As Covid-19 brings the spotlight on the online crowdfunding market which will reach transaction value of $9 Mn-plus in 2020, will startups in this segment tap into the new wave of interest?

While changing regulations are a constant threat for the crowdfunding segment, will scams and frauds continue to erase the trust factor even as regulators play catch up

Reputed consultants and charity monitors estimate that India offers a huge market for social and charitable giving but also for crowdfunding new ventures, but low investor interest has limited the formal market size. Will this change with the success of ACT Grants, Donatekart, Milaap, GiveIndia and others in the past few months?

Remember the #Babakadhaba controversy on social media a few months ago? It all began with a video on social media that went viral. Octogenarian Kanti Prasad, who ran a local eatery Baba Ka Dhaba in Delhi, was seen in tears as his sales hit rock bottom during the lockdown. He pleaded for help and it seemingly arrived in the form of an online crowdfunding campaign by a social media influencer.

Prasad, who was not even earning INR 60 a day then, suddenly saw lakhs being raised in his name. But in a twist, he filed a police complaint against the influencer for allegedly misappropriating the funds.

Controversies are part and parcel of online crowdfunding, whether it is pre-Covid or during the past few months. Appeals for help, funds for causes and healthcare campaigns are seen too frequently on Indian crowdfunding platforms. In India, online crowdfunding campaigns range from outright calls for donation to peer-to-peer (P2P) fundraising to digital crowdfunding platforms, which allow people to support and back projects, businesses or causes in exchange for a nominal payment or a tier-based structure with additional perks at various levels.

But given the state of trust in online crowdfunding, despite millions being raised during the last few months for various Covid-19-related causes or even to help out those impacted, there are quite a few questions around this space. How will the changing regulations hit crowdfunding startups, will scams and frauds continue to erase the trust in online charitable platforms even as regulators play catch up, and why have investors not really backed the ventures that are operating in crowdfunding in a big way, unlike other sectors in India.

The Rise Of Online Donations In Covid-Hit India

Even before online crowdfunding came on to the scene, everyday giving played a key role in Indian society and culture with a large part of it being driven by . According to various accounts, India has the greatest number of people volunteering and donating money in the world, ahead of the US and China. In terms of the categorisation, raising funds through donations falls under community crowdfunding, where there are no financial financial returns involved. As per Statista, transaction value in the crowdfunding segment in India is projected to reach $9.1 Mn in 2020, and expected to grow at an compounded annual growth rate (CAGR) of 1.4% to reach $9.7 Mn by 2024.

But when it comes to P2P lending, investors expect to get their money back with some nominal interest. In light of the potential for scams and frauds in crowdfunding, the Reserve Bank of India has issued certain guidelines for P2P lending, but there is no specific mandate on purely donation-based fundraising. However, the third type, known as equity-based crowdfunding where investors acquire equity shares in exchange for their capital, is not legal in India.

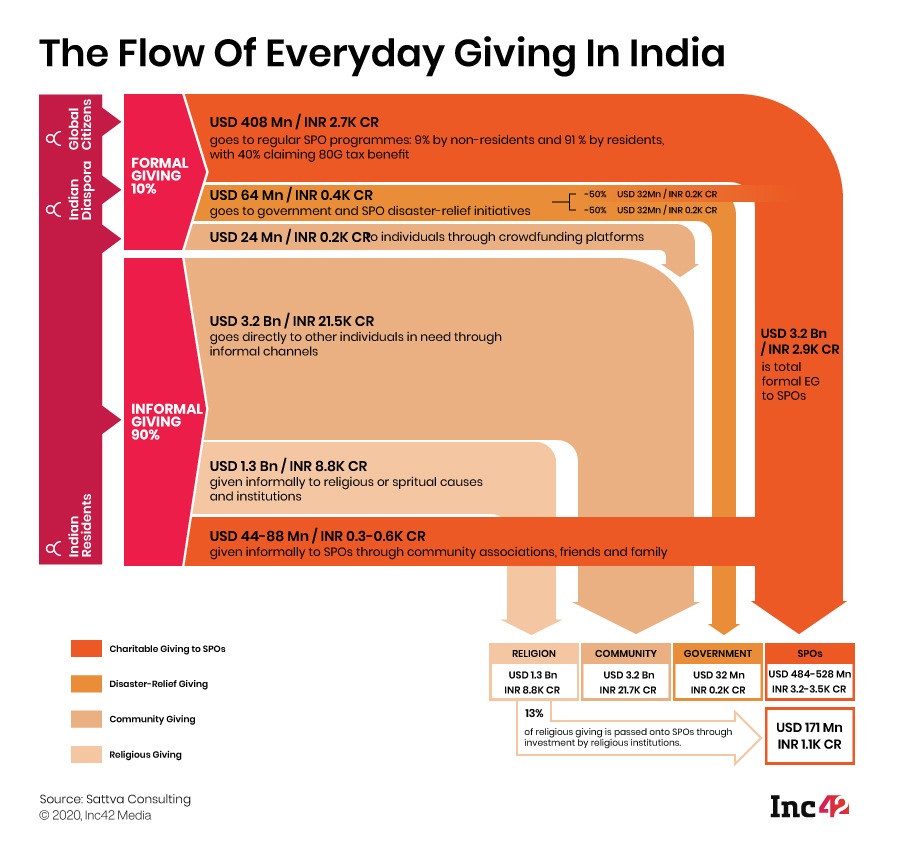

According to government reports, a total of 3,068 NGOs received foreign funding above INR 58,000 Cr during 2016-2019. A majority of these donations were informal, though. The IDR, in its review, has estimated that Informal giving to community and religion accounts for 90% (INR 30,700 Cr) of everyday donations and charity.

According to government reports, a total of 3,068 NGOs received foreign funding above INR 58,000 Cr during 2016-2019. A majority of these donations were informal, though. The IDR, in its review, has estimated that Informal giving to community and religion accounts for 90% (INR 30,700 Cr) of everyday donations and charity.

But as in the case of #Babakadhaba or thousands of similar incidents, the Covid-19 pandemic has brought in a huge wave of online crowdfunding, especially in terms of donations. Take, for instance, ACT (Action Covid-19 Team) Grants, created by India’s startup and VC ecosystem, and online donation platform GiveIndia, which raised more than INR 100 Cr and INR 220 Cr, respectively, in two of the biggest crowdfunding projects within a span of six months. ACT Grants and GiveIndia claim to have impacted more than 140 Mn and 5.5 Mn lives, respectively, during the pandemic.

Interestingly, it is not only about a caring attitude but also about the convenience of technology. Having an easy-to-use, all-inclusive transaction platform like the UPI in place has proved to be a huge driving force for pan-India donors and their beneficiaries. “Covid-19 has helped us understand to what extent startups and founders want to solve social issues. At ACT Grants alone, we received more than 1,200 applications,” says Prashanth Prakash, partner at Accel India.

However, the role of technology goes much deeper. Prakash, who is also a core team member of ACT Grants, said, “Any crowdfunding programme, which intends to make an impact across the Indian society, cannot do so without the help of technology.”

The large-scale adoption of smartphones and the internet has also been a game changer. Prior to the pandemic, most donations used to flow in from Tier 1 cities. Now, young people from every nook and cranny of a digital India got the taste of philanthropy; the giving landscape is changing fast, observes a social media executive who does not want to be named.

Going by the current trend, most of the informal and offline donations may slowly move to online platforms, says Rashmi Deshpande, a Supreme Court lawyer and Partner at Khaitan & Co. In the Finance Act 2017, the Indian government introduced certain amendments, according to which if a donation made in cash exceeds INR 2,000, the donor would not be able to avail the benefits of tax exemption under Section 80G of the Income Tax Act. Therefore, people donating bigger amounts are likely to do it online and the culture of online donation is expected to surge soon.

India’s Diverse Online Crowdfunding Models

ACT Grants, which has funded 55-plus startups in 92 projects around the Covid-19 theme, is also exploring other key challenges such as environmental and social issues to make a bigger impact. Although this organisation is relatively new, there is no dearth of startups, for-profit and not-for-profit organisations in the online crowdfunding space, most of whom have come up in a big way during Covid times.

GiveIndia president Ashok Kumar, an entrepreneur who had jointly set up the online investment platform Scripbox, attributes the stellar fundraising to the huge number of donors from India and abroad. “From Sundar Pichai to Indra Nooyi to nameless individuals, we received donations from everyone. Otherwise, it would have taken us a long time to amass this amount,” he says.

Over the past 20 years, GiveIndia has curated and verified more than 2,000 NGOs and lists their respective causes on its platform. “It is like the Amazon of online donations. You can pick the cause to which you want to donate. Out of the 2,000 NGOs, we have listed more than 200 NGOs under GiveAssured where monthly beneficiary reports are also published,” says Kumar.

For-profit platforms such as Milaap, Ketto and ImpactGuru have also witnessed a huge surge in the past few months. Donatekart, a relatively new startup in this space, is also collecting INR 5 Cr – INR 6 Cr on a monthly basis. The rise in online donations is phenomenal, said founder Anil Kumar Reddy.

According to him, entrepreneurs have explored and adopted this impact model over the past few years and changed the game of online donations with the help of technology. “Having spent three weeks in Chennai (during the 2015 floods), I realised that people want to donate. But there was a clear gap between what people were donating and what was in demand on the ground. For instance, donors were sending food and other stuff, but the flood-hit people were asking for tarpaulins and mosquito nets. This inspired me to set up Donatekart, a platform where we supply what is needed.”

While Ketto mostly focuses on crowdfunding for medical emergencies, Milaap has evolved as a tool for both individuals and NGOs seeking to raise funding for a specific cause. “It means people seeking to donate to the cause of their choice can do so on our platform,” says Milaap’s cofounder and CEO Anoj Viswanathan.

As part of the online crowdfunding services, many of these startups are also organising live funding and donation events, which require customised tech support. “We had organised a live distribution programme for Mumbai Dabbawalas. It saw a collection of more than INR 2.5 Cr,” says Reddy of Donatekart. Last year, the company raised a seed round from a slew of investors.

Live streaming has already disrupted this space and it is going to bring in a big change in online crowdfunding, says Viswanathan. “Online donations is an interesting area where live streaming will help enable a lot of transparency. It is just a matter of time before it becomes an everyday event. Moreover, access to virtual reality (VR) will essentially create unique experiences for donors. This is what giving is all about. This is about empathy, about stepping into someone else’s shoes. Virtual reality would help enable that experience of altruism.”

Of Controversies And Loss Of Trust

Although online crowdfunding will be instrumental for startups and entrepreneurs keen to make an impact on society, startups can play a key role in bringing more transparency and traceability, says Prakash of Accel Partners

While most of the NGOs are working as foot soldiers, there seems to be a gap between a donor’s expectations and experience. Similarly, there is a mismatch between what NGOs need on the ground and what donors are supplying, many founders in this space say.

Worse still, there are controversies galore around donations raised and their right usage. What happened between Prasad of #Babakadhaba and the social media influencer who helped him brings forth an ugly picture, but it is, by no means, a solitary case. Think of the hue and cry over Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM-CARES Fund) and its lack of transparency. Then there was the Sahara scam and other cases which forced capital markets regulator SEBI (Securities and Exchange Board of India) to issue a blanket ban on equity crowdfunding. iBackPack in the US forced the Federal Trade Commission to issue a warning to the donors and investors participating in a crowdfunding initiative.

All these have made us review the legal clarity in Indian crowdfunding. Do donors have the right to ask a fundraising platform about all spending details? Are these platforms legally bound to respond?

“Unfortunately, there is no rule specifically pertaining to online crowdfunding,” says Deshpande of Khaitan & Co. “In the case of equity-based crowdfunding, it is SEBI which is the regulatory authority and SEBI has banned it for now. But for P2P lending, the RBI is the regulatory body. However, for online donations, it is the tax regulation that kicks in. Even then, there are no rules and regulations out there in the public.”

According to her, in cases like #BabakaDhaba, Section 420 of the Indian Penal Code (or similar sections) are usually applied, but there is a greater need for regulations. Plus, there is a need for amendments to the Information Technology Act and the Draft Personal Data Protection Bill 2019, and the RBI should also come up with its own set of rules and regulations.

Incidentally, as per the central bank’s latest fintech report, 185 fintech companies in India are recognised as having a business model based on online crowdfunding.

How Startups Are Coping With Trust Issues

Online crowdfunding has several trust issues, but the most crucial is donors’ privacy and data safety. In recent years, there had been massive leaks of donors’ data on the dark web and other platforms. Cybersecurity firm Cyble has recently revealed that the donors’ database of the ruling Bharatiya Janata Party (BJP), which also includes their financial details, is available for sale on the dark web. Similarly, the personal data of 12,000-plus donors who donated blood to an NGO is available on the internet. Their data included sensitive information such as names, phone numbers, email IDs and passwords, PIN codes and blood types.

“In the case of online donations/fundraising, many of the issues are the same as other online platforms such as ecommerce. Trust has been an issue. Most of our growth has happened in the past three-four years. But the first six years had gone towards building credibility,” Milaap’s Viswanathan said.

That is not surprising as a company’s credibility matters most in the online crowdfunding space. “In the US, the general perception is that unless you prove me wrong, I am going to trust you. In India, it is the other way, regardless of the causes. We look through the prism of what could go wrong. India is a low trust society.”

A few companies such as GiveIndia, Milaap and Ketto provide all donation-related information although this practice is quite limited in India. In most of the cases, NGOs do not offer such insights. Given the scenario, more efforts are needed to bring in more transparency and traceability to increase the trust factor.

According to Donor Trust Report 2020, only 19% of people highly trust charities. To address critical issues like donors’ privacy and data safety, the US-based Better Business Bureau, the organisation behind Give.org, has launched a privacy-focussed donation platform built on the Ardor (ARDR) blockchain.

According to Art Taylor, CEO of BBB Wise Giving Alliance, “Even prior to the COVID-19 pandemic, charities were facing a wide variety of challenges in how their traditional fundraising model operated. We believe this new donation platform will help strengthen donor trust in charities while also providing a bridge to younger donors seeking new forms of engagement. All personal information is stored on the Ardor blockchain and is only accessible to charities with donor permission.”

Agreeing that blockchain could be immensely beneficial to the online crowdfunding industry, Varun Sheth, cofounder and CEO of Ketto, says, “In the next decade, blockchain is one technology that will grow among industries and in online donation in particular. It will, however, take a few years before we could see a full-fledged blockchain-based donations platform in India.”

Sheth, however, is worried about the way NGOs are curated. If GiveIndia has vetted only 2,000 organisations out of the millions registered, what could be its implications? Both Ketto and Milaap claim to have a verification process in place and curate the cases listed on their platforms. Donatekart, too, follows a similar process and is currently working with around 200 NGOs.

“We have a dedicated team which checks each and every case, and consult the doctors and the hospitals where people are admitted. We do not give money to these people; we directly hand it over to the hospitals,” explains Sheth, stressing on his platform’s credibility.

Are Investors Wary Of Online Crowdfunding Models?

While Sattva, IDR and other reputed consultants have estimated huge market opportunities in the area of online giving, the formal market is still too low. Ashok Kumar of GiveIndia has estimated it to be a couple of thousand crores while Sheth of Ketto thinks it to be around $4 Bn. “This is mainly due to the lack of awareness. It is the topmost challenge for us,” says Kumar. Unlike other well-funded startups, online donation platforms like GiveIndia cannot afford to spend money on marketing, he adds.

Under-reporting is another issue that plagues these platforms. Many of the NGOs and crowdfunding platforms are not as transparent as they should be, alleges Kumar. “Sadly, they do not publish detailed reports and share the same with their donors; they do not inform where exactly a donor’s money has been spent. This is important.”

Similarly, people should be passionate about joining this sector. For a long time, NGOs have not hired top talents and paid them competitive salaries, which seem to be affecting the sector, said the GiveIndia chief

The bigger issue could be policy clarity on multiple accounts and constant support from the authorities as this segment can usher in never-before social changes with little or no pressure on individual donors.

Are these stumbling blocks keeping the investors away from yet another sunrise sector with huge potential? So far, Ketto has raised around $1 Mn from Mumbai Angels, ah! Ventures and others, Milaap has bagged $1.4 Mn from Junglee Ventures, et al, and ImpactGuru has raised $2.5 Mn from RB Investments, Apollo Hospitals, Currae Healthtech Fund and from other investors.

“So far, investors have done some early-stage funding. They are still looking at how these platforms will scale before some large amount comes in. The platforms will have to demonstrate a bit more scale,” Accel India’s Prakash said.

However, things could be changing fast in a post-Covid world and scale may not be a problem as outreach is growing due to cutting-edge tech enablement. For instance, ACT Grant, which was set up in April 2020, claims to have helped more than 140 Mn people across 24 Indian states. “It has sparked a possibility – that of rapid scalability of these crowdfunding models – and it could be impactful in other areas as well.”

Ad-lite browsing experience

Ad-lite browsing experience