The massive layoffs and dwindling funding have announced the onset of the Indian startup winter

The macro perspective of the funding winter is imperative for the long-term growth of the startup ecosystem

By remaining focused, adaptive, and tenacious, early-stage startups can not only survive but also thrive through a funding winter

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

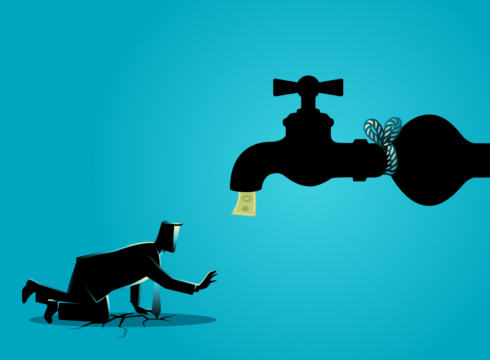

It is sweltering out there, but winter has set in for the startup ecosystem. The world has undergone a transformation in the span of just 100 days. The massive layoffs and dwindling funding have announced the onset of the Indian startup winter. After two years of skyrocketing valuations and big-ticket funding rounds, VCs have now tightened the funding tap for startups.

The abnormal period of fundraising built on irrational exuberance has transformed the way fundraising deals happen in the ecosystem. Establishing an entirely novel entity is an exhilarating endeavour. The voyage, however, can rapidly become daunting, particularly when dealing with an environment of the Funding Winter, but everyone should get used to it.

The number of early-stage startups getting initial funding is abysmally low. As per a report, only 1.5K out of 2 Lakh startups get funded at this stage. For such startups, angel investors, networks and accelerators continue to be the top horses. On the contrary, late-stage companies experience the most pain. Public-market companies are down 60% or more, and they tend to be the leading indicator of how VCs are similarly going to value startups down the road. So, what better can be done to help early-stage startups get their basics right and navigate the funding winter chill?

Emphasise On Revenue Generation

During the fundraising winter, entrepreneurs must concentrate on building a Minimum Viable Product (MVP). This may necessitate the idea of solving the core market problem with a product that has a minimum set of features and can play a crucial role in reducing the cost and time to build the final product.

As a result, startups can test and launch their products with minimal resource usage and start generating revenue from the early stages themselves.

Do Not Underestimate Bootstrapping

Businesses that run on positive fundamentals are actually the game-changers. Raising venture capital is not the only way to build a business, especially at an early stage. There are some key benefits that come with bootstrapping.

It is still applauded as startups do not have to rely on external sources to fund their operations. Instead, they utilise their own savings and credit to maintain control over their business with 100% equity.

Join Cohort Programmes

Strategic partnerships with accelerators or joining a cohort programme can also lead to subsequent investment opportunities. Startups can gain access to a network of experienced and like-minded entrepreneurs.

In addition, they can make the most of their valuable resources like legal advice, office space and connections. A few prestigious accelerators are helping companies gain traction at an early stage and secure funding.

Explore Alternate Fundraising Avenues

Early-stage startups that are built on a strong business plan and growth potential are more likely to secure funding based on other financing options like revenue-based financing, factoring and equipment leasing.

It allows the startup to grow without diluting its equity while still accessing the capital to expand its operations. Similarly, seeking out investment opportunities from high-net-worth individuals, corporate sponsors, etc.

Apply For Government Grants

Apart from favourable tax policies, the government has set up several schemes to fund startups. Many state governments offer grants and funding to startups in different fields and geographic locations to nurture the Indian startup ecosystem.

By gaining access to government grants, startups can invest in their growth through non-dilutive funding and fund their business expenses to scale.

Final Words

The macro perspective of the funding winter is imperative for the long-term growth of the startup ecosystem. It will not endure for long, the markets will recover, and summer will be back soon. Several prominent investors have closed large funds in the last 18-20 months, providing enough resources to fund businesses for the next two to three years. They have significant capital that needs to be deployed.

Remember to keep in mind that endurance is essential and pain is temporary. By remaining focused, adaptive, and tenacious, early-stage startups can not only survive but also thrive through a funding winter. Undoubtedly, the sun will shine again for entrepreneurs and be much brighter this time.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.