Chennai-based Villgro claims to be one of India’s pioneering incubators of social enterprises and believes that innovation and market based models are powerful solutions to alleviating poverty and creating social impact at scale

Villgro’s CEO Srinivas Ramanujam believes for a large scale impact to happen, madis, agri businesses and startups should be able to process 2-3% of the total produce

Many of the entrepreneurs in agritech space have great technologies, but they have very poor understanding of farming conditions in the country, says Ramanujam

“Today, startups working in an agriculture space are not even a drop in the ocean. The impact is yet to trickle down which will at least take a decade to mature,” — Srinivas Ramanujam,CEO of impact incubator Villgro Innovations Foundation.

Despite years of efforts through tech intervention and solutions from modern agritech startups, the disruption in the agri-related sectors has been slow to say the least. And Ramanujam has not lost sight of this despite Villgro’s presence in India spanning nearly two decades since its inception in 2001. He emphasised that the incubator’s impact on the agritech space is just about 0.01% when compared to the size of the industry and the potential addressable market. The impact and disruption from tech will only widen, he said, when local mandis, agri businesses and startups are able to process at least 2-3% of the produce.

These factors and underserved segments are today driving investments towards market linkage models in agritech. This has inevitably led to many investors shying away from bold investment decisions in the space, the Villgro India chief said.

“Unfortunately, investors don’t understand technologies as they are not able to get their hands on how to value the company, how they should scale and what should be their business model. Thus, investors end up giving it a pass,” the CEO of the social enterprise incubator added.

In recent times, on the back of reforms and policies agritech investments are on the rise with VCs such as Omnivore, Omidyar Network, Arkam Ventures, Ankur Capital, Accel Partners and others actively scouting for agritech deals. At the same time, incubators such as Villgro have also mushroomed — as per Startup India, 100 out of 456 incubators registered in India offer incubation facilities to agriculture and allied areas.

Besides Villgro, the likes of Agri Business Incubator, Indian Agricultural Research Institute, TERISAS, Huddle, Association for Innovation Development of Entrepreneurship in Agriculture (AIDEA) – NAARM, NutriHub are among the leading agritech incubators in India.

Founded by Paul Basil, Villgro is backed by donors like Rockefeller Foundation, Aspen Network of Development Entrepreneurs, The Sir Dorabji Tata, Lemelson, Hivos People Unlimited among others. It positions itself as an incubation network integrator and collaborates with other incubators as well as donors, government agencies and educational institutions in social impact sectors.

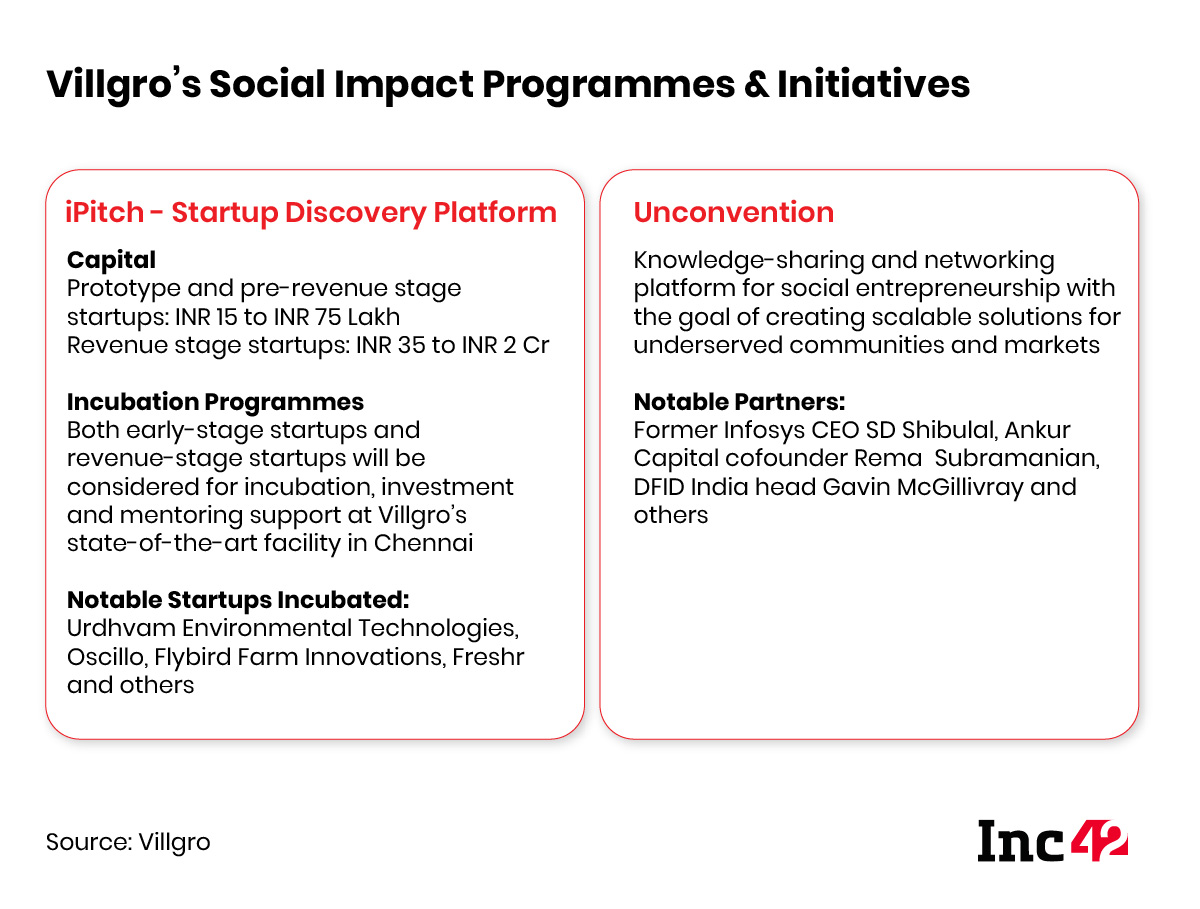

Villgro intervenes at different stages of product and startup lifecycle development through programmes and initiatives across the low income states such as Rajasthan, Madhya Pradesh, Uttar Pradesh, Bihar, Chhattisgarh, West Bengal among others. In the recent past, it has set up mini incubators in partnerships with education institutions like Startup Rise in Jaipur, IIT Kanpur, IIM Calcutta and KIIT in Bhubaneswar among others.

How Agritech Impact Incubator Villgro Raises Funds

With its business model and capital supply linked to donor organisations in India and outside, Villgro has the unique advantage of having mentor-investors. Over 75% of the non-profit cash flow comes from grants and other third-party contributions, both private as well as government.

“Our mentoring program has been rated the most valuable incubation tool by our incubatees. We have a rich pool of seasoned professionals who are passionate about social entrepreneurship, and our milestone-based agreements with mentors ensures a targeted approach to mentoring,” Ramanujam added.

According to him, the return on investment coming from agritech startups incubated at Villgro, ranges anywhere between 10%-20% IRR. Over the years, Villgro has influenced the course of agritech startups such as solar powered cold storage startup Ecozen; disposable utensils company Tamul Plates; weather forecasting platform Skynet among others.

Till date, Villgro has backed over 300 social impact startups in the last 19-plus years by enabling entrepreneurs to validate their ideas, gain unique market insights and build sustainable channels to market. Under its current portfolio, Villgro claims to be incubating nine agritech startups, including AI and IoT-based irrigation solutions startup Cultyvate; data-driven water resource management platform Kritsnam; tech-enabled integrated agri value chain startup BharatRohan; produce quality analysis startup Raav Techlabs; sustainable agri-solutions startup Krimanshi among others.

Typically, the impact incubator offers support to early-stage startups through seed funding (grants or equity-linked), access to industry experts, low-cost or pro-bono mentoring and technical assistance as well as networking to forge market connections and access.

The CEO outlined Villgro’s investment philosophy as enabling founders with sound technical knowledge along with a clear idea of solving problems that impact millions of Indians “At Villgro, we believe in startups having sound unit economics, alongside a strong rock solid business model, which has soft or gross margin positive from day one so that they are able to grow in a scalable fashion,” added Ramanujam.

He believes that agritech models cannot sustain cashburn like consumer-focussed tech products such as Ola, Zomato, Swiggy or others. This investment model means startups spend millions to acquire customers and achieve scale, but this is simply not possible in agritech, where sustainability is at the heart of all offerings.

In agriculture, Villgro focuses on startups that are working in building resilience of farmers as well as the farming supply chain. Few of the areas of interest include automation and mechanisation, farm management and advisory, feed and fodder, post processing, production services and financial linkages, water efficiency and management.

Today, many investors talk about the startup pipeline not being great at the incubator level, stressed Ramanujam and a large majority of startups are comfortable closer to the urban markets and catering to smaller audiences. This is, in a way, leading to biased models where the majority of startups are focussed on solving demand-side challenges in the agri value chain, instead of focusing on the supply side or understanding farm-level problems. For Ramanujam, the key areas within agriculture which offer the biggest scope for disruption include:

- Dairy, poultry farming and animal husbandry solutions

- Monitoring and tackling food losses in the supply chain

- Farm input management

- Smart food processing units and farm gate value addition

- Financial inclusion for agri communities

Widening Entrepreneurial Reach For Agritech

“Many entrepreneurs in agritech space have great technologies, but they have very poor understanding of farming conditions in the country. The on-ground insights are really poor.”

For Ramanujam, entrepreneurs are working on fancy eye-catching tech such as blockchain and IoT, without even understanding what exactly happens in the agri supply chain.

So Villgro makes it a point to look at a wide pool of entrepreneurs and startups not only in metros and Tier 1 cities such as Mumbai, Delhi, Bengaluru, but also smaller cities such as Jodhpur, Lucknow and even semi-urban districts such as Kalahandi, Odisha. “The entrepreneurs who are technologically mature in nature usually come from Tier 1 and Tier 2. However, the waste-to-value kind of micro entrepreneurs are emerging from Tier 3 and Tier 4 markets.”

Given that the focus is on entrepreneurs and solutions emerging from smaller cities and towns, Villgro takes a patient approach to investments and prioritises long-term impact rather than short-term returns. Also, the fact that its fundraising is dependent on donor organisations and not limited partners as in a conventional VC firm, means that there is less pressure on the fund to find quick exits. “We believe in helping startups develop products and solutions and get them a foothold in the market as that is more important for us in building the ecosystem, develop businesses from scratch to prove themselves and scale to newer heights,” said Ramanujam.

When it comes to reporting structure, Villgro’s proprietary system follows a structured approach to monitor startups. Ramanujam said that it talks to its portfolio startups once in two weeks. Further, sales data, revenue and financial performance are captured in real-time with a bigger focus on impact metrics instead of the typical product metrics such as adoption or paying customers.

For Villgro, the key metrics include aspects such as the number of lives touched, jobs created, environmental impact, water usage, air pollution metrics and more — what Ramanujam calls social impact parameters.

Taking its lessons from India, Villgro is now taking its agritech impact investment playbook to accelerators and incubator organisations in the US, Kenya (through Villgro Africa) and Southeast Asian markets like the Philippines. “In the coming days, we are looking at expanding our platform to other incubators and social impact focused venture capital firms so that they are able to manage the entire process of screening, selecting applications and investing in startups seamlessly.”

Ad-lite browsing experience

Ad-lite browsing experience