Following a stock downgrade, Nykaa might lose some visibility among public market investors at a time when competition in the beauty ecommerce space is intensifying

Nykaa, which has been the most popular beauty marketplace, has had to fight off Reliance Tira, Flipkart-owned Myntra, Tata CLiQ and others but has to invest heavily in omnichannel and private label expansion

As its profitability and traction have declined, Nykaa needs to fix things for the long run without losing too much money as it does not have the capital reserves similar to its rivals

In the first week of July, the Nykaa

From a near monopoly in the beauty ecommerce space, Nykaa has lost its top spot. Not to mention, new competition, in the form of D2C brands and behemoths such as Tata and Reliance, has complicated the situation even more.

The downgrade by the AMFI means that Nykaa is no longer an attractive largecap stock in India, and this could have an impact on the company’s visibility in the near future.

So, what exactly triggered this collapse?

It was only in November 2021 that Nykaa’s INR 5,352 Cr IPO saw 82x subscription, the highest among large startup IPOs in India. Having withstood competition from marketplaces such as Amazon India and Walmart-backed Flipkart and Myntra, Nykaa seemingly set a new benchmark for Indian ecommerce startups with its blockbuster IPO.

But the last 20 months have been nothing short of disruptive. Reliance-backed AJIO has grown in stature, and the Indian conglomerate has also launched Tira in the beauty ecommerce space.

Meanwhile, Tata has also bolstered its beauty and personal care product assortment on its platform Tata CLiQ. Furthermore, the Tatas have added 20 beauty tech stores across the country, aligned with its ecommerce operations, while Myntra Beauty has registered 2X-3X growth in recent months and expanded its brand collection. Therefore, Nykaa needs to come up with something exceptional to compete with the aforementioned well-funded BPC contenders.

Adding to the company’s woes was the announcement of the issue of bonus shares in a 5:1 ratio and changes in key management personnel after a successful IPO. This did not go down well with investors. Bonus shares announcement was largely perceived as a way to keep the company’s anchor investors from offloading shares at the end of their IPO lock-in period.

Experts believe that amid declining year-on-year profitability, Nykaa could see a cash crunch as it prepares to combat with deep-pocketed corporations. For now, it will be interesting to see if Nykaa can hold onto its market share?

Nykaa’s Losing Its Footfall To AJIO & Myntra

First, let’s look at the bread-and-butter for ecommerce platforms such as Nykaa — that is visits, page views, engagement and repeat orders.

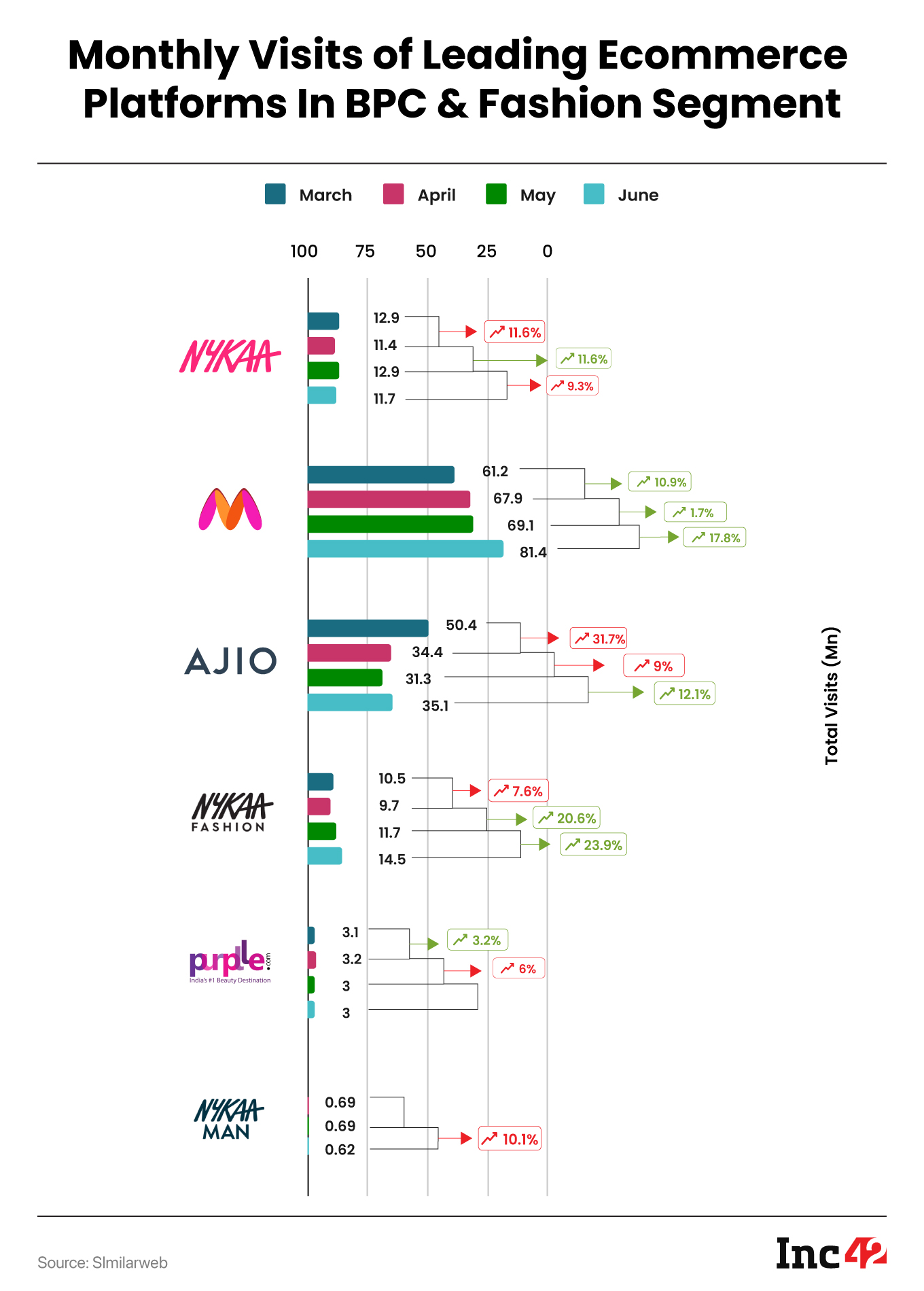

It must be noted that Nykaa has separate properties for fashion (Nykaafashion.com) and beauty (nykaa.com). If we look at the performance over the last 3-4 months, the fashion vertical has definitely seen some gains, but Nykaa.com itself has experienced negative growth in total visits.

The flagship property is bleeding users due to an ever-intensifying competition, which is quite clear in the graph given below.

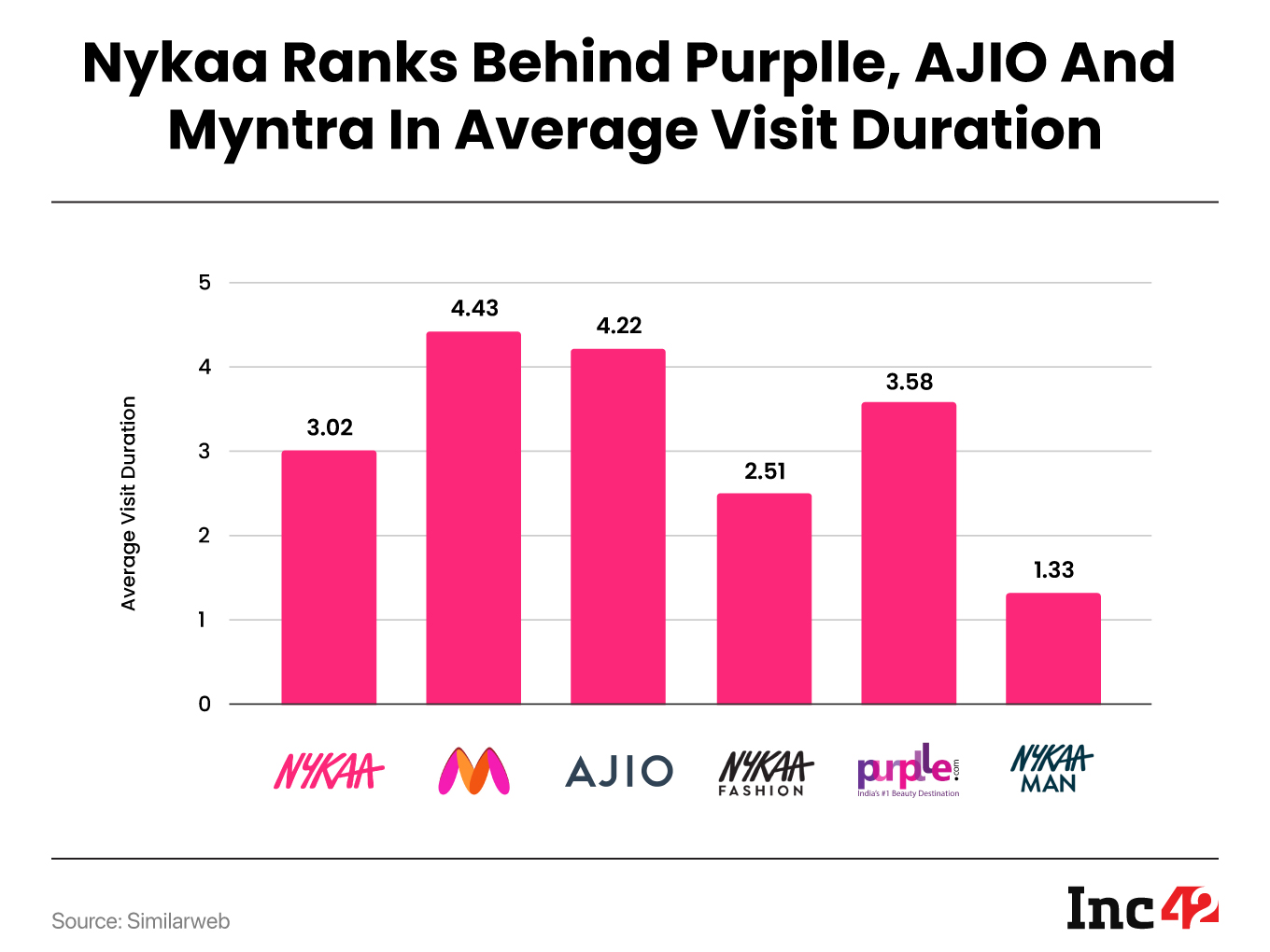

Further, Nykaa, Nykaa Man and Nykaa Fashion have the lowest numbers when it comes to average visit durations.

On the ecommerce front, Nykaa has a lot of catching up to do against its competitors. Some of Nykaa’s private labels — take Dot&Key for instance — have become popular discounted items on Myntra, AJIO, Amazon India and other marketplaces, which shows that the company is forced to use its competition to sell its products.

In contrast, Myntra, AJIO, Tira and Amazon’s private labels are largely walled inside their respective marketplaces. To beat the competition and stay in the public spotlight, Nykaa has opted for the omnichannel strategy, and it is looking to add brand-owned stores on the retail front. But here too, the competition is stiff.

Nykaa Faces Challenges With Its Online-To-Offline Strategy

When we look at the omnichannel operations, Nykaa has 145 physical stores, 38 fulfilment centres, and 2,749 stores of its owned brands. The company plans to open more physical stores this year, according the announcements made in its last earnings call.

Nykaa’s founder and CEO Falguni Nayar had earlier said, “Physical retail is a necessary investment that we need to make, even if it adversely affects overall profitability. So, we are aiming for the optimal mix of online, offline, and duty.”

This is where the situation becomes more complicated. Being primarily an online platform, Nykaa has managed to stay lean and achieve profits thus far. However, opening more stores means more investments and a significant increase in operational expenditure, including higher employee expenses.

Plus, this entails entering into fierce competition with Tata and Reliance.

Reliance Retail alone has launched over 3,300 new stores in FY23 under its various brands, including Tira Beauty, Trends, and others.

Similarly, Tata has been a well-known name in the BPC and fashion industry. It introduced the first-ever cosmetics brand, Lakme Cosmetics, to India (later sold to Unilever). Tata has over 22 in-house labels for its Westside brand, which operates over 200 stores across the country.

While Tata plans to open 20 beauty tech stores, equipped with AI and VR, it already has 391 Zudio stores nationwide.

For Tata and Reliance, it is relatively easier to build an online business backed by their offline stores compared to Nykaa’s strategy of building an offline presence backed by online operations. These large conglomerates have years of experience in building retail brands in the offline space.

So, essentially, Nykaa seems to have lost ground in its strength areas of ecommerce and offline retail, as it is not as experienced as its rivals.

Speaking to Inc42, Devangshu Dutta, the founder and CEO of Third Eyesight, a boutique management consulting firm explained, “Apart from the impact of Covid, in the last 3-4 years, many brands have started moving offline because that’s where the bulk of the business happens. But moving offline means entering a completely different business. You’re not able to centralise inventory as much, and you may not be able to respond to market-specific segments as quickly.”

He also believes, like any other offline retail business, Nykaa will face high operational costs, but it has an advantage in the fact that it may be able to use data more effectively from its online operations. Nevertheless, this is a minor advantage.

“Your store locations have to be correct, and self-sustaining quickly, at least on a cash operating basis. At the business level you may look at profitability in a longer term,” Dutta added.

Profits Plummet: Nykaa’s Other Big Worry

India’s beauty and personal care market, presently valued at $16.8 Bn, is poised to grow at a compound annual rate of 11%, with cosmetics and perfumes categories growing at a faster clip.

According to a joint report by international beauty brand Estée Lauder and Gurugram-based business insights firm 1Lattice, a substantial portion of sales worth about $1.3 Bn are through ecommerce channels. This is expected to grow at a CAGR of 30% during FY22-27, followed by companies that retail beauty products in health and beauty stores and modern retail shops.

With 30% of India’s BPC market share, Nykaa has so far managed to stay ahead in the race. Nykaa’s beauty category (55% of the broad BPC category) saw 33% full-year growth with a GMV of INR 6,649 Cr. On the fashion side, the GMV grew 47% for the full year at INR 2,570 Cr.

BPC and fashion are the two mainstays of Nykaa’s business, even though fashion is a relatively new vertical for the Mumbai-based company. The company had earlier launched Nykaa Man, a separate platform for men’s grooming, beauty and fashion, but with less than 1 Mn visits, it has failed to grow over the last few years while AJIO has grown from 0-37 Mn users, as per analysts.

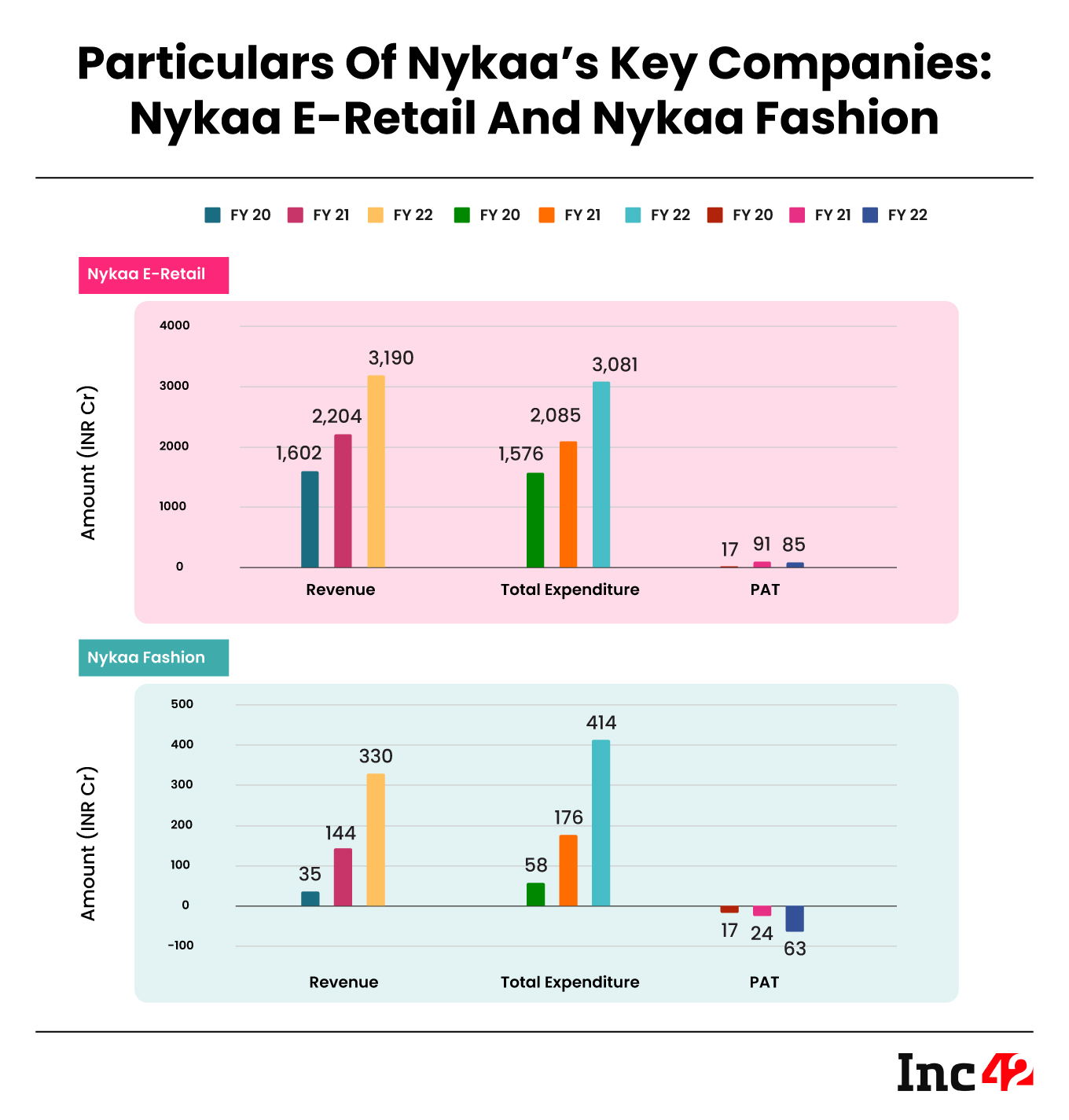

“At one end, Nykaa’s online PAT has been going down for the last two years, while Nykaa Fashion’s loss for the year has grown consecutively, putting Nykaa business in a fix,” said an analyst from PwC.

Nykaa needs to bring a balance between short-term losses and long-term profits. However, the company’s current strategy fails to show a way out, the analyst added.

The Balancing Act For Nykaa

As per the analyst quoted above, the company’s BPC products have so far had lower prices than Myntra and AJIO, where discounts are typically lower.

However, when compared to Amazon India and its long list of D2C brands and private labels, Nykaa products were slightly more expensive. Amazon also scored over Nykaa with its better supply chain and distribution.

Nykaa banked on product assortment, the assurance of quality and authenticity of products, but as more and more brands join Tira, AJIO and Tata CLiQ, this is also fast eroding.

Access to international brands is no longer exclusive to Nykaa, so it needs to tackle distribution and supply chain, where its rivals score heavily.

Giving Nykaa the benefit of the doubt, a consultant from brokerage firm Motilal Oswal recently said, “There is no clear playbook for these businesses. When Nykaa entered the segment, it was pioneering many aspects in India.”

However, now the company needs to exercise extreme caution regarding expenses and investments because of heavyweight competition with deeper pockets.

P Ganesh, chief financial officer at Nykaa, highlighted that the company still has funds remaining from the IPO, which will be utilised to secure future capital needs.

Ganesh added, “It’s worth noting that while we have observed a considerable increase in working capital as the company scales up, the number of working capital days is expected to stabilise. This means that the amount of funding allocated to working capital should moderate in the future.”

But analysts also believed that Nykaa cannot afford to sacrifice its market share in India’s rapidly growing beauty, personal care, and wellness segment. One thing that is advantageous for Nykaa is that Reliance-owned Tira is still new in the market and will take some time to get to critical mass adoption.

This is a window of opportunity for Nykaa to stretch its lead and fight off its rivals. Nykaa’s brand value primarily comes from its online business, so it must not let offline expenses hinder its online growth plans. However, given the competition, Nykaa is in a Catch-22 situation.

In the BPC segment, owned and private label brands play a vital role in increasing long-term profitability and repeat purchases. All of this will require extensive investment from Nykaa’s leadership — there are segments in BPC where Nykaa has no private label or owned brands.

As of now, the question remains: Can Nykaa maintain its dominance in the online market while facing fierce competition on multiple fronts?

Ad-lite browsing experience

Ad-lite browsing experience