundraising. Private equity investment can provide the necessary capital for expansion and strategic initiatives. They evaluate potential companies based on their track record, sector expertise, and investment thesis.

- Strategic investors: Identify strategic investors who can add value beyond capital infusion. Strategic investors may offer market access, distribution channels, or technological expertise. Connect with strategic investors that align with your company’s long-term objectives and growth strategy.

Once you’ve identified the most suitable funding sources for your startup, the next step is to navigate the fundraising journey effectively. This involves developing a clear fundraising strategy, articulating your value proposition to potential investors, and building relationships with key stakeholders in the investment community.

Whether you’re pitching to angel investors, approaching venture capital firms, or exploring alternative funding avenues, honing your pitching skills and refining your business plan are essential for capturing investor interest and securing funding.

Conclusion

Focus on strong business fundamentals. Whether it’s a startup or a Pre-IPO company, a strong business model, pitch deck, valuations, equity restructuring and financial reports are essential.

Equity restructuring should be well-documented to attract potential investors. Both startups and Pre-IPO companies can attract funding quickly with the right preparation. By having a robust business model and engaging with the right investment partners, companies can accelerate their growth journey and unlock new opportunities.

Fundraising isn’t just about raising capital; it’s about building relationships, demonstrating resilience, and positioning your company for long-term success. It is a critical enabler for entrepreneurial success as you navigate the fundraising landscape, and explore the endless possibilities that lie beyond the beaten path.

Ad-lite browsing experience

Ad-lite browsing experience