India’s consumer internet market will reach a size of $1.6 Tn by 2025, growing at a CAGR of 28% during 2021-2025

As per Inc42 analysis, fintech will account for 71.7% of the domestic consumer internet market by 2025

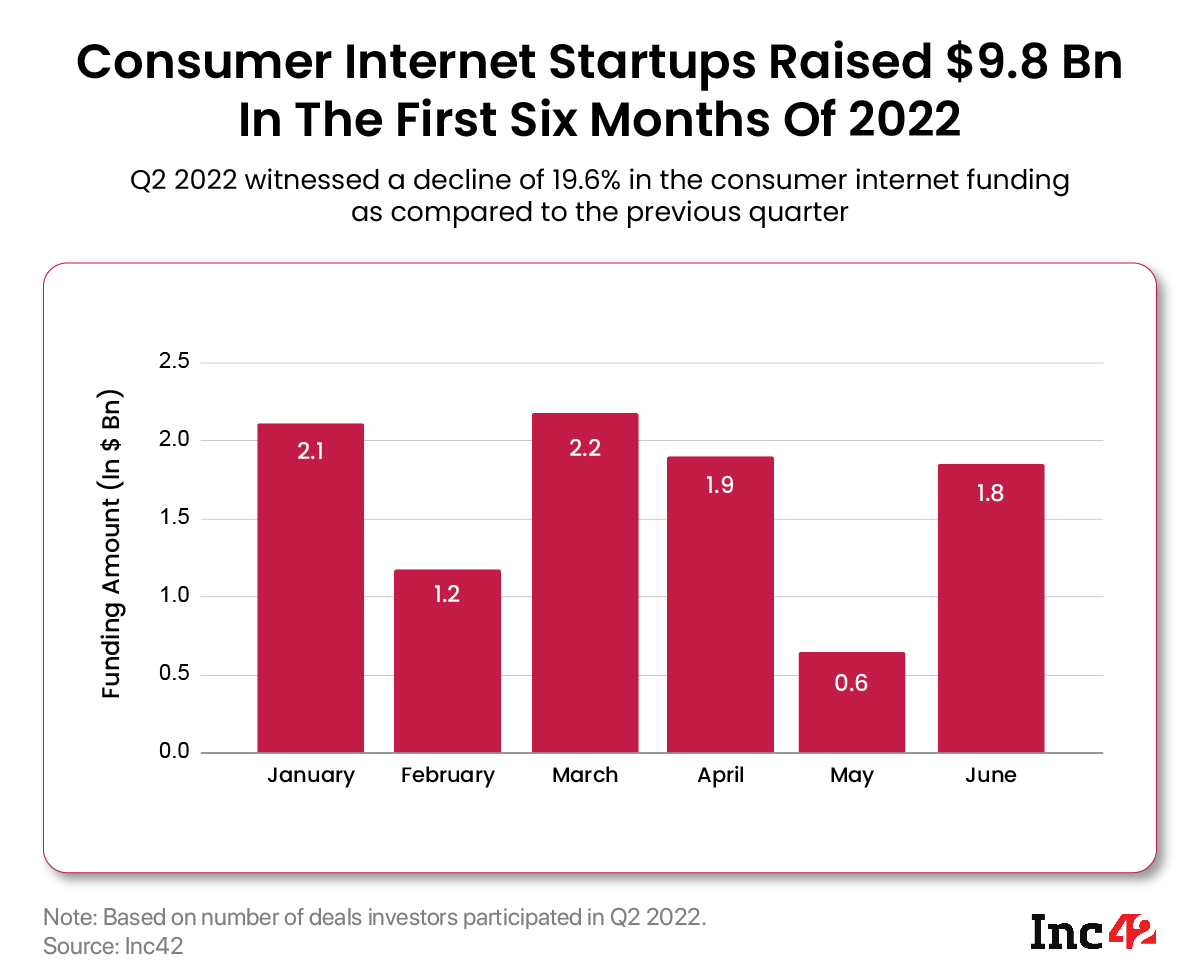

In Q2 2022, India’s consumer internet startups raised $4.5 Bn across 201 deals from 835 investors

The Indian consumer internet economy is a distinctive combination of multiple sectors. In the last two decades, startups in segments such as ecommerce, edtech, fintech, healthtech, consumer services, media and entertainment have laid the foundation for making India a strong and unique consumption-led market.

The Indian consumer internet market is projected to reach a size of $1.6 Tn by 2025. Investors across the globe have been putting the best of the minds at work to identify and invest in the startups in the sector.

“In the last decade, technology has outpaced itself and internet has been a source of entertainment and education alike. As a result, investors grew their interest in a wide range of consumer internet companies such as ecommerce, fintech, travel platforms, e-learning, mobile apps, and digital health etc,” according to Mitesh Shah, partner at Inflection Point Ventures’ fund Physis Capital.

According to Inc42’s latest ‘State of Consumer Internet Report, Q3 2022’, the sector has over 20K startups and 60 unicorns, which raised $84 Bn between January 2014 to June 2022.

In Q2 2022, the consumer internet startups raised $4.5 Bn across 201 deals from 835 investors. The data suggests that while investors’ most preferred sector is fintech in terms of the deal size, the ecommere sector bagged the maximum deals during April-June 2022.

“The consumer internet industry has witnessed unprecedented growth over the last two years. While the pandemic has encouraged consumers to adopt e-commerce, now after two years, it has become a part of everyone’s life,” said Nakul Saxena, head fund strategy and investor relations at LetsVenture.

The investors are now looking more at bridge-stage startups. According to the Inc42 report, bridge funding saw the highest year-on-year surge among consumer internet startups in Q2 2022.

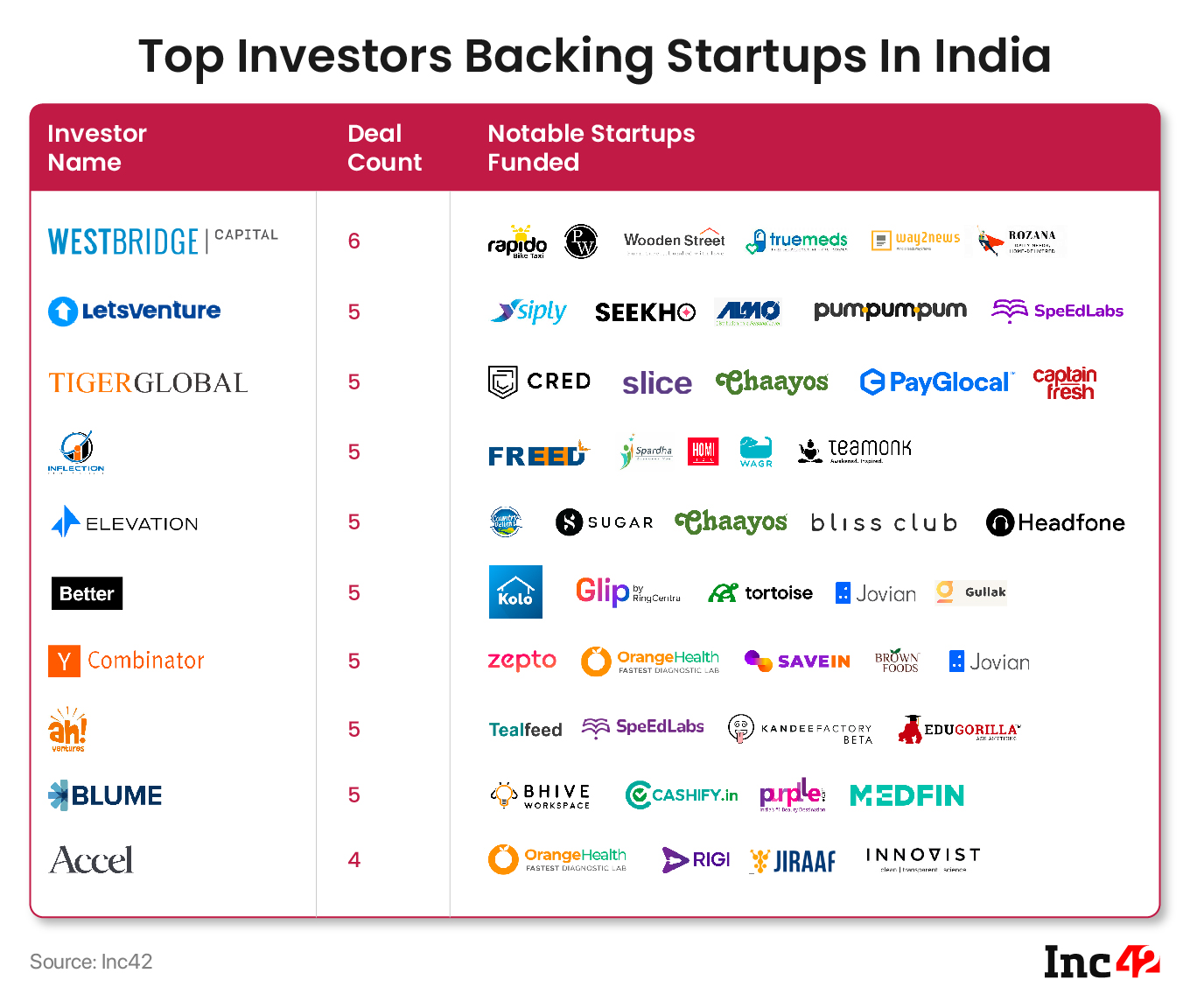

Let’s take a look at the top 10 investors who placed their bets on the Indian consumer internet startups in June quarter of 2022.

Note: This list is not a ranking of any kind. The investors have been included based on the number of deals recorded in Q2 2022. If you want to recommend/nominate investors backing consumer internet startups, write to [email protected].

Accel

Accel made its foray in India in 2005, and set up an India-focused fund, called Accel India Venture Capital Fund, in 2008 with a corpus of $10 Mn.

In March, it secured $650 Mn for its seventh fund called Accel India VII to invest in early-stage startups in India and the Southeast Asia.

It invested in four consumer internet startups in the second quarter of 2022 – OrangeHealth, Rigi, Jiraaf and Innovist.

Ah! Ventures

Ah! Ventures, set up in 2009 by Harshad Lahoti and Abhijeet Kumar, invests in early-stage startups across sectors.

The investment firm has a network of over 2,000 angel investors and 1,000 venture capitalists. It has infused about $28.5 Mn in 54 startups and exited 10 startups till date, according to its LinkedIn page.

In the second quarter of 2022, it invested in five consumer internet startups – Yoro, Tealfeed, SpeEdLabs, KandeeFactory, and EduGorilla.

In June, it also set up an AIF angel fund with a corpus of around $14 Mn. The fund would invest in early-stage startups in the domestic and international market.

Better Capital

Set up in 2018 by Vaibhav Domkundwar, the pre-seed venture firm claims to have a portfolio of over 150 Indian startups such as Khatabook, Bijak, Airmeet, Kutumb, and Dukaan.

Its portfolio companies are cumulatively pegged at over $7 Bn. In 2021, it also set up a $15.28 Mn sector-agnostic fund to invest $300K in 40-50 pre-seed and seed-stage startups.

In Q2 2022, Better Capital backed five startups in the consumer internet space – Kolo, Glip, Tortoise, Jovian and Gullak.

Blume Ventures

Blume Ventures, set up in 2011 by Karthik Reddy and Sanjay Nath, invests in early-stage tech startups. Besides, it also offers mentorship to its portfolio startups.

It claims to have exited several startups like ZipDial, Taxi For Sure, 1CLICK, Framebench, Runnr, Zenatix, Mettl and E2E, among others, till date.

In the second quarter of 2022, it backed four startups – BHIVE, Cashify, Purplle and Medfin.

Elevation Capital

Set up in 2002 by Ravi Adusumalli, Elevation Capital invests in early-stage and growth-stage startups.

The Gurugram-based venture capital fund claims to have invested nearly $2 Bn in more than 150 startups, including FirstCry, Makemytrip, Meesho, Swiggy, and Unacademy. According to Elevation Capital, 13 startups from its portfolio have turned unicorns so far,

In April, it set up a $670 Mn Fund VIII to invest in early-stage startups working across consumer tech, consumer brands, fintech, SaaS and Web3 sectors.

In Q2 2022, it backed five startups – Country Delight, Sugar, Chaayos, Bliss Club and Headfone – in the consumer internet space.

Inflection Point Ventures

Set up in 2018 by Vinay Bansal, Ankur Mittal, Mitesh Shah and Vinod Bansal, Inflection Point Ventures primarily backs early-stage startups working across sectors, including healthcare, fitness, finance, HR, AI, education, supply chain and logistics, among others.

The venture fund claims to have a network of over 7,000 angel investors. In the second quarter of 2022, it invested in five startups – FREED, Spardha, Homi Lab, Wagr and Teamonk.

In 2021, it invested in 45 startups, including Vested Finance, Stylework, and LoanKuber.

LetsVenture

Founded in 2013 by Shanti Mohan and Sanjay Jha, LetsVenture has invested over INR 2,800 Cr across 722+ fundraising deals to date.

It claims to have a portfolio of $8 Bn and has set up 100 micro venture capital funds so far. Spottabl, Expertrons, Airmeet, Melorra, Sugar Cosmetics, Yulu, Agnikul, Zuddl, Citymall and Classplus, among others, are its portfolio startups. It also claims to have a network of more than 10K investors across 60 countries.

Marquee investors such as Accel, Chiratae Ventures, Nandan Nilekani, Sharad Sharma, Anupam Mittal, and Ratan Tata have backed the investment firm.

Most recently, LetsVenture partnered with the Ministry of Electronics and Information Technology (MeitY) to invest up to $100K in early-stage startups under the Centre’s SAMRIDH startup accelerator programme.

In the second quarter of 2022, it invested in five consumer internet startups – Siply, Seekho, PumPumPum, SpeedLabs, and Almowear.

Tiger Global

Set up in 2001, Tiger Global primarily backs public as well as private businesses working across sectors such as internet, software, consumer tech and fintech sectors, among others.

The New York-based venture company founded its public equity fund in 2001, which makes long-term investment bets. In 2003, it founded its private equity business that has invested in several growth-stage and pre-IPO companies across 30 countries, as per its LinkedIn profile.

In 2021, it participated in 58 fundraising deals of startups like Pristyn Care, Apna, and Captain Fresh, among others, across the globe.

In India, it invested in five consumer internet startups in Q2 2022 – CRED, slice, Chaayos, PayGlocal and Captain Fresh.

WestBridge Capital

Founded in 2000 by Sumir Chadha and Sandeep Singhal, WestBridge Capital invests in late-stage startups in India and South Asian countries. It writes cheques between $25 Mn to $200 Mn, and currently has over $5.6 Bn of assets under management (AUM), as per its LinkedIn page.

In the second quarter of 2022, it invested in six consumer internet startups including Rapido, Wooden Street, Truemeds and Rozana.

In 2021, the investment firm invested in 15 Indian startups, including DealShare, Vedantu, and Rapido, across sectors.

Y Combinator

Set up in 2005, Y Combinator is an early-stage startup accelerator. Under its three-month accelerator program, it writes cheques of $500K to early-stage startups, according to its website.

In the second quarter of 2022, the US-based startup accelerator invested in five consumer internet startups – Zepto, OrangeHealth, SaveIN, Brown Foods, and Jovian.

Most recently, it announced the name of 250 startups selected for its summer edition of biannual cohorts. The list included 15 Indian startups.

Note: This list is not a ranking of any kind. The investors have been included based on the number of deals recorded in Q2 2022. If you want to recommend/nominate investors backing consumer internet startups, write to [email protected].

Ad-lite browsing experience

Ad-lite browsing experience