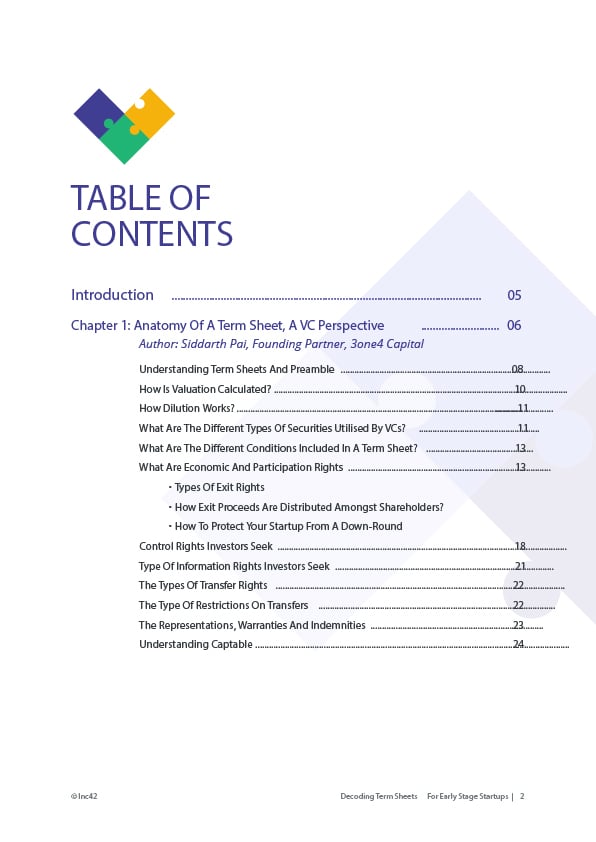

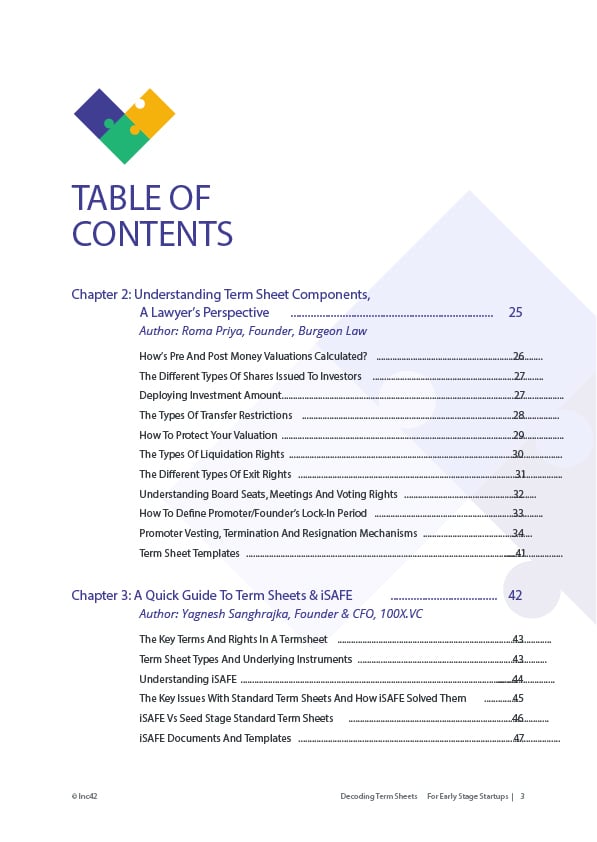

Decoding Term Sheets For Early Stage Startups

Investment term sheets always end up becoming a complex topic for early stage startups.

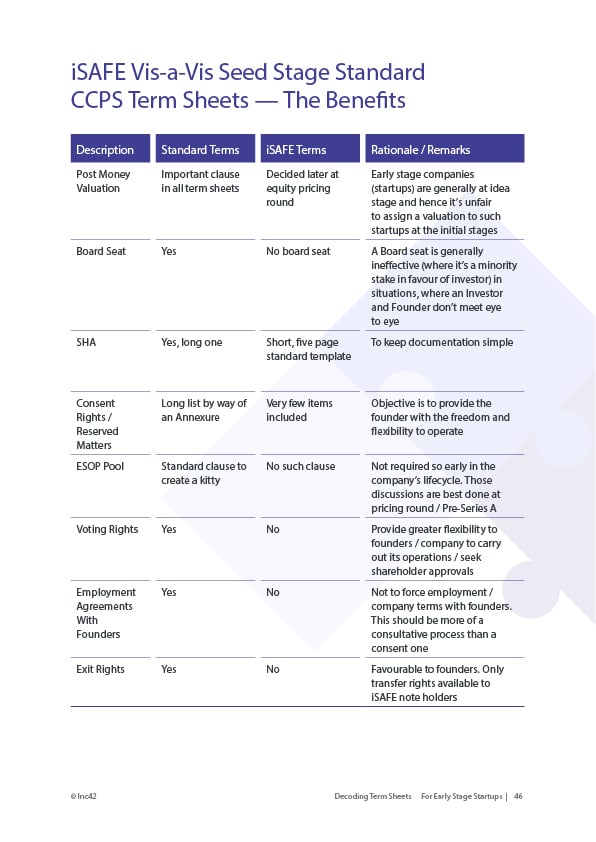

This guide will help founders get familiarised with the first document they receive from an investor as an offer to invest in the company which typically contains everything material in relation to the valuation, investment details, rights of the investor, restrictive covenants and exit commitments. The guide also talks about a new form of CCPS — “iSAFE”.

RECOMMENDED FOR yOU

Reading this will help startups raising seed or Pre Series A funding prepare for what is coming inevitably and help navigate through the most commonly used terms, the process involved and typical investor asks!

Ultimate Guide To

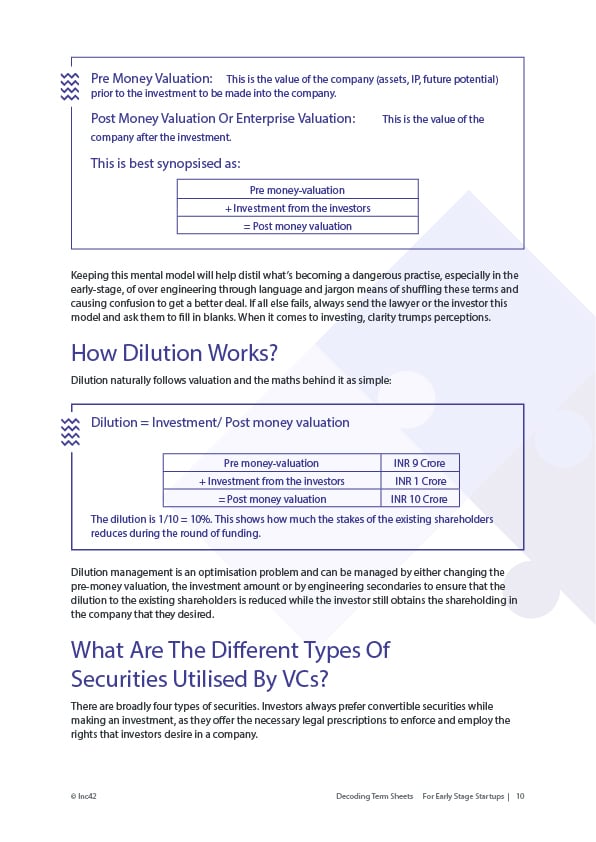

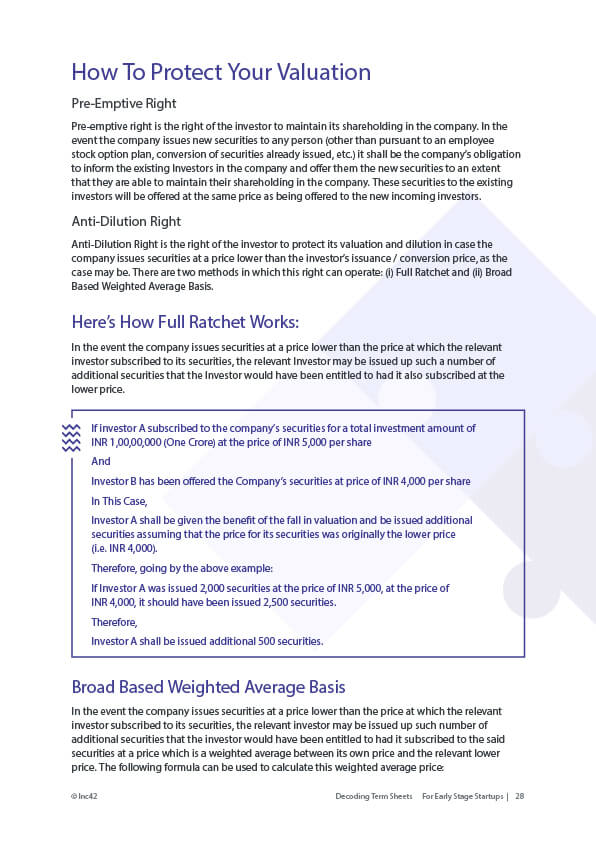

- Understanding how to structure terms to meet the interests of both startups and investors

- The crucial terms included in the early stage term sheets and their impact

- The process involved and typical investor asks

- Importance of various types of shares, capitalisation table & other key terms

- How “iSAFE” works

- Along with, term sheet templates & more