With resilient business models becoming the talk of town, will 2023 be the year of cockroach startups?

It may be hard to believe that the term ‘cockroach startups’ predates the coining of ‘unicorns’. When Y Combinator cofounder Paul Graham wrote about looking for startups that can survive a nuclear war in 2007, it was more than half a decade before venture capitalist Aileen Lee coined the term unicorn in a 2013 Techcrunch article.

If nothing else, perhaps this chronology should tell us a bit about what the priority for most startups should be. It’s not surprising though that ‘cockroach startups’ are back in vogue in public discourses and social media debates, especially amid the unprecedented slowdown in 2022, which looks like continuing well into 2023.

But is this all just a factor of market conditions souring? Or is this a beginning of a real change? This week, we are looking to answer whether 2023 will be the year of cockroach startups. But before we get there, let’s look at the top stories of the week

- Startup Layoffs Continue: As Inc42 exclusively reported Tiger Global-backed startups Sirion Labs and Innovaccer joined the downsizing spree at tech startups, taking the total layoff tally to over 21,500 employees

- G20 Startup Push: The G20 Startup20 Engagement Group kicked off its inception meeting, looking to foster synergies between startups, corporates, investors and other key stakeholders of the ecosystem

- Republic Day Tenets For Startups: On India’s 74th Republic Day, we spoke to influential founders and investors about their 10 commandments for startups to navigate the downturn in 2023 and emerge stronger.

Unicorns Vs Cockroach Startups

There’s a reason we call it a startup ecosystem. There’s all kinds of biodiversity within startups, and this is as much true for India as it is for any other market.

We have unicorns, gazelles, dragons, dinosaurs, zebras, mosquitoes and what not, but a cockroach is still one of the most sought-after species. That’s because, unlike a unicorn, a cockroach is firstly not mythical, and the label describes the startup itself and not its valuation, which is more often than not determined by external factors such as VC funding.

Ironically, startups that can survive on very little funding and rely on whatever cash they have on books are investor favourites. And these are the very startups that do not need funding to achieve some ‘status’. A cockroach startup is sought after by investors, but the startup itself may not make itself available to these investors.

So while investors might celebrate cockroach startups, there’s also a feeling that they are missing out on them. That’s not to say that all cockroach startups are bootstrapped in nature. Some of them do raise funds, it’s how they use them that sets them apart.

Frugality Makes A Cockroach

TV Mohandas Pai, partner at Aarin Capital and former Infosys CFO, believes that differentiating factor is respect for capital. He says:

- One: don’t blow up money. Don’t be extravagant.

- Two: remember that capital is always in short supply and when you go on diluting you may get a high valuation but eventually, you become an employee.

- Three: Be frugal in the use of this capital.

- Four: be ready to raise capital. That means keeping all your documentation, the due diligence report ready, accounting ready, legal compliance ready and so on.

Pai added that raising capital in the current market has become a long-drawn process. It takes three to six months, but businesses don’t prepare themselves for when the market opens up.

“Remember, the idea of a startup and entrepreneurship is to make money for yourself and your business. If you get diluted you’re making more money for others then what is the point? So you must have a good stake. So be frugal in the use of capital such that you have the leverage when negotiating with investors,” he added.

Of course, we often hear founders and investors talk about so-called cockroach startups when market conditions sour or when there is some kind of funding slowdown. This is often forgotten when the market bounces back, which is perhaps the biggest drawback in the current system. Indeed this is the most common refrain from investors.

Will Poole, cofounder and managing partner of Bengaluru and Seattle-based Unitus Ventures, believes startups rejigging their approach is not necessarily a bad thing. Most investors and nearly every entrepreneur in India have seen nothing but up markets, which make them all look brilliant.

“In an up market with easy money, massive mistakes are papered over with easy money and discipline is never established. We are excited to see this correction, forcing rational thinking both with investors and founders and getting everyone back to building the businesses that India’s economy needs to win in the evolving new world order,” Poole told Inc42.

Building Startups For All Seasons

But now is the time to create a startup that can survive winter and also sustain itself in so-called spring without the need for external fuel. Founders and investors believe that new-age businesses cannot continue to operate in a bubble and have to fall in line with the market conditions as and when they change.

For instance, Rahul Garg, founder of industrial B2B ecommerce unicorn Moglix believes “Being a cockroach or not in the startup world is a function of the macro industrial environment and competitive landscape. Any outlier might not survive in the long run. While building a resilient business is never optional, the bullish or bearish behaviour to drive growth and frugality is driven more by the industry one operates in rather than funding winter or boom.”

Sanjay Mehta, angel investor turned founder of 100X.VC, concurs. “One cannot expect to accelerate when there is a brick wall ahead, but at the same time when there is a clear stretch of the road, you cannot remain slow. You have to follow what you have in front of you.”

But there’s more to it than simply saying move as the market does. The fact is that certain sectors and segments require a lot more capital to scale up and grow — even sustainably — than others. This is particularly true for B2C startups; the spate of acquisitions in the D2C segment indicates that the funding crunch will hit some startups harder than others.

Simply put, not every startup can be a cockroach.

And over the course of the next few weeks, we will be diving deeper into how startups can build resilience in their business models, the investor viewpoint and of course, whether this march towards sustainability is here to stay.

Sunday Roundup: Startup Funding, Tech Stocks & More

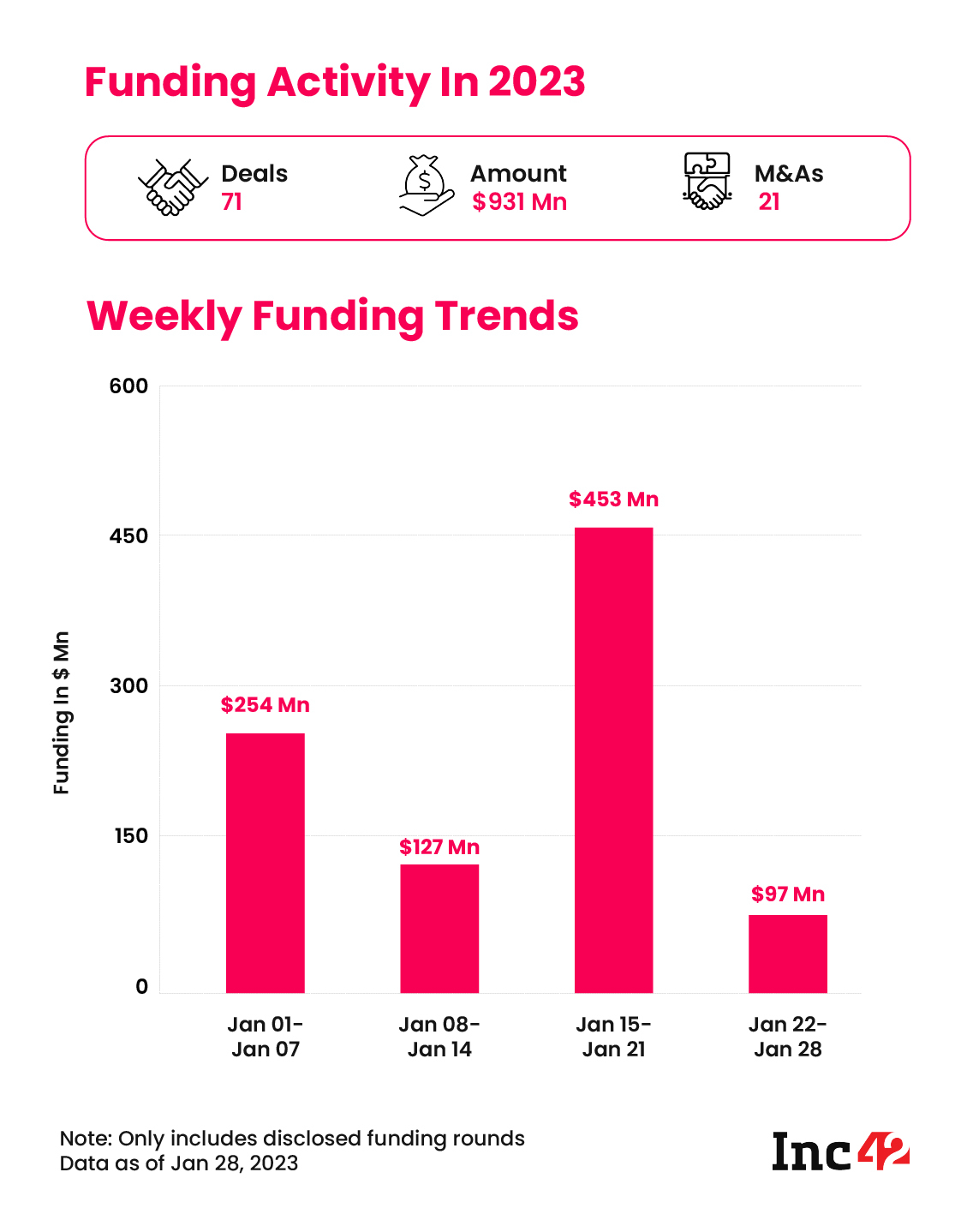

⏬ Funding Drops: After a brief spurt in funding in the first few weeks of the year, startup funding plummeted to under $100 Mn in the past week. With just $97 Mn raised in the past week, things are looking grim for the startup ecosystem

⏬ Funding Drops: After a brief spurt in funding in the first few weeks of the year, startup funding plummeted to under $100 Mn in the past week. With just $97 Mn raised in the past week, things are looking grim for the startup ecosystem

?WazirX Vs Binance: WazirX cofounder Nischal Shetty refused to retract statements that Binance had acquired the Indian startup as the ownership battle between the two crypto exchanges continues

? Tech Stocks Crash: A majority of the new-age tech stocks slumped this past week in line with the overall Indian stock market ahead of the Union Budget next week. EaseMyTrip, Zomato and Droneacharya saw the biggest dips falling by over 10% compared to the previous week

☀️ OYO’s Optimism: Even as most startups are racking up huge losses, OYO believes it’s on course to become EBITDA-positive for the first time in its history in FY23

We’ll be back next Sunday with more insights and a roundup of the top stories from the world of Indian startups. Till then follow us on Instagram, Twitter and LinkedIn to get the latest news as it happens.

Ad-lite browsing experience

Ad-lite browsing experience