Blockchain technology can play a key role in helping data aggregators manage consumer financial data

Two promising blockchain protocols in this area include homomorphic encryption and secure multi-party computation

Banks that weren’t sure what to make of data aggregators five years ago see them as valued partners today

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

People know their banks and their favorite fintech applications. However, consumers are generally not aware of data aggregators like Plaid and Finicity, which collect consumer data from banks, crunch it and feed it to fintech applications. Blockchain technology can play a key role in helping data aggregators manage consumer financial data while complying with regulations and empowering consumers.

Data Aggregation

Data aggregators use two methods to access people’s financial information. The first (now largely outdated) method is screen scraping, in which a person provides their banking usernames and passwords in exchange for using a fintech application. The second (and preferred) method is API access, in which the bank and the data aggregator share information through a direct, technology-enabled feed.

Once data aggregators have collected someone’s financial information from different bank accounts, credit cards and investment accounts, they process and format it so that it can be fed to fintech applications. This enables someone to split a bill with a friend on or set a financial goal.

Data aggregators power fintech companies in fields like personal financial planning, investment, peer-to-peer payments, lending and foreign exchange.

Blockchain’s Role

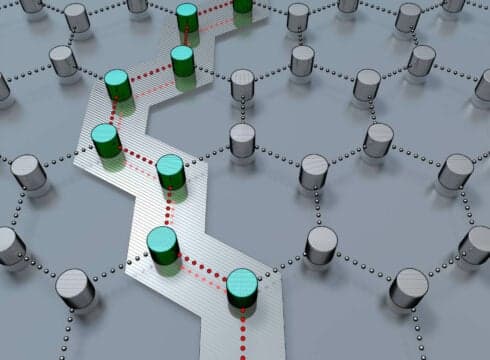

In addition to maintaining the trust of banks and fintech companies, data aggregators have to navigate the complex regulatory environment for handling sensitive consumer financial data. Blockchain technology can help data aggregators manage data in four key areas: security, privacy, analysis and auditability.

Blockchains store data in a decentralized, tamper-proof manner, thereby bolstering its security. When configured correctly, blockchains strengthen privacy by allowing for data to be stored, shared and analysed without disclosing its contents.

Two promising blockchain protocols in this area include homomorphic encryption (which allows the analysis of encrypted data without knowledge of the data’s contents) and secure multi-party computation (which allows parties to trust each other and analyze each other’s data without revealing the contents of that data). These blockchain protocols can help data aggregators achieve their objectives of analysing sensitive data from multiple sources while preserving its security and privacy.

Blockchain-based solutions also hold the potential for instant auditability, enabling any transacting party to easily verify compliance with the latest financial and privacy regulations.

The complex and fluid regulatory regime for consumer financial data includes federal legislation like Dodd-Frank, state laws and industry standards. Data aggregators argue that they should be regulated as consumers’ agents, which face less regulatory scrutiny than many other actors in financial services.

However, even when regulations don’t directly apply to data aggregators, banks often bolster their own compliance with regulations by requiring data aggregators to enter into data-sharing agreements as a condition of accessing consumer data.

A blockchain-based, tamper-proof and auditable transaction history, combined with pre-programmed rules ensuring that new transactions are compliant with current regulations, can greatly simplify regulatory compliance for data aggregators and help them maintain the trust of banks and fintech companies.

Industry Maturity And Open Banking

Though data aggregators constitute a relatively new industry within financial services, there are signs that the industry is maturing. Banks that weren’t sure what to make of data aggregators five years ago see them as valued partners today. While data aggregators experienced massive growth and drew sustained investor interest over the past several years, there are also signs of industry consolidation.

Another sign of industry maturity is the creation of the Financial Data Exchange (FDX) in 2018. Today, FDX’s membership includes data aggregators, financial institutions, fintech companies and global consulting firms. FDX’s goal is to promote an Application Programming Interface (API) and standards for transparency, security and usability that put customers in control of their financial information.

FDX’s members include companies that are actively exploring the potential of blockchain technology to put customers in control of their data. For example, a research team at Visa recently recognized the potential of the blockchain to help share customer data with fintech applications. Visa’s plan to acquire Plaid for $5.3 billion could position Visa as a leader in data aggregation and blockchain.

Seizing The Opportunity

Data aggregators, firmly established as a layer between banks and fintech applications, are now well-positioned to add value to banks by analysing their data and to enable customers to control their own data. Blockchain Technology will help them both these objectives while keeping regulators happy.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.