More than 20 micro VC funds announced their debut in 2021 and 2022, and the overall number reached more than 80

Between the years 2020 to 2022, the seed stage deal volume below $200K continues to be less than 10% of the total deals, a key gap micro VC funds are keen to address

Micro VCs are expected to become startup discovery engines in near future

Traditional venture capital funding in the Indian startup ecosystem has been on a tear for nearly a decade. But with thousands of new companies entering the ecosystem every year and macro disrupters like the pandemic, geopolitical unrest and a funding winter impacting the world of business at large, the VC game and funding playbooks have seen significant changes.

One such phenomenon is the rise of the micro VCs whose small-ticket funding into pre-seed and seed-level startups have grown markedly in the past couple of years, taking the investment ecosystem by storm.

For context, more than 20 micro VC funds announced their debut in 2021 and 2022, and the overall number reached more than 80. This growth is fuelled primarily by the rising demand for seed funding in the ecosystem.

According to Inc42 datalabs, between 2014 and September 2022, as much as $5 Bn was invested in seed stage startups in India. In fact, there was nearly a twofold jump in seed funding in 2021, around $1.14 Bn from $409.8 Mn in the previous year. But this accounted for only about 3% of the total $42 Bn raised in 2021; and almost 4% of total $12 Bn raised in 2020.

Considering the sample set below including only the seed stage deals with disclosed funding, it is observed that across the three years, the deal volume remain concentrated at the range of $1 Mn – $5 Mn. While, the deal volume below $200K continues to be less than 10% of the total deals. This underlines the widening funding gap in the seed stage that micro VC funds are keen to address.

Rise Of Micro VC Funds In India

This rise of micro VCs due to their impressive involvement in seed stage startup funding, and, in some cases, follow-on rounds, is not a stand-alone trend. It has become mainstream in the west, and nearly 50% of all fund closures in the western markets include micro VC funds. They manage a significant share of AUM and have grown very fast.

They started gaining traction in India post-2016, fuelled by the rising number of young founders with little or no experience in entrepreneurship.

“On the supply side, the number of startups is increasing, and they need capital as well as guidance. Traditionally, these companies would have never received capital from growth stage VCs as the latter usually comes in post-Series B. But how can a company that has just started (and so many like it) reach that stage without capital? This has built the entire premise for micro VC investments in India,” said Shashank Randev, founder VC at 100X.VC.

By that time, VC funds had been in the country for 10-15 years, and folks part of that ecosystem wanted to do something on their own.

“The entrepreneurial mindset also kicked in there, and small funds were set up, leading to the growth of micro VC funds,” said Pearl Agarwal, founder and managing director of Eximius Ventures.

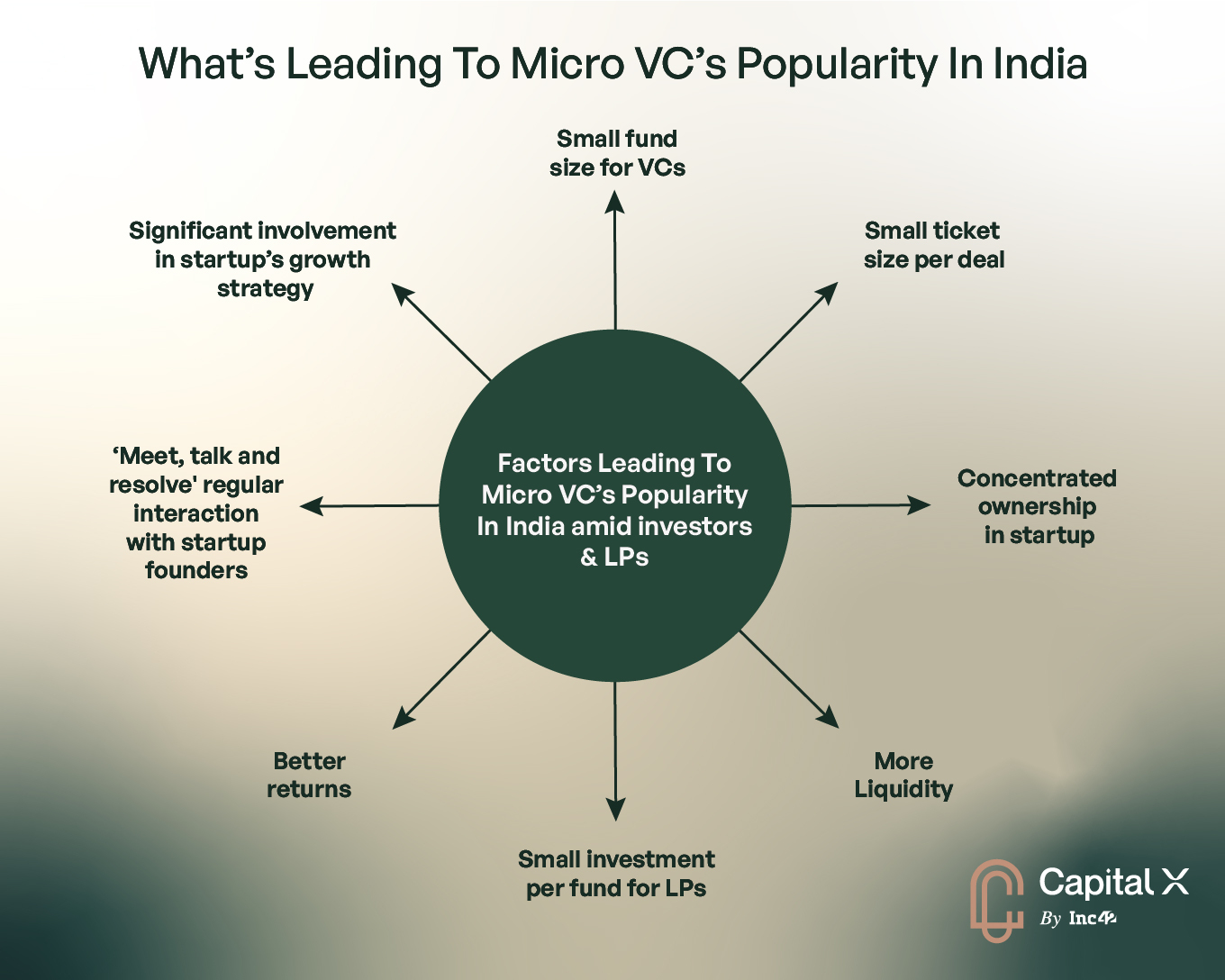

But before we delve deeper into the trend and its impact, let us look at what makes micro VC funds exceedingly popular among startups and investors (limited partners) and across the VC ecosystem.

The Industry Lens: Small Funds Fulfil Return Expectations, Helps With Pro-Rata Rights

As indicated by various VCs during their interactions with Inc42, a micro VC fund is typically under $100 Mn and the strategy defines that the fund cannot be too large.

Traditional VC funds have a corpus range of $0.5 Bn-$1 Bn+, looking at funding rounds of $10 Mn-$15 Mn. But in India, seed rounds worth $10 Mn are a rarity and not even a Series A round often amounts to $10 Mn as excess capital tends to kill early stage companies.

The VCs further emphasised that in India, one needs to right-size the fund to write an INR 3 Cr-INR 5 Cr ($350K-$600K) cheque that can help startups grow from the seed stage to Series A. The cost of lifting a company to Series A could be around INR 8 Cr-INR 10 Cr ($978K-$1.2Mn), excluding core deeptech and R&D categories. If a very large fund writes a seed cheque, its investment cost will be much higher than the returns from that deal. Moreover, 100x returns from a Series A will always be a remote possibility.

Here is an example to explain this further. A typical VC with a fund corpus of INR 1000 Cr ($122 Mn) will preferably look for a minimum $10 Mn valuation round at seed stage. In order to return a 100x on its investment to the VC, the startup will have to create a value of $1 Bn without dilution and $3 Bn-$4 Bn with dilution.

At the same time, a typical micro VC fund with a seed stage fund corpus of $30 Mn has the capability to invest in a startup at $3 Mn-$3.6 Mn (INR 25 Cr-INR 30 Cr) valuation. This startup will have to only create a value of $367 Mn (INR 3,000 Cr) without dilution and $735 Mn (INR 6,000 Cr) with dilution to give 100x returns to the VC.

“Imagine you are an INR 1,500 Cr fund and writing an INR 3 Cr cheque. Even if that returns you 100x, you are getting INR 300 Cr, but the rest of the fund (INR 1,200 Cr) is still left to be deployed. VCs with a fund corpus of $150Mn+ mostly prefer to write a minimum $1 Mn cheque. But that is very big in the Indian context. We want our founders to be frugal and innovate,” said Anirudh Damani, managing partner and director at Artha Venture Fund.

VCs also indicate that too big a corpus can kill returns. If an INR 200 Cr fund has to create 10x value for its LPs, it will amount to INR 2,000 Cr. On the other hand, when an INR 2,000 Cr fund has to generate 10x value, this will require INR 20,000 Cr across portfolio companies, and the maths will be entirely different.

Again, a micro VC is likely to hold 14-15% equity stake in a startup while investing across stages – pre-seed to follow-on funding rounds above Series A, thus ensuring significant pro-rata rights in future rounds and greater returns.

“If I write random cheques of INR 20 Cr in a Series B round which is led by a larger VC, I might get only1%-2% ownership. That is not a meaningful ownership stake, and I won’t have any way to work with the founder,” added Damani.

The LP Lens: Small Investments, More Opportunities To Diversify

Unlike the traditional pension funds and university endowments, domestic LPs mostly include family offices and HNIs comfortable with $1 Mn-$2 Mn cheques. Then again, a large fund will involve many LPs, but General partners (GPs) may find it difficult to manage the lot. More importantly, many of these LPs are looking for more granular details and greater involvement to have better control over their capital. But such alignments are not possible when one invests in a large fund. Therefore, a lot of LPs are now gravitating towards micro VC funds.

Also, more growth opportunities will be there if LPs are putting their money in multiple micro VC funds across sectors. The beauty of small funds is that it allows LPs to have diversified investments and create an investment mix for high value returns.

For instance, to raise a INR 3,000 Cr-INR 4,000 Cr fund, LPs need to write INR 50 Cr-INR 100 Cr cheques. But India doesn’t have many people who can write such big cheques

Let us put it in numbers for more clarity. An LP putting INR 10 Cr in an INR 450 Cr micro VC fund gets a little over 2% ownership and sizable returns in seven or eight years. Wherever an LP putting INR 10 Cr in a larger INR 2,000 Cr fund gets a minuscule (0.5%) ownership, and returns are expected after a minimum of 15 years.

“The biggest competitor here is the Indian stock market, giving 18% annual returns and doubling the money every four years,” added Damani.

Other Factors Leading To The Rise Of Micro VC Funds In India

Angels may lose relevance as funders and mentors

Going by our recent conversations with the VCs operational in India, the country’s startup ecosystem may not see any angel investment five years from now. Unless we are talking about marquee angel investors who can write an INR 50 Lakh cheque for a single investment, existing ‘angel funds’ may shun the tag as an investment worth INR 2 lakh-INR 3 Lakh will not generate much value.

Further, as observed, sometimes to raise only INR 95 Lakh, a startup had 43 investors on its cap table. Founders were getting the money, but there was no guidance for them. At an early stage, the colour of money is the same, but its weightage is different. However, when a micro VC fund with a committed seed capital comes into picture, they have a 10-12% stake at risk and have eight or nine people sitting there just for portfolio management. Every rupee they are investing is worth 3x for the investor. But an individual angel may not have the time for it.

Micro VCs bring more value to the table

There is a dire need for venture capital players who can come at a very early stage, invest $100K-$500K and lead on with continuous investments in follow-on rounds. Micro VCs are just doing that, putting in an amount in-between angels and the larger lead VCs.

According to Adith Podhar, founder of Gemba Capital, startup founders have now realised that a pre-seed or seed round is just an optionality cheque for large VCs. They invest $1Mn-$2 Mn out of a $2 Bn fund to see how the company grows.

“Without any value addition, such VCs are more suitable for Series A funding and above. Also, if they don’t come at the next stage (post-seed), it sends all the wrong signals. But for micro VCs like us, every deal is important. That is why founders prefer to take the money from micro VCs at the seed stage,” he added.

Entrepreneurs, family offices target the micro VC space

In recent years, three new types of LPs have started taking an interest in the micro VC funding strategy.

- To begin with, between 2015 and 2022, India saw its number of unicorns grow from 10 to 108, giving rise to a class of billionaire tech entrepreneurs who have seen exits through acquisitions and IPOs and are now investing in micro VC funds as LPs.

- Second-generation entrepreneurs from India’s marquee family offices are now looking at the startup ecosystem as a potential asset class.

- The third category includes veteran entrepreneurs, part of the giant unicorns. Their ESOPs have created considerable wealth, and they are now investing in young startups.

New players fill the vacuum as traditional seed funds get big and move on

Seed funds like Blume Ventures and Sixth Sense have grown from INR 100 Cr to INR 1,000 Cr-INR 2,500 Cr entities over the apst decade. With the rise in corpus, they have moved away from pre-seed and seed funding to pre-series A, Series A and beyond. This funding vacuum has opened the gates for new-age micro VCs.

The Road Ahead For Micro VCs In India

According to Brijesh Damodaran Nair, founding partner of Auxano Capital, going by opportunities available, the pace of disruption, and the current demographics of India, micro VCs have a lot of advantages. He believes that micro VCs are standing at the right place at the right time and have certain advantages in terms of language, state of education, cultural diversity, lifestyle, infrastructure among others.

Although micro VC funding has recently gained traction in India, the concept is not new. Since 2005, American technology incubator Y Combinator has provided $500K in seed money to young startups and mentoring support. Y Combinator has pursued this model for nearly two decades while floating an additional continuity fund.

The ecosystem is still at a nascent stage, primarily operating below Series A, but slowly making a foray into the growth stage or the middle of the pyramid via follow-on rounds into portfolio companies.

Although there is no industry-defined micro VC manual analysing their growth, investment trends and likely pivots, the VCs who recently interacted with Inc42 were confident of structured growth over the next two to three years. Here is a quick look at the five hot trends that can dominate this ecosystem.

- Increase in sector-focussed micro VC funds: Given the rapid growth of capital-efficient technologies and how angels with experience in those sectors are now floating micro VC funds, there will be a rise in sector-specific investment vehicles instead of sector-agnostic entities.

- Intriguing growth side stories: Entities doing this as a side gig by utilising their extra capital and networking prowess will be able to invest through well-structured micro VC units. On the other hand, those who have entered the micro VC space as a way to grow their funds (AUM) and evolve into growth VCs with a focus on one or more sectors will continue to add value across the funding ecosystem.

- Continuity funds will tick up: Micro VCs will float more and more continuity funds to support their portfolio companies, generate value and ensure better returns.Take, for instance, Artha Select, a $55 Mn (INR 450 Cr) follow-on investment fund started by the parent fund. Not only this will boost the confidence of portfolio companies but will also give a positive signal to growth stage VCs in future. The VC ecosystem may also expect two or three micro VCs to come together for a larger round without a growth stage VC.

- Existing strategies to continue: Most of the micro VC funds will continue with their investment theses as there will be more impetus for value creation. For example, 100X.VC does not intend to change its investment thesis until it funds 500-700 companies, as indicated by 100X.VC’s Randev in a recent conversation with Inc42. Podhar of Gemba Capital also intends to continue with seed stage funding. “At the most, we will move up to pre-series A, and the fund size will always increase. Our fund should be large enough so that we can write all the cheques (up to Series A). We will be the lead investors, and we will continue to fund pre-seed, seed and Series A rounds. So, instead of writing $150K, we will be writing $1 Mn cheques,” he added.

- Micro VCs will be vital for startup discovery: As of now, early stage VCs explore incubators and accelerators to track promising startups. However, most of those startups are at the idea or MVP (minimum viable product) stage. With micro VCs coming in as a layer between the MVP and pre-Series A stages, traditional growth VCs can look at a micro VC portfolio as a differentiated and structured discovery and investment engine.

In our earlier story decoding the micro VC landscape in India, we have detailed how micro VCs are floating follow-on funds for portfolio companies to cement their presence from the pre-seed level to selective exposure in Series B and Series C. This will further free up the resources for growth stage VCs investing at a later stage and help companies raise late stage rounds faster.

[Edited By Sanghamitra Mandal]

Ad-lite browsing experience

Ad-lite browsing experience