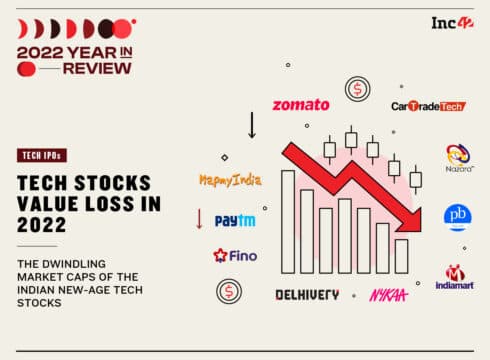

From a market cap of over INR 1 Lakh Cr ($14 Bn) after its listing in July 2021, Zomato has lost over 60% of its market value. Its current market cap stands at INR 45K Cr

($5.5 Bn), down 62% YTD

Paytm’s valuation has nosedived nearly 68% YTD from over INR 86K Cr ($11.63 Bn) in December 31, 2021

Nykaa and Policybazaar have lost 62% and 58% of their market cap, respectively, so far this year

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

The year 2022 has been the year of defeat for most Indian new-age tech stocks. Troubled by macroeconomic uncertainties, unstable capital markets, mounting startup losses, and regulatory challenges, these stocks have successfully managed to repel investors this year.

What’s more interesting is that eight out of the 11 new-age tech stocks listed in 2021 have together shed over INR 2.1 Lakh Cr (more than $30 Bn) in market capitalisation so far this year. These stocks include Nykaa, Nazara, Zomato, Paytm, Policybazaar, CarTrade, Fino Payments Bank, and MapmyIndia.

Download Annual Funding Report 2022Against an aggregate market cap of almost INR 3.66 Lakh Cr ($49.18 Bn), as on December 31, 2021, the current aggregate market cap of the aforementioned stocks stands at almost INR 1.58 Lakh Cr ($19.16 Bn) as of December 25 this year. Among these stocks, Nykaa, Zomato, and Paytm have witnessed the steepest fall.

Although volatility haunted the overall Indian stock market in 2022, it must be noted that the country remained more resilient compared to its Asian or global counterparts in the face of headwinds arising from rising inflation, interest rate hikes, strengthening of the US dollar, geopolitics uncertainties, and retreating Foreign Institutional Investors (FII).

In a report, domestic brokerage firm Motilal Oswal highlighted that the resilience was witnessed on the back of several structural tailwinds. The brokerage further opined that India was able to outperform due to a strong consumption demand and a pick up in capex by the Centre, which revived the Indian economy from the Covid-led slump.

While volatility is expected to continue even in 2023, market experts believe that the Indian stock market could perform better than others, piggybacking on several sectoral growth stories. In fact, some experts see the IT sector spearheading the next big rally. However, it is still unclear how the fate of the newly-listed tech companies will be in 2023.

While some say that the new-age tech stocks will continue to embrace a downward trend, at least in the first half of 2023, others are of the opinion that their performance on the capital markets cannot be predicted right now. Despite a foggy spectacle, they are positive about the long-term prospects of these stocks.

The Losers Of 2022

While we have already pondered upon the tumultuous global scenario, it is pertinent to note that these new-age tech stocks have seen a massive dip in their valuations due to their not-so-promising business fundamentals and several issues pertaining to strategic decision-making.

Among them, Paytm, Zomato, PB Fintech or Policybazaar, Nykaa, and Delhivery made the headlines almost daily.

Now, let’s understand what shook investors’ confidence in these stocks.

Delhivery’s Market Cap Has Halved Since May 2022

Logistics unicorn Delhivery is one of the three new-age startups that got listed this year. Though the market sentiment was extremely positive for the company in the first few months after its listing in May, its stock dipped below its IPO issue price of INR 487 in October. By October 31, Delhivery’s share price was trading at INR 344.35 on the BSE.

Delhivery’s market cap crossed the INR 50K Cr mark in July, joining the list of high-valuation companies such as Mahindra & Mahindra, Godrej Consumer Products, and Reliance Industries, among others, on the BSE. But the startup’s unclear road to profitability and weak near-term projections and the expiration of the lock-in period of its pre-IPO investors made investors jittery, which led to a 41% drop in its market cap in just a month.

Alibaba, one of its early investors, sold the company’s shares worth $200 Mn, or a 3%stake, last month. The startup’s market cap has now halved to about INR 23K Cr ($2.8 Bn) from almost INR 40K Cr ($5 Bn) in May.

Zomato Falls In Love

The issues with Zomato are a bit more complex. The company remained under the Competition Commission of India’s (CCI) lens throughout the year for alleged anti-competitive behaviour pertaining to pricing and discounts.

While undergoing regulatory concerns, Zomato’s Blinkit acquisition raised questions about the feasibility of its profitability goals. Further, Zomato faced investors’ ire when it preferred not to disclose the marital relationship between Blinkit’s founder Albinder Dhindsa and Zomato’s Akriti Chopra.

In fact, ahead of its IPO, Zomato promoted Chopra from chief financial officer to the cofounder of the company. Chopra joined the startup in 2011. Zomato had mentioned Chopra as the key managerial personnel at Zomato in its DRHP. However, it did not make any such disclosure in its filings at the time of acquisition.

Meanwhile, the foodtech giant’s lock-in expiry led to an exodus of some of its principal pre-IPO investors like Sequoia, TPG Capital, Lighthouse India, Tiger Global, SoftBank, Alibaba, and Uber.

From a market cap of over INR 1 Lakh Cr ($14 Bn) after its listing in July 2021, Zomato has lost over 60% of its market value. Its market cap stands at over INR 45K Cr ($5.5 Bn) as of December 25, down 62% YTD.

Paytm Received Multiple Blows This Year

Earlier this year, the Reserve Bank of India (RBI) barred Paytm Payments Bank from adding new customers, citing gaps in its IT systems that had a negative impact on its market performance for a few days.

Further, there were allegations that the company’s Payments Bank servers were sharing information with China-based entities, which indirectly held its shares.

Besides, there have been speculations about the fintech giant’s profitability goals, the feasibility of its share buyback plan and the issuance of more ESOPs amid a liquidity crunch.

Meanwhile, competition has also intensified due to the rise of Jio Financial Services. Recently, brokerage Macquarie pointed out that Jio Financial Services’ entry as a separate entity and its listing on the bourses might come as a major competitive threat to Paytm’s business.

After its lock-in expiry in November, one of the major pre-IPO investors SoftBank Group offloaded its stake in Paytm. The Japanese investor divested its 4.5% stake, or 2.9 Cr shares, in the company. SoftBank Group earlier held 17.45% in Paytm.

Recently, Paytm’s plan to buy back shares via the open market sparked a debate. Since Paytm is a loss-making entity, the Street was largely expecting the share buyback to take place through a tender route. However, due to the open market route, Paytm’s retail investors were not allowed to participate in the buyback, and the Street deemed its share buyback offer as a way to favour its pre-IPO investors amid a huge valuation loss.

Paytm’s market cap is down nearly 68% YTD at about INR 31K Cr ($3.73 Bn).

6 Others Swallow The Red Pill

So far this year, Nykaa and Policybazaar have lost 62% and 58% of their market cap, respectively. The valuation loss was largely driven by lower-than-expected financial results, rising competition and unstable capital markets. While the lock-in expiry period of pre-IPO investors significantly hit Nykaa’s shares in November, Policybazaar remained largely unaffected.

However, what hit Policybazaar the most was the Insurance Regulatory and Development Authority of India’s (IRDAI) decision to launch Bima Sugam and regulatory uncertainties in the insurance space. Bima Sugam is a one-stop portal for sales and claims for life and non-life insurance products.

So far this year, Policybazaar’s market cap has declined to almost INR 20K Cr ($2.38 Bn) from INR 43K Cr ($5.84) Bn on December 31, 2021.

Other newly listed stocks such as Nazara Technologies, MapmyIndia, Fino Payments Bank, and Cartrade Technologies also lost their market cap in line with the volatility in the overall market sentiment. However, India’s uncertain gaming regulatory environment impacted Nazara’s valuation in particular.

While Nazara’s market cap is down 58% YTD, MapmyIndia, Fino Payments Bank, and Cartrade Technologies have lost 41%, 44%, and 52% YTD, respectively.

Among the newly listed tech startups, only EaseMyTrip was able to witness an increase in its market cap this year. The traveltech major has witnessed more than 21% rise in its market cap this year.

The Fate Of Recently Listed Startups In 2023

Most market experts believe that it is difficult to predict the market scenario for the listed startups in 2023. Besides how the global events shape up, there are a few aspects like the ongoing selling pressure, and profitability factors, among others, which could decide their fate.

It is pertinent to note that there has been some pressure in terms of how institutional investors have reacted to the listed startups over time. Deepak Shenoy, the founder and CEO of Capitalmind, believes that until the selling pressure calms down for stocks like Zomato, Nykaa, and Policybazaar, the pressure on their stock price will remain.

“The selling spree of large institutional investors could last for another six months to one year,” he said.

“This is more of just forced selling, where, essentially, the VCs who invested in these companies have to sell the stocks and exit because they need to give returns to their shareholders,” Shenoy said.

“It is not that they don’t like the companies anymore, but their mandate is to buy private companies not to hold public properties. So, whether these companies perform or not, they will face this pressure for some time,” he added

Meanwhile, Ganesh Dongre, senior manager and technical research analyst at Anand Rathi, said that the freshly listed tech stocks would require some time, one or two solid quarters, to win investors’ confidence. Also, once investors see these stocks forming a rounding bottom pattern on the technical front, more will join the queue.

Dongre added that on the technical front, most of these tech stocks are on a consolidation level. Hence, these stocks are expected to remain range-bound and show sideways movement. It would take one or two years to see a consistently strong rally in the newly listed tech startups.

Retail Investors’ Increased Appetite

The growing interest of retail investors in tech stocks has already been noticed globally. In fact, despite volatility, small investors have continued to infuse funds into the stock market.

As per various reports, retail investors have been dominating the Indian stock market since the Covid-19-induced lockdowns. At the end of the December quarter of 2021, retail investors’ shareholding across listed companies on the NSE reached an all-time high of 7.32%, a research report stated.

In its December 2022 report, global management consulting Zinnov noted that 93% of retail investors today show investment interest in new-age financial products like small cases, REITs, NFTs, and digital gold. Besides, 38% of retail investors today are interested in investing in new IPOs.

As of September 2022, the retail investors had an aggregate shareholding of over 71 Cr in the startups that were listed in 2021.

Even the trend has remained the same for the latest listings in 2022.

During DroneAcharya’s IPO, which is the latest tech stock IPO in India, the stock was oversubscribed by 262X. While around 20.92 Lakh shares were earmarked for its retail investors, it received bids of around 69.19 Cr shares.

Similarly, during Tracxn Technologies’ IPO In October, the retail investors placed bids for over 1.88 Cr shares in the startup versus 38.67 Lakh shares on offer for them.

While it seems like the retail investors’ confidence in the new-age companies is expected to remain strong, the huge valuation dip may have an impact on their activities going forward.

Conversion rates: $1=INR 74.43 (Dec 31, 2021) & $1=~INR 82.77 (Dec 25, 2022)

Download Annual Funding Report 2022{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.