The Zaggle story began with employee rewards and recognition, but today it encompasses employee engagement to gifting to spends management to accounts payable and more

Eleven years after inception Zaggle is ready for its IPO and founder Raj P Narayanam insists that that the IPO journey is only for resilient entrepreneurs and businesses

The next big focus area for Zaggle is a product around credit cards that could help fill another gap within expense management for new-age companies, including startups

The year was 2012 and Raj P Narayanam saw a big gap in employee welfare in the Indian market. Even though corporations and enterprises had adopted rewards and recognition processes, Narayanam believed that the paper-first approach was not enough. And that was the starting point for Zaggle.

Eleven years later, Zaggle’s IPO opens today (September 14, 2023) and for several reasons, this journey makes for a unique story in the Indian tech ecosystem.

As Narayanam recalled in a conversation on the eve of the Zaggle IPO, the story began at employee rewards and recognition or R&R, but today it encompasses a lot more — from employee engagement to gifting to spends management to accounts payable and counting. “Our customers have been the key factor in helping us figure out where to expand and what problems to solve,” the founder and executive chairman told Inc42.

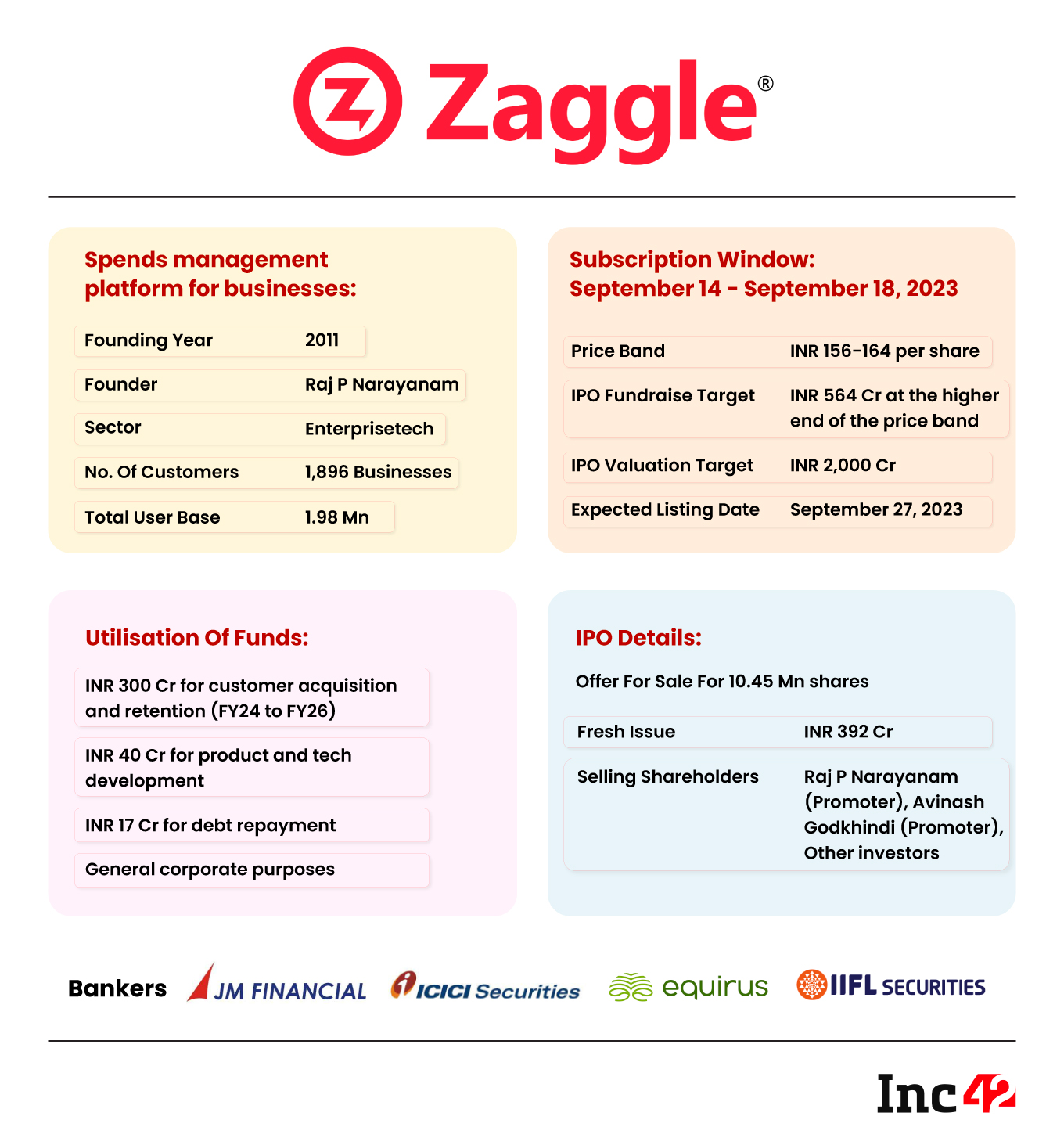

The IPO of Zaggle, led by Narayanam and CEO and MD Avinash Godkhindi, opens on September 14 and closes on September 18, 2023. For Narayanam, these past few months have been unflinching.

“It was a brutal and tiring journey, but totally worth it. When you go for an IPO, prepare your mind as if you are going into a war. But the biggest takeaway is that an IPO is a new beginning point for us, and not the end of the journey.”

The IPO comprises a fresh share issue of INR 392 Cr as well as an offer for sale (OFS) element of 10.5 Mn shares. The startup is getting listed on both NSE and BSE.

Zaggle’s public issue will invite subscription bids in the price band of INR 156 to INR 164 per equity share. On the upper end of the price band, Zaggle’s total IPO issue size stands at INR 563.4 Cr.

The startup plans to utilise the net proceeds from the IPO to meet the expenses related to customer acquisition and retention, development of technology and products, repayment or prepayment of certain borrowings, and general corporate purposes, which, as Narayanam told us, could also include some right-sized acquisitions in the future.

Founder Narayanam and CEO Godkhindi will dilute about 1.5 Mn shares each from their holdings in the company, along with six other shareholders, including VenturEast Proactive Fund, GKFF Ventures, and VenturEast SEDCO Proactive Fund.

Before we look at how Narayanam and Zaggle view the post-IPO journey and how this might change the company, it’s pertinent to see how the company arrived at this juncture in the first place.

The Initial Years

“I believe that back then the problem we were solving was around R&R. We saw a lot of breakages and most employees couldn’t utilise these rewards adequately,” Narayanam recounted.

This led to the first product from Zaggle. The startup launched a network-agnostic card in 2012 that would have the same kind of acceptability as a Visa debit or credit card. The process, back then, involved applying for a prepaid payments instrument (PPI) licence, partnering with banks, payments processors as well as PoS network companies to build its first rewards card.

Naryanam claimed that customers loved the solution because it reduced the breakage in the rewards redemption process that employees often complained about. It also allowed companies to manage the rewards process transparently and customise it for various occasions. “Between 2012 and 2015, we were working with close to 200 companies on the rewards platform, which is when we had enough of a critical mass to build more products based on engaging with customers,” the founder added.

In 2016, Zaggle realised its customers wanted customisable solutions that could potentially solve the problem with meal vouchers and other coupon products that were often distributed to employees.

“Companies used to offer Sodexo or other coupons to employees as part of their compensation plans, but at the time there were no multi-wallet products. That’s when Zaggle launched Zinger, which was the second major innovation from our company.”

With Zinger, employers could manage the delivery of coupons to dedicated wallets. “Today, we have about 99 different wallets within Zinger for categories like uniform, food, transport, internet and more, which are typically covered by coupons or reimbursement policies. Businesses could choose any configuration they want within these categories.”

Zaggle’s Evolution Towards Fintech-SaaS

“We were already at the cross-section of fintech and SaaS, so our focus turned to building more products that fit into our thesis. Companies asked us if there was a way we could also look at expense management, which was another area where there was a lot of paperwork and opacity,” Narayanam recalled, adding that the goal was to continue doing things completely digitally, where the competition from VC-backed startups was just coming up.

Zaggle’s approach involved building its expense management product within the Zaggle suite that would allow customers to manage everything that Zaggle offered through a single window. The bundling approach has since then become a default GTM for many horizontal SaaS players — the likes of Zoho, Freshworks and others had already set the trend, which was adopted by the enterprise products ecosystem en masse.

Zaggle’s bet on expense management has seemingly paid off. The startup is primarily known for its spend management product today, but it has also ventured into areas such as accounts payable with a product named Zoyer that helps companies automate payments to vendors and customers.

But catering to enterprise or mid-market companies means being able to customise products as much as possible. As of March 2023, the company’s SaaS subscription business accounted for INR 20 Cr of revenue, while INR 170 Cr came from programme fees, which is the commission that Zaggle charges when its cards are used by employees.

The largest contributor, around INR 350 Cr, came from commissions after employees and channel partners redeemed their Propel rewards points. These points have a monetary value and Zaggle gets a piece of Propel points consumed by employees or channel partners.

Over the past 11 years, Zaggle claims to have provided over 5 Cr prepaid cards in the Indian market, with over 2,400 lifetime customers. But as digital solutions and business management software came to the fore, Zaggle found that its clients required a lot more than just digital rewards and vouchers.

As per its red herring prospectus (RHP), Zaggle’s profit after tax (PAT) declined to INR 22.9 Cr in the financial year 2022-23 (FY23) from INR 41.9 Cr in the previous fiscal. Its operating revenue jumped to INR 553.5 Cr in FY23 from INR 371.2 Cr a year ago.

In late August, just a month before the IPO, Zaggle raised INR 98 Cr in two tranches as part of the anchor round from Vikasa India, Acintyo, and Value Quest. Prior to this, the IPO-bound company raised INR 50 Cr in debt funding from Vivriti Asset Management in March.

A day before the IPO, the company further raised INR 253.52 Cr from 23 anchor investors at a price of INR 164 per share.

Enterprise Vs SMBs: Zaggle’s Balance

Typically, the biggest concern around bundling is that it prices out some low-volume customers or small businesses that cannot afford the higher pricing for bundled software. For Zaggle, the focus has always been on mid-market and enterprise companies, which meant that its customers could afford to pay a little more for a real value proposition that the company claims to unlock.

The company also offered some solutions to SMBs through partners such as Razorpay, but never directly went after the SMB segment. Narayanam believes that the Indian SMB base is ready to adopt products but the customer acquisition cost and product distribution costs are still high when it comes to this class of customers.

“Our focus is not on small companies because the enterprise segment itself has a high growth ceiling. We want to cater to companies having over 200 employees. India has about 1.5 Lakh such companies and we have only reached 2,000-odd companies. The enterprise TAM in India is very huge,” the Zaggle chairman added.

But looking to address the top-of-the-funnel challenge, Zaggle launched XPNS, a DIY expense management app, which businesses can use to get started on their digitisation journey. This free product is meant to bring more smaller businesses to Zaggle’s doorsteps.

Narayanam claimed that Zaggle has customers across 18 different industries, including IT services, pharma, automotive, and manufacturing. No single customer constitutes more than 2.6% of the overall Zaggle business, he added.

The next big focus area for Zaggle is a product around credit cards that could help fill another gap within expense management for new-age companies, including startups, that often rely on credit cards for discretionary working capital expenses.

Life After IPO For Zaggle

Besides this, post the IPO, Zaggle is also looking at international expansion, which has so far been a low priority.

“The opportunity for SaaS is very high outside India. Customers typically pay 10X what Indian customers do, and we are already looking at offering a unified platform that addresses all regulatory headwinds that arise with global business management tools.”

North America and the Middle East are the primary targets for Zaggle, and the founder believes that international revenue would become a sizable chunk for the company in the future.

Zaggle partnered with Yes Bank for a RuPay corporate credit card that allows businesses to more closely watch expenses, set individual spending limits, apply merchant category restrictions, and other diverse controls. The Zaggle card is similar to other corporate credit cards offered by startups such as Karbon, Kodo, Happay, RazorpayX, Enkash and others. “We are looking at a major push in this space. This is a combination of software and a payment instrument, which is our forte and expertise,” added the Zaggle founder.

Along with the optimism about the growth opportunity in this space, there’s also an acknowledgement by Narayanam that the IPO will change life for Zaggle and its employees. “There is constant growth, and we have to constantly change ourselves to be able to meet the needs of enterprises. But we are a capital-efficient company, and we want to remain like that even after raising money in the IPO.“

Being a company that’s headquartered in Hyderabad has been a great advantage, Narayanam claimed, as this allowed Zaggle to work away from the tech spotlight of Bengaluru or Delhi NCR. Of course, closer to the IPO, the founder wishes that he had peers in Hyderabad that could show the company the right way to list publicly.

“There was not much focus on us, therefore we could build peacefully. The second thing is that we were able to attract talent at a lower cost. You know, we’re largely a bootstrapped company. So, we were able to get to new products before our competition because of these advantages. We will have to become extra responsible and cautious after the IPO. But one thing we can assure public investors is that our ‘What You See Is What You Get’ approach will not change.”

Now that Zaggle is about to get the national spotlight (and potentially global as well), the public listing is expected to bring in a lot of “goodwill” for the Hyderabad startup ecosystem, which Narayanam believes is set to reach new heights in the next couple of years, but that won’t change Zaggle much.

Ad-lite browsing experience

Ad-lite browsing experience