Tyke capitalised on the growing need for retail public markets investors in diversifying towards startups, but there are some grave questions about whether it is actually benefiting the investors at all

Right from taxation to startups not abiding by their campaign promises, investors have raised concerns regarding how founders have reneged promises made during the fundraise campaigns

In order to address the issue of CSOPs' liquidity, Tyke has also launched a P2P platform Tyke Square where CSOP holders could actually buy and sell their SARs

The pandemic disrupted businesses across sectors and retail investments saw a notable transformation.

In January 2020, the cash segment (equities market) of the National Stock Exchange (NSE) boasted around 3 Mn active retail investors. In January 2022, this skyrocketed to 11.7 Mn, a staggering 4X surge in two years.

In total, a whopping 10.4 Mn new investors were recorded in FY20, and this bloomed to 14 Mn by FY21.

All companies and promoters wanted to have a slice of this mushrooming class of retail investors. Though individual investments might have been relatively small, the cumulative impact of this groundswell resulted in substantial fundraising efforts.

In line with this, with an ambitious target of facilitating transactions worth INR 1,000 Cr, Tyke Invest launched around this time and envisioned a crowd fundraising platform for startups based in Mumbai and capitalised on the rising interest of retail investors in diversifying assets within their tech portfolio.

Tyke effectively enticed retail investors to invest in promising startups, facilitating a mutually beneficial ecosystem. Of course, startups could also benefit from the faster fundraising mechanism, claimed Tyke.

At the early stage, startups have to sell their equities at a meagre price tag. This troubles later. With multiple instruments of investments, Tyke Invest offered startups an opportunity to raise funding without losing the equity.

But things have changed dramatically post-2022. What was once easy fundraising avenues have now become a lot messier and could pose existential threats to new startups.

Understanding Tyke: Crowdfunding, Angel Network Or Something Else?

Tyke made a compelling promise to retail investors; it brought seemingly painless access to startup investments. Its advertisements boldly challenged the notion that startup investments were exclusive to the ultra-rich, as Tyke’s investment opportunities began at just INR 5,000, eliminating a big hurdle.

The mainstream popularity of investing in startups was already soaring at this point, in part due to the influence of shows like Shark Tank India that fuelled people’s aspirations to be part of the startup ecosystem.

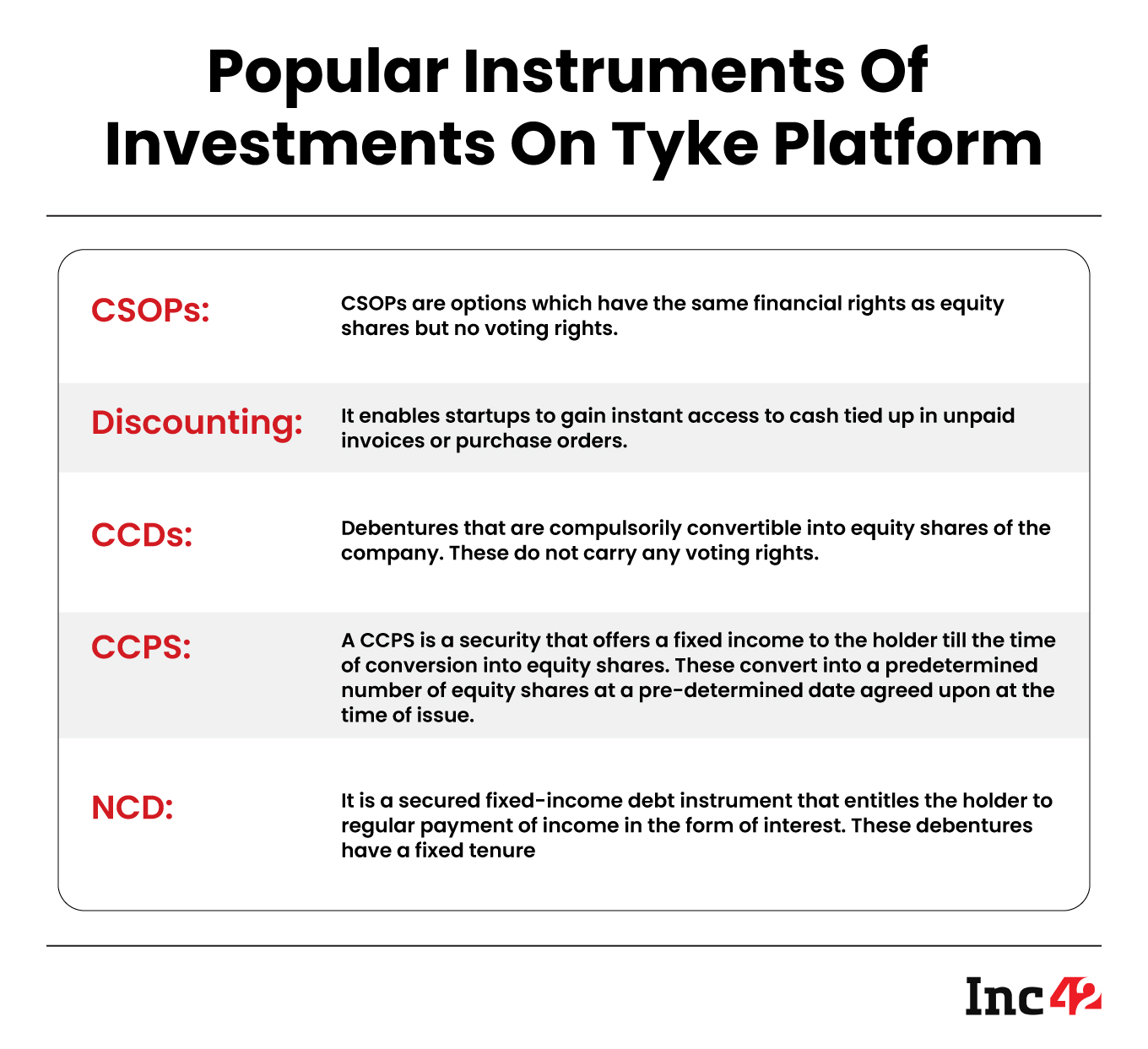

However, unlike other angel networks and angel funds such as LetsVenture or AngelList, Tyke Invest had a unique investment instrument called CSOP (or Community Stock Option Pool) along with other alternative options like Compulsorily Convertible Debentures (CCDs), discounting, Compulsorily Convertible Preference Share (CCPS), Non-Convertible Debenture (NCD) or Invoice Discounting.

It is worth noting that, unlike CSOPs, invoice discounting, and NCDs, CCDs give investors access to the cap table and hence trigger Section 42 of the Companies Act, 2013. According to Section 42 of the Companies Act, CCDs can be offered only to select persons as identified by the board of the company.

The offer cannot be made to more than 200 people. A company making a private placement cannot offer its securities through any public advertisements or utilise any marketing, media, or distribution agents or channels to inform the public about such an offer.

Unlike equities, CSOPs didn’t put retail investors on the startup’s cap table but instead got similar to what are called share appreciation rights (SAR). It seems like a win-win situation for founders who don’t want their equity diluted early on.

“We currently focus on operating with CSOPs and invoice discounting. However, we remain highly responsive to market demands, and while other instruments like CCD and NCD have not been placed on Tyke, we continuously evaluate the landscape to offer suitable choices that align with public demand and industry trends,” said Tyke Invest’s cofounder and CEO Karan Mehra.

Tyke’s model quickly garnered attention and the company secured funding for its own growth. It successfully raised $100K from Navin Surya initially and later received a substantial investment of $1.5 Mn from prominent investors like Venture Catalysts, 9Unicorns, Better Capital, Jupiter’s Jitendra Gupta, and Pine Labs’ Amrish Rau, among others.

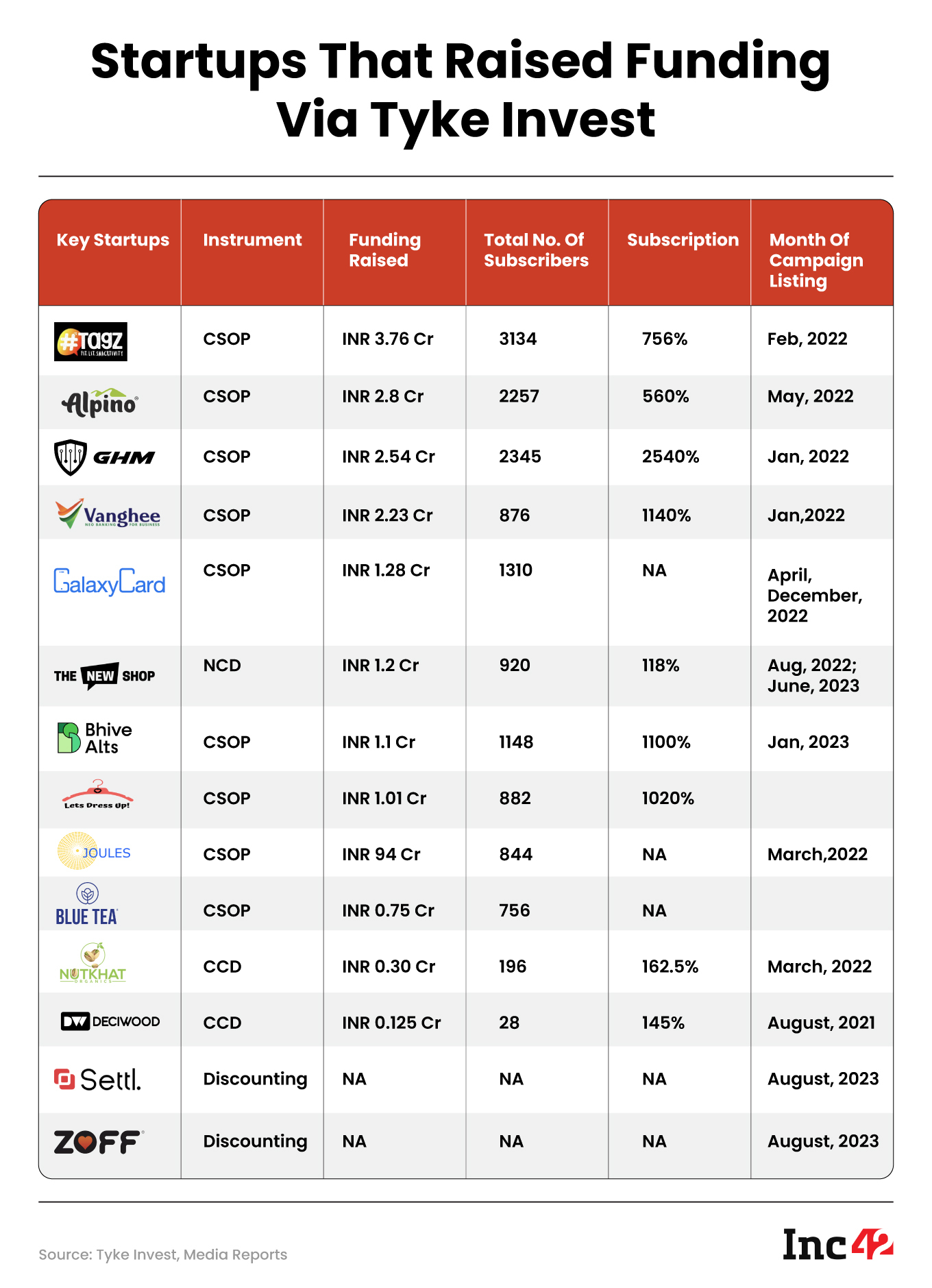

By the end of 2021, Tyke had become a sought-after avenue for startups seeking angel/seed stage funding. So far, with a subscriber base of 200K registered investors, Tyke claims to have facilitated 500+ deals, making a significant mark on the startup ecosystem.

Tyke’s initial success prompted competition such as Jiraaf and InfuBiz, which also offered retail investment opportunities in startups for as low as INR 5,000.

The question, of course, is did startups really benefit from this seemingly wider net cast by Tyke and others.

“Tyke offers an opportunity not only to raise funding without diluting any equity, but, more importantly, it helps in branding. These investors act as the brand ambassadors for the company and influence others to adopt their brands,” said Naveen Srinivas, the founder of Bengaluru-based smart TV brand Ridaex, who had earlier raised funding through Tyke.

Tyke Invest claims to be investor-friendly as well. For instance, if anything goes wrong or a deal does not happen, Tyke refunds the money to investors. In some cases, investors have even got their refund with interest as well.

Overall, Tyke’s fee structure aligns with the range of services it provides to companies, according to some of the companies we spoke to.

Like Kickstarter, Indiegogo or other crowdfunding platforms, Tyke allows startups to offer perks to investors to attract more backers. Ridaex offered extras such as a silver coin for first-day buyers or a flagship 32-inch Ridaex Future TV for investors planning to invest over INR 1 Lakh.

Other startups too that have gone through the Tyke journey told Inc42 that, like on Shark Tank India, the Tyke platform is equally for marketing and branding. It helps establish connections with a community pool of brand ambassadors who have invested in the product and are more likely to speak positively about the product and spread the word.

The Curious Case Of Deciwood And Nutkhat Organics

Not all campaigns go as smoothly as Ridaex.

Back in August 2021, Deciwood (Legal name: Anbronica Technologies), a D2C speaker brand based in Delhi NCR, successfully raised INR 12.5 Lakh through CCD on Tyke.

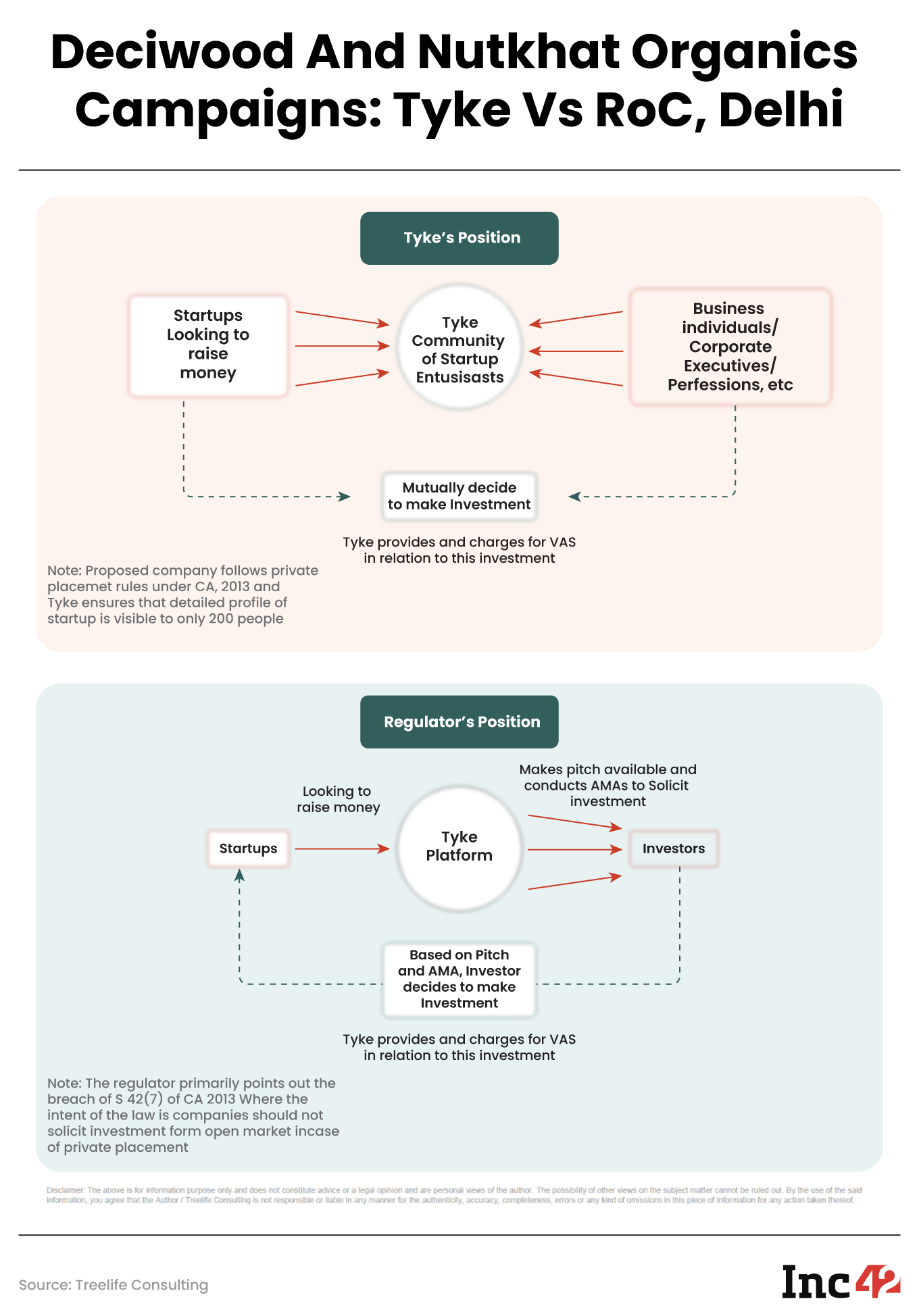

In February 2023, the Registrar of Companies, Delhi, ordered Deciwood and another company Nutkhat Organics (Legal name: Septanove Technologies) to pay a penalty of INR 4 Lakh each for violating Section 42(7) of the Companies Act.

As mentioned earlier, this Section prohibits companies from soliciting investments for equity issues through public ads or media, marketing, or distribution channels that advertise on their behalf.

Moreover, the Section mandates that private placements of equity issues should be made exclusively to a select group of individuals identified by the Board, with the number of such persons not exceeding 200.

The RoC also issued show-cause notices to Tyke and startups on December 27, 2022.

Later, in its order, RoC stated that no satisfactory responses were provided by none of the two companies.

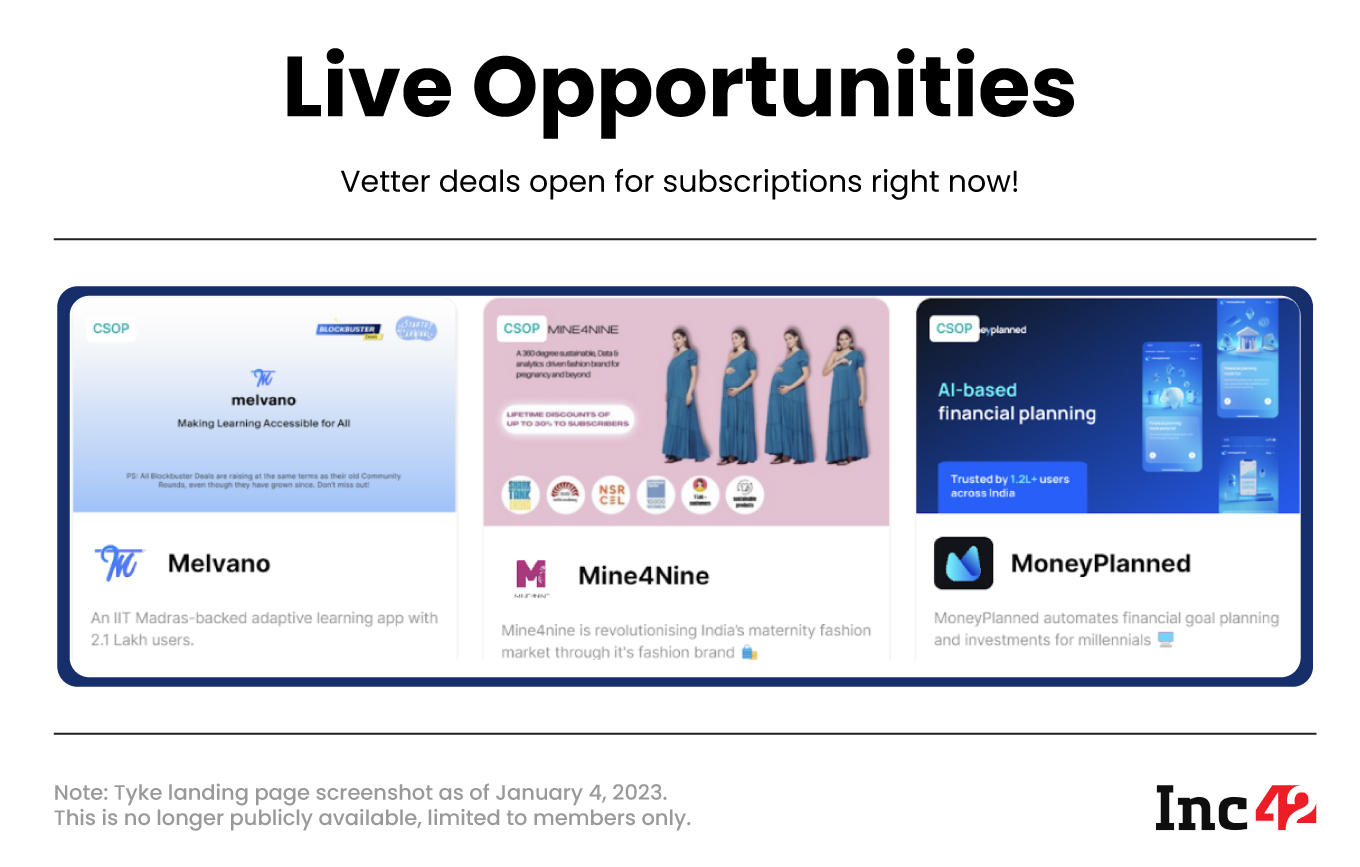

It noted that there were significant changes on Tyke’s website. Previously, a substantial amount of pitch-related information about companies utilising the Tyke platform for raising securities was visible without the need for a login.

After the show-cause notice, Tyke put all this information behind the members-only section. “At one point, Tyke claimed to have around 1.5 Lakh members, which is still a sizable number of individuals who would be able to see information about the pitching companies,” observed the RoC.

The RoC also pointed out that Tyke’s platform showed CCDs (Compulsorily Convertible Debentures) being oversubscribed, indicating that more than 200 investors participated in the campaign.

Septanove Technologies, which was fined by the RoC Delhi, raised over INR 30 Lakh by issuing CCDs to 196 people, leading to a penalty of INR 4 Lakh.

Deciwood has already filed an appeal with the Regional Director, Ministry of Corporate Affairs (MCA) against the order.

A Deciwood executive, without wanting to be named, however, clarified that the oversubscription on Tyke Invest merely reflected that the company had exceeded its fundraising target of INR 10 Lakh; it ended up raising INR 14.5 Lakh. But the actual number of people who bought during the campaign was only 28, far from the limit of 200 investors.

Mehra said, “We are hopeful that the appeal would result in a positive outcome.”

Sarika Raichur, partner of Luthra and Luthra Law Offices India said that publicising the issuance of any securities by a private limited company (including CCDs and CSOPs and SARs) is barred by law. Accordingly, any videos by or for the benefit of private companies soliciting investments into securities also violate the Companies’ Act 2013.

Despite explanations given by both Tyke and the companies that have raised from the platform, the Indian regulator looks primarily at the intent of the law, which prohibits private placements (fundraises) from being published in open markets to solicit investments through communities or other closed groups.

Jitesh Agrawal, founder and CEO of legal firm Treelife Consulting, said that in the US, this asset class is considered high-risk, leading to restrictions on the annual investment amount for regular investors apart from ‘accredited investors.’

While Tyke no longer focusses on CCDs, some of the investors have pointed out that there are some other platforms that still assist crowdfunding through equities and the campaign remains visible to all the members. Inc42 has not been able to verify them independently.

Is it time that India brings more clarity to such rules?

Let’s take a look at the most popular instrument of investment — CSOP.

CSOP: How Does It Work

In the wake of Tyke Invest, Infubiz and other smaller investor platforms, CSOPs have gained popularity.

Holders of CSOPs have the opportunity to benefit from the increase or appreciation in the value of the company’s stock, especially if the company raises funds in subsequent funding rounds at higher valuations. This benefit can be realised when CSOP holders decide to sell their CSOPs or during an IPO.

The CSOP agreement is a contractual agreement where SARs are granted to the subscriber, but critically, as many have pointed out SARs do not give subscribers any shares in the company.

It’s largely a formula for calculating payout and the process of such a payout to the subscriber at the trigger of an exit event, Raichur explained.

As per the sample contract reviewed by Inc42, Tyke offers the following clarifications to investors:

- A CSOP plan is an incentive-based scheme designed by the company to reward its community evangelisers and is not considered a security under the Companies Act, 2013. It does not grant any rights to the holder in relation to the company as a security holder.

- The contribution to the CSOP Plan is considered a subscription, not a deposit or loan to the company, and subscribers cannot request a refund of the subscription amount except in case of an exit event.

- A CSOP plan and the agreement do not guarantee any monetary return to the SAR holders. Instead, it offers the SAR holders an opportunity to benefit from the growth of the company.

- The company and the founders shall not be liable in any manner to the SAR holders in relation to the payout amount for the SARs held.

It’s worth noting that CSOPs do not provide investors access to the company’s cap table. Instead, it’s more about chasing a potential upside in the long term, if at all.

Are CSOPs issuance governed by the Securities Contract Regulation Act 1956 (SCRA)?

Raichur explained that SARs are basically “securities” in the nature of “derivatives” under the Securities Contracts (Regulation) Act, 1956. Such “securities” may only be offered by a private limited company by way of a private placement or rights or bonus issue in accordance with the processes set out in the Companies’ Act 2013 and the relevant rules.

“There is a regulatory grey area in respect of issuance of SARs by private companies as there is no specific mention of SARs in the Companies’ Act, 2013. In this fast-changing world of securities, amendments must be brought in to cover the issuance of SARs and similar securities for ensuring better compliance with the Companies’ Act, 2013, she added.

Are CSOPs Even Worth It?

Several investors, preferring anonymity, have voiced concerns about how expensive CSOPs are currently and said their decision to invest in startups was largely due to the popularity of Shark Tank India and the mainstream buzz around startups.

High taxes have made it challenging for investors to benefit from CSOPs as they are categorised as products or services, attracting an 18% GST.

Sanjeev Sachdeva, partner at Luthra and Luthra Law Office, further explained that after CSOPs are granted, the discounts and benefits allotted thereunder to the investor would be permissible as a deduction from the value of supply on which GST is to be discharged for all future supplies made by the company to such subscribers.

All of this might be too complicated for someone who just wanted to invest because they enjoyed what they saw on Shark Tank India. And it doesn’t get easier.

“The redemption of SAR in the form of deferred cash payout would qualify as an actionable claim under GST laws. Actionable claims, other than lottery, betting and gambling, are neither considered goods nor a service and hence fall outside the purview of taxability under GST. A subscriber can freely transfer CSOP to other persons. Such transfers would also attract GST at the rate of 18% if the transferring subscriber is a registered person under GST laws,” added Sachdeva.

Additionally, for companies running CSOP campaigns, the revenue generated through CSOPs is shown as revenue, subjecting them to an additional direct tax. This becomes particularly tricky when campaigns are run in March and companies cannot show the expenses for the same.

Mehul Shah, partner at Rasesh Shah and Co, said, “Startups should not run their campaign when the fiscal year is about to end. Else, they would not be able to claim the expenses and the entire revenue would attract tax over revenue from other sources.”

According to Tyke’s document on Accounting and Taxation Treatment for CSOPs, which Inc42 has reviewed, total subscription fee collected is accounted as revenue to the company and shall be subject to any further IT payable as applicable. Taxes applicable on the CSOP subscriptions are:

- 10% IT TDS deduction is applicable (only if company’s subscriber is a Company/Firm/AOP/Individuals & HUF with turnover exceeding INR 1 Cr during previous year and payment to a particular company is exceeding INR 30,000 during a Financial Year)

- 18% GST

Further, it states that CSOPs are recorded as long-term/short-term provisions on the equity and liabilities side of the balance sheet. The same is not an allowable expense u/s Section 37 of the Income Tax Act, 1961 for the purpose of calculating tax payable.

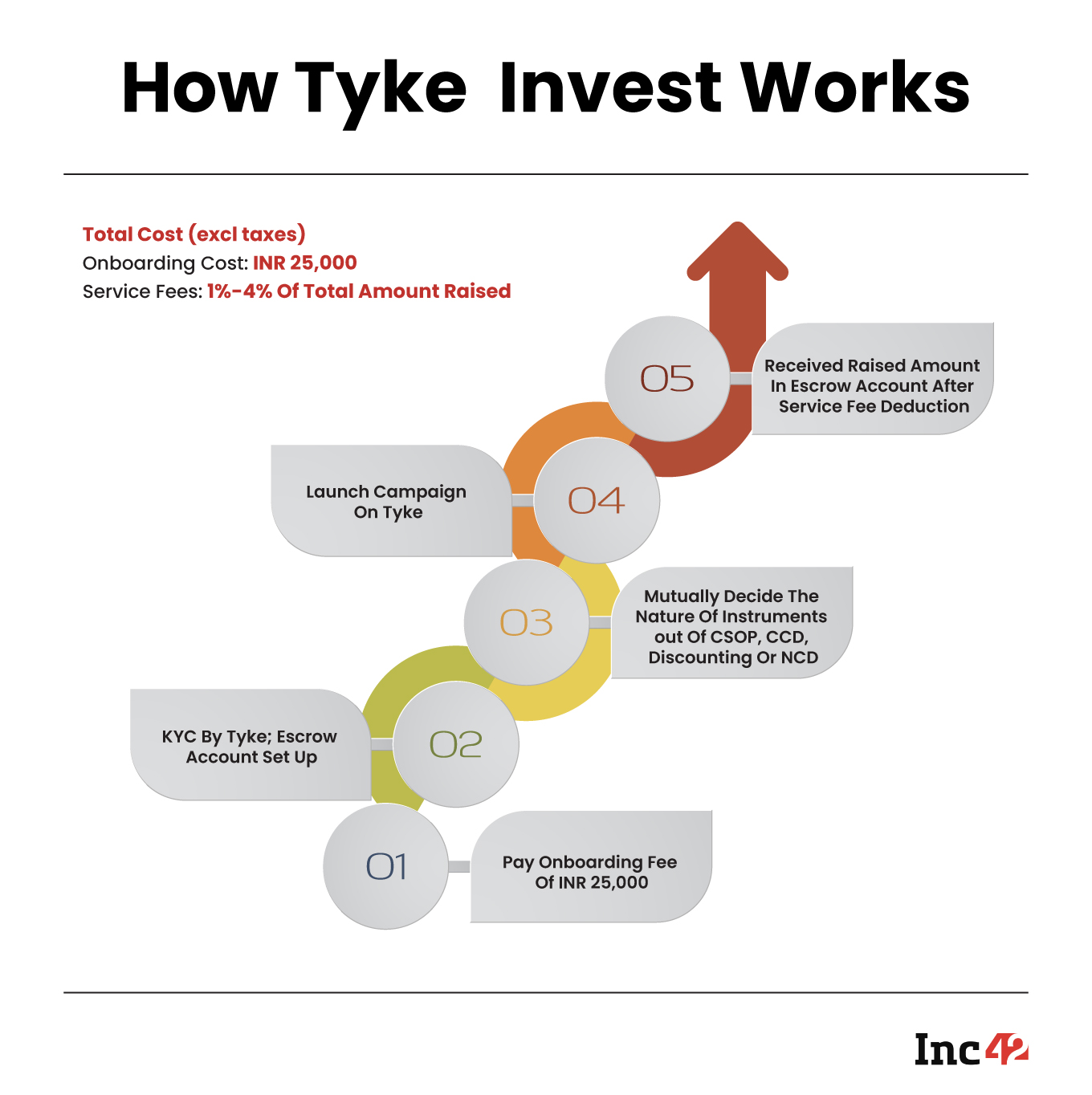

Moreover, Tyke Invest charges a commission ranging from 1% to 4% over the total funding raised.

However, tax is not the only concern of investors. Investors alleged that startups often don’t meet the promises they make while running their CSOP campaigns.

Startups Break Promises After Raising Funds

It’s not unusual for startups to entice potential investors with alluring promises, which later investors claim were too tall to be fulfilled.

For instance, in February 2023, Geeani electric tractor, featured on Shark Tank India’s Season 2, got on-air commitments from three judges. It subsequently raised over INR 1.5 Cr through Tyke.

As part of the campaign on Tyke, the company promised an electric cycle worth INR 60,000 to every investor that invested more than INR 1 Lakh. Over 50 investors said to have invested over INR 1 Lakh each, but the founder did not deliver on the promised electric cycles, citing pending approvals and certifications.

This response left investors dissatisfied, prompting a hullabaloo, and eventually, Tyke has now agreed to refund all investments, said one of the investors.

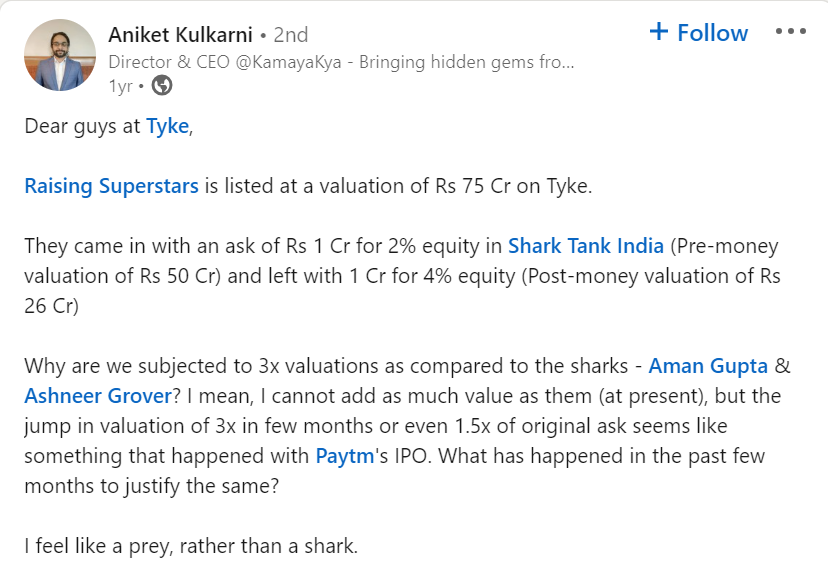

Raising Superstars, another startup offering games-related activities for babies 0-6 years, also appeared on Shark Tank India, and raised INR 3.78 Cr from Tyke at INR 75 Cr valuation. On TV, though, the company got a commitment of INR 1 Cr from one judge at a much lower valuation of INR 26 Cr. This left the subscribers in a lurch.

Some vented their frustration on Linkedin and other social media platforms.

Tyke, however, later issued a clarification to the investors that the deal was offered to the sharks in October 2021, almost four months before the Tyke Campaign and the company meanwhile continued to grow with new products, and geographically.

At the time of the campaign, the company was also raising a total of INR 6-8 Cr from external investors, and already had 60% committed at a valuation of INR 75 Cr (approx. 4x of annual revenues run rate) with a discount of 20% to the next round.

Later, Raghav Himatsingka, founder of Raising Superstars wrote a letter to all the CSOP subscribers stating that the company will refund all their subscription amount with interest. Inc42 has reviewed the copy.

Speaking about these two cases, Mehra of Tyke stated that regarding Geeani Tractor, the agreement is still in place, and that Tyke has communicated with all subscribers to keep them informed. The refund process has not been initiated yet, and the Tyke team is working closely with investors and clients to ensure a smooth resolution.

As for Raising Superstars, they made an internal decision not to proceed after the raise was completed. “In such cases, it is not uncommon for deals not to materialise after reaching the final stages. Rest assured, all investors received a full refund along with 1% interest. We value transparency and maintain open communication with our community, ensuring that their investments are handled with the utmost care and diligence,” said Mehra.

He added, “In the past year, we have observed numerous instances where startups faced challenges leading to their failure, often attributed to either their business category or the lack of clarity in the pitch presented by their founders to the subscribers. However, we are proud to state that the failure rate of campaigns for onboarded startups remains impressively low, at less than 5%.”

While Tyke, investors said, helps resolve the concerns. Regrettably, such cases are not isolated incidents, they said.

CSOP subscribers may not be in the position to do due diligence on the potential startups they are backing. Subscribers alleged that for many campaigns, founders fail to uphold their promises.

Several subscribers told us they were never invited to any events promised as part of the perks and did not receive any curated deals or other benefits.

These issues raise concerns about the level of risk retail investors might be undertaking in the name of startup investments. Moreover, since CSOP contracts are not considered securities, they fall outside the purview of SEBI’s regulatory oversight. Any potential legal implication could leave investors with no recourse for a few months at the very least.

In such a scenario, it becomes crucial to address the interests of these aspiring startup investors and ensure transparency and accountability in the fundraising process.

The Liquidity Issue

One of the biggest challenges with CSOPs has been that it is highly illiquid, as even SARs of startups cannot be sold easily on an exchange or similar secondary trading platform.

One of the startups that raised funding through Tyke Joules Health in March 2022 purchased 20% of the SARs at 2x in the month of March 2023.

However, these were far and few. In order to address the issue of CSOPs’ liquidity, Tyke Invest has now come up with another peer-to-peer platform, Tyke Square, where CSOP holders could actually buy and sell their SARs after three months. Tyke claims that a SEBI-approved Trustee oversees all movements of money.

“Since its launch, Tyke Square has witnessed over 750 transactions in just a few weeks. As we continue to enhance the platform and expand its offerings, we remain committed to providing our users with unparalleled investment opportunities and a seamless exit experience,” said the Tyke Invest cofounder and CEO Karan Mehra.

Navigating The Landscape

Tyke Invest entered the market with the promise of democratising startup investments, providing retail investors with access to promising ventures through innovative instruments like CSOPs. However, the journey has been marked by a mix of successes and red flags.

The rise of retail investors in the equity market during the pandemic created a lucrative market for platforms like Tyke, offering a novel way for startups to raise funds. The CSOP-based model aimed to bridge the gap between startups and investors, but it treads in a regulatory grey area and faces scrutiny for its approach. The conflict arises from the question of whether CSOPs should be subjected to SEBI’s oversight.

Furthermore, instances of startups failing to deliver on promises made during fundraising campaigns and regulatory violations have raised concerns about transparency and accountability. Tyke’s efforts to address issues such as liquidity through the introduction of Tyke Square show a commitment to improving the ecosystem, but challenges remain.

The overall impact of Tyke’s approach and the broader landscape of crowdfunded startup investments rests on a nuanced assessment. While Tyke’s intentions to open doors for retail investors are commendable, the story underscores the need for clarity in regulatory frameworks and due diligence in evaluating startups before investment. As the startup ecosystem evolves, it becomes essential for platforms like Tyke Invest and regulators to work collaboratively to protect investors while fostering innovation and growth in the sector.

Update | August 8, 2023 6.28 PM

The logo of Bhive Alts has been updated. Earlier, it referred to Bhive Workspace.

Ad-lite browsing experience

Ad-lite browsing experience