The Board Meeting Is An Important Part Of Any Startup Journey

You’ve raised funds and formality has begun. This means monthly or quarterly meetings with your Board and your newly appointed members from investors. As per their information rights, they need updates from you. Darn. Another thing to do! To help you, I’ve put together a Board deck template to lighten the load of conducting a Board Meeting.

Why do you need a Board deck?

Starting up is hard and you don’t always have the answers. Fortunately, a good Board is at hand to ask the tough questions, provide a sounding Board as well hopefully valuable insight.

As an early stage startup, you are likely going to have meetings with the Board monthly, so there is no hiding. It’s expected that you will prepare material beforehand.

I’m not going to write a load of boring stuff about what a Board meeting is, why you need them etc. (People like Steve Blank cover this stuff to various degrees). So, take my word you will have Board meetings… and that having a nice template to kick things off will be handy! Let’s get into the pragmatic stuff

General Advice For Board Material

- Don’t spend too much time making everything perfect unless you are a public company with a thousand staff. You need to build your startup. Oli Samwer freaks out at MDs if the slides are pretty. Use my template and everything will look decent and structured.

- Slides should be simple and use bullet points. They are talking points – this is not an essay. The meeting is for discussion.

- It’s ideal to always use a consistent structure for each meeting so people know what is coming. Only change it when you reach a different point in your company that warrants it, such as moving from searching for product-market fit to scaling.

- Targets and deliverables need to be specific and someone has to be accountable for delivering every account point.

- Don’t use jargon till everyone understands it.

- Make it really clear how the Board can help. Ask specifically and directly! Don’t ask for recruiting help, ask for a specific role and ideally have a JD to hand.

- You need to ‘report’ information, but really useful meetings are forward focussed on what you should do. This is where your future is, more valuable than the day before!

Best Practice Before A Board Meeting

- Send the deck 3/4 days in advance, at minimum 24 hours and tell the Board to be prepared. If directors have feedback, update your deck with their comments. Make the meeting and material dynamic, rather than purely one direction. Including tough questions to be discussed enables directors to ruminate over them and come to meeting prepared with insight. If you have all your financials and KPIs included you don’t need to run through numbers line by line which gives you time for value add activities

- Schedule the meeting a week in advance at minimum. Ensure it is in everyone’s calendar. Send a recurring calendar invite and check people accept your invite

- Ensure everyone is agreement on the frequency and duration of meetings. Once a month is advisable for early companies. For later stage companies meetings can be quarterly. The meetings should be 2-3 hours long. As Brad Feld says “I think two hours is too short. But more than three hours of intense discussion will turn most brains to mush. So, you can’t go on too long either.”

- If you need to discuss anything controversial, discuss this with each Board member first before the meeting. You don’t want to surprise everyone on a call. No one likes suprises. There is a reason that McKinsey presentations are rubber stamp meetings. Everyone knows what they are going to say

- Think critically about the agenda and your elected “focus session.” Whenever the Board meeting runs over time, it is you, the CEOs fault. If you introduce too much information and talking points, nothing will really get done and everyone walks away feeling like nothing is resolved

Best Practice Running A Board Meeting

- Don’t stand in front of everyone like you are presenting. Sit at the table next to everyone else. The Board is there to support you, so don’t stage the situation that you are on show and they are there to judge you. Standing doesn’t put you in control, it puts you on the defensive.

- Make sure everyone is prepared. If a director is unprepared at the meeting, pause at the start and give them 10 minutes to read the update to be able to be in a better position to contribute. But it is worth being cognisant that the most incriminatory thing that can happen to a Board member is realising that all of their peers prepared for the meeting and they didn’t…

- Assuming everyone is prepared, you can ask if everyone understands the template stuff like financials, so you don’t need to spend time on them. If there are any points people want to discuss, you can factor them in when allocating time to each topic. You don’t have to spend time on each slide, so you don’t have to act like you do. So, for your option grants, if you are happy with the allocation just ask “anyone have an issue with the grant? No, ok, let’s just approve it then.” Same goes for financials and KPIs.

- Immediately appoint a Secretary who takes notes. Ideally you should have a template to fill out to make things easier. The Secretary should circulate the notes and they should be agreed at the next meeting.

- Save all the notes in a folder– you will need to provide them to investors during due diligence at your next fundraise. Also, while you are at it, save each Board deck so you can easily provide them too.

- Get bad news out of the way first. Pull the bandaid off. Neither the Board nor you want to wait in suspense for bad news to drop.

- It’s ok to be vulnerable and say when you need help. The Board is there to help and probably is aware of these points already. Trying to cover your weaknesses is dangerous and could result in you getting an ‘advisor role’ of your own company. The best CEOs started knowing nothing, but they learnt fast.

- Tell the Board upfront in your CEO introduction what the main thing you want out of the meeting and how the Board can help. That way you can ensure it gets addressed. It doesn’t have to be the first thing you discuss, but make it known.

- Don’t read the deck like a school room presentation to the class. Assume you are talking to bright people that can 1/ read faster than you can talk and 2/ are ready to give insight. What’s the point scheduling a meeting with ~5 people to listen to a deck they could read on their own schedule? The meeting is for discussion.

- Board meetings should have structure, but not too much to stifle conversation. It’s ok to allow conversations to deviate from the agreed upon structure where it is warranted. Your Board meetings are about attacking hard topics, not finishing on time or following your structure.

- You can decide what you want to discuss. If members bring up topics that you don’t want to talk about such as doing an hour-long review of cohorts or your landing page, it’s ok to take control and say outright that you don’t want to use the Board time on that. You can offer to invite them to come to the office and sit with the marketing team and discuss product marketing etc.

- Bring your key execs to the meeting/call if you are having a focus session. Your VP of sales can discuss pipeline, CTO the technical developments and CFO the cash situation. It also gives your leadership team the opportunity to shine and encourages them to be well prepared. Talking to the Board is daunting to everyone, so leverage it. It also shows transparency and you are happy to give them credit.

- Be frank and explicitly talk about elephants in the room. If you don’t bring them up with the Board, trust they will discuss them when you aren’t there

- For highly controversial topics, it may be advisable to have your lawyer attend. They might not charge as they get face time with your investors (nice, way to hustle ;)).

- In person meetings are best if you can. It’s easy to play with your phone when no one is watching… Where logistics are difficult, organise two calls per quarter and one in person meeting.

- If you are going to discuss topics which include data points you used before, include them in your deck. Some investors are on a lot of Boards and it’s a waste of time to make people search their email to find the material you might reference. Make it easy for people to be ‘on the ball’ and just focus on the task at hand.

- Try to get the formalities out of the way first. This is how my template is structured. Yes, you need to get through ‘approvals’ but they don’t move the needle. Once the boring stuff is done you don’t have to stress if a discussion takes a life of its own, and the ESOP allocation you promised staff doesn’t get approved.

Best Practice After A Board Meeting

- There should be no open topics and ambiguity about who is responsible for executing on them. If there are they should be automatically being added to the next meeting’s agenda (which is an action, per se).

- If a director said they will do something, expect them to do it. Follow up and make sure it happens. Add it to the next Board meeting and hold them accountable! You’ll find people will make sure they don’t get called out.

- Dinner or drinks after evening meetings are encouraged. The nature of conversations can also be different. Nirav Tolia, CEO of Nextdoor recommends you do dinner or lunch before the Board meeting, and include some of your VPs. This will enable you to keep the actual Board meeting on time, and allow the Board the opportunity to get to know key people outside the high-pressure environment of the meeting itself. You can alternative depending on availability with just one Board member

- Offer the Board members an ‘executive session’ at the end of the meeting. This is a Board meeting without the CEO in the room/call where they discuss the meeting and the key takeaways. It’s an opportunity to regularly get feedback (“How am I doing?”) about your performance, strategy, the team and general performance. This is great as you don’t want a shock when you go to investors asking for a pro-rata and they ‘surprise’ you saying they don’t want to… It may run 5 minutes or an hour, not that you care, but FYI. The Board may have a lot, or very little to discuss. Don’t head into a meeting, stick around in case the Board want you back. The Board ex-CEO may invite you back for a debriefing. An alternative is that the Chairman of the Board can call and do a debrief.

- Solicit feedback from individual Board members outside of the meetings. Call each separately for 30 to 45 minutes in advance if need be so you know how they’re going to vote, what they think about the agenda, and bust any potential issues or surprises. As Albert Wenger, Union Square Ventures says “Some people are oddly quiet in group meetings. Don’t assume that means they are in agreement with everything that is said.”

The Agenda For Your First Board Meeting After A Fundraise

Congrats (or not) on closing your fundraising round! You want to start with your best foot forward and that means setting things up properly. David Teten at ff Venture Capital recommends the following agenda points to get everyone on the same page:

- Decide who is Secretary (typically same person at every meeting).

- Determine how to handle governance education for all members.

- Verify appropriate accounting processes in place.

- Establish thresholds for Board approval of actions (e.g., conflicts of interest, contracts other than day-to-day operations).

- Designate Audit Committee and Compensation Committee (or just individuals with those roles).

- Discuss profile of additional Board members (if any).

- Determine frequency and schedule future Board meetings (including annual CEO performance review and mutual Board member assessment one year from now). Recommend monthly at first.

- Discuss how information for Board will be shared and discussed, and which technology platform if any to use.

- Review management’s recommendation for KPIs and formal milestones.

- Review draft budget (by second meeting at latest date).

Some of this may be totally over your head, that’s cool. At least you know what needs to get done. Discuss with your lead investor and get their input in ensuring everything is done right. They will be delighted you took the initiative and will reflect maturity on your part.

Approach To This Template

I wanted to make a Board deck template for my own founders and this is it. There are some decent ones online, but I didn’t think they really suited early stage companies and they are a little more like how to guides than here you go, use it and get back to work (which I like).

The best guides are from Sequoia and NextView. I’ve ripped off all their insight. I’ve also trawled the internet for all the pearls of wisdom I could find and incorporated them too (Like having a slide up front with the key goal of the meeting). So, this represents the state of the art in my humble opinion.

Note – every business is different! You are going to have to refactor some slides so they suit you. Every slide in the ‘calibration’ segment needs to be redone to your KPIs. I’ve set things out pretty to give you inspiration, but it’s just inspiration. Keep things simple and try show your actuals vs plan as much as you can. Your investors want to know if you are on track or not.

Note: If you are a SaaS company, there are some good metrics slides in this template deck to get inspiration from.

The Template Board Deck Slides

Thought has gone into the order and content in the Board deck template. Let’s go through each slide now so you understand them and the thought behind them.

Section 1: Intro

- This sets the scene for the meeting and ensures everyone agrees with the agenda.

Slide 1: Title

- Add your logo and change the date. Simple.

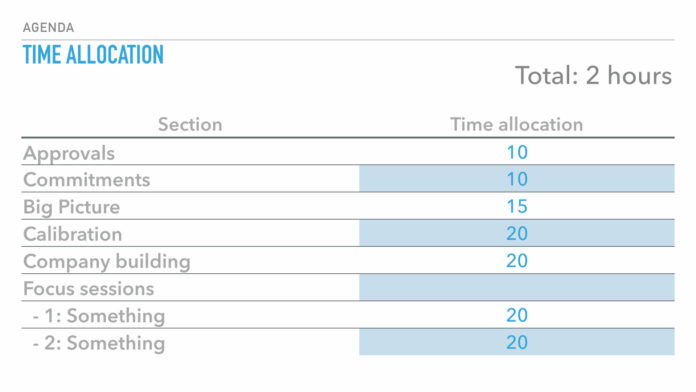

Slide 2: Agenda / time allocation

- The format is always the same so investors know what is coming.

- The only thing that changes in terms of content are your ‘focus sessions.’ Think critically about what they are and input a brief header for the topic.

- Month to month, you can change the time allocation, depending on what needs to be covered and feedback you got before the meeting.

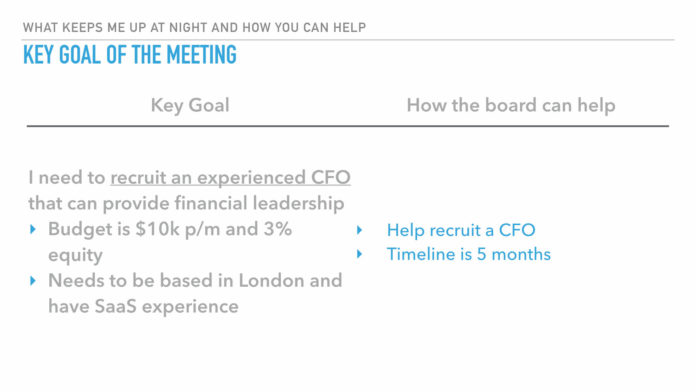

Slide 3: Key goal of the meeting

- Best practice is ensuring one big topic is covered. This slide explicitly states: 1/ what is keeping you up at night, and 2/ how your Board can specifically help.

- Put some effort into writing it and do some ground work. Don’t write “Finance needs to be better!” Write “I need a CFO” and add specifics..

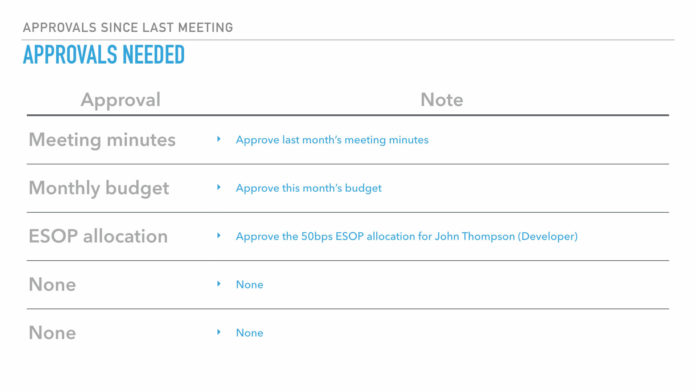

Section 2: Approvals

- Making sure all the decisions get done before the meeting gets into the swing of things.

Slide 5: Approvals needed

- It’s best to get the hygiene out of the way so you can get into the meat. Just get it done before anything else.

- Under ‘Approval’ write the main point. Under note, write the approval specifically needed to be made. In the meeting just say “Do we approve the meeting minutes? Vote. Passed. Next. Do we approve the monthly budget? Mary, I know you had a concern about some expenses? Ok cool, let’s keep as proposed. Vote. Ok, passed.”

Slide 6: Budget

- Have your monthly budget in here in your format as you agree with the Board. You do not need to discuss it. But as above, if someone wants to check it before approval, it’s there and ready so no one is looking for it.

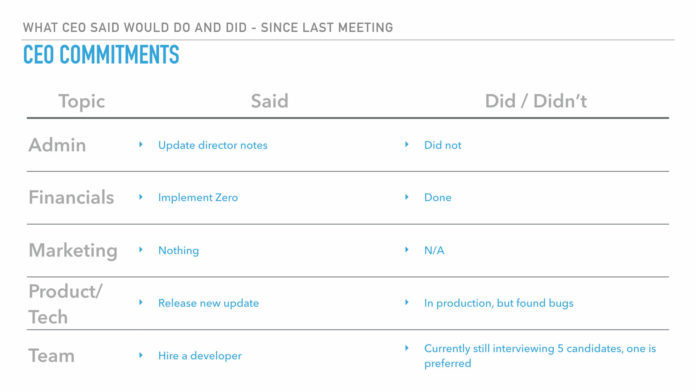

Section 3: Commitments

- What people said they would do and did or did not. This is for both you the founder and your Board members.

Slide 7: CEO Commitments

- You do not have to have this slide. For early-stage companies where the Board is hands on, guiding the CEO, I like to have really clear accountability. Startups are so under resourced and there is so much to do it makes for good relationships if the CEO/team does exactly what they said between each meeting. This builds trust. Over time you can remove it if you are against it. However, I think it’s really useful since it lets you have the next slide…

- Note I say ‘CEO Commitments.’ The implication is the CEO is responsible for the team delivering. If there is another founder on the Board you can change that so two people are accountable, but make it clear who has to do things and did it (or not).

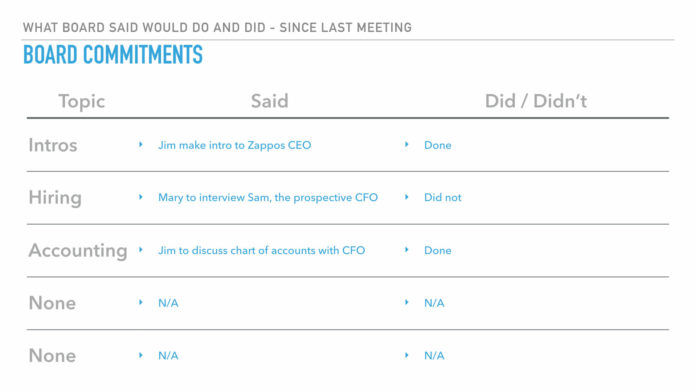

Slide 9: Board Commitments

- The CEO has to report on his monthly commitments, so why not ask the same of the Board.

- The Board is there to work for you not just judge you and your terrible t-shirt choices. During each meeting, you should state specifically what help you need and then dole out tasks for your Board to do! The best areas your Board can help with is in intros and help recruitment. So as above, write the topic, what they said they had to do and did or did not do it.

Section 4: Big Picture

Time for your big shot CEO to shine and cover updates of what is going well and what is not, as well as any comments on how the industry is evolving. Your Board does not know what you know, so share succinctly the key things they need to be aware of. If you prepare well before hand, you can deliver this briefly and elicit insight from your Board to get perspective. So, don’t stay on stage long. Treat it like stand-up comedy – deliver your lines and then get positive or negative feedback quickly. If there isn’t much to respond to, move on.

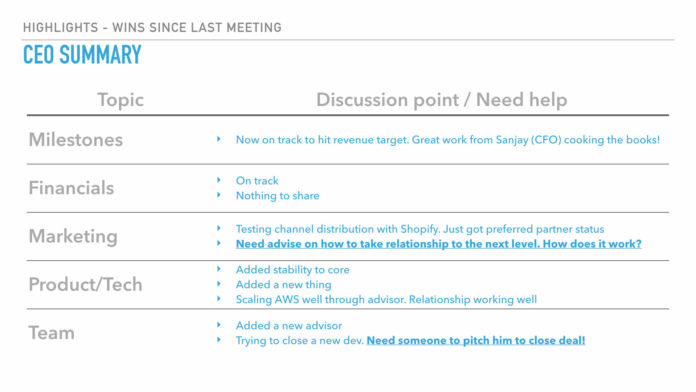

Slide 11: CEO Summary – Highlights

- The topics have been selected to cover all the main areas. Change them depending on your business. Change the next slide structure too, then

- This is what is going well. Celebrate your small wins!

- Fill in the topic and then the key takeaway. Be sure to add areas where you need help adding to the fire to help you double down on these wins. An example is getting someone to call and pitch a potential hire to close them. Remember to add it to next month’s commitments!

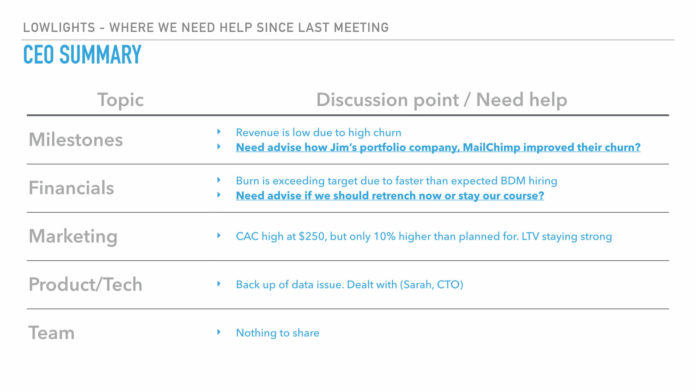

Slide 12: CEO Summary – Lowlights

- This is the same as the highlights, except they suck more. Be honest and open – don’t hide the bad. You need your investors to keep funding you, or putting a good word to the next bunch to do your Series A.

- Just a little note, notice I put the names of people in brackets. I think it’s good to give credit to who fixes things as it’s illustrative of a cohesive team

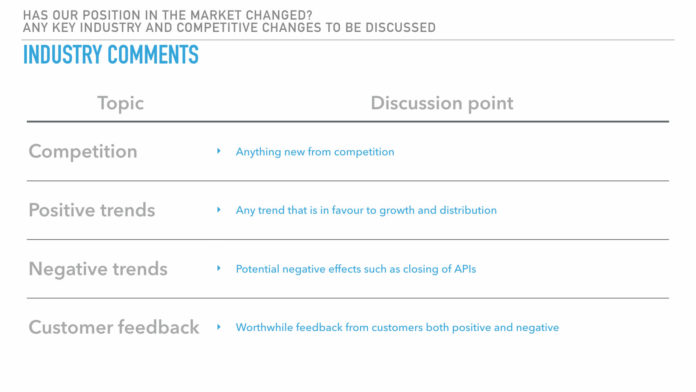

Slide 13: Industry comments

- You should know everything about your industry. Share anything notable with investors. They might pretend like they know, but they really don’t (They practice looking smart).

- Comment anything material in terms of competition, positive and negative trends as well as customer feedback.

- If your Board is new, this is useful for you to build credibility (that you know what is going on).

Section 5: Calibration

- In this section, I tried to apply an AARRR metrics approach to go top of funnel down. Depending on your business you may need to change this whole section. It really depends on your business model. You need to cover KPIs, financials, plan vs actuals and anything specific to you such as NPS. If you are enterprise, maybe talk about sales cycles?

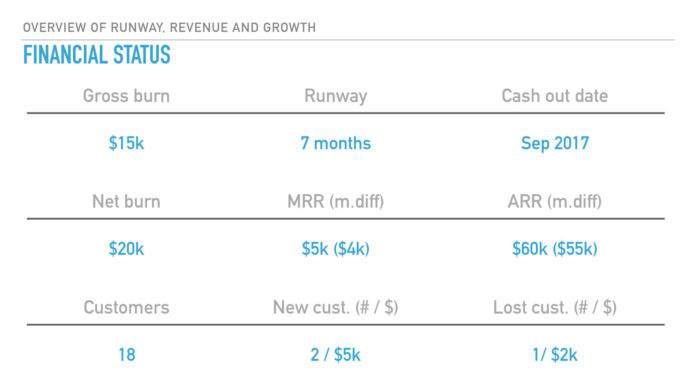

Slide 15: Financial status

- This is about communicating your runway, revenue and growth metrics. This simple grid is a nice way to show all the key things very briefly like taking a temperature

- Change the KPI depending on your business model.

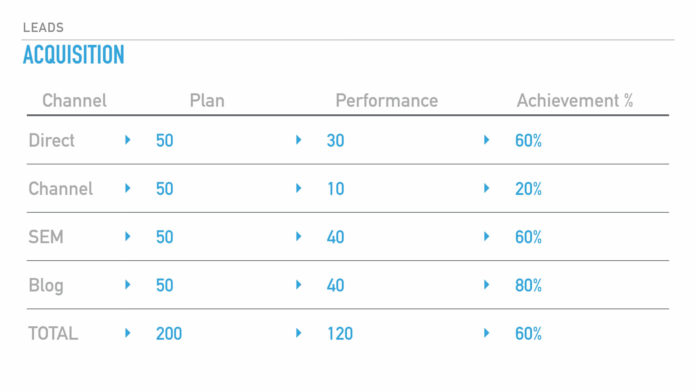

Slide 16: Acquisition – leads

- This is your top of funnel. VCs care about your growth and go to market. You don’t grow if your marketing sucks, so get into it.

- I set out your key channels for customers then present this month’s plan and your performance, then the % of achievement.

- I would do this very differently if I had your data, depends on you.

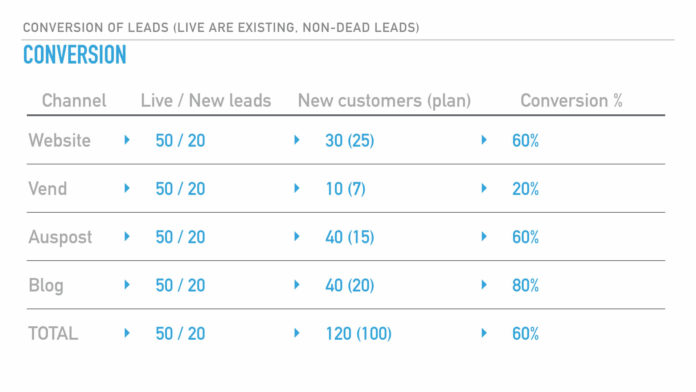

Slide 17: Conversion

- How are you converting your leads/traffic? This comes down to your on-site optimisation, sales team etc. Depending on the data you have, restructure this so it suits you. Maybe you can just copy paste a report someone in marketing sends you.

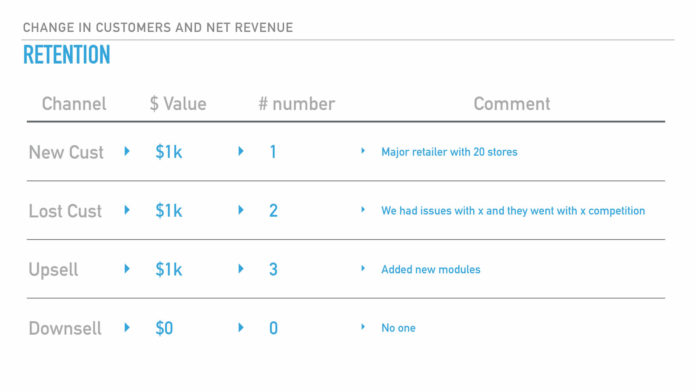

Slide 18: Retention

- This matters more for SaaS. If you are ecommerce, perhaps change it to ‘referrals’ or similar. What you want to do is show you attract, retain and monetize (and get referrals) from customers

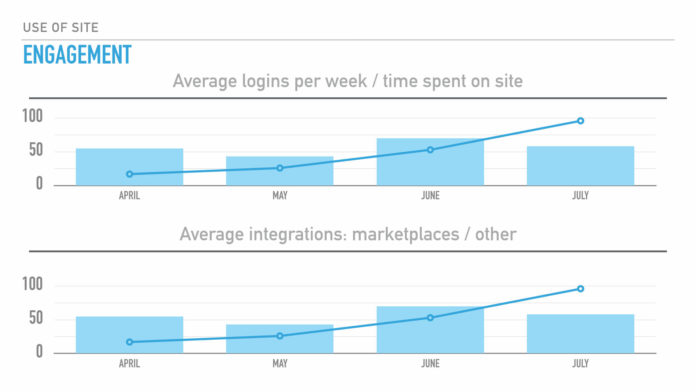

Slide 19: Engagement

- Do customers like your service? Do they use it a lot? The sign of any good business is that they do!

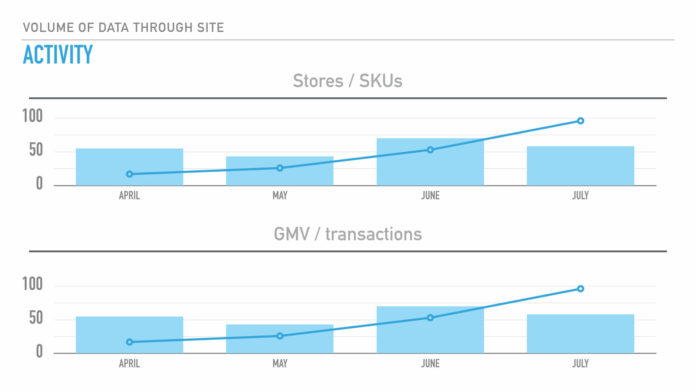

Slide 20: Activity

- What’s going on with the site? If you are a marketplace then liquidity matters, right? What metrics show that?

Slide 21: Performance vs plan

- Show for your KPIs the trend in your plan vs your performance. Your Board really cares that you are on track. Depending on your data you can show a longer trading history, you can also show your projections and how they compare against your planned forecasts.

Section 6: Company Building

- This section details the nuts and bolts of how you are executing. Sequoia has a nice write up of what they want to see in this section but it’s more for later stage companies- the template keeps it fairly simple and orientated for earlier stage companies.

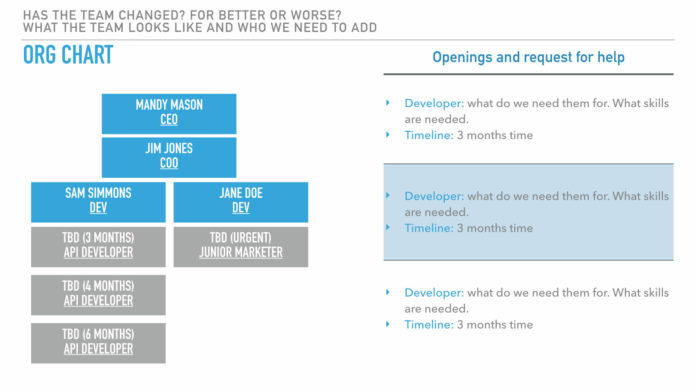

Slide 23: Organisation Chart

- What does the org chart look like, has it changed for better or worse and who do you need to hire?

- The RHS sets out who you are hiring for and a request for help in finding these people. VCs talk to a lot of people so if they know who you need they can bear you in mind

Slide 24: Compensation and hires

- This slide depends a little on how many staff there are. Early stage you don’t have many so this suits. The slide sets out who and how much they are paid; how much they are paid and equity holding. Add people you are hiring and what you plan on paying them so the Board can give their input. The start date lets them know when they are coming on Board.

Slide 25: Product roadmap and timeline

- Your product is key to your success so the Board wants to know the roadmap. Everyone does this differently, so paste an output of something you are using operational, but just make sure it is high level and doesn’t have erroneous detail.

- This can take time to make so make sure it is something you are using for other purposes and can do easily. Ideally dedicate it to someone in product/tech.

Slide 26: Technical Core Initiatives

- Don’t put the Board to sleep, but set out clearly what you are doing on the tech side. Map out the key initiatives and then briefly show the status, and perhaps deadlines as well as responsibility. Discussion can be around priorities, bottlenecks and the materiality of your focus. You do not want to get into an esoteric debate on AWS; this is not what the Board meeting is about.

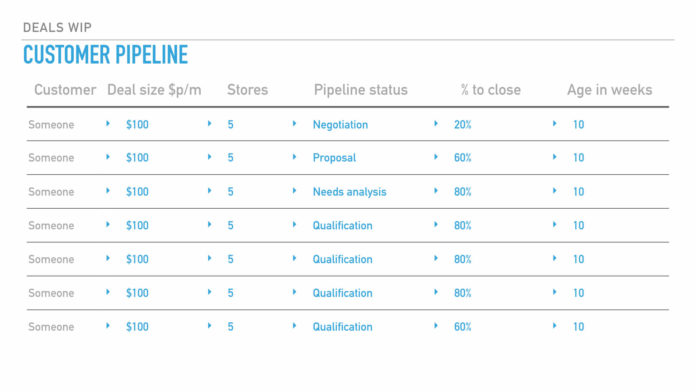

Slide 27: Customer Pipeline

- This is more important for SaaS and enterprise companies where you have a sales function. Replace with something customer related if you have a different business model.

- This example slide sets out who you are pitching and your status with each, as well as the materiality.

Slide 28: NPS and Customer Feedback

- Everyone should be tracking customer experience quality in some form. For ecommerce, there is a simple NPS from an exit poll. Google has a search quality score etc.

- Show your NPS or similar and add direct quotes from customers. You should absolutely be talking to your customers. Having this slide will encourage you to record feedback. It’s also super to share the feedback with staff, positive and negative.

Section 7: Focus Session

- Now you have got through all the update, the focus sessions are the real value of Board meetings. Pick 2, no more than 3, ‘hot topics’ you really want to dig into. Set out the topic and a few key thoughts for discussion points. Again, ask for how the Board can help.

- Depending on the topic, you may add a number of supporting slides. For example, if the focus session is on a big business development deal, you might add a timeline of conversation, paste screen shots of conversations etc. The material should support discourse, not detract from it.

- I haven’t set out template slides as it will depend so much on the topic, and if it matters to you, you will know what you want to add!

Conclusion On How To Conduct A Board Meeting

There we have it.

Here are your next steps:

- Download the Board deck template now!

- Add your logo on the first page.

- Go through each slide (reading my guide notes above) and restructure the deck, change the points etc., especially in the calibration section.

- When you are happy with it, send it to your Chairman of the Board, or your lead investor Partner and ask for feedback. Incorporate the comments.

- Circulate to the rest of the Board. Tell them you worked with the Chairman on it and want feedback and buy in to the format

- Use it!

[This post by Alexander Jarvis first appeared on the official website and has been reproduced with permission.]

Ad-lite browsing experience

Ad-lite browsing experience