Given the current market conditions, startups must maintain a runway of at least 18-24 months, particularly at the seed stage

At a time when the world is looking at an impending recession, startups need to scrutinise their R&D activities to preserve cash and ensure their financial stability

Startup founders will have to think like a cockroach in a bid to ensure long-term survival for their businesses

In our previous article, we established why 2023 will be the year of cockroach startups, what makes them so different from fancy unicorns, and the sectors, business models, and stages that could be fostering them. With that being flawlessly covered, it is time to explore why 2023 will be all about staying cash rich, a basic tenet of cockroaches, for Indian startups.

In one of his Twitter statements, the group CEO & cofounder of ixigo, Aloke Bajpai, said, “Revenue is Vanity, Profit is Sanity, Cash is Reality.” Although the words are quite inspiring, they also give rise to two of the most crucial questions:

- Why and for how long do startups need to maintain their cash reserves?

- How can a startup reserve cash without impacting its pace of growth?

Sustainability Is The Key To Success

In our endeavour to get the answers to these two key questions, and a few others, we spoke with many industry experts and investors. Quite surprisingly, the answer to the first question was simpler than expected.

According to the experts, given the current market conditions, startups must maintain a runway of at least 18-24 months, particularly at the seed stage. This is because investors now prefer sustainable startups over high-growth ones. Also, extended due diligence at the investors’ end has increased the timeline to lap up new funding.

According to the managing partner at Omnivore, Mark Kahn, the fundamental reason for prioritising cash runway is to keep the business running smoothly between funding rounds, as investor sentiments are going through significant changes.

“Liquidity or runway gives you time to re-strategise and improve your product and GTM (go to market); hence, the longer the runway, the longer the chances of survival and growth. Revenues and profit will follow if one will use cash judiciously over the next 12-15 months,” said Yagnesh Sanghrajka, cofounder & CFO, 100X.VC.

Now, let’s delve deeper into understanding the second question, which is also one of the biggest challenges for Indian startups currently.

One Size Does Not Fit All

Experts want startup founders to understand that there is no one simple approach to reserve cash without touching the pace of growth. They will have to experiment and juggle a lot between strategies to see what works for them.

It is imperative to track key metrics, and continuously evaluate and tweak business strategies. Further, a startup can also improve its unit economics by increasing revenue and, at the same time, decreasing costs.

According to Ankur Bansal, cofounder of BlackSoil, some of the key areas where startups can focus to reserve cash without impacting the pace of their growth are:

- Increasing Pricing: By improving the value proposition, differentiating the product or service, or building a strong brand

- Decreasing Costs: By streamlining operations, reducing overheads, or finding more cost-effective suppliers

- Increasing The Lifetime Value (LTV) Of A Customer: By upselling, cross-selling, or creating recurring revenue streams

- Increasing The Efficiency Of Sales Funnel: This can be done by optimising the conversion rate, decreasing the cost of customer acquisition, or improving the lead generation process

- Improving Scalability: Building a product or service that can be sold at scale and with minimal marginal costs

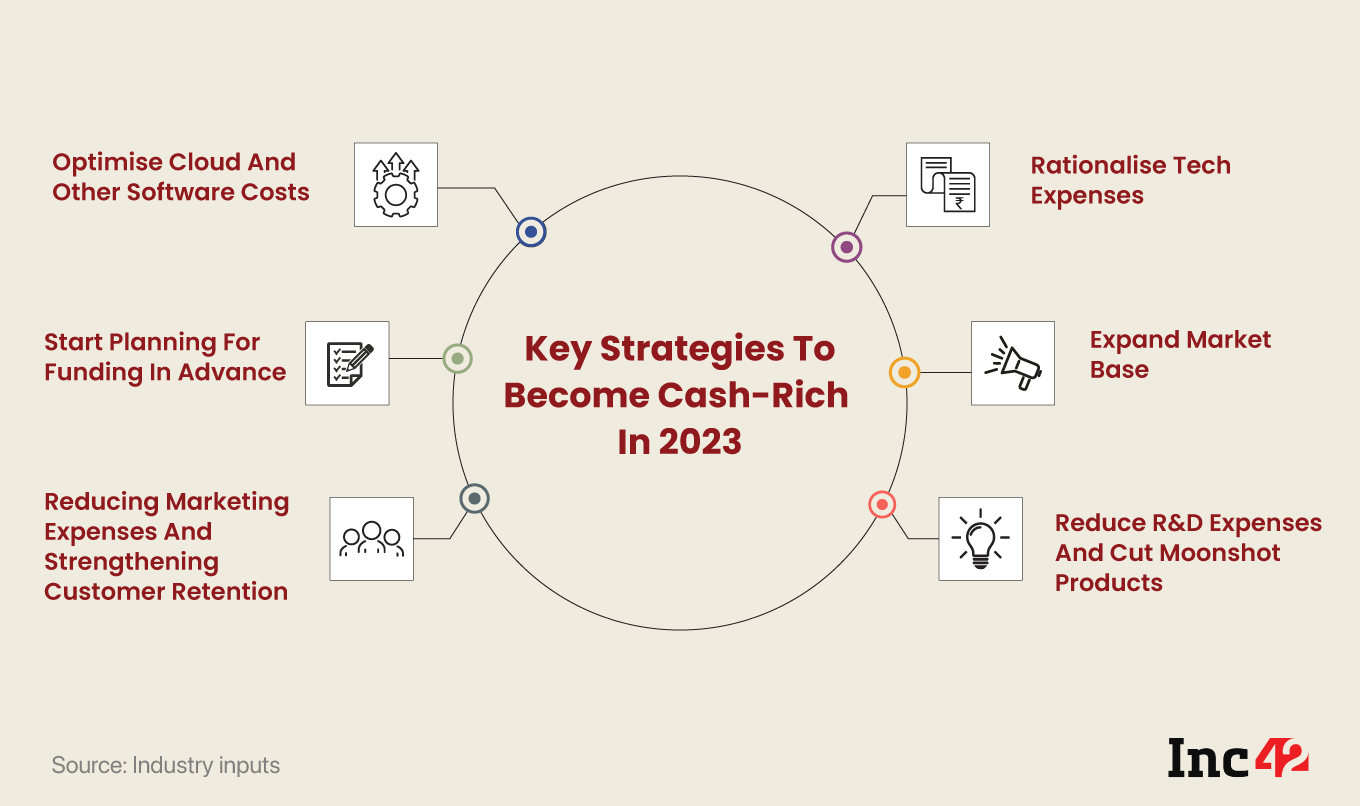

Key Strategies To Become Cash-Rich In 2023

Here are some of the key strategies suggested by the industry stakeholders that startups should adopt to strengthen their unit economics and reduce expenses in 2023.

Start Planning For Funding In Advance

According to 100X.VC’s Sanghrajka, all early-stage founders must ramp up their fundraising efforts when they are left with a runway of 9-10 months. This would ensure that they receive funding at least three months before their cash dries out.

Reducing Marketing Expenses And Strengthening Customer Retention

Building frugal customer acquisition strategies is vital. By maximising monetisation from an existing base of customers, startups can boost revenues while optimising costs.

This shift will eventually build strong word of mouth and drive organic growth. It is at this point that startups should hire instead of building a team based on future projections, Omnivore’s Kahn said.

Reduce R&D Expenses And Cut Moonshot Products

The founder & CEO of KredX, Manish Kumar, highlights that startups in a recession need to take a balanced approach and find ways to reduce expenses while investing in future growth.

At a time when the world is looking at an impending recession, startups need to scrutinise their R&D activities to preserve cash and ensure their financial stability. It is crucial for companies to re-evaluate their current projects, prioritise the ones with the highest potential, and reduce the scale of R&D efforts.

Moreover, companies need to cut down on unviable or moonshot products and discontinue projects that have proven unfeasible or are unlikely to generate significant revenue in the near term.

Optimise Cloud And Other Software Costs

Currently, cutting cloud costs has become a top priority for many businesses across industries. In order to achieve meaningful cost savings, it’s important to take a holistic look at cloud usage.

Some of the ways by which companies can optimise their cloud and software costs are by choosing cloud solutions that are cost-effective, scalable, and meet the needs of the business. Regularly monitoring software and cloud usage to identify areas where costs can be reduced is also crucial.

Startups can effectively manage their cloud and software costs by implementing cost allocation and tracking tools to monitor and control spending on cloud and software services.

Rationalise Tech Expenses

It is important for startups to rationalise their technology expenses to preserve cash. Companies need to prioritise essential technology needs, eliminate non-essential tech expenses, and monitor usage to ensure cost efficiency.

“In addition to this, startups should also implement cost-saving technologies, re-evaluate technology plans and adjust spending as needed,” added Kumar.

Expand Market Base

Startups need to explore and tap markets where their products have the potential to generate higher revenues. Investing in market research, identifying new markets, and adjusting products or services to cater to the needs of their target customers in those markets can help.

The last few years have been about investment splurges and cash burns. However, now, due to the ongoing headwinds and an uncertain business environment, the Indian startup space does not have the luxury to continue on the same path. Therefore, startup founders will have to think like a cockroach to ensure long-term survival for their businesses.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech