What exactly propelled Mamaearth and Honasa towards the major milestone of a full year of profitability?

Many have celebrated Zomato’s rise to profitability, and how it has managed to stay there over the course of four quarters. But the same credit is due to Mamaearth

After reporting profits in the last three quarters, the company ended FY24 with profits of INR 110.52 Cr, a big turnaround from the INR 150.96 Cr loss of FY23.

So what exactly propelled Mamaearth and Honasa towards this major milestone? And has Honasa cracked the house of brands model to finally realise the promise of this model?

That’s what we will look at but after these top stories from our newsroom this week:

- Paytm’s Big Test: After reporting 3X higher year-on-year losses in Q4FY24, Paytm is on the ropes, but it has a plan to get out of its current financial turmoil. Can Vijay Shekhar Sharma turn things around?

- Tira’s Next Phase: As competition intensifies in the beauty segment — not least from Honasa — Reliance-backed Tira is banking on unique value propositions through its private labels. Is it enough to fight off rivals?

- ixigo On The IPO Trail: With the startup IPO season in full bloom, ixigo is waiting in line to join the bourses. Does it have enough of an edge over the travel tech competitors?

What Worked For Honasa?

Honasa started out in 2016 with Mamaearth and an eye on making the most of the direct-to-consumer ecommerce wave that was about to kick off. For the first four years, it was largely an online-only brand, till the Covid-19 pandemic when it began looking at retail outlets as a way to be closer to consumers.

While ecommerce boomed and flourished after the initial days of the lockdown, Mamaearth focussed heavily on the omnichannel model expanding to 10K stores by the second half of 2020 and with an eye on long-term brand building. In fact, this helped Mamaearth establish itself as a new-age alternative to traditional FMCG brands in the beauty, skincare and personal care segments.

In fact, in FY24, the company made nearly 35% of its revenue from offline sales, and a bulk of this has come from general trade retail outlets, which shows that Mamaearth positioned itself not as a premium product but targetted mass availability.

But it was also during this time, the company even acquired other large brands with affinity to beauty and personal care, that have helped it have a good mix of premium and mass products. We will look at how these acquisitions have proved critical later, but it is the omnichannel distribution that has also become one of Honasa’s key strengths over the years.

One D2C founder told us that while everyone was talking about omnichannel in 2021 and 2022, it takes years to establish the distribution network that has paid off for Honasa in FY24.

In FY24, Honasa also began a transition journey by eliminating super stockists from its supply chains and going to direct distributors. This eliminated a big cost and allowed the company to walk towards profits. The direct distributor model is active in Honasa’s top 10 cities by sales and is expected to be adopted across its key markets.

While there was an impact in terms of sales growth in Q4FY24 due to inventory reduction and supply chain recalibration, the company expects to recoup in the quarter ahead, according to its analyst call post the earnings. Next on the cards is broader expansion of offline retail presence, and that means taking what worked for Mamaearth and taking it to other brands.

Honasa’s House Of Brands: Looking Beyond Mamaearth

As we mentioned, soon after the funding peak of 2021, Honasa acquired two major brands. First there was Mumbai-based BBlunt from Godrej Consumer Products and then Dr Sheth’s, a dermatologist-formulated premium skincare brand. Honasa also acquired a health content platform Momspresso, which was subsequently shut down due to inefficiency in scaling.

It also invested in building Aqualogica, Ayuga and The Derma Co as standalone brands, and most recently launched Staze 9to9. In May, the company also acquired Cosmogenesis Laboratories, a research-led cosmetics development company.

These brands and their individual product lines and positioning has been key for Honasa. The company identified a premium gap in its lineup and launched new products under differentiated brands. The acquisition of BBlunt gave it a strong channel for beauty products, while Dr Sheth’s expertise allowed it to explore new-age formulations.

Ayuga targetted the trend of ayurvedic and herbal products in BPC, while Aqualogica created a water-based patented formulation. These are significant investments that take time to gather momentum and in FY24, some of this seems to have paid off.

In FY24, The Derma Co scaled to an annual recurring revenue (ARR) of INR 500 Cr and is now expected to touch an ARR of INR 1,000 Cr within 3-5 years.Honasa is now focusing on rolling out The Derma Co in offline channels through the more upmarket modern trade stores and chemists.

Similar growth projections are also anticipated for its other brands Aqualogica and Dr. Sheth’s, which are expected to have ARR of INR 500 Cr as well as BBlunt, which is expected to touch INR 250 Cr in the same time frame.

CFO Ramanpreet Sohi told analysts that the company sees 20%+ revenue CAGR in the next three years, with Mamaearth’s growth expected to be in the double-digit figures and other brands driving a significant part of the growth.

The company is quite certain that investments in new product development have worked out. New products contributed 18% to sales in FY24. Cofounder Ghazal Alagh told analysts that product innovation is a key driver of growth and will contribute over 50% to the incremental revenue in FY25 and ahead.

Honasa’s Place In The Beauty Landscape

While it’s clear that Honasa has the momentum of the past couple of years behind it, the company is set to experience increased competitive intensity in the online space with conglomerates targeting the beauty category and individual brands growing large.

The former of the two can splurge on discounts, while the latter can have the product edge in the long run, if Mamaearth fails to identify emerging trends. Analysts were clearly told that Honasa is not focussing on categories outside beauty and personal care (say, home care or lifestyle accessories for example) and it is also not looking at mass categories within BPC. Skin care is the largest segment for Honasa (accounts for 60% of the topline) and is the fastest growing category, followed by hair care, colour cosmetics and baby care.

Honasa wants its brand to be aspirational in nature and focus on retail where typically there is higher per-capita spending on beauty and personal care, but brokerages such as Kotak Securities believe that quick commerce will be a key for higher margins for Mamaearth in the long run.

These are all highly competitive areas with the likes of Tira and Nykaa investing in private labels and offline penetration. The growth seen by the likes of The Minimalist, Nat Habit, Pilgrim, The Beauty Co, Plum and others and the entry of new brands such as Gabit will also test Honasa in the long run. Many of these are also using Honasa’s playbook to expand offline.

The heavy reliance on Mamaearth as a brand is also a worrying factor for the group. Even at the time of its IPO, the Mamaearth factor was seen as a weakness in Honasa’s house of brands. So going forward, it will be critical for the company to build other brands to Mamaearth’s levels.

In this regard, Honasa will have to continuously invest in brand recall on quick commerce and retail channels. While FY24 showed that Honasa can ring in the profits, the maturing beauty market in India means there is no time to rest.

Sunday Roundup: Tech Stocks, Startup Funding & More

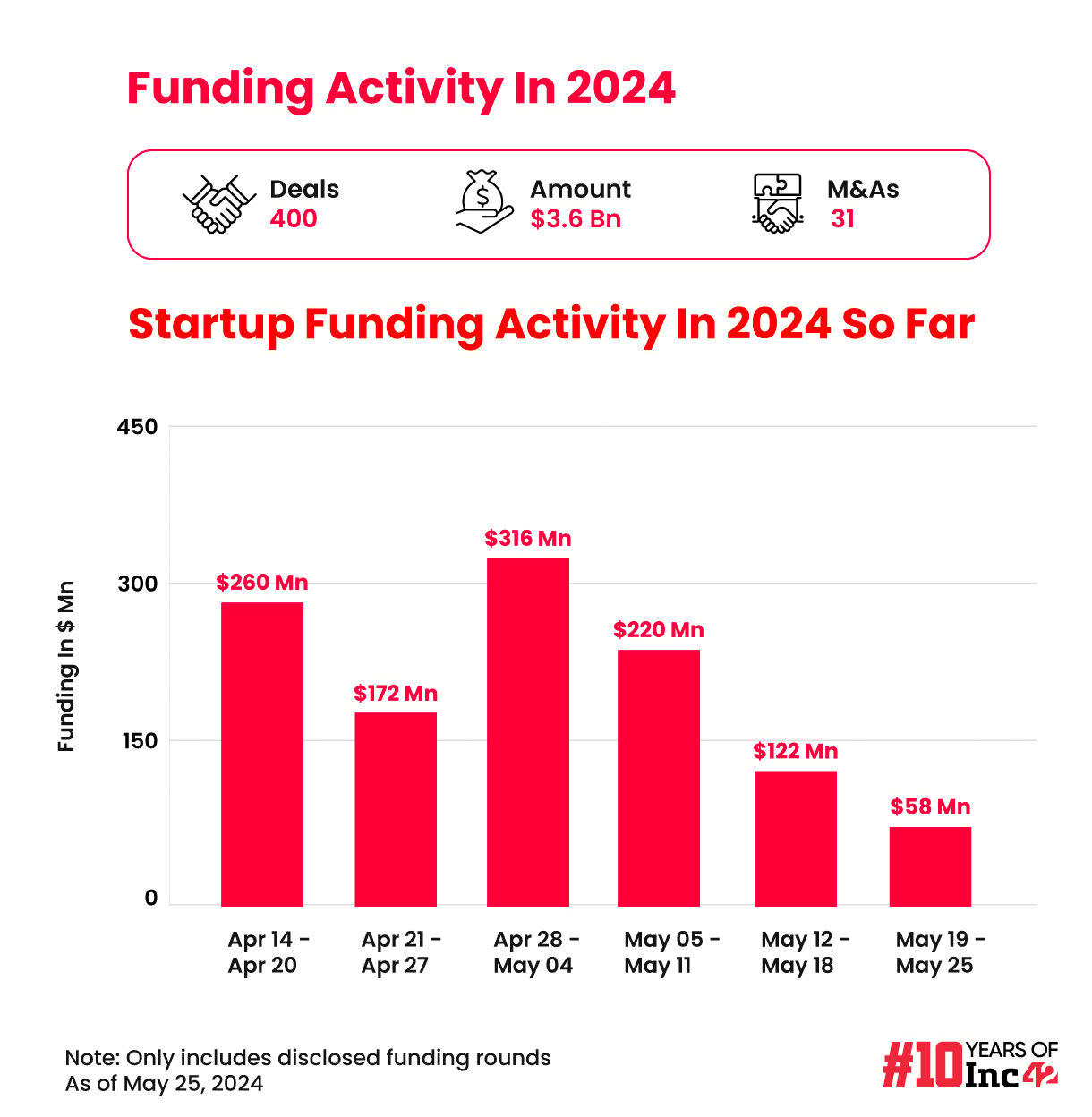

Funding Drops By Half: Week-on-week startup funding saw a major dip as just $58 Mn was raised by Indian startups this past week

Google’s Flipkart Bet: Walmart-owned Flipkart has brought Google on board as a minority investor but has not disclosed the size of the investment

Awfis Awaits Listing: The public issue of coworking space provider Awfis was subscribed 11.4X after bidding closed for the IPO. Will it make a bumper debut on the markets?

Digit’s Lukewarm Debut: A day after listing, Go Digit General Insurance was given a Sell rating by brokerage firm Emkay for its rich valuation and lack of competitive advantage

Blinkit Gets Sporty: Blinkit has added branded sports goods, athleisure wear and gym equipment to its quick commerce cart in a bid to diversify its product mix.

Ad-lite browsing experience

Ad-lite browsing experience