In India, the level playing field for both Meta and the government has been uneven due to the absence of a proper data protection law in the country

Despite difficulties and allegations of a political bias, Meta has largely maintained peace with the Indian government

Besides India, several other countries have their legal actions pending against Meta, including the European Union antitrust regulators' investigations into the misuse of consumer data

The year 2022 has been challenging for big tech majors in India and globally, and Mark Zuckerberg-led social media giant Meta (formerly Facebook) is no exception.

The Indian government revamping and tightening regulations around data protection and the ongoing questions around the misuse of its market dominance kept the tensions between Meta and India blazing. Amid all this, the California-based company kept making headlines for numerous other controversies, including reports of data breaches, internal issues, and more.

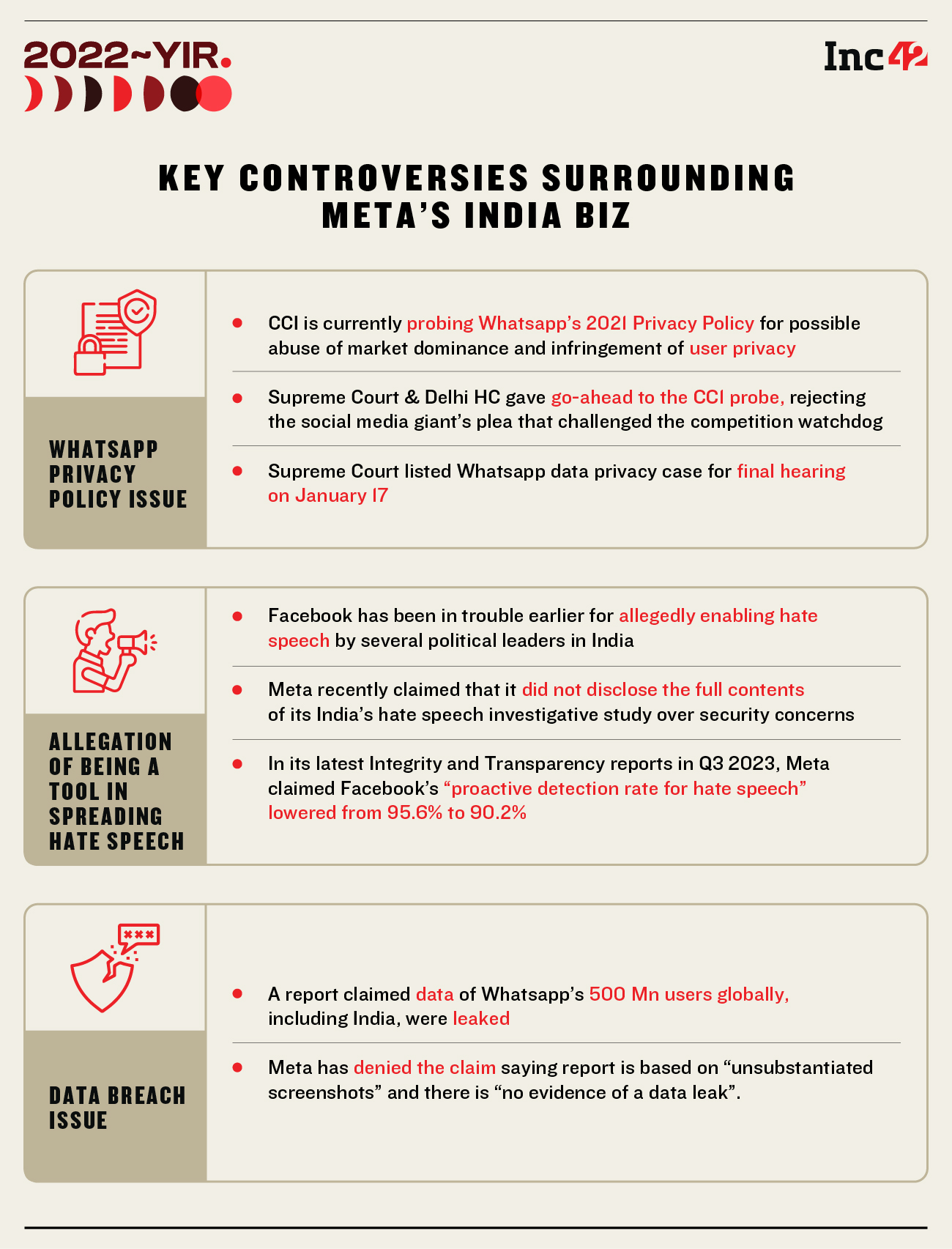

Download Annual Funding Report 2022The Competition Commission of India’s (CCI) probe into Meta-owned messaging platform WhatsApp’s Privacy Policy, introduced in 2021, did not find a resolution even this year, with the final hearing of the case scheduled in January 2023.

Meanwhile, the criticism that Meta faced in 2020 for allegedly supporting the hate speech of several Indian political leaders of the ruling party got backed by more documentary evidence and data this year. Meta’s human rights impact assessment report on India in July this year received accusations that it failed to adequately control hate speech against religious minorities.

Adding to the debate, Meta recently told a human rights group privately that security concerns prevented it from disclosing the full contents of its India’s hate speech investigative study.

To keep the American tech giants in check, India changing its IT rules added to the company’s woes.

While Meta largely maintained peace with the government amid difficulties and allegations of a political bias, its peer Twitter was vocal.

Earlier this year, the microblogging platform took the Indian government to court for the latter’s content takedown orders on the platform. It is pertinent to note here that Meta fought in the court against the CCI’s probe on WhatsApp’s alleged market dominance.

Meta Locks Horns With Competition Watchdog

The CCI probe against WhatsApp started in early 2021 on the grounds of allegedly violating the Competition Act, 2002, as the regulator called the platform’s updated privacy policy ‘exclusionary’ and ‘exploitative’.

According to the updated company’s policy, it can share more user data, including transaction data, IP addresses, mobile device information and other non-personally identifiable information, with its parent company Meta.

The messaging platform’s fight in the court started after that. First, WhatsApp challenged the probe order in the Delhi High Court where a single-bench judge ordered in the favour of the competition watchdog. Next, the company took the matter to a two-judge bench of the Delhi HC, but the new bench, too, declined to intervene in the CCI’s probe.

In the meantime, India’s Ministry of Electronics and Information Technology (MeitY) filed an affidavit in the Delhi HC, highlighting that WhatsApp’s privacy policy violated the Information Technology Rules (IT Rules) 2011, on five occasions.

In October, WhatsApp moved to the Supreme Court to stop CCI’s investigation. However, the apex court ruled in the favour of the competition commission.

As per the latest updates on the matter, the Supreme Court has listed the long-pending case for the final hearing on January 17 and reportedly asked both parties to conclude their arguments by December 15.

Meta Fails To Become A Trusted Partner Worldwide

While it is true that Meta has often been accused of political bias in India and globally, the platform has also remained a bone of contention for governments worldwide. In fact, Meta received severe criticism and allegations of playing a major role in the Capitol riot in the US last year after the country’s presidential election.

Besides India, several other countries have their legal actions pending against Meta, including the European Union antitrust regulators’ investigations into its use of consumer data.

In India, the level playing field for both Meta and the government has been uneven due to the absence of a proper data protection law in the country.

To tighten the rules around the functioning of Meta and other big tech companies, the Indian government notified the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, with a major focus on the intermediaries establishing grievance redressal mechanisms to resolve user complaints. In its draft amendments to IT Rules, 2021, earlier this year, the government, once again, noted that a grievance appellate committee would act as a decision-maker on taking down content on social media platforms.

In the new draft amendments, the government also mandated that the grievance officer would have to address user complaints against questionable content on social media intermediaries within 72 hours as against 15 days earlier.

While the amended rules have now come into effect and demand that social media intermediaries like Meta, take more cautious steps, we cannot ignore that several legal experts and independent bodies criticised the existence of a committee with the government’s direct intervention, especially in the absence of a robust data protection law.

However, the government has now released a new draft of the Digital Personal Data Protection Bill, which as per the IT ministry, is expected to ‘end the misuse’ of consumers’ data.

Meta found itself in another trouble recently when its WhatsApp messaging platform witnessed the longest-ever outage worldwide. Following this, MeitY asked Meta to submit a report.

Leadership Exodus In India Adds To The Worries

At a time when external pressures on Meta were building, the company’s internal issues also started drawing attention. In the past two months, Meta has witnessed resignations from some of its top leaders in India.

WhatsApp’s India head Abhijit Bose and Meta’s India public policy director Rajiv Aggarwal resigned in November. Their exits were followed by Meta India head Ajit Mohan’s resignation. Mohan resigned from Meta to join Snap.

The changes in Meta India’s top leadership positions also come amid the company’s global restructuring effort.

Last month, Meta announced its plans to slash 13% of its global workforce or more than 11,000 employees. Meanwhile, a Meta spokesperson said that the exits made by the top executives were unrelated to the company’s layoff plans.

In September, Manesh Mahatme quit as the chief of WhatsApp Pay in India to join Amazon.

Meta’s Revenue Dwindles, Costs Rise

Amid the global macroeconomic slowdown, Meta reported revenue of $27.71 Bn during the quarter ending September 30, 2022, down 4% year-on-year (YoY). Meta’s total costs and expenses rose up 19% YoY to $22.05 Bn during the quarter. Further, Meta founder and CEO Zuckerberg hinted at near-term challenges in generating revenue.

“While we face near-term challenges on revenue, the fundamentals are there for a return to stronger revenue growth. We’re approaching 2023 with a focus on prioritisation and efficiency that will help us navigate the current environment and emerge an even stronger company,” he said.

The company also spoke about its cost-cutting measures. “We are holding some teams in terms of headcount, shrinking others and investing in headcount growth only in our highest priorities,” Meta had said in a statement following its third quarter 2022 results.

Meanwhile, Facebook India Online Services witnessed a 132% YoY rise in its net profit to INR 297 Cr during FY22, while Meta India’s total income in the year stood at INR 2,324 Cr.

It must be noted that Apple’s decision to limit the access of its user data has already dented Meta’s advertising revenue. Further, increasing competition, multiple regulatory hurdles, and expensive Metaverse bets are adding to its woes.

Meta has lost a whopping $9.4 Bn on its Metaverse technology so far this year.

What’s Next For Meta?

In the fourth quarter of 2022, Meta expects to clock a total revenue in the range of $30 Bn to $32.5 Bn. Meta’s full-year 2023 outlook for total expenses (in the range of $96-$101 Bn) is also significantly higher than most analysts’ estimates.

At a time when the fundamentals are lacklustre, the regulatory risks globally as well as Meta’s internal conflicts multiply its challenges.

In another incident, a publication recently reported that a database containing phone numbers of 487 Mn WhatsApp users worldwide was put on sale on a hacking community forum by an unknown seller.

However, the messaging platform denied the report stating that the claim was based on unsubstantiated screenshots and there is no evidence of a data leak from WhatsApp.

As challenges galore, Meta has lost 66% in its share value year to date and investors have already started voicing their concern about its metaverse bets. As per reports, in October, some of Meta’s biggest shareholders protested its decision to ramp up its effort in building the metaverse.

Jim Tierney, the chief investment officer for US growth at AllianceBernstein, who is also a Meta shareholder, reportedly said, “If any other company had done this, you’d have activist investors writing letters, proposing alternative slates of directors, demanding change.”

Reportedly, many investors have vented out their anger in meetings with Meta management, some of which were attended by Zuckerberg.

Many other major Wall Street investors have accused Zuckerberg of remaining indifferent to the concerns of the investment community and being stubborn in his decisions.

While it is yet to be seen how things play out for Meta on other parameters, regulatory concerns are expected to continue to take their toll on the company.

Meta Ready To Dance To India’s Tune

In India, though the new regulatory actions, particularly the Digital Data Protection Bill, is less harsh than the EU’s GDPR, the central government’s decision to come up with rules under the new Digital Personal Data Protection Bill keeps Meta’s destiny at risk.

“Earlier, we did not have any set of clearly defined rules under which these companies would operate. This has led to the government going back and forth so far. But, from now on, the government’s intervention will be through rules and they won’t be ad hoc intervention,” said senior advocate Sanjay Sen.

Sen, however, added that while the recently published Digital Personal Data Protection Bill draft is a cleaner version of the earlier draft, a lot of things have been left to the discretion of the central government, which could be a matter of concern not only for Meta but for all big tech companies.

Echoing a similar concern, Bharat Chugh, a former judge and an advocate in the Delhi High Court, said that the new data protection bill lays down very broad principles on who is a data fiduciary, who is the person that has to deal with the data in a certain way, and what are the responsibilities of the companies.

“So, depending on what a particular situation is, the government may come up with too many or fewer regulations. And all of that would depend on how the centre frames the rules,” Chugh said.

“One more important aspect for companies like Meta would be that they may have certain additional obligations under the law as they deal with huge volumes of personal data. For example, they need to have a data protection officer. Meta is already in a tiff with the government on having a grievance officer in place. Under the data law, it also needs to have an in-house data auditor in India,” he added.

Though, we must note that Meta has voiced its support for the bill.

Nick Clegg, President, Global Affairs, Meta said, “In broad terms, I think the Indian government has done some thoughtful work in terms of providing this draft… it is a promising turn of events.”

For Meta, India May Be Challenging But Not A Market To Ignore

According to legal experts, only time will reveal what Meta’s regulatory affairs are going to look like in the coming years. Besides, Meta’s perseverance and intelligence would be tested by how the Zuckerberg-led management modifies as per the requirements.

Currently, Meta’s WhatsApp has a significant market opportunity in India given the growing United Payments Interface (UPI) ecosystem. While PhonePe, Google Pay, and Paytm continue to dominate the UPI market in terms of transactions and users, WhatsApp Pay is slowly catching up with its increasing market share.

In November, WhatsApp Pay emerged as the biggest gainer in terms of the month-on-month rise in its UPI transaction value. WhatsApp Pay saw an 8.6% increase to INR 769.29 Cr in November in UPI transaction value from INR 708.56 Cr in October.

Besides, Zuckerberg recently said that JioMart on WhatsApp is set to be a big opportunity for Meta.

Despite the tussle between Meta and the Indian government, Meta is clearly backing the latter’s startup innovation idea and investment.

Recently, MeitY Startup Hub partnered with Meta to launch an accelerator programme to support extended reality (XR) startups in the country, which aims at skilling India’s large talent pool in emerging and future technologies.

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience