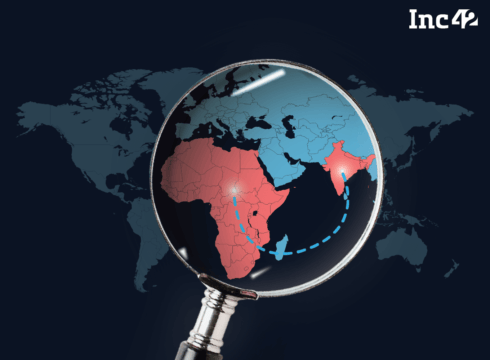

Africa Business Angels Network and Economic Development Board of Mauritius have invited Indian angel investors for a summit

The summit could formalise the establishment of an India-Africa investment corridor with plans to exchange resources and capital

At least 2 angel investors and VC funds are expected to be announced for the India-Africa corridor

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

In any developing startup ecosystem, the role of angel investors is crucial. This category of investors brings in the much-needed risk capital for early-stage startup ecosystem and angels also address the needs of startups beyond capital such as mentorship and networking.

Today, India is counted as the second largest startup ecosystem in the world, with more than 39K active tech startups and more than 30 unicorns. According to DataLabs by Inc42, Indian startups raised a total of $11 Bn in 2018 across 743 number of deals.

Not only this, India today boast of multiple startup corridors and startup investment channels with nations such as Israel, the US, UK, China, Japan, Korea, Singapore and the Netherlands. The contribution of angel investors — both Indian and international — in this context cannot be denied in this growth.

Taking inspiration, the world’s second-largest and second most-populous continent Africa is now headed in the same direction. Going through a similar disruption like India, Africa is home to many innovative startups — the total number of tech hubs in Africa in 2019 increased to 618, which represents a 40% leap since last year’s study, which counted 442 hubs.

Recently, the Africa Business Angels Network (ABAN) and the Economic Development Board of Mauritius had invited Indian angel investors for a meet where prominent investors of India and Africa will discuss building an India-Africa investment corridor, which would help startups in India and Africa exchange knowledge, capital and resources to grow and flourish.

The first India Africa Entrepreneurship & Investment Summit is scheduled to take place this month in Mauritius from August 16 to 18. It will be hosted by India-Africa Economic Forum in partnership with the India Angels Network (IAN) and the Africa Business Angels Network (ABAN) and with the support of the Economic Development Board of Mauritius.

“We are expecting at least 2 Angel/VC Funds to be announced at the Summit that will specifically target the India Africa corridor. The event will also mark the official launch of the Angel Investors of Mauritius (AIM),” said Baljinder Sharma, convener of the India Africa Economic Forum in Mauritius.

Sharma is a serial entrepreneur and an active investor in the India Africa corridor. He is presently an investor in four companies and a board member and advisor to several global private equity and venture capital funds.

Inc42 reached out to Padmaja Ruparel, founding partner, IAN Fund and Sharma to understand more about the similarities and synergy between the two startup ecosystems and the plans for the India-Africa Investment Corridor. Here is an edited excerpt of the same.

India-Africa Investment Corridor: Opportunities For Angel Investors

According to Ruparel, Africa today is possibly where India was 10 years ago in terms of its ecosystem with two significant differences. First, it has internet penetration rates matching those of India. Second, its population size and demography is also the same as India.

“This would provide a “Catch Up Dividend” for India and Africa to appropriate to each others’ benefit,” she added.

Ruparel further believes that the most number of opportunities exist in Africa at the angel level — including the opportunity to fund, support, mentor and bring startups to the late seed or Series A level. In some cases, it can also help existing successful and innovative Indian companies to sow the seeds for future acquisition.

“This is best achieved by travelling to each other’s geography, walking the streets and dipping your feet to the extent possible, but most importantly by developing trustworthy relationships,” she added.

Synergy Between The India And Africa Startup Ecosystems

The core idea behind an India-Africa investment corridor would be to take engineers and startups to Africa to help the ecosystem in the countries that have shown the most promise. Countries such as South Africa, Botswana, Rwanda, Kenya, Mauritius etc have taken tremendous strides in areas such as infrastructure, engineering, mobile money (MPesa) and in wildlife tourism etc.

“They face the same or similar challenges as India and learning from each other can only improve outcomes. Entrepreneurial connections can be magical in their impact,” said Sharma.

Moreover, Africa is fast adopting the latest technology. Africa leapfrogged straight into GSM unlike many other countries and does not have the baggage of legacy in many other sectors. Clearly as indicated before Africa is far behind India in many indicators, but the angel investments are growing rapidly from a low base.

“India and Africa are well poised to partner each other in their startup activities providing bilateral knowledge, funding and market opportunity to its early-stage enterprises, thereby strengthening existing efforts in increasing trade and development between the two economies,” added Sharma.

India-Africa Investment Corridor To Bust ‘Africa’ Myths

Pre-colonial Africa was known to be home to as many as 10,000 different states, each with their rulers and tribes. For long, the continent had been held by these disparate dynasties and the slavery practised by Western colonisers decimated the workforce in the 19th century. These factors create several hurdles in the development of this continent.

But it doesn’t mean things aren’t changing. As Ruparel said, there is a lot of misinformation about Africa.

“If you look at the continent closely there has been no single coup/conflict in the last three years – but the image of Africa as a risky place remains. People to people contact can only eliminate this,” she added.

African governments have realised that they do not have a choice other than promoting entrepreneurship and have supported a number of incubators and accelerators in partnership with the private sector and foreign governments. In an information-rich world, the possibilities to learn from each other are immense and the governments of African nations could take inspiration from what is happening in India and China.

“Most of the countries are open and welcoming as can be seen from the presence of diaspora – British and Dutch in South Africa and Indians in East Africa and Europeans in Nigeria and Ghana. Years of slavery and colonial rule meant exploitation of the native but it also allowed them to know each other in the process. There is a lot of intermixing and understanding of cultures these days,” added Sharma.

To conclude, India and Africa are both riding the wave of economic disruption and are counting heavily on their startup ecosystem. Startup disruption being one of the prominent factors in economic growth in a digital world, it’s essential that developing countries focus on creating a thriving environment for entrepreneurs to grow and expand. And the India-Africa Investment Corridor is the ideal opportunity to make this happen.

India’s lessons could very well be what Africa’s startups, founders, entrepreneurs and developers need from the India-Africa Investment Corridor. And with angel investors of both regions forging a bond to create the India-Africa investment corridor, the sleeping giant of a continent could finally be ready to wake up.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.