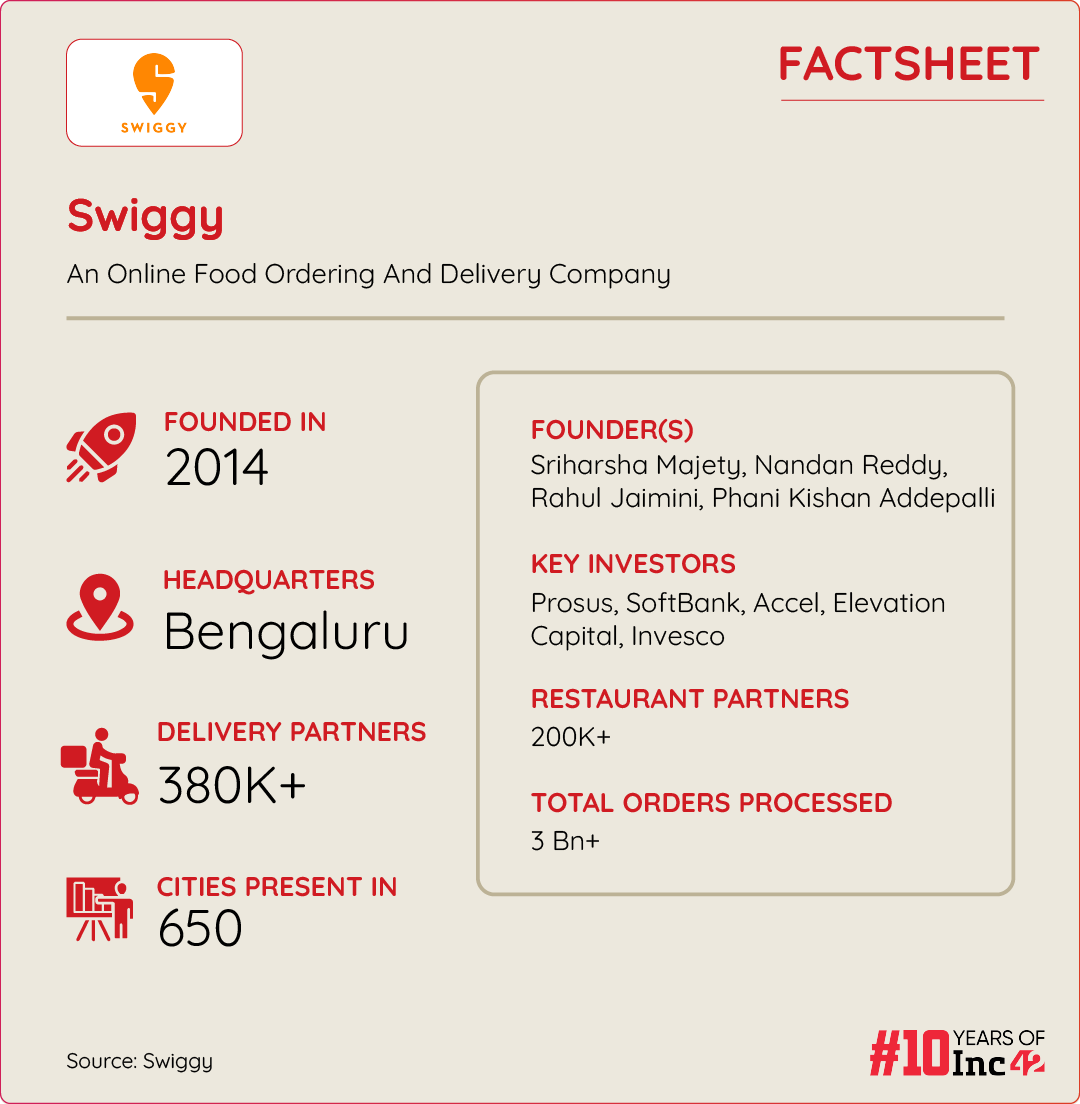

Alongside cofounders Nandan Reddy and Phani Kishan, cofounder and CEO Sriharsha Majety has built a team that sees quite a few experienced professionals from the world of ecommerce, consultancy and technology products

Over the past few years, all of Swiggy’s key businesses including food delivery, quick commerce and dining out have seen a change guard at the top, with Instamart getting the most new hires

With revenue for each of its key verticals ranging from INR 1,000 Cr to INR 6,000 Cr, there is a lot of responsibility resting on some of the relatively new leaders steering Swiggy’s ship towards the IPO

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Swiggy is not shy of an experiment or two — from products like SuprDaily, InsanelyGood, Scootsy, and Swiggy Mall to multiple changes in its subscription/loyalty programmes to new food delivery segments.

The new Swiggy — the one going to the IPO table in 2024 — is more than just food delivery. Instamart and quick commerce have taken centrestage. Other services are becoming just as critical for long-term profitability.

And there’s a lot of optimism even within Swiggy about its fortunes. Following Zomato’s 80% share price growth over the past six months, Swiggy has revised its IPO size from the originally planned $1.25 Bn to $1.4 Bn.

The company, initially set to raise $450 Mn through a fresh issue, will now issue fresh shares worth $600 Mn, while maintaining the offer-for-sale as previously planned. This positions Swiggy’s IPO as the fourth largest on Indian bourses, after LIC, Paytm, and Coal India. And naturally all eyes are on the food delivery and quick commerce giant.

And the role of the key people leading the various verticals will be just as critical for IPO success and beyond. Alongside cofounders Nandan Reddy and Phani Kishan, cofounder and CEO Sriharsha Majety has built a team that sees quite a few experienced professionals from the world of ecommerce, consultancy and technology products.

The Swiggy Universe: Food Delivery Is King

Unsurprisingly, Swiggy’s food delivery vertical is the dominant contributor to revenue, accounting for over 81% of its gross earnings, followed by Instamart, which generated INR 1,100 Cr, contributing around 10%.

Swiggy’s food delivery business grew 17% to INR 6,100 Cr in FY24. When compared to Zomato’s food delivery revenue of INR 6,161 Cr, Swiggy is neck and neck with its chief rival. But Zomato-owned Blinkit reported INR 2,301 Cr in revenue, more than double of Swiggy.

The silver lining is that Swiggy reduced losses by 44% from INR 4,179 Cr to INR 2,350 Cr. This reflects Swiggy’s improving financial performance and a path to profitability ahead of the IPO. With the company expected to file its RHP with the SEBI later this month, it’s important to examine just who is in charge of leading the food delivery and quick commerce giant to the stock exchanges.

On the food delivery front, while cofounders Majety and Reddy oversee overall product innovation and direction of the business, Swiggy appointed former OYO India CEO Rohit Kapoor as the lead of the food marketplace segment in August 2022.

Interestingly, Kapoor comes with over twenty years of experience in sales and finance in enterprises and companies such as Max India and McKinsey & Company, before a stint at OYO where he was also CEO of India & Southeast Asia operations and later the Global CMO.

Not being from the consumer services industry, Swiggy is relying on Kapoor’s expertise to get to profitability on the food delivery front by FY25

Another key exec is Tapojoy Chatterjee, VP and head of product, and as such his role overlaps with other verticals, given Swiggy’s one-app approach, as opposed to Zomato and Blinkit.

Kapoor also oversees the Dineout business, which Swiggy acquired in 2022, and is likely to be a big focus for Swiggy going forward if Zomato is successful in scaling up District and its own going-out business.

On The Quick Commerce Front

The quick commerce (QC) market is set to outgrow the online food delivery sector, having already surpassed 50% of its size by 4QCY23, according to JM Financial. QC’s growth is expected to continue, fueled by its broader target market and high customer satisfaction. In contrast, the food delivery market’s growth is projected to remain modest at around 20%, with QC potentially overtaking it in the next 3-4 years.

Swiggy, like Zomato, Zepto, and BigBasket, is betting heavily on QC. Reports suggest Swiggy plans to allocate a significant portion of the funds from its upcoming IPO to expand Instamart.

The company aims to double its network of dark stores, which supply groceries and home essentials, to over 1,000 locations in the next four years as it increases its presence in various cities. The new dark stores are expected to be larger in size to cater to the non-grocery category, which is a critical factor for profitability in quick commerce.

Interestingly, Blinkit aims to hit 1000 stores by FY25, and double this in the next year. So Swiggy is looking to go toe-to-toe with Zomato once again, even as Zepto grows as a challenger.

In September 2024, Swiggy appointed Amitesh Jha, an IIT Delhi and IIM Ahmedabad alumnus with 14 years of experience at Flipkart, as the CEO of Instamart. Previously, Instamart was headed by cofounder Kishan.

One clue about Jha’s focus comes from CEO Majety’s statement during his appointment. “His extensive experience includes leading core categories such as smartphones, general merchandise, fashion, and large appliances, as well as managing their logistics arm,” the cofounder said in September when Jha came on board.

Just last month, the company appointed Sairam Krishnamurthy, a former head of supply and marketing at Ola, as the COO of Instamart.

Besides this C-Suite recruitment, Swiggy bolstered its product and management layer for Instamart with Himavant Srikrishna Kurnala as head of product for Instamart, Mayank Rajvaidya as VP of fruits and vegetables, and Manu Sasidharan as AVP of the FMCG category. Other key leaders at Instamart include Abhishek Shetty, who leads marketing, and Anirban Roy, VP of category, revenue, and growth.

Swiggy Mall, earlier, the company’s non-grocery product category on quick commerce has now been fully merged with Instamart.

This will be the most critical piece in Swiggy’s org structure, given how significant Instamart is from a revenue point of view. Notably, while Blinkit—part of Zomato—registered a 3x growth in FY24, increasing revenue from INR 809 Cr in FY23 to INR 2,301 Cr in FY24, Swiggy’s Instamart has struggled to keep up with competitors.

Despite being an early entrant in the QC space, Instamart’s revenue reached only INR 1,100 Cr in FY24, trailing behind Blinkit in revenue.

Plus, now Swiggy also has to compete for revenue share with the likes of BigBasket and Flipkart. The company cannot afford to fall behind in the quick commerce race, as this is the biggest potential revenue contributor in the long run.

Swiggy’s Dineout Needs More Muscle

Finally, there’s Dineout, Swiggy’s dining-out platform, which was acquired in 2022 for $120 Mn.

Initially led by cofounder Ankit Mehrotra after the acquisition, this vertical is led by Rohit Kapoor since June 2023. Kapoor was tasked with unlocking revenue streams for Dineout and works closely with the product and growth teams.

The company has plans for this product as well with table reservations added to discounts and rewards as a way to bring in more users and revenue.

In FY24, Dineout recorded a 98% year-on-year growth in gross order value (GOV), reaching INR 2,200 Cr, up from INR 1,100 Cr in FY23. Adjusted EBITDA improved as well, reducing from -12.4% in FY23 to -8% in FY24.

The company credited this growth to higher commissions, advertising fees, user charges, and additional revenue from event ticket sales on the platform. Dineout competes with platforms like Zomato, EazyDiner, BookMyTable among others.

Post-COVID, the restaurant table booking industry in India has undergone a transformation. Both Swiggy and Zomato are now focusing on offering more than just table reservations, expanding into booking experiences.

Many restaurants now host live events, making bookings extend beyond just lunch or dinner, further boosting the platform’s scalability. This has opened up the opportunity for Swiggy and Zomato to extract more revenue from users in the dining-out space.

Zomato once again has been ahead of Swiggy in the race and has acquired Paytm’s live ticketing business in a deal valued at over INR 2,000 Cr. Will Swiggy also jump in with both feet into this mix?

But Dineout as a product itself is looking a bit pale in comparison to what Zomato has planned. Will Swiggy look to beef up this vertical in the next few months? There are signs. In fact, back in 2022, Swiggy acquired Stepping Out, an experiential events platform that hosts a variety of events, including night markets, live music shows, concerts, and comedy nights. Stepping Out is currently part of Dineout.

In September 2024, Dhruvish Thakkar was appointed as AVP for revenue and growth at Swiggy Dineout. Thakkar is another former Flipkart executive jumping over to Swiggy, and has led growth for fashion, beauty, social commerce, gaming, and healthcare categories at his previous employers.

Sriharsha Majety Steps Out Of The Limelight

The hiring for leadership across verticals is critical for Swiggy ahead of a potential IPO. Not only does it add a wealth of relevant industry experience to the company’s leadership, but their experience of scaling up retail and ecommerce giants such as Flipkart would be critical for Swiggy in the long run.

Interestingly, with the various new leaders in place over the past year, Swiggy is preparing for life as a public company, where CEO Sriharsha Majety cannot take complete control of the show as he has done for the past decade. As a result, Swiggy is building depth in the leadership and management layers across food delivery, quick commerce and dining out.

The biggest challenge for this group of leaders will be profitability. While Swiggy might fall short of Zomato on the valuation mark at the time of IPO, that’s not really the attractive part for investors. All eyes will be on whether Swiggy has cracked the formula needed to come out of the red and into profits.

Only then will the scale built over the years come into the picture.

Naturally, there is a strong spotlight on the people and the leaders taking Swiggy to the IPO pole and beyond. Can they guide the Swiggy ship to the right bay at this critical time for one of India’s most prominent startups?

Update 5.30 PM, September 21, 2024

The images have been updated.

[Edited By Nikhil Subramaniam]

Key Highlights

Funding Highlights

Investment Highlights

Acquisition Highlights

Financial Highlights

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.