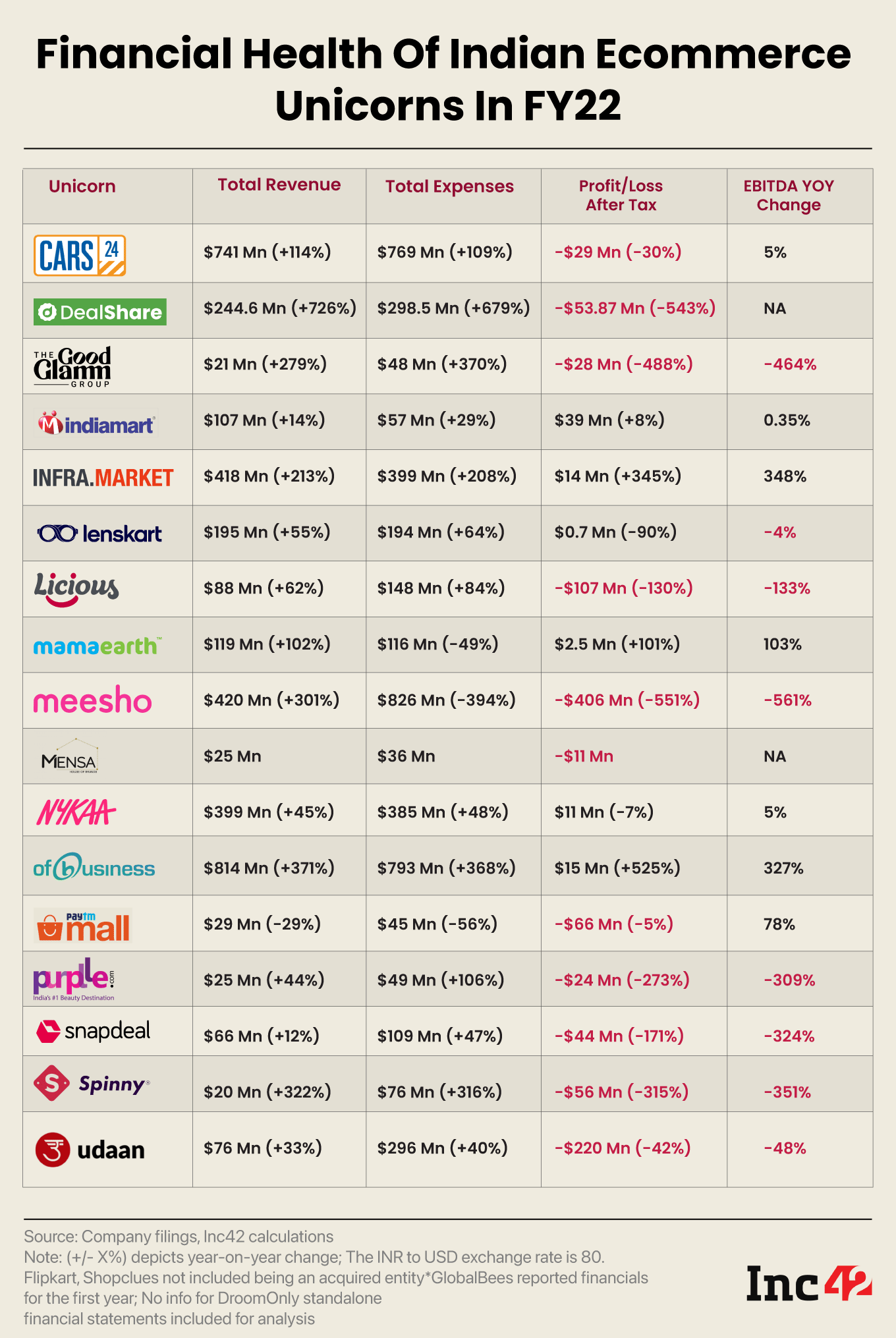

According to an Inc42 analysis, of the 19 Indian ecommerce unicorns, whose all financial metrics were available, only six were profitable in FY22

Amid the push for profitability, many ecommerce startups are now trying to build new revenue channels either by adopting the omnichannel model or exploring cross-border opportunities

Despite the gloom, there is a silver lining, as, unlike startups in many other sectors, ecommerce unicorns have not seen any noticeable valuation cut from their investors

During the peak pandemic years of 2020 and 2021, the investment bull run only provided a short-lived respite for the players operating in the country’s ecommerce market pegged to reach $400 Bn by 2030. This is because, in the aftermath of the pandemic, founders burned through hefty amounts of investor capital to boost revenues and acquire customers in a world that was returning to business as usual.

The situation became dire when the market was hit by a fall in consumer discretionary spending on the back of an uncertain job market, a rise in interest rates, and fears of an impending recession. The balance sheets of these players became the witnesses to this series of unfortunate events, which constantly challenged their unit economics and stability prospects.

According to an Inc42 analysis, of the 19 Indian ecommerce unicorns, whose all financial metrics were available, only six were profitable in the financial year 2021-22 (FY22).

It is pertinent to mention here that Udaan, Meesho, and Licious remained the most loss-making unicorns during the period.

Bogged down in profitability concerns, these startups were forced to reduce their expenses, which led to layoffs. Of the 26,848 layoffs since January 2022, 12.6% (3,378) have been from ecommerce companies, according to Inc42’s layoff tracker.

Speaking with Inc42, the cofounder of the D2C brand The Souled Store, Vedang Patel, said that it’s impossible to reduce the customer acquisition cost (CAC) unless the code to repeat purchases is cracked in this sector. The Souled Store raised $16 Mn (INR 135 Cr) in March 2023 from Elevation Capital and RPSG Capital and Xponentia Capital and Patel is confident that it wouldn’t have been possible if they were unable to show profitability.

Download The Report“There has been rationalisation when it comes to funding across sectors in 2022, a correction which was perhaps a little overdue. Capital is available for problem solvers who are passionate and have sound business fundamentals. The decline in funding is compelling startups to look at profitability at an earlier stage,” said Sheetal Bahl, a partner at Merak Ventures, in an earlier interview with Inc42.

Ecommerce Giants Struggle as Mega Deals Dry Up

The Indian ecommerce sector cherished approximately five mega deals with an average deal amount of $403 Mn, every year, between 2014 and 2018, making it the highest-funded sector.

After a brief funding lull in 2019 and 2020, when the fintech space became investors’ favourite bet, ecommerce players saw a revival in 2021, with more than $11 Bn raised across 302 deals, including 29 mega deals.

However, the funding greens of the peak pandemic times dried out too soon, and unfortunately, there are hardly any visible green shoots of revival to date.

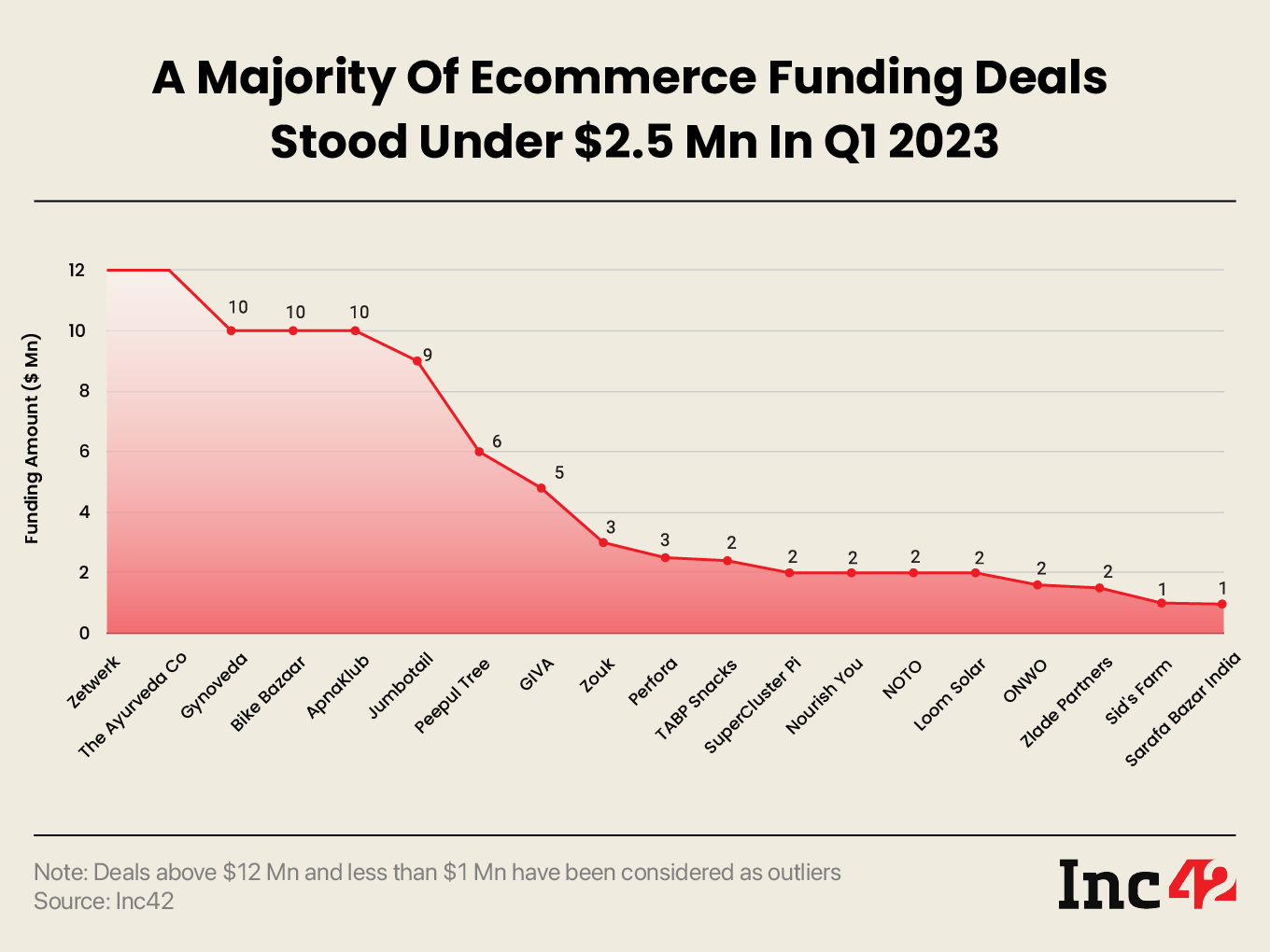

In fact, the highest deal value, excluding the mega deals, in the first three months of 2023 stood at $36.2 Mn only (raised by Mensa Brands). Further, only 19 ecommerce startups were able to raise anywhere between $1 Mn and $12 Mn. Additionally, almost 35.5% of the total ecommerce deals that happened in the segment stood below $1 Mn.

Meanwhile, here are a few key funding metrics from Inc42’s latest ecommerce report — State of Indian Ecommerce In Q2 2023:

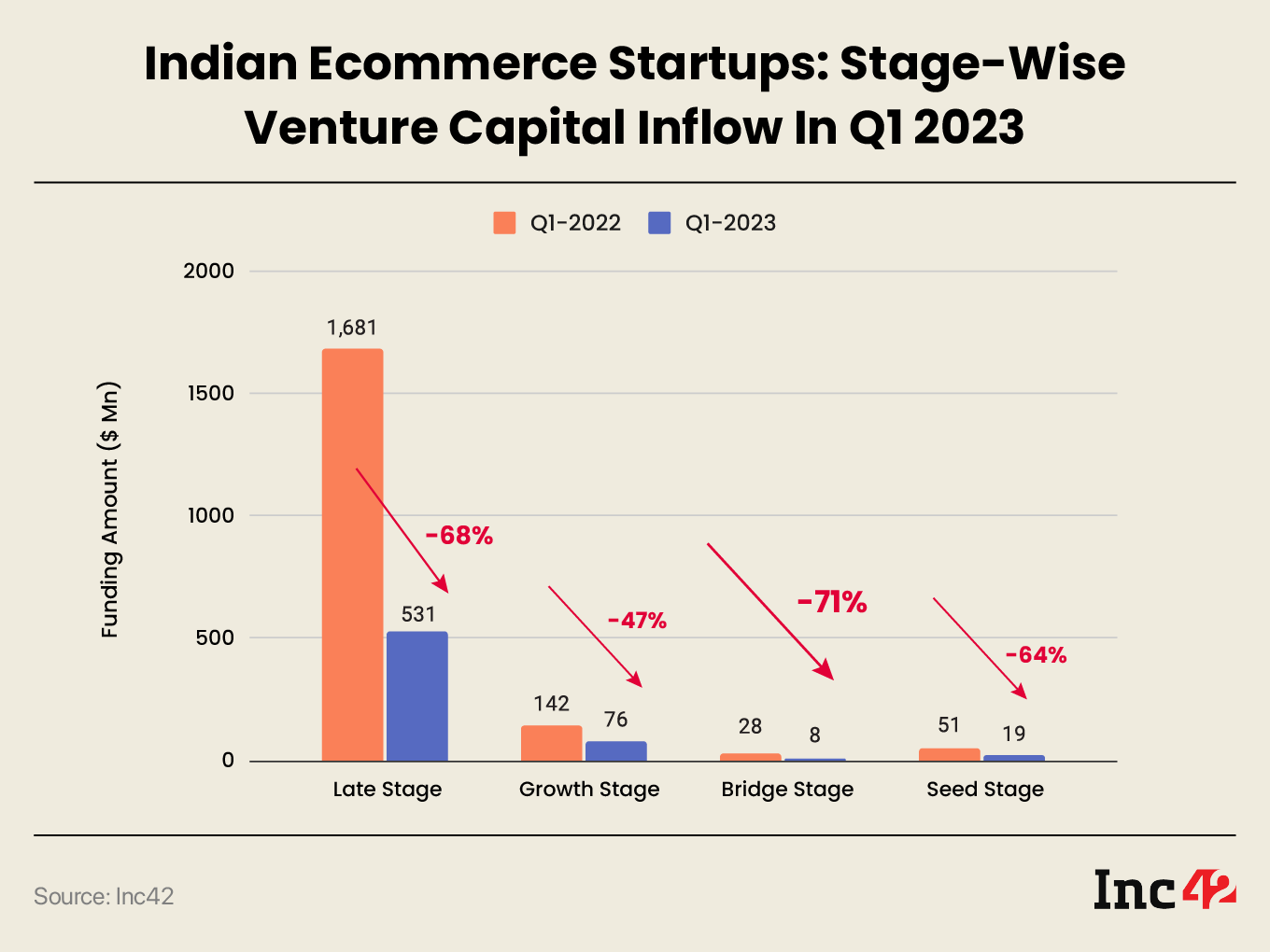

- Total Funding Dropped 67% YoY: The Indian ecommerce startups raised a total funding of $633 Mn across 38 deals in Q1 2023, down 67% and 62% YoY, respectively, from $1.9 Bn raised across 99 deals in Q1 2022.

- Q1 2023 Recorded Only Two Mega Deals: There were only two mega deals reported in the first three months of 2023. While Lifestyle D2C brand Lenskart lapped up a $500 Mn deal in March from Abu Dhabi Investment Authority, FreshToHome raised $104 Mn in February from Amazon Sambhav Venture Fund, E20 Investment, Mount Judi Ventures, and Investcorp, among others.

- Median Size Of Top 10 Deals Tanked 91% YoY: The median size of top 10 deals in Q1 2023 stood at $11 Mn, down 91% from $125 Mn in Q1 2022. The highest median size of the top 10 deals since 2012 stood at $229 Mn in Q1 2021.

- Seed-Stage Startup Funding Declined 64% YoY: After raising $51 Mn across 50 deals in Q1 2022, the seed-stage funding declined 64% to $18.6 Mn across 20 deals in Q1 2023.

Is Omnichannel & Cross-Border The Future Of Ecommerce?

Is Omnichannel & Cross-Border The Future Of Ecommerce?

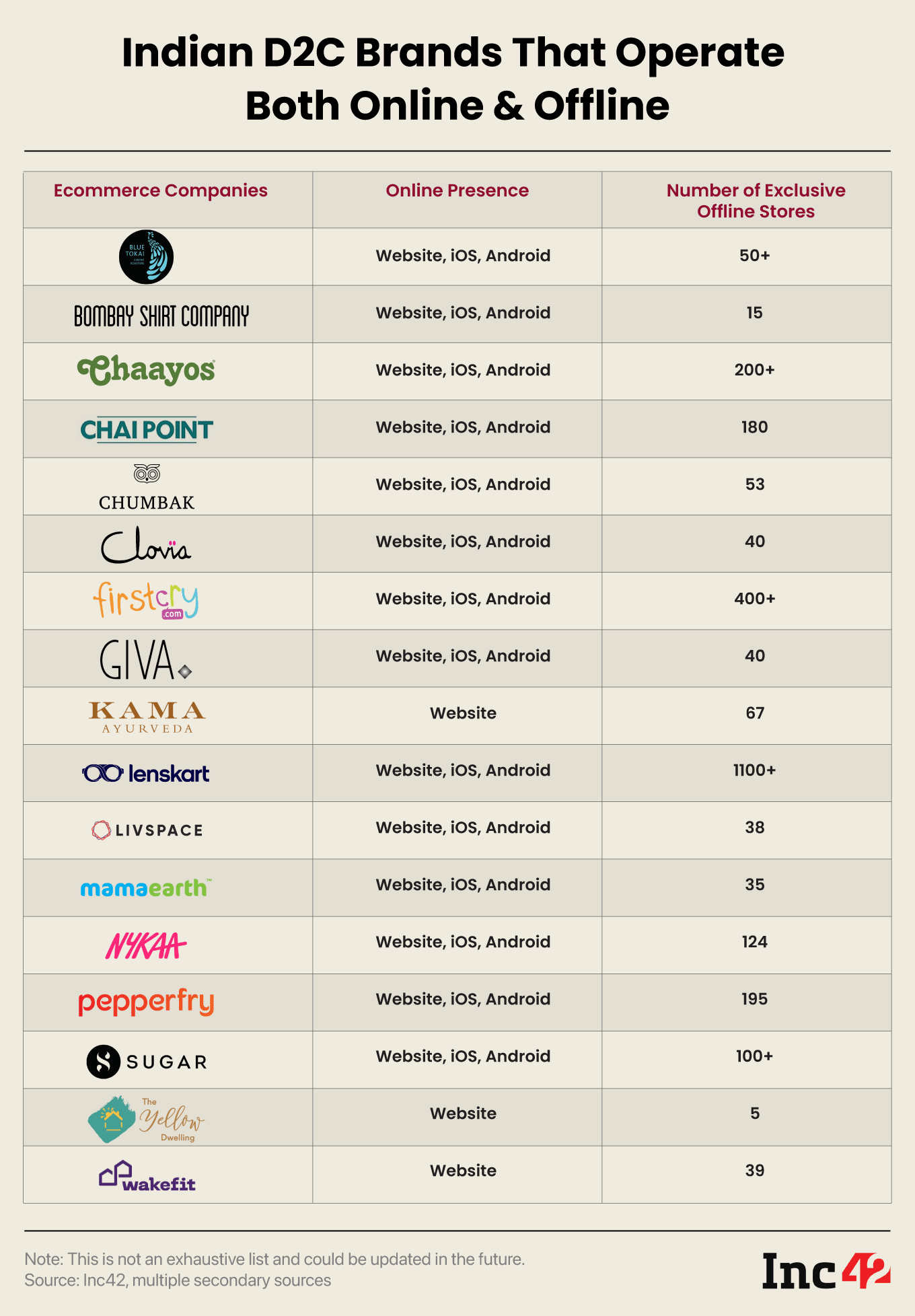

Amid the push for profitability, many ecommerce startups are now trying to generate new revenue channels either by adopting the omnichannel model or exploring cross-border opportunities.

A case in point is FreshToHome, which launched 30 offline stores last year and is now looking to have more than 100 stores in the next three years. In February, ENGN, a women’s performance wear brand, announced to increase its offline presence to 5-6 stores this year, eyeing a revenue contribution of 30%.

According to a survey conducted by Inc42, 94% of the C-suite executives surveyed see international expansion as a lucrative opportunity. Major D2C brands have already gone cross-border, with the UAE being the most preferred geography.

In the last few years, many direct-to-consumer (D2C) startups have gone global, either by setting up their own operations in foreign territories or by using local marketplaces such as Amazon. Some of the prominent D2C brands that have gone global include Lenskart, Nykaa and Chumbak.

However, the road to profitability still seems long. For instance, FreshToHome gets only 12% of its overall revenue from cross-border operations in seven emirates of UAE. Another D2C men’s grooming startup Bombay Shaving Company has operations in five countries but claims only 4-5% of its total revenue from there.

Navigating Through An Extended Series Of Challenges

Given that investors today have become more serious about generating returns and want to put a stop to the misadventures of burning cash, the pressure is mounting on founders to deliver.

In a bid to sustain and grow profitably, many startups have now started focussing on SAM (serviceable addressable market) along with TAM (total addressable market).

Next, as discussed above, the implementation of either an omnichannel model or cross-border expansion will remain key bets for the year. However, one must not forget that the cost of setting up infrastructure is quite high. Further, sustaining in India’s highly unorganised retail market could be challenging for the players that plan to enter the offline space with organised playbooks.

Additionally, even though we have ONDC, which has now expanded to 236 cities in India and has onboarded 36K merchants and 50-plus startups, there is no surety as to when the government will pull the plug on deep discounts and free deliveries.

Overall, the next 12 months may push the Indian ecommerce startups, particularly the growth stage or above, further down the rabbit hole.

Despite the gloom, there is a silver lining, as, unlike startups in many other sectors, ecommerce unicorns have not seen any noticeable valuation cut from their investors. Further, many experts believe that funding would gradually pick up momentum in the space.

Meanwhile, the only interesting thing will be to see how long the founders operating in the ecommerce domain can sustain the harsh ongoing winter until the funding floodgates reopen.

Download The Report

Is Omnichannel & Cross-Border The Future Of Ecommerce?

Is Omnichannel & Cross-Border The Future Of Ecommerce?

Ad-lite browsing experience

Ad-lite browsing experience