SUMMARY

Cash on delivery has been an important catalyst for the initial ecommerce boom in India, and it is not likely to go away when the D2C subsect is estimated to cross $300 Bn in another seven years

Although digital payments are growing at a fast clip in India, a whopping 62% of online shoppers preferred COD over other payment methods in 2022

As D2C brands want to tap into the next billion ecommerce users, they need to enable early cash remittance to solve the cash flow lag resulting from COD orders

Familiarity, convenience and trust (or the lack of it) are the three major reasons why cash on delivery (COD) is still the preferred mode of payment among Indians shopping online. This is especially true about the burgeoning Tier 2 markets and beyond, the epicentre of B2C ecommerce growth in post-pandemic India. But does it also signal the end of India’s cash-on-delivery habit?

Ideally, it should, given the large-scale adoption of smartphones and widespread internet access that did away with the knowledge hurdles. Today, Indian consumers are increasingly using digital payments, and the country witnessed record UPI transactions in value and volume in 2022 at INR 125.95 Lakh Cr and 7,404.45 Cr respectively, as per Inc42.

Additionally, new-age fintechs like Paytm, PhonePe, Pine Labs and their ilk are constantly championing the techvantage of digital payments and incentivising people to use their platforms.

But here is the biggest anomaly that can pull down ecommerce retail.

Cash Is Still King And COD Rules Ecommerce

A 2022 Statista report showed that a whopping 62% of online shoppers in India still preferred COD over other payment methods. What this likely proves is that despite online transactions becoming faster and more secure, we still live in a low-trust society, and Indian consumers prefer to be safe than sorry. They worry about online frauds (2,331 cases worth INR 87 Cr in the first six months of FY23), damaged goods and the long-drawn-out refunding processes. Worse still, many do not have credit/debit cards, especially in rural areas, which means cash is still king in the hinterland.

Simply put, COD will not go away anytime soon, although customers are getting more comfortable with digital payments. Industry experts also think this can be generational and may take another 10-15 years to move away, similar to other markets like Japan. Others believe COD may stay here longer due to its historical context. It has been an important catalyst, triggering the initial ecommerce boom in India, and no immediate shift in consumer mindset is likely to happen.

Do D2C Brands Benefit From COD?

Although COD is highly advantageous for buyers due to secure and easy transactions (they can even change their mind about payments if products fail to meet expectations), direct-to-consumer (D2C) brands, a subsect of the broad B2C ecommerce, may win several brownie points from this payment mode.

“The COD option plays a vital role in building brand trust,” emphasised Gaurav Mangla, cofounder and CEO of Pickrr, a Gurugram-based third-party logistics (3PL) player. As this process puts all risks on brands/sellers and none on the buyers, it tends to boost customer confidence and enhance the trust factor, quite an achievement for D2C players aiming to grow their market.

When brands build trust through credibility and integrity, they also build customer loyalty, a killer strategy to enable sustainable growth without spending a lot on customer acquisition costs (CAC). In addition, it will ensure a wider reach and a larger consumer base in no time, help clock higher impulsive buying and thus ensure better cash flow, instead of the routine low-value transactions one associates with COD.

“Cash on delivery can further help brands avoid risks like fraudulent buyer identity, stopped payments and card disputes,” said Mangla.

Too Many ‘Cons’? How 3PLs Can Help

Despite the ‘pros’, cash on delivery (also known as payment on delivery or POD) has many disadvantages, which can put brands in a tight spot. However, skipping this option altogether will not work for D2C brands eyeing the $300 Bn India opportunity, as they must cater to ‘Bharat’ shoppers with a penchant for cash payments. Otherwise, they stand the risk of losing out on a big slice of the ecommerce pie.

“Although digital payments are fast and efficient, almost all of our customers (read D2C brands) keep COD as one of their payment options for this reason,” added Mangla.

On the flip side, one faces the snowball effect of COD that can affect revenue, profit and long-term growth. According to Mangla, one of the key risks includes a high rate of return to origin (around 30% RTO loss is estimated), leading to double shipment charges, refund issues, heightened risks of in-transit damage and pending insurance claims if goods are returned too frequently. Then there will be delayed remittance of cash payments by logistics providers (settlements can take around 5-6 days, as per industry estimates) as well as the reconciliation of goods versus the cash received.

The question is: How can D2C brands navigate this trouble-torn path to achieve sustainable growth?

One of the ways to flourish despite the COD impact and ensure seamless customer experience (CX) is to get into partnerships with new-age logistics enablers like Pickrr and its ilk.

In fact, Pickrr claims to leverage AI-ML tools to analyse millions of data points and derive actionable insights to provide best-in-class inventory management, shipping, warehousing and other value-added solutions at affordable rates to help its clients (read D2C brands) reduce overall costs and maximise efficiency. More importantly, it is now a joint effort on the part of the brands and their logistics partners to offset the disincentives of COD.

How Prompt Cash Remittance Can Address Cash Flow Issues, Drive Growth

Faced with a harsh funding winter brought on by many macroeconomic and geopolitical factors, D2C brands (or any business, for that matter) are compelled to extend their runway and boost cash flow to ensure adequate operating capital.

In a 2021 Statista survey, 38% of startup founders/owners cited ‘running out of funds’ as the top reason for shutting down the business. With COD orders making a significant chunk of D2C sales, it is not surprising that CXOs would want to maintain a steady cash flow from these transactions.

When it comes to COD orders, shoppers hand over the cash to delivery executives upon successful order fulfilment. But unlike digital payments, where D2C brands receive the amount in real time, payments collected by logistics partners can take up to 5-6 working days to be remitted, leading to a severe cash crunch.

Add to that the additional shipping costs and handling fees incurred on RTOs and how they impact the overall cash flow. For brands, these orders do not materialise in sales despite the high CAC, and there has to be a considerable lag in reprocessing and reselling the returned goods. Unsurprisingly, online sellers try to minimise COD orders or incentivise their customers to convert those to prepaid ones by offering discounts and other freebies.

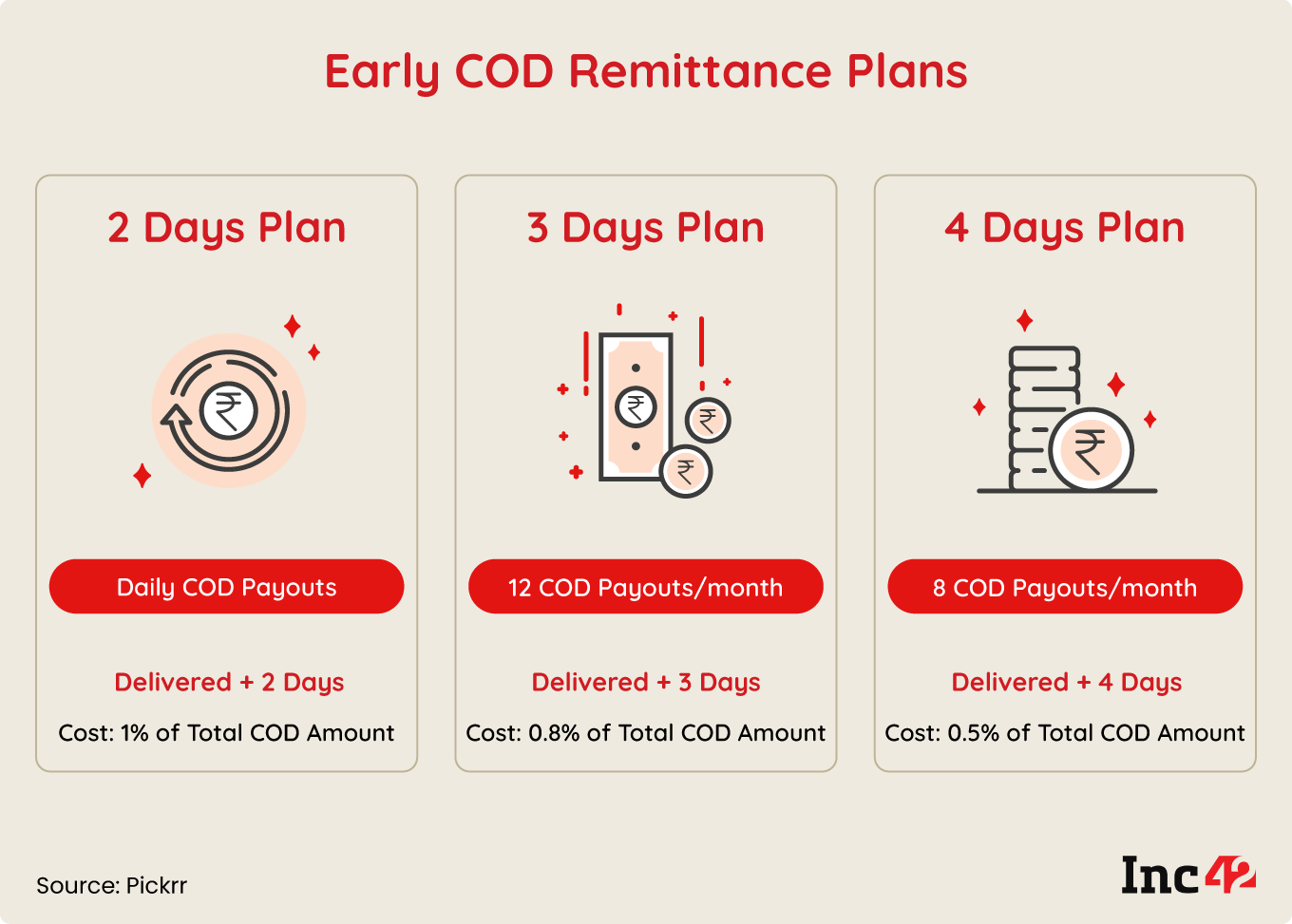

To help D2C brands overcome cash flow challenges with COD payments, Pickrr has introduced a value-added service known as Early COD remittance. Online sellers going for this service can choose from three options where COD payments are remitted daily, three times a week (12 payouts per month) or twice a week (eight payouts per month). Pickrr’s charges for the same are 1%, 0.8% and 0.5% of COD amount respectively.

“This helps the brands maintain a steady cash flow, freeing up founders to focus on building and growing their businesses,” said Mangla.

Interestingly, most brands or their logistics partners now charge a cash-handling fee when customers opt for COD. Take, for instance, brands like The Souled Store or Max Fashion. As of January 2023, the fees levied by these two brands on a COD order stood at INR 25 and INR 49, respectively. Ecommerce behemoth Flipkart also announced late last year (2022) that it would levy INR 5 per COD order, according to a media report. With consumers always looking for free shipping as an incentive to buy from a particular D2C brand, these additional fees can prove to be a dampener. On the other hand, it can push online shoppers to opt for digital payments. For context, online payments can incur fees/commissions of 2-3%, for merchants/ brands, charged by payment gateways.

Why COD Is Integral To Capitalising On The Next Billion Users

Already a major force among global digital economies, India is likely to rise to the top in the coming years, driven by increasing internet and smartphone penetration. According to Inc42 estimates, India could be home to 1.3 Bn+ internet users by 2030 and 500 Mn online shoppers, providing impetus to the $300 Bn D2C opportunity.

As D2C brands look to tap into the massive markets across Tier 2 regions and beyond, COD can pave the path for millions of new but apprehensive shoppers keen to give ecommerce a try for the first time.

“If I have to quantify it, I would say the ratio of COD and digital payments is 60:40,” said Mangla. “The adoption of digital payments is growing at a fast clip, but COD as a feature is here to stay, although its contribution (as a percentage) will decline.”