After raising $700 Mn from Walmart and a partial spin-off by Flipkart, PhonePe has a deadline for hitting profitability and IPO, but the company is not battle-ready yet, think experts

Unlike Paytm Money, Zerodha, Kuvera or Groww, the company offers regular funds, which incur higher expense ratio without extending any advisory support

Besides profitability, PhonePe’s IPO success would also depend upon the IPO performances of Flipkart and Paytm, say experts

The recent spin-off of PhonePe from its Indian parent company Flipkart and its subsequent fundraising from global behemoths is a case in point. Bengaluru-based PhonePe, one of India’s biggest digital payments platforms, recently bagged $700 Mn from Flipkart’s US parent Walmart and other existing investors at a post-money valuation of $5.5 Bn. Soon after that, it raised another $21 Mn from the Indian ecommerce giant that still holds 87% stake in PhonePe.

But the latest rounds of funding amassed by PhonePe come with a string attached, apparent from the slew of announcements the company has made. These include a bouquet of new products, getting profitable by 2022 and most importantly, getting ready for a 2023 initial public offering (IPO). These are not mere rhetoric as PhonePe has already entered key segments such as mutual funds and insurance and is planning to enter loans in 2021.

What’s more, in its new avatar, PhonePe will compete with deep-pocketed rivals, including Alibaba-backed Paytm, industry veteran Zerodha and the likes of Google Pay and Amazon Pay which could be eyeing further growth away from the well-trodden digital payments space. But before we analyse PhonePe’s marketworthiness, a quick look at its product portfolio, both old and new, is bound to reveal its fintech muscle.

PhonePe’s Business Evolution And What It Means

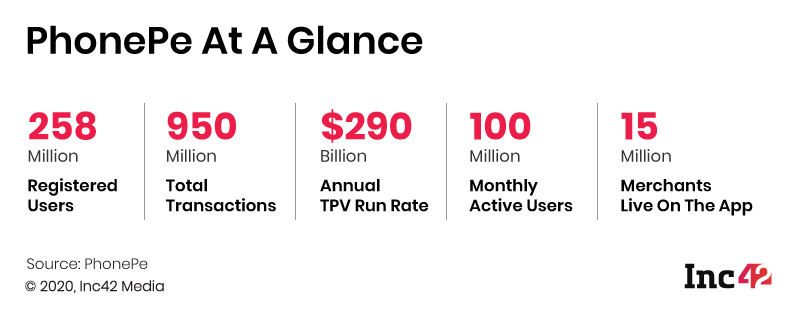

Set up by Burzin Engineer, Rahul Chari and Sameer Nigam, the digital payments company was acquired by Flipkart in April 2016, just five months after it was incorporated. Primarily known for its leading role among the third-party payment apps (TPAPs) on the Unified Payments Interface (UPI) network, Phonepe has initially focussed on utility bill payments, merchant payments for shopping and selected bus-ticket booking and cab-booking features (redBus tickets and Ola rides). The company claims to have captured around 42% market share in terms of UPI transaction volume. PhonePe says it has more than 258 Mn registered users and 100 Mn-plus monthly active users (MAU) who generated nearly 1 Bn total digital payment transactions by October 2020.

But there is a catch. Its leading position on the UPI interface will not earn the company much revenue, thanks to the government’s zero MDR policy. The policy, implemented by way of amendments to the Payment and Settlement Systems Act, 2007, takes away any income that banks and payment service providers (PSPs) such as third-party UPI apps may receive for enabling digital transactions.

Given this broken revenue model on the UPI, it is not surprising that PhonePe has entered a few lucrative segments and tested the waters. After Flipkart’s acquisition by Walmart, the PSP registered three more entities with the Ministry of Corporate Affairs (MCA). These include PhonePe Wealth Services (a mutual fund distributor), PhonePe Insurance Broking (a third-party insurance distributor) and PhonePe Technology Services.

In the mutual fund space, the company has launched several products such as super funds, liquid funds and tax-saving funds. These aim to target users from Tier 2 and Tier 3 locations, those who have never experienced any financial solution beyond traditional banking. According to Terence Lucien, head of mutual funds and gold at PhonePe, “The launch of seven new curated sets of MF categories will cater to investors who want greater flexibility and control in building their investment portfolio.”

Insurance is another crucial area that PhonePe has focussed upon. The company entered this segment at the beginning of 2020 and launched a number of insurance products such as international travel insurance for business and leisure travellers, domestic travel insurance, Covid-19, dengue and malaria insurance, personal accident cover, hospital daily cash and car and bike insurance.

How PhonePe Stacks Up Against Paytm Money, Zerodha

Now that PhonePe has moved away from its comfort zone – that of UPI payments – can it evolve into a one-stop destination for key financial services? The competition will be quite tough even if it targets the next billion internet users beyond the metro cities. For instance, there are 1,037 AMFI-registered (Association of Mutual Funds in India) MF distributors in India and more than 500 corporate agents registered with the Insurance Regulatory and Development Authority of India (IRDAI). Unless the company comes up with a specific strategy to drive penetration and build a sound customer base in these all-too-crowded segments, its growth plans are likely to remain elusive.

According to Karthik Raghupathy, vice-president, strategy and business development, at PhonePe, the traction is triggered by the simplicity of its app, the user-friendly interface that helps people invest easily.

“Bringing in the next half-a-billion depends on building user awareness, creating trust and developing simple UX form factors to reach every single Indian. Even as we do this, we need to stay relentlessly focussed on execution as the organisation scales both in terms of products and the value we bring to our customers,” he said.

The competition will always be there as legacy banks and fund houses do bulk MF distribution. But unlike traditional financial houses, startups such as Paytm Money, Zerodha and PhonePe have their own USP as they focus on user-friendly interfaces. Moreover, there is a stark difference in these startups’ product offerings. PhonePe only offers regular funds, unlike Zerodha and Paytm Money, which are into direct funds. Scripbox is another company that offers regular plans like PhonePe.

Srikanth Meenakshi, the cofounder of FundsIndia and Redwood Research, was not appreciative. “PhonePe products are definitely poor compared to other product options available in the market. The funds on its platform are regular, but there is very little advisory support, unlike Scripbox.”

Platforms like Zerodha, Paytm Money and Kuvera offer direct funds, and hence, you decide where to invest and how to manage your portfolio. But PhonePe is offering almost no support despite charging extra money in the name of regular funds, Meenakshi told Inc42.

Both Zerodha and PhonePe rely upon the BSE StAR MF for transaction processing while Paytm Money says it has built its own customised platform.

According to Meenakshi, in the absence of any advisory, investing in super funds incur higher costs, including an extra charge for fund-of-funds’ (FoF) expense ratio. “It is unconscionable to pay these extra amounts for investing. When an entity sells regular plans, it is supposed to provide advisory and customised fund recommendations. PhonePe does neither, and charges investors a cool 0.75% extra just for offering an FoF on its platform,” he earlier pointed out in an article.

Meenakshi of FundsIndia thinks PhonePe’s super funds are unlikely to see more traction as these are debt funds in nature and do not incur equity fund-like taxation. “Overall, PhonePe has made certain improvements since it launched its MF products, it is yet to catch up with the competitors in terms of product placements and value offerings,” he added.

To date, the company has sold its MF products to customers from 15K-plus pin codes, including Tier 1, Tier 2 and Tier 3 cities.

In the insurance space, PhonePe is again locking horns with archrival Paytm that has been offering numerous products for a while and has already acquired insurance firm Raheja QBE for $74 Mn to strengthen its offerings, PhonePe claims to have processed more than 11 Mn insurance premium payments on its platform in 2020. Also, half of these payments came from users residing outside metros.

Interestingly, the insurance market in India is underserved compared to global markets in spite of tough competition among incumbents. According to IRDAI, India’s insurance penetration increased marginally to 3.7% in FY2018-19 from 3.69% in FY2017-18, against the global penetration at 6%.

With digital payments companies like PhonePe, Paytm, Amazon Pay and Google Pay riding high on UPI penetration across India, there is an increasing notion that these platforms would help accelerate India’s insurance adoption. This could also be understood by WhatsApp’s foray into insurance and lending sectors.

Profitability Will Be Key To IPO Success

Young fintech firms are gaining traction from users and investors alike, but they need to fine-tune their products and develop sound business plans across service segments for future growth, be it external funding or a mandated IPO as in the case of PhonePe.

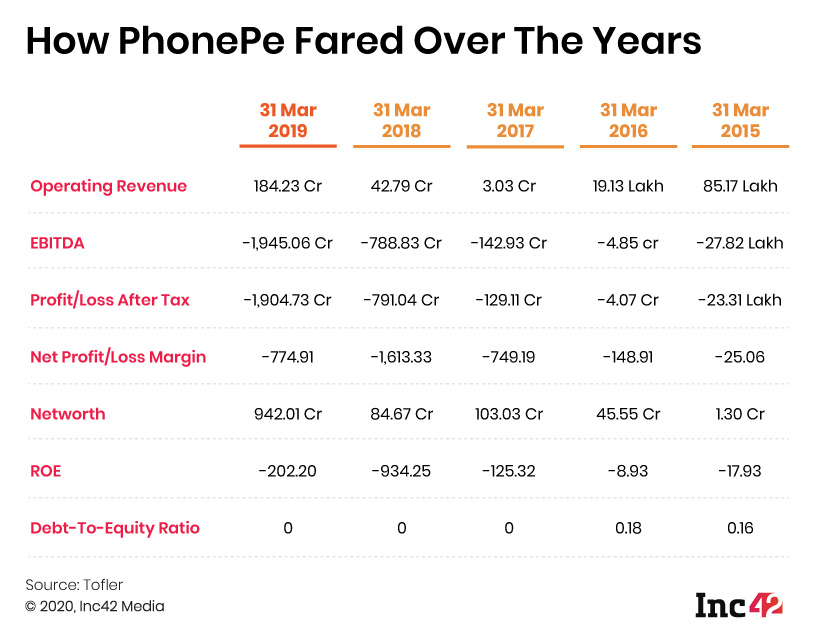

Profitability will be the key when the company goes for an IPO, but this will not be easy for several reasons, said a former top employee of PhonePe, requesting anonymity.

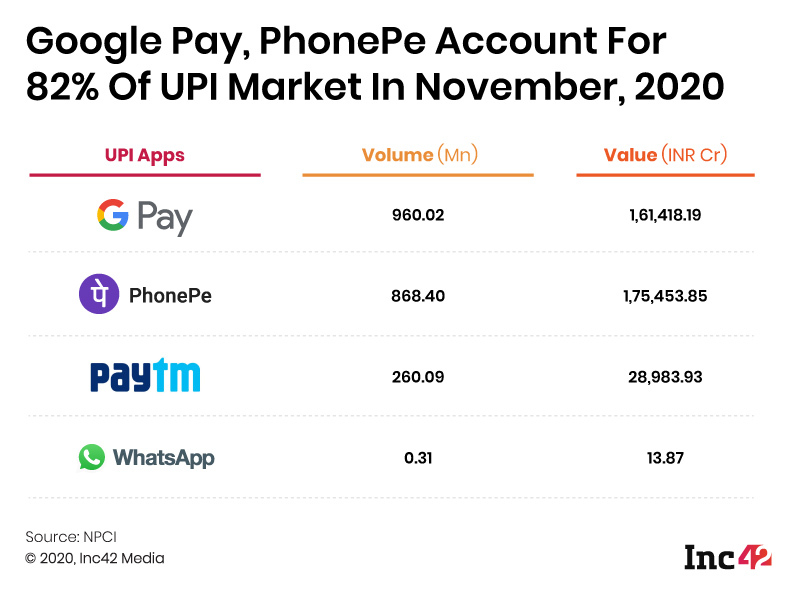

For starters, PhonePe has been struggling since the zero-MDR rule came into play as its revenue from UPI payments dipped drastically. Its market share in the UPI transactions space is set to slide by 2023 due to stiff competition from digital payments platforms such as Google Pay and Paytm. In fact, Google Pay has already dethroned PhonePe in terms of transaction volume. Given the sorry state of affairs, especially with Walmart’s IPO mandate hovering in the background, the company is compelled to diversify in a hurry and burn a significant amount of cash for marketing. It also explains why Aamir Khan has been pressed into service as the company’s brand ambassador.

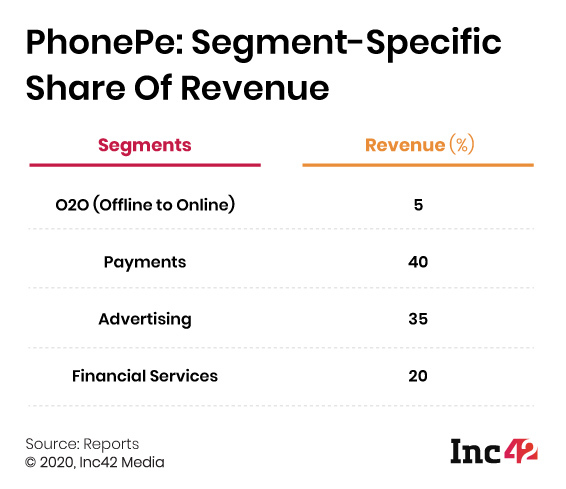

Asked about the company’s product and revenue diversification plans, Raghupathy declined to share more details. “We have multiple product lines which generate revenue for the company. These range from payments (cards and our wallets), to financial services, gold, insurance, in-app distribution and advertisements. We will not be able to comment on these product lines’ revenue share, but these are all significant contributors. We continue to add product lines and use cases at an ever-increasing rate to solve a variety of problems faced by Indian citizens.”

Product diversification should not be a problem either, said Raghupathy, even though the company does not hold a first-mover advantage in the new segments. “PhonePe continues to add millions of customers to its platform month on month, which shows there is still massive headroom for growth as the overall (fintech) pie gets bigger. Our product innovation and mass-market focus (beyond metros) also help.”

Not all feel equally optimistic. Commenting on the zero-MDR conundrum, Dr Chirag Malik, a professor at the School of Management, BML University, said that it is a cost to the industry. At the same time, the 30% cap on all UPI transactions done on any payment app gives a company a favourable opportunity to explore untapped markets.

The former PhonePe executive mentioned before is openly sceptical, though. Profitability is all that matters for a company. But PhonePe is still busy launching new products in Tier 2 and Tier 3 markets. These are not metros, and it may take years to reach the right level of penetration, the person added.

Malik, too, concurred, saying new product launches have faced difficulty during the Covid-19 pandemic. Besides, the MF industry has taken a hit, and fund managers have a pessimistic view of its growth as most people are investing in stocks.

Besides profitability, companies should learn from the likes of Uber or WeWork, said Malik. Pricing the IPO right to bring out PhonePe’s intrinsic value may work well. Or the markets may be tested in advance to set the floor and ceiling prices of the IPO. Add to that a robust Indian stock market or some of the most successful IPOs of the pandemic year (think Airbnb and DoorDash in the US or Burger King India and Mrs Bectors Food Specialities closer home, which mirrored massive investor response), and the outlook seems strong.

But that brings us back to the never-ending debate – will PhonePe (or Flipkart, for that matter) list overseas?

“Walmart’s experience with the Indian market has not been outstanding. On the other hand, it understands the US market quite well, and hence, there is a greater probability that both companies (Flipkart and PhonePe) would list in the US. However, there are external factors. For instance, PhonePe’s IPO is panned after Flipkart and Paytm. Therefore, it would heavily depend on those companies’ listings too and how well they do,” said an analyst from Duff and Phelps on the condition of anonymity.

Although Raghupathy declined to comment on it, given that Walmart has roped in Goldman Sachs for PhonePe’s IPO listing along with Flipkart’s, experts have suggested a greater chance PhonePe would go the Flipkart way.

With inputs from Sanghamitra Mandal

Ad-lite browsing experience

Ad-lite browsing experience