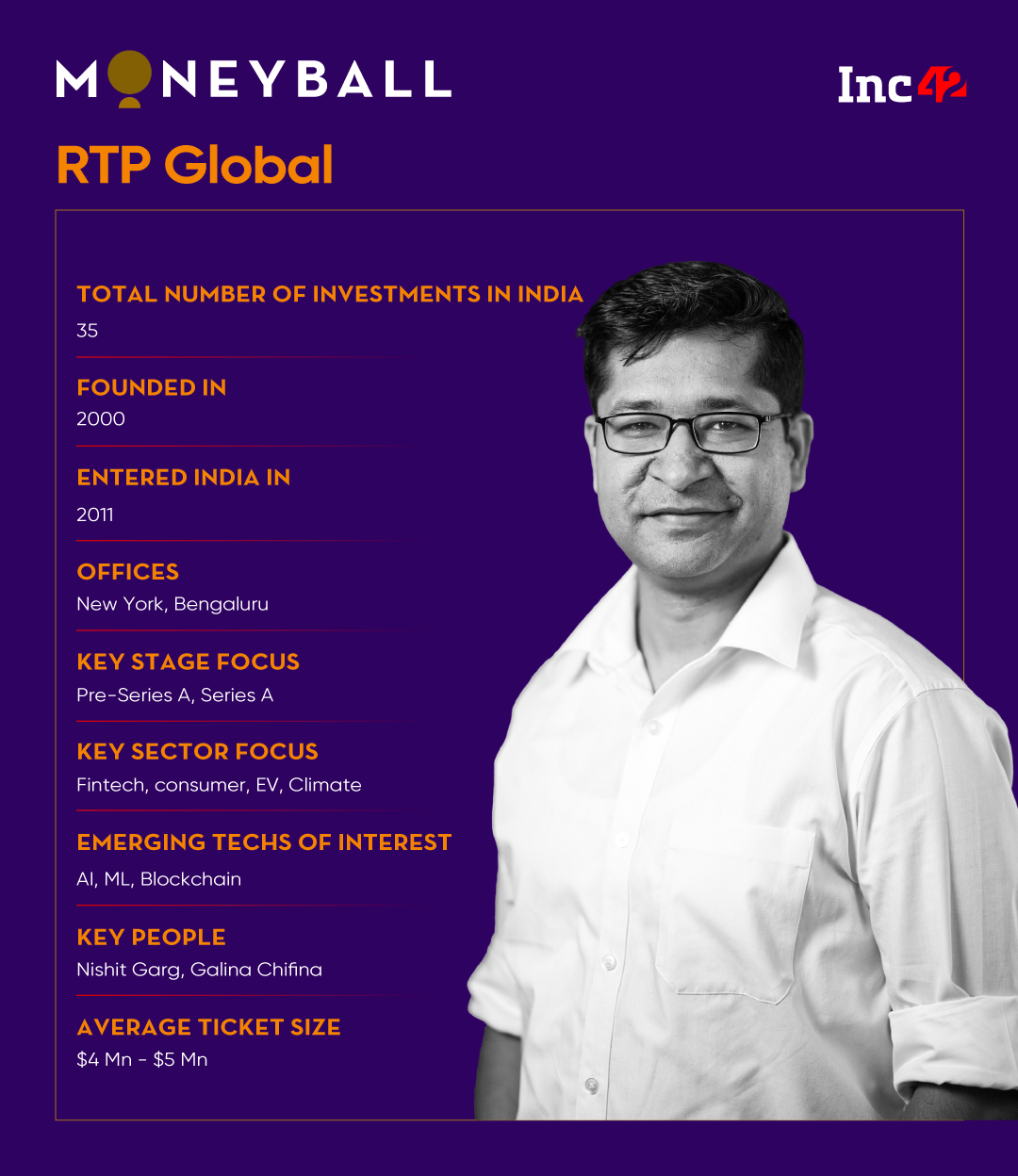

RTP Global entered India in 2011 and has invested in 35 startups across three funds

The VC firm will invest nearly one-third of its latest fund’s corpus in 20 Indian startups

Some of its notable bets include Snapdeal, FreeCharge, CRED, DeHaat, Rebel Foods, MPL, Practo, Wiom, IBC, Newton School and Vahak, among others

India’s burgeoning startup ecosystem comprises 68K ventures and counting, cementing its position as the third-largest global startup hub. The country is also home to the youngest population among the top five economies worldwide and has increasingly attracted substantial venture capital funding locally and globally.

As a result, more than 9.5K investors put in an impressive $142 Bn+ in the ecosystem between January 2014 and June 2023. Moreover, in spite of a market correction since January 2022, funds have already amassed more than $28 Bn, which is set to boost entrepreneurship and the startup economy.

RTP Global is one of the VC firms that ventured early into India to explore its unique opportunities. Set up in 2000, the UK-based firm makes strategic investments in early stage technology startups across three major markets – the US, Europe and Asia. Its global portfolio boasts 110 startups and 25 exits so far. Among the notable exits are Delivery Hero (Germany), Groupon and Datadog (the US) and Snapdeal and FreeCharge (India).

In June 2023, the VC firm announced its latest fund, RTP IV, with a corpus of $1 Bn, more than 50% the size of its third fund. It will invest nearly one-third of the corpus in 20 Indian startups operating in artificial intelligence & machine learning, enterprise software, fintech, ecommerce and other emerging sectors. Globally, of the $1 Bn fund, $600 Mn will be used for early-stage investments, while the remaining will be reserved for follow-on investments in RTP IV’s best-performing portfolio companies.

RTP Global initially operated in the UK, but the team sought to expand its reach and explore new markets. In 2007-08, the firm turned its attention towards the rapidly growing Indian ecommerce industry, with particular interest in startups like Flipkart and Snapdeal. Impressed by their growth stories, the VC firm entered the Indian market in 2011.

The expansion was spearheaded by Galina Chifina, who was then a partner at RTP Global and currently holds the position of a partner in Asia.

In January 2022, former Flipkart veteran Nishit Garg joined the VC fund as a partner to set up operations and expand its network. The venture capital company focussed on consumer tech, fintech and emerging sectors to expedite its investment play.

Since its India foray, RTP Global has invested about a third of its corpus across three funds, added 35 startups to its portfolio. Notable investments include Cred, DeHaat, Rebel Foods, MPL, Practo, Wiom, IBC, Newton School, among others.

“The company’s capital structure stands out as it relies solely on the returns from its initial investments, starting with the founder’s million-dollar contribution and continuing to the present day as the fund utilises return from investments to invest further. We don’t have that many LPs. This structure gives us a lot of flexibility. The company can implement unconventional measures when needed, avoiding unnecessary bureaucracy in its processes,” Nishit said.

Here are the edited excerpts from the interview.

Inc42: When RTP Global entered India in 2011, how did you perceive the startup ecosystem?

Nishit Garg: The roots of our capital can be traced back to the U.S. IPO of Yandex. It served as the initial seed cheque for RTP Global, marking the beginning of our investment journey. Initially, the company used to focus a lot more on the UK. But in 2011, the fund went global, extending its reach to three key markets – the US, India and Europe.

Even then, we had the foresight to consider India a significant market compared to the US and Europe.

Inc42: How did the investment thesis change over the past decade?

Nishit Garg: Our strategy consistently revolves around early stage investments in tech and tech-enabled businesses in India, and we mainly focus on Series A and Pre-Series A funding.

When we entered India in 2011, the objective was to understand the Indian market thoroughly. While ecommerce was thriving globally, thanks to industry giants like Amazon and Alibaba, the Indian ecommerce landscape remained uncertain. Price points, profit margins and logistics were not there in the country.

So, we initially focussed on ecommerce and invested in wallet businesses. Early investments in FreeCharge and Snapdeal also paid off, paving the way for more capital deployment to India.

With RTP’s Fund II, we initiated early investments in startups like Rebel Foods (2015), CRED (2018), MPL, Plantix (2019). Later, RTP Fund III, introduced in 2020 with a corpus of $650 Mn, marked a shift towards more assertive investments. We led the funding rounds and deployed large amounts, transitioning from $1 Mn to $10 Mn first cheques.

Until 2020, most startups operated in consumer tech and fintech sectors, with SaaS yet to gain significant traction. Later, we expanded our portfolio and entered new sectors [like agritech] with Bijak (2020) and DeHaat (2021) funding. The shift was initiated when we were raising Fund III.

Inc42: Have you noticed any shift in sector focus in India post-pandemic, say after 2020 and 2021?

Nishit Garg: In 2022, we expanded our horizon by entering the crypto and Web3 space but later decided to steer clear of these domains. Instead, we are focussing on blockchain alone.

In addition, RTP Global has ventured into electric vehicles (EVs) and the climate space, and we are actively looking to invest in both. The EV industry is undergoing a significant transformation, with opportunities emerging in several areas such as battery technology, battery manufacturing and charging networks. We aimed to establish a strong presence early on, as we recognised that the industry would mature in the next seven to eight years. As for the climate space, we actively seek companies engaged in carbon offsetting initiatives.

For us, the timing to enter a sector for investment is very important.

Inc42: Given the current state of the Indian startup ecosystem, how large is the opportunity for RTP Global? Do you find it challenging, as many homegrown early stage VCs are in the market?

Nishit Garg: Our India investments range from $1.5 Mn to $10 Mn, with an average ticket size of $4 Mn – $5 Mn. In contrast, our U.S. operations have an average funding of $10-12 Mn. However, this approach depends on partner preferences.

India’s timeline for value creation may be longer, around 10 years or so, compared to the five to six years typical in the Valley. But the ecosystem is maturing and offering more opportunities.

Inc42: Does RTP Global have a different exit strategy in India?

Nishit Garg: The VC ecosystem in India gained momentum in CY 2007-2008, bringing significant funding for companies like Flipkart, Snapdeal, Ola, BYJU’S in corresponding years. Several funds were also set up in CY 2015-2016. As most VC funds typically have a span of 8-10 years, many of those funds are yet to complete their life cycles. These funds are now nearing the conclusion of their first fund cycle as we approach 2024-2025, sparking increased discussions about exits in the market, which is a natural progression.

In contrast, our experience in the US has been different. Market conditions are more favourable there and established processes exist to assess a company’s trajectory within three to four years. Exit strategies can be planned accordingly, be it through an IPO, a strategic M&A, or a distress sale. But such processes and ecosystems are still evolving in India.

With the macro pressures that emerged since 2021 (due to the Covid-19 pandemic and geopolitical issues), many funds, including ours, now focus on building the capability to navigate exits with well-defined processes.

Moreover, industry majors like Reliance, Microsoft and Adobe are increasingly involved in the tech startup ecosystem. This trend has created a growth channel for startups with high potential but limited scaling capabilities. They can now partner with larger entities that may be less nimble but have vast distribution networks.

We also anticipate increased M&A activities and consolidations (which may lead to more exits).

Inc42: Tell us about some notable exits in India.

Nishit Garg: We have seen good exits from FreeCharge and Snapdeal. (The former is a digital payment and financial services company, while Snapdeal is a leading player currently specialising in value ecommerce.) We were involved with FreeCharge during 2014 and Snapdeal finally acquired it in April 2015. That was a highly profitable exit for us. I can’t disclose specific numbers, but it was an exceptional return on our investment.

When Snapdeal was a nascent business in CY 2014-2015, a foreign venture firm wanted to purchase our stake in the company. Initially, we were not inclined to sell it, but we valued our partnership with the VC firm and ended up selling it (partial exit, we still hold a minority stake in the company). This, too, yielded a substantial return. So, I would say our presence in the ecosystem has resulted in significant returns.

Inc42: What are the key challenges investors and entrepreneurs face in India?

Nishit Garg: There is substantial competition in the Indian market, presenting opportunities and challenges. But the primary challenge comes from the fact that the venture capital ecosystem in India is relatively young – it has been here for about 24 years. This is different from the more mature U.S. and the EU markets.

Since a VC brigade or the startup ecosystem has not been here for a long time, India lacks a significant cohort of successful founders who can mentor and guide new entrepreneurs. This gap in mentorship hinders the success rates of new companies. However, the situation is improving and we hope to see more experienced mentors in the next five years.

Another challenge is that investors have become overly cautious, especially after market downturns. They now require specific metrics for Series A investments, which can cause funding delays.

This caution is partly due to the limited investment experience of many VCs. As the investor ecosystem matures and more successful entrepreneurs emerge, this challenge should ease, benefiting new businesses.

Inc42: What are your targets for FY24 and vision ahead for the Indian market?

Nishit Garg: Our goal is to become a leading fund in India and the first choice for founders seeking investments. We made significant progress towards it in the past decade and aim to achieve this goal in the coming years.

At RTP, we believe that as investors, we cannot single-handedly rescue struggling companies or reshape their destinies. Only entrepreneurs can bring in such transformative changes. Our primary responsibility is to speed up their learning process, especially when they venture into new markets.

We avoid pressuring founders and provide them with comprehensive data, highlighting even the less favourable aspects. This helps support their informed decision-making.

RTP wants to be recognised as a partner of choice for entrepreneurs. This entails more than mere financial support. It is about offering the right guidance and assistance at the right time. We want to be the partner who invests and helps founders navigate their journeys.

Ad-lite browsing experience

Ad-lite browsing experience