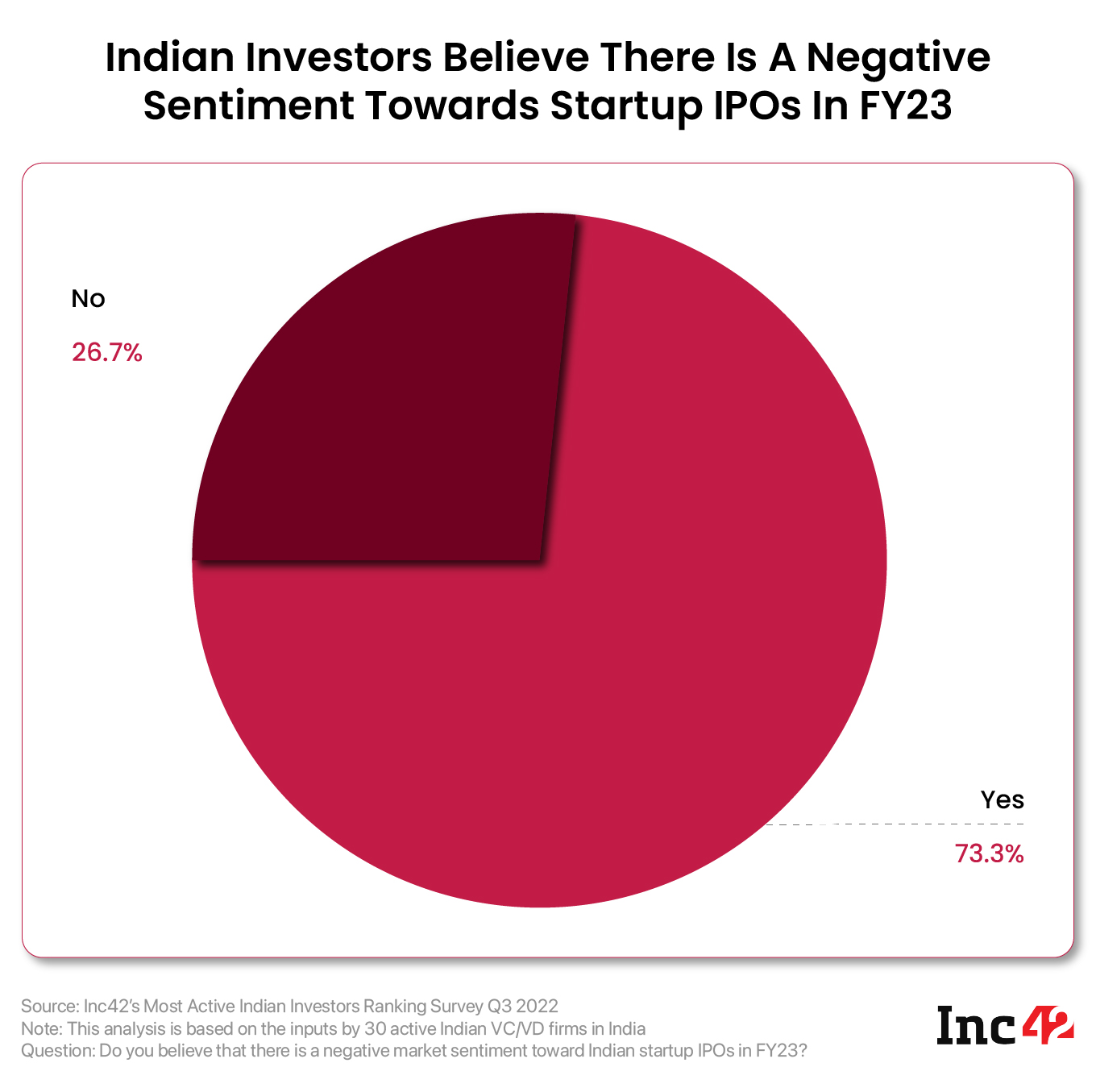

According to Inc42’s ‘Most Active Indian Investors Ranking Survey Q3 2022’, 73% of the investors have a negative sentiment toward startup IPOs

While 11 Indian startups have gone public since the start of 2021, 23 more are eyeing an IPO in the next few quarters

The combined valuation at IPO of the 11 listed startups was over $70 Bn; their current market cap stands at around $32 Bn

Buoyed by the tailwinds generated by the unprecedented funding boom during 2021, several Indian startups started looking at equity markets to raise funds during the year. Many unicorns and late-stage startups made their debut on the stock exchanges or firmed up plans to go public.

Since the start of 2021, 11 Indian startups – Paytm, Nykaa, CarTrade, MapmyIndia, EaseMyTrip, Delhivery, Fino Payments Bank, IndiaMART, Nazara Technologies, Policybazaar and Zomato – have gone for a public listing in some of the biggest initial public offers (IPOs) in the country’s history.

However, barring a few, the shares of most of these startups have been under pressure and most of these new-age tech startups are trading at a significantly lower price than their listing price.

This has shaken investor confidence in startup IPOs and the general sentiment is negative towards them. According to Inc42’s ‘Most Active Indian Investors Ranking Survey Q3 2022’, which saw the participation of 30 active venture capitalists (VCs) in the Indian startup ecosystem, 73% of investors have a negative sentiment towards startup IPOs.

It is prudent to mention here that as many as 23 Indian startups and unicorns are looking for an IPO over the next few quarters. The combined valuation of these startups, including the likes of Flipkart, PhonePe, BYJU’S, Swiggy and OYO, stands at $111.5 Bn.

Of the startups looking to go public, eight have either filed their draft red herring prospectus (DRHP) or have received the Securities and Exchange Board of India’s (SEBI’s) nod for their IPOs.

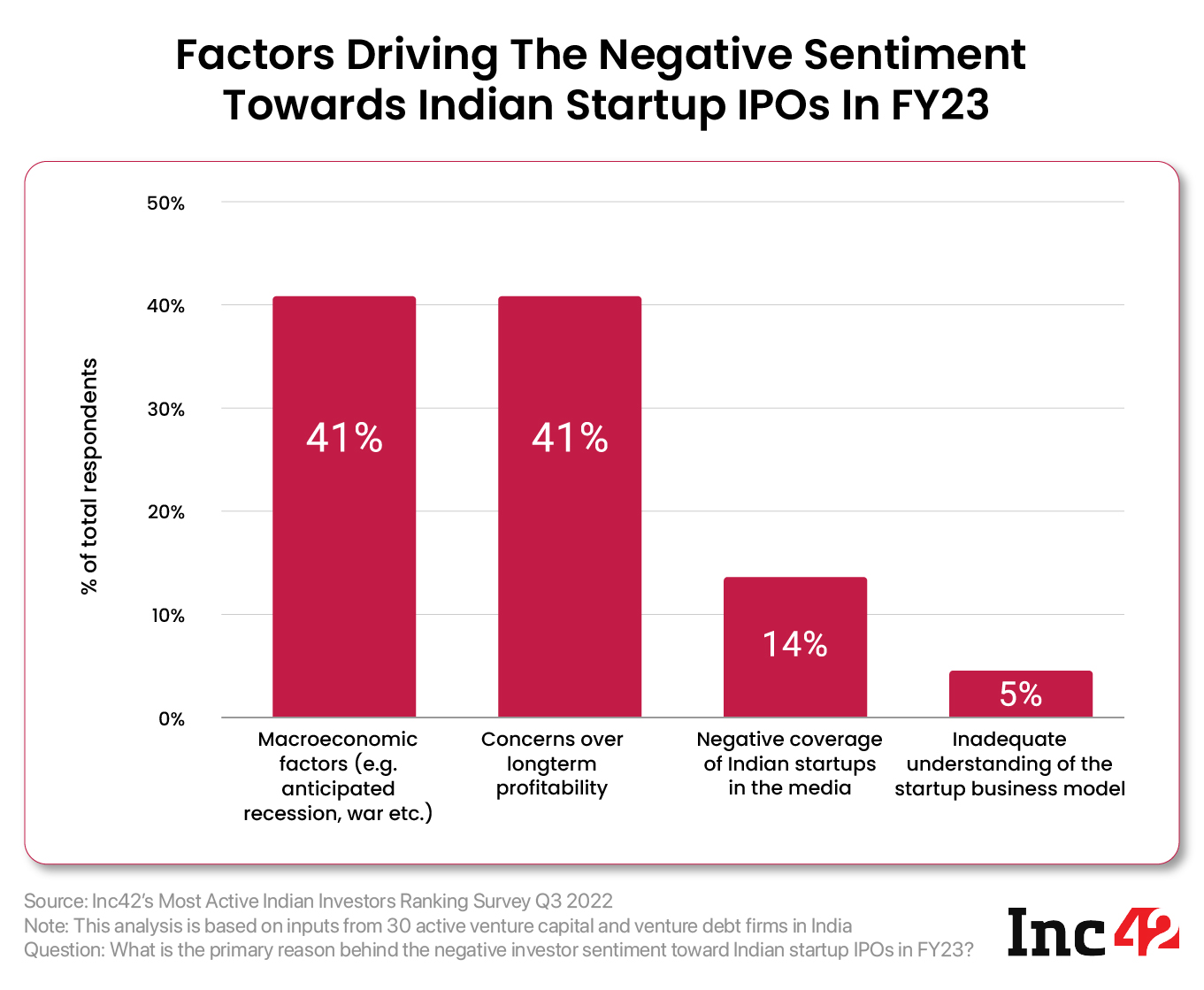

Factors Driving The Negative Sentiment Towards Indian Startup IPOs

The headwinds being faced by the Indian startup ecosystem since the beginning of 2022 have made investors cautious about startup IPOs. In the investor survey conducted by Inc42, investors cited reasons from tough global macroeconomic conditions to the negative media coverage received by startups behind the negative sentiment.

Adverse Macroeconomic Conditions: The geopolitical tensions since Russia’s invasion of Ukraine are the primary reason behind this.

The US and the European Union sanctioned Russia following the invasion. In retaliation, Russia has reduced energy supplies to Europe. Besides, inflation has been on a rise globally. This has forced central banks across the world, including in India, to hike interest rates, which has created fears of an impending recession.

The US Federal Reserve has increased interest rates aggressively, making it the highest increase since 1980. The move has strengthened the US dollar against all other currencies. The Indian rupee reached an all-time low of INR 82.22 against the US dollar on October 7.

All these have led to a rout in the global equity markets, with investors moving to safe-asset classes like the US dollar. For context, the BSE Sensex achieved a yearly high of 60,611 in April this year. From there, it fell to 51,360 on June 17, a fall of over 15% in two months.

The Sensex has since recovered, closing at 58,191.29 points at the end of the day’s trade on October 7. However, the impact on the private equity market is still evident.

Even as investors announced or launched new funds worth $12.3 Bn in the first half of 2022, the funding raised by Indian startups has been consistently on a decline.

Concerns Over Long-Term Profitability: Many Indian startups have a high cash burn. During last year’s funding boom, the startup ecosystem was in the ‘growth at all costs’ mode, with profitability not too high on the priority list.

India has minted 107 unicorns so far. However, only around a third of them are profitable. Some of the biggest names in the Indian startup ecosystem are yet to achieve profitability.

Incidentally, of the 11 startups that have gone public since last year, Paytm, Delhivery, Policybazaar and Zomato are still trying to figure out a path to profitability. The four listed startups have a combined market cap of INR 1,64,493 Cr (around $20 Bn) as of October 6 or almost 63% of the total market cap of all the listed startups in the country.

The ongoing funding winter has brought investors’ focus on profitability.

Speaking on the same in August, Infosys cofounder Nandan Nilekani said, “I think the question of growth or profitability comes only if the basic unit economics are not correct. But if your unit economics are such that you are making money on every sale, you are going to do both, grow and be more profitable. If you get that right, the rest follows.”

The cash crunch has forced many startups to lay off employees to cut costs. According to Inc42’s ‘Indian Startup Layoff Tracker’, 42 Indian startups, including unicorns Vedantu, Cars24, LEAD, Ola, Meesho, MPL, Innovaccer and Unacademy, have laid off almost 12,600 employees so far in 2022.

Therefore, investors have become cautious about funding startups with no clear timelines for achieving profitability. Even though 73% of Indian startup investors invested more in Q3 2022 compared to Q3 2021, the overall funding has decreased by 82% in Q3 2022 compared to Q3 2021.

“Public markets are wary of unit economics and pathway to profitability. The private market might accord a premium for growth at all costs but the public market is not able to understand that, and hence will not offer you a premium for that,” Apoorva Sharma, partner at Stride Ventures, said on the negative sentiment surrounding startup IPOs.

Further, Sharma noted that public market analysts compare startups with traditional companies in the same industry.

Traditional companies are being valued less than startups despite having a lot more assets on the balance sheet and cash flow generation capability, and this gap creates discomfort among investors, she added.

Negative Coverage Of Startups In The Media: Around 14% of the investors that participated in the Inc42 survey noted that the negative coverage of Indian startups in the media has also created a negative sentiment around startup IPOs.

From layoffs to corporate governance issues, from the path to profitability to a decline in share prices, news reports have raised many critical questions about Indian startups.

For context, the 11 startups that have gone public since 2021 were cumulatively valued at over $70 Bn at their respective IPOs. Currently, the combined market cap stands at around $32 Bn. Therefore, the collective valuation of the new-age tech startups has declined by more than half since going public, obliterating billions of dollars of investor money and prompting a barrage of coverage of the fall in valuations and stock prices.

The critical coverage, however, has created a lot of uncertainty among Indian investors. Coupled with the underperformance, investors have become wary of startup IPOs.

Inadequate Understanding Of The Startup Business Model: A few investors also noted in the survey that there is a limited understanding of the business models of the startups, and this leads to anxiety among investors.

The startups may not have the positive cash flow and strong balance sheet which investors traditionally look at, and this steers them away from investing in new-age tech stocks.

Startup IPOs Need To Deliver On The Value They Claim

The funding winter has brought the spotlight on the high valuations commanded by Indian startups in the private market, with investors calling for lower valuations. Investors in public markets also seem to be wary of the steep valuations of the new-age startups and are unwilling to invest in them.

“The founders have to become a little more realistic in terms of expectations on the valuation multiples that the public market can accord in order to ensure a good debut on the stock market,” said Sharma, when asked if the prevalent negative sentiment around startup IPOs will continue.

Amid the adverse market conditions, many startups looking to go public have either postponed their plans, cut down IPO size or altogether shelved their plans.

Public markets are sensitive to even minor changes in the macroeconomic landscape and are unlikely to give premium valuations like the private markets. Startups looking to go public should be prepared to either deliver on their valuations or sink.

Ad-lite browsing experience

Ad-lite browsing experience