Charging Batteries, Infrastructure Still Key In Making Electric Vehicles Mainstream

Several 2-wheeler manufacturers had announced discounted prices in the lead-up to the goods and services tax (GST) that was implemented on July 1, but Electric 2-Wheeler original equipment manufacturers (OEMs) could be the real winners of the new tax. The government’s focus on the expansion of electric vehicles (EVs) means that the GST for this segment is only 12% as opposed to 28% for traditional 2-wheelers and vehicles. The Union of Heavy Industries (MIH) even suggested exempting EVs from the GST altogether, but building out charging infrastructure remains key.

All EV OEMs will of course benefit from the 12% GST or exemption, but 2-wheelers are poised to benefit even more, given the smaller cost premium associated with electric 2-wheelers compared to electric cars. A Bloomberg New Energy Finance report notes that the 30%–100% premium associated with battery electric vehicles (BEVs) has been a significant barrier to EV sales when price is the most important factor for the Indian consumer. The INR 1.2 Lakh provided represents just 3%–6% of an electric car.

The recent report by government think-tank NITI Aayog and North American RMI, however, identifies the electrification of 2 and 3 Wheelers as an immediate opportunity given total cost of ownership (TCO) is only 7% higher for EVs than conventional models in this segment.

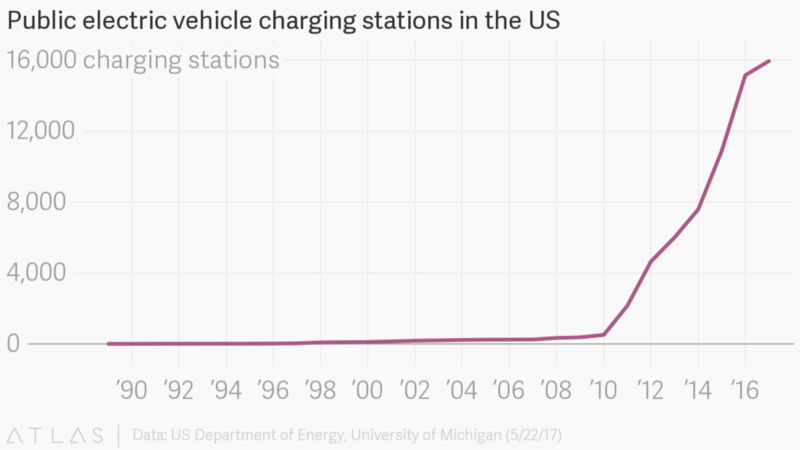

Building out charging infrastructure for EVs remains essential even without a cost premium compared to internal combustion engine models. A new report shows the United States has over 16,000 public charging stations, and China is on course for 800,000. India, by contrast, has less than 400. BMW India President Vikram Pawah has pointed this out as a major obstacle to EVs and reason for his company’s reluctance to dive into the space. “Obviously we will have to wait till infrastructure is set up before we bring in the electric vehicles.”

via ATLAS

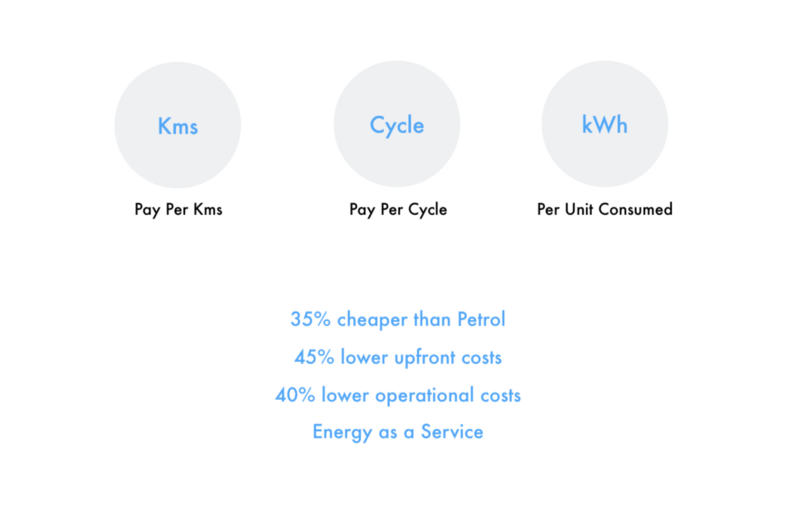

The charging infrastructure required for 2–wheelers is different from cars, however, and 2-wheelers again have the advantage. Instead of building large and expensive stations that take at least 30 minutes for a car to charge, 2 and 3-Wheelers could stop at relatively tiny and inexpensive kiosks and swap out a modular battery and be back on the road in a few minutes. This is a proven and successful model in Taiwan which is now being adopted by Indian policy-makers and academics. We at ION are no strangers to batteries and the benefits that come with swapping versus charging. This is a part of our vision as we continue building the infrastructure that makes ‘energy-as-a-service’ a viable business model.

ION Energy is enabling approachable and affordable ways of using high performance batteries.

Most electric 2-wheelers in India currently utilise cheap lead-acid batteries, however, but lithium-ion technology is vastly superior and critical for the swappable-battery infrastructure model. India’s dependence on lithium battery imports from China is another barrier to EVs and is part of the argument for exempting EVs from the GST. “We need to develop indigenous production capabilities for lithium-ion batteries so that electric vehicles can become affordable,” said MIH Secretary Girish Shankar at the end of May. The Central Electrochemical Research Institute (CERI) recently announced it has made the first steps to make Indian lithium-ion manufacturing a reality.

Lithium-ion batteries will also be essential as energy storage as India adds more renewable capacity, so policy-makers must think about the batteries beyond EVs. Bloomberg New Energy Finance’s New Energy Outlook 2017 projects renewables to make up 49% of the country’s energy portfolio by 2040. There are setbacks with Lithium-ion batteries, but as MIT Technology Review illustrated with the recent bankruptcy of Aquion Energy, it remains the most viable technology for energy storage.

So, while India ramps up its own lithium-ion manufacturing, policy-makers must perform the delicate balancing act of incentivising the import of these batteries for purposes other than automobile manufacturing.

NITI Aayog, who recently took charge of the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles program (FAME) from MIH, noted in a report that batteries not included in the vehicle itself were previously taxed at a higher rate. Amending this with the new GST is critical for both energy storage and the swappable battery infrastructure for 2-wheelers.

[This post by Stefan Johnson first appeared on Medium and has been reproduced with permission.]

Ad-lite browsing experience

Ad-lite browsing experience