Ola wants to be be in the middle of everything that could change India in the future, and at the moment, that’s not ride-hailing. It’s EVs, AI and chips

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

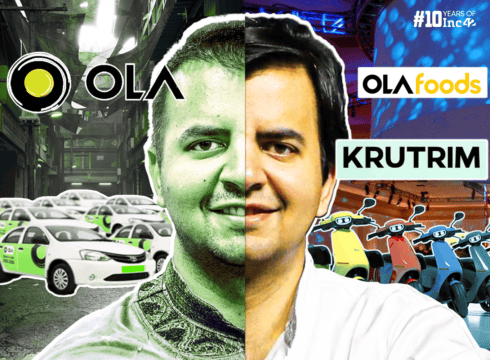

We have seen Bhavish Aggarwal take to the stage and say many things in the past. The week gone by was no different. Ola’s huge Independence Day event ‘Sankalp’ saw Aggarwal lay out the vision for newly-listed Ola Electric and his latest big bet Ola Krutrim. Curiously, not only was Ola Cabs shunted to the sidelines but also renamed to Ola Consumer.

However, it was hardly surprising. Ola’s transition from a ride-hailing company to a EV maker has been three years in the making, but Aggarwal has also positioned Ola as a future-focussed tech infrastructure company to compete against the AWSes and NVIDIAas of the world, as well as a consumer platform that could potentially become a digital commerce behemoth.

Those who admire Aggarwal have long called him the Elon Musk of India, but at the same time, Ola’s trajectory does hint at an Amazon-like platform that works as the backbone of the upcoming AI revolution and for digital commerce. So perhaps a comparison with Jeff Bezos is not unwarranted either.

But this is not a paean. What we are trying to say is that Ola is changing. It wants to be in the middle of everything that could change India in the future, and at the moment, that’s not ride-hailing. It’s EVs, AI and chips.

So, should we already be preparing our eulogies for Ola’s ride-hailing business? Not quite yet, but that time looks to be getting close.

Before we see why, here are some of the other top stories from our newsroom this week:

- The New Instamojo: Instamojo faced an existential crisis in October 2023 after the RBI barred it from operating as a payment aggregator, leading to a major pivot. Now the startup is a Shopify challenger looking to bring MSMEs to the ecommerce fold. Here’s how the company changed itself

- Dunzo Still In Doldrums: Reliance Retail could well save Dunzo, but other investors are still on the fence about the future of the startup that has barely survived through months of cash crunch. In fact, even if Reliance saves Dunzo, what future awaits the company?

- Exam Time For VCs: SEBI is making it mandatory for AIFs in India to have at least one certified decision maker in investment teams, and VC funds are scrambling to comply before the May 2025 deadline. What’s SEBI thinking and why do some believe it’s taking it easy on funds?

An Ola For India

Ola is just a copy of Uber for India. This low-hanging fruit naturally became the central criticism for Ola Cabs when it first launched in India.

In fact, Ola in those days meant a cab, and it’s only in 2023 that one had to really clarify they are talking about Ola Cabs and not Ola Electric. Even now, it’s really hard to speak about Ola Electric, without the ‘baggage’ of the other Ola.

But Aggarwal is hell-bent on changing that. Or at least that’s what we saw at Ola Sankalp. For simplicity’s sake, we are using Ola here very loosely to signify the group.

What was on display on August 15, 2024 at Ola Sankalp was unbridled ambition, some cherry-picked stats and a vision that had a grandeur seldom seen in Indian startups. At least not in the same unabashed manner.

The Ola Sankalp livestream ran for over three-and-a-half hours and rivalled the runtime of the LOTR trilogy. Its content was perhaps just as fantastical, as we said in our examination of some of Aggarwal’s and Ola’s claims.

But parsing all that PR speak and grandeur, we can see where Aggarwal is looking to take Ola. And that’s being everything that India needs or is seen as needing. In this context, the ‘excluding China’ disclaimers sprinkled throughout Ola’s Sankalp presentation, are about positioning India as the main China alternative for the manufacturing of semiconductors and electric vehicles.

Incidentally, that idea worked for smartphone manufacturing, with Apple making the biggest push. Can Ola Electric similarly catalyse chip and EV manufacturing, which are its biggest focus areas right now?

What Is Ola Today?

Ola is a chip maker; it’s an EV maker; it will provide cloud services and power digital commerce, logistics and AI copilots through Ola Consumer. It seems mad, but there is a method.

These are unsurprisingly the areas that the Indian government wants to focus on for its economic growth targets. India sees itself becoming the semiconductor capital of the world over the next decade, with a huge outlay of government spending to propel the industry.

Aggarwal is painting Ola Krutrim as the poster child for this revolution, with the AI chips, which the company claims would outperform the current market leaders, when they launch sometime in 2026.

This is a claim that cannot be tested yet, and perhaps Ola can indeed pull it off if everything falls into place. But there are a lot of moving pieces, and even the semiconductor industry could see major changes in the next couple of years. For now, Ola is saying it will be the company to drive that change in India, whatever it may be.

A similar pattern can be seen in the Ola Electric vision. Besides new product launches, there were big numbers, market-beating expectations and claims that are hollow at-present, but could become true in the next three to four years.

Here too, Aggarwal latched on to the hot topic of self-reliance or ‘atmanirbharta’ as far as energy production is concerned, with his vision for the Gigafactory and cell manufacturing. Ola Electric could very well be a critical part of India’s aim to reduce imports of batteries. But at this point, it is a nice story that sells well in the right circles.

Curiously, these are targets that Ola Electric has not tried to sell in its IPO pitch. Undoubtedly though, it is great content for social media reels and highlights.

And finally, Aggarwal’s pitch for the Ola of the future was about Ola Consumer, a new platform that essentially crams in everything that Ola makes. This brings us to the end of Ola Cabs, formerly known as just Ola.

End Of The Ride For Ola Cabs?

Okay, perhaps the end of Ola Cabs is a little overstated, and hopefully, it did serve as a lure to get you this far. But here’s one thing we are having a hard time changing our mind on. Bhavish Aggarwal is perhaps not in love with ride-hailing any more.

In some ways, it would be hard even for Aggarwal to shed the Ola Cabs business, which explains the vociferous denials last year when reports of a Uber-Ola merger surfaced.

We don’t want to analogise too much about smoke and fire, but can you really deny that Ola has given up on cabs in recent years. The service quality has taken a nosedive, and perhaps the biggest indication is that rivals have caught up.

Rapido and BluSmart have made gains and both have the funds they desperately need to scale up. Rapido basically stepped into every gap that Ola left in the ride-hailing business, and sources in the industry believe it is poised to dethrone Ola as the second largest player in this segment.

Another newish rival is InDrive, which is gradually adding more drivers and expanding to smaller cities. Even Uber is turning a corner by utilising India as its tech hub for the global operations, as we uncovered in our look at the US giant’s India experience in recent years.

Ola had the first-mover advantage, which it squandered by not addressing weaknesses in the operations and service quality. For long, Ola Cabs rested on the fact that the advantages presented by an Uber-Ola duopoly could only be broken by something really massive.

In the past few years, that ‘something massive’ has happened. Ola Cabs is now a cab stuck in the mud, and rather than pull it out and try to spark the engine again, Aggarwal is building a big manor around it.

Within this manor that’s being built, cab-hailing will rarely be spoken about, but Aggarwal is keeping some of the Ola Cabs vestige alive with Ola Share or ride-sharing.

Other ride-sharing services have not fared very well in India, but we can see why Ola is adding ride-sharing for now as an option. Sharing is more popular in smaller cities and towns, which is the key user base of Ola Consumer as well as ONDC.

As Ola Consumer builds on the ONDC network, Ola will likely look to own the last-mile mobility needs in smaller cities, and scale that up. But here, it will have capitalised rivals like Namma Yatri and others as well. It’s challenging to scale up ride-sharing in markets that don’t offer a high volume of active users, and that’s only if you don’t discount rides.

Ola says on its website that Ola Share prices are always fixed and payment has to be done before the ride starts, but the service will be cheaper than typical Ola rides. Given this, Ola Share right now looks like a way for Ola to stay in the mobility game, and keep the Ola Cabs car running on low fuel.

It’s a ride that could end any time.

Sunday Roundup: Tech Stocks, Startup Funding & More

- A temporary blip or a start of a turnaround? With $395 Mn raised by startups this week, this is comfortably the highest weekly tally in recent months

- Does BYJU’S have any fuel left? The fallen giant is likely to shut nearly half of its 250 BYJU’S Tuition Centre to cut expenses further

- Blinkit across borders! The quick commerce giant is now allowing customers overseas to place orders for their siblings in India for Raksha Bandhan. How long before it becomes a permanent thing?

- FirstCry pops on debut! The ecommerce giant listed on the stock exchanges at a 35%-40% premium over the issue price, with M&M, SoftBank, TPG Growth making big returns from the IPO

- Unicommerce’s stellar listing! The B2B ecommerce company debuted at a premium of 117.59% over the issue price, which was expected by many thanks to the rampant oversubscription for the IPO

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.