How Flipkart, Snapdeal, Amazon, And Alibaba Are Battling Indian Ecommerce

A year is a long time in Indian ecommerce. It all looks very different. Amazon has sucked away all the oxygen out of the space leaving everyone else (Flipkart, Snapdeal, Shopclues) gasping for breath. Suddenly, the visions of a multi-player, multiyear battle have evaporated and all the venture capital and private equity players have fled the battle scene.

It is now Amazon versus the Rest. The ‘Rest’ clearly coalescing around SoftBank (and Alibaba), with Tencent as the supporting cast.

A brief word of explanation for the post-truth generation – TTLG (Through the Looking Glass) was the sequel to Alice’s Adventures in Wonderland. It is a ‘fantastic’ story with many adventures and interestingly, it ends with Alice asking if she had dreamt it all?! There is Alice, a Red Queen, and a White Knight…

SoftBank, in its second coming, is everywhere, having announced a $1.4 Bn commitment to Paytm and expected to invest a similar amount in Flipkart while forcing a merger with Snapdeal. Wal-Mart is the shy wallflower, smiling at everyone but refusing to dance.

Flipkart has finally managed to raise $1.4Bn (Tencent/eBay/Microsoft) with the promise of more to come from SoftBank. They have clearly modelled themselves on JD.com as a controlled marketplace with a focus on electronics, apparel (Myntra/Jabong) and appliances. Interestingly, Flipkart has become the go-to place for ecommerce businesses after they die – LetsBuy, Flyte, Jabong, eBay India and now Snapdeal!

Snapdeal has turned into a Greek tragedy, albeit one in which the founders and even some of the investors have made decent returns leaving the others to rue their fate. Once again, ‘too big to fail’ didn’t end up being true!

Paytm has split its payment and ecommerce businesses with Alibaba taking control of the latter. While still a work in progress, the initial capitalisation and chatter seem to indicate a more controlled launch with direct sourcing from China and focus on deals on those products. Shopclues has had a tough year, was hit hard by demonetisation (high cash on delivery percentage and vendors cash flow woes) and seems to have lost the plot a bit.

Flipkart And The Ecommerce Bandwagon: Who Moved My Cheese?

There is a bigger problem. The market which rapidly reached $13 Bn in 2015 grew only 12% to $14.5 Bn in 2016. While there were factors like reduction in discounts (regulation, cash burn) and demonetisation in November 2016, this suddenly made the optimistic long-term forecasts – $50 Bn, no $80 Bn even $100 Bn by 202X look like fairy tales.

The magnitude of the capital invested in the businesses is surreal, at over $10 Bn. Most folks are confused and some are angry. Was this all a mirage? Can these companies really hire and fire thousands of employees in just a few years? What about their loans and EMIs? Who will pay their vendors? Will these companies ever make money?

The pundits are out in full force. It seems that the business models were all wrong. Changing habits is too costly and not a worthy goal. Companies should have always focussed on profits. A lot of mistakes have been discovered. The market was smaller than expected (think 10/30/50 Mn and not 1.2 Bn shoppers), the capital was wasted (customer acquisition, marketing, over the top salaries), India is really three countries and the cost of doing business is too high. Phew!

Take a deep breath and exhale!

Let’s go back to first principles and answer two questions.

- First, can online commerce be a large business in India?

- Second, is there a sustainable business model for an ecommerce company that has a hope (prayer!) of making money in India?

Of course, the two questions are inter-related in that if there is no sustainable way of addressing the market opportunity then it really doesn’t exist.

Potential for Online Commerce in India

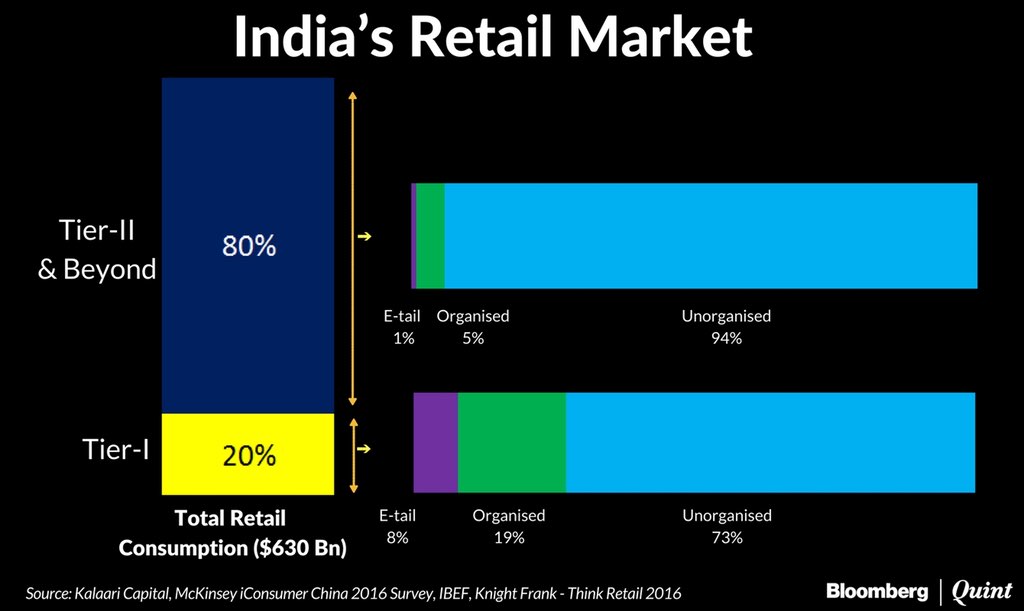

At face value, this seems an easy question to answer. Retail in India is a ~$630 Bn market growing at 8%-10% a year (around nominal GDP growth) of which only ~9% is organised and only ~2% is online. Intuitively, the growth prospects of online commerce look bright with the lack of physical retail and slow pace of fresh real estate development. Given the vastness of the country, one can easily see ecommerce being the more efficient solution to even address the availability issue for many goods.

The above figure put together by Kalaari Capital illustrates the opportunity beautifully. It is even more difficult for organised retail to reach Tier II and beyond. These are also the cities where smartphone and data penetration are growing the fastest. Anecdotally, both Amazon and Flipkart talk about these cities as the engines of their growth. In China, these already account for a majority of the ecommerce market.

While everyone recognises that the next hundred million Internet users will be different, they continue to address them in the same way, except for some lip service with language translations.

This is not an English language issue – when deals are good, Indian consumers figure out a way to buy! The real issue is the cost to serve them and the buying process as these consumers come from a different context.

They need to be helped – think videos, buying guides and much better and relevant filtering. The industry understands these issues but has been engaged in a brutal war for survival so perhaps there has been no time to implement plans yet. This should change with time.

Sustainability Of Ecommerce In India

This, of course, is the more difficult question. Let’s break this down into a few parts:

Experience Thus Far

The experience so far has been difficult but it is somewhat inevitable in the early growth stage of an industry. Almost $10 Bn has been invested to generate $~14.5 Bn of GMV. To put this number into perspective, $10 Bn spread over 50 Mn consumers means $200 (~Rs. 13,000/-) over and above what they have paid for the product!

We can quibble with the math but, clearly, this is not a sustainable pace and the equation has to change.

The good news for the industry is that despite overall burn coming down since last summer, GMV growth resumed at 20%-40% year on year from October 2016 and is continuing into this year. Amazon seems to have capped their burn at $80 Mn-$100 Mn per month and Flipkart at $40 Mn-$50 Mn per month.

Willingness To Keep Burning

This takes us to the second point – the willingness to keep burning at these high levels on the part of Amazon, Flipkart and Paytm. Amazon has signalled that it is willing to keep going at these levels ($1 Bn or so a year) but despite the slew of new initiatives (Prime Video, Payments, Grocery) there appears to be recognition that going beyond this is unlikely. Flipkart has raised $1.4 Bn, with the promise of more to come from SoftBank, and is expected to have about $2 Bn to manage the next few years with. We can clearly see 3-5 years of market growth even if players don’t make money.

The Global Experience

It is clear that the leaders make money – Amazon and Alibaba. They tend to make money at scale and leverage their business model to make money not as much directly from retail (as in buying and selling) but from services – advertising/logistics/listing in the case of Alibaba and AWS/Prime in the case of Amazon.

However, things get murkier when you move past the leaders and even very large $100 Bn+ GMV players like JD.com continue to lose money.

That said, the scale of burn for the level of GMV achieved in India is historic, to say the least! Amazon has raised less than $7 Bn in equity and Alibaba a similar amount while delivering hundreds of billions in GMV. Flipkart has raised almost $5 Bn while barely achieving GMV of $3 Bn.

The Organised Retail Experience In India

Organised retail does make money even in India so it cannot be said that retail in India can’t make money. Even in ecommerce, it is only the platforms that lose money hand over fist; the other participants – vendors and logistics players make some money. You can argue that they have no choice but to make money as they are not VC funded!

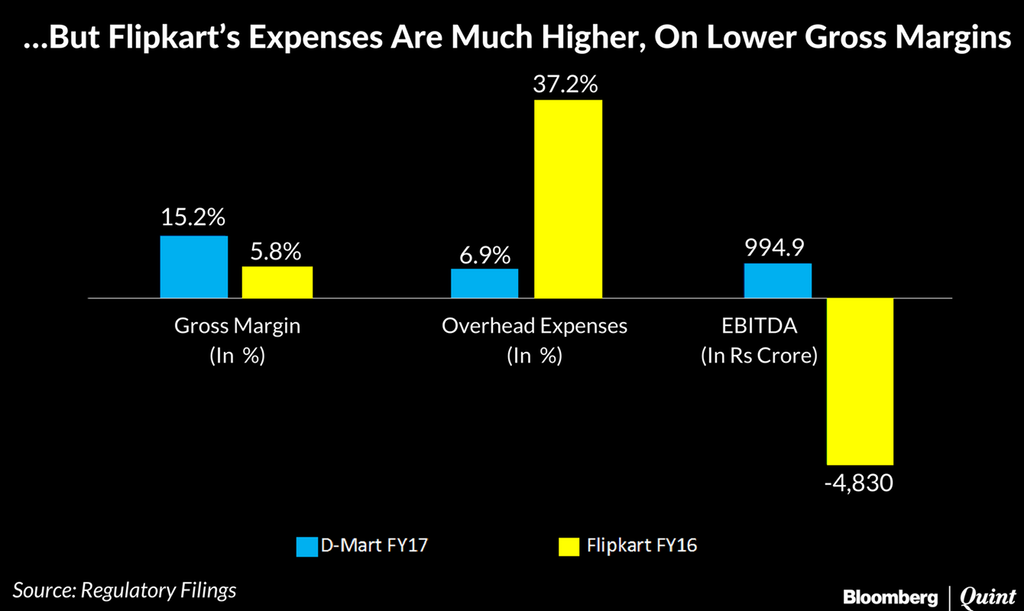

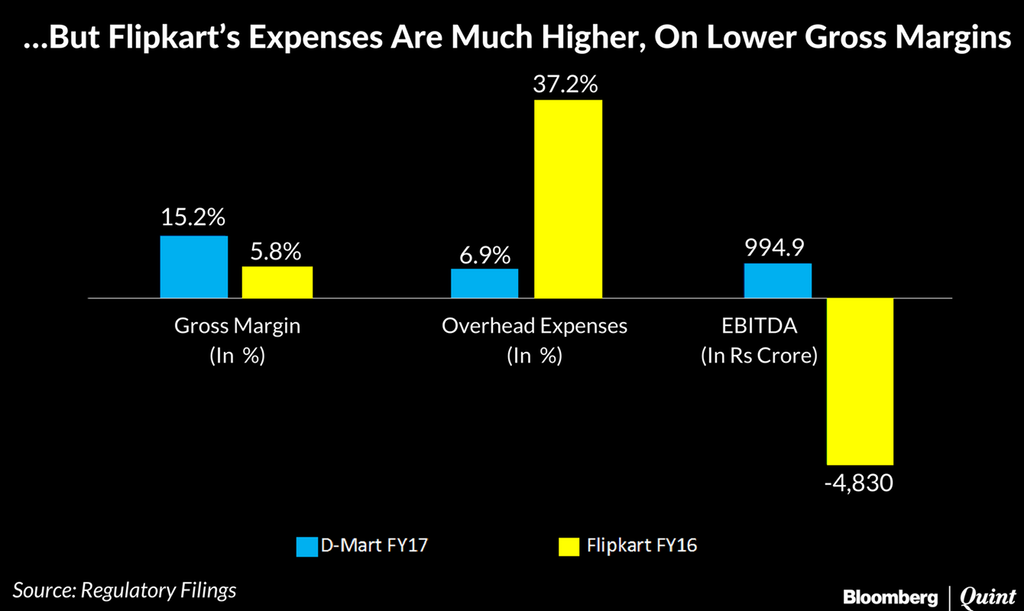

While one can go on forever on this subject, empirical evidence is always the best way to resolve such issues. Fortunately, the recent listing of DMart has given us a company with comparable scale, comparable growth rates yet with a significantly more profitable business model.

Herein lies the rub. Having a lower gross margin can still be explained away (early stages of the industry, habit change etc.) but the killer is spending 5x on the overheads (marketing, delivery, employees)! The whole point of ecommerce is to avoid paying rent, salespeople, store fixtures and instead leverage economies of scale to offer a huge selection, lower prices and deliver directly to the consumer.

This is also where the waste shows up in the form of crazy spending on marketing, overpaid and too many employees. Either the ecommerce companies have to deliver 5x the volume or reduce costs dramatically.

There is also a clear valuation disconnect – DMart despite its otherworldly $7 Bn valuation (from an Indian stock market perspective) is a steal compared to Flipkart’s $11.6 Bn value!

Ecommerce: View Through The Looking Glass

Ecommerce, in the blink of an eye, has become a big boys’ game with no room for young founders, VCs or PE funds.

The battle for the Indian market is clearly between Amazon and SoftBank/Alibaba.

There are some wildcards – WalMart, Tencent (6-7% stake in Flipkart is just a toe in the water) and perhaps, the big Indian business houses – Reliance, Tata, Birla.

Also, make no mistake, Flipkart, or rather its investors, need SoftBank’s capital – the backing from the $100 Bn fund else they would never consider merging with Snapdeal. This creates a logical long-term exit option for them given the SoftBank-Alibaba relationship. Many have discovered that investing in Indian ecommerce is a bit like invading Russia – easy to enter but tough to exit alive!

SoftBank is now the king of the hill again, despite disastrous first innings, with ~$2 Bn written off in Snapdeal, Ola, Grofers & Housing.com. They are back with renewed vigour and an even bigger chequebook.

The next phase will see Flipkart and Paytm getting closer, driven by SoftBank. Amazon will continue its relentless march and bring its entire product range to India. Amazon has taken the ‘habit’ stand, positioning itself as the nation’s store (“India ki Dukaan”) for all things big and small.

Flipkart has taken a differentiated position as the store for (mostly) high-value electronics, appliances and apparel – betting on a large number of first-time buyers in these categories who care about price and service leaving the costly business of habit creation to Amazon.

This seems plausible (as JD.com has shown) but they must be really sharp in differentiating themselves, as Amazon is really leaving no white space.

Consumers will have to get used to lower discounts and a few more trips to their neighbourhood malls as prices normalise online and physical retailers start becoming good value again. We are still in Wonderland though. The world’s largest companies are willing to continue spending billions a year to please Indian consumers. Enjoy it while it lasts!

[This post by Sarbvir Singh first appeared on LinkedIn and has been reproduced with permission.]

Ad-lite browsing experience

Ad-lite browsing experience