In 2022, the VC firm partially exited Open at a valuation exceeding $650 Mn. The strategic exit resulted in an 85-90x blended return, doubling the initial value of Fund I for LPs

The VC firm launched its Fund II in June 2020, when the COVID-19 pandemic wreaked havoc across the globe. The fund has seen zero write-offs so far

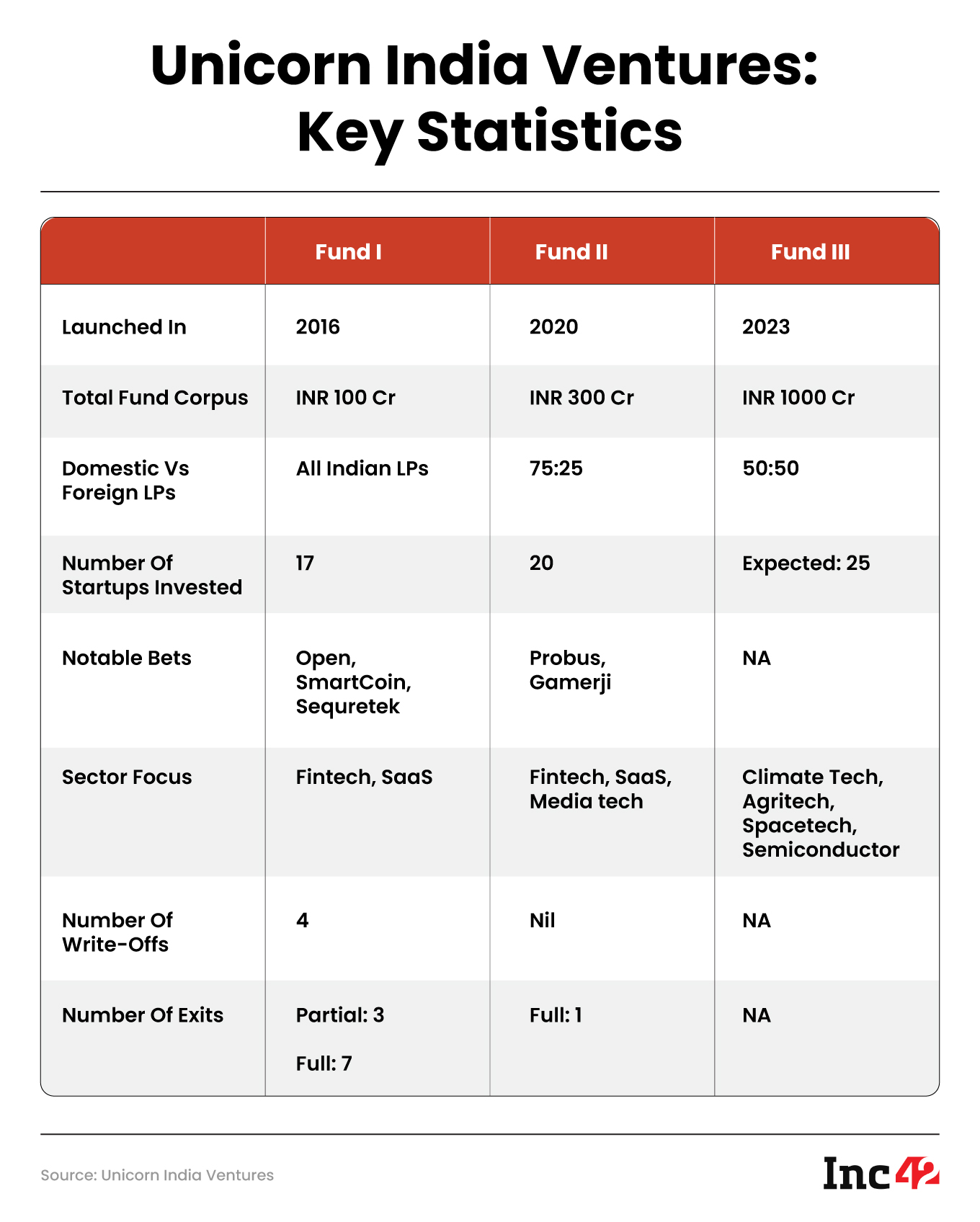

Upping the game further, the VC firm on September 5, 2023, announced the first close of its INR 1,000 Cr Fund III at INR 225 Cr

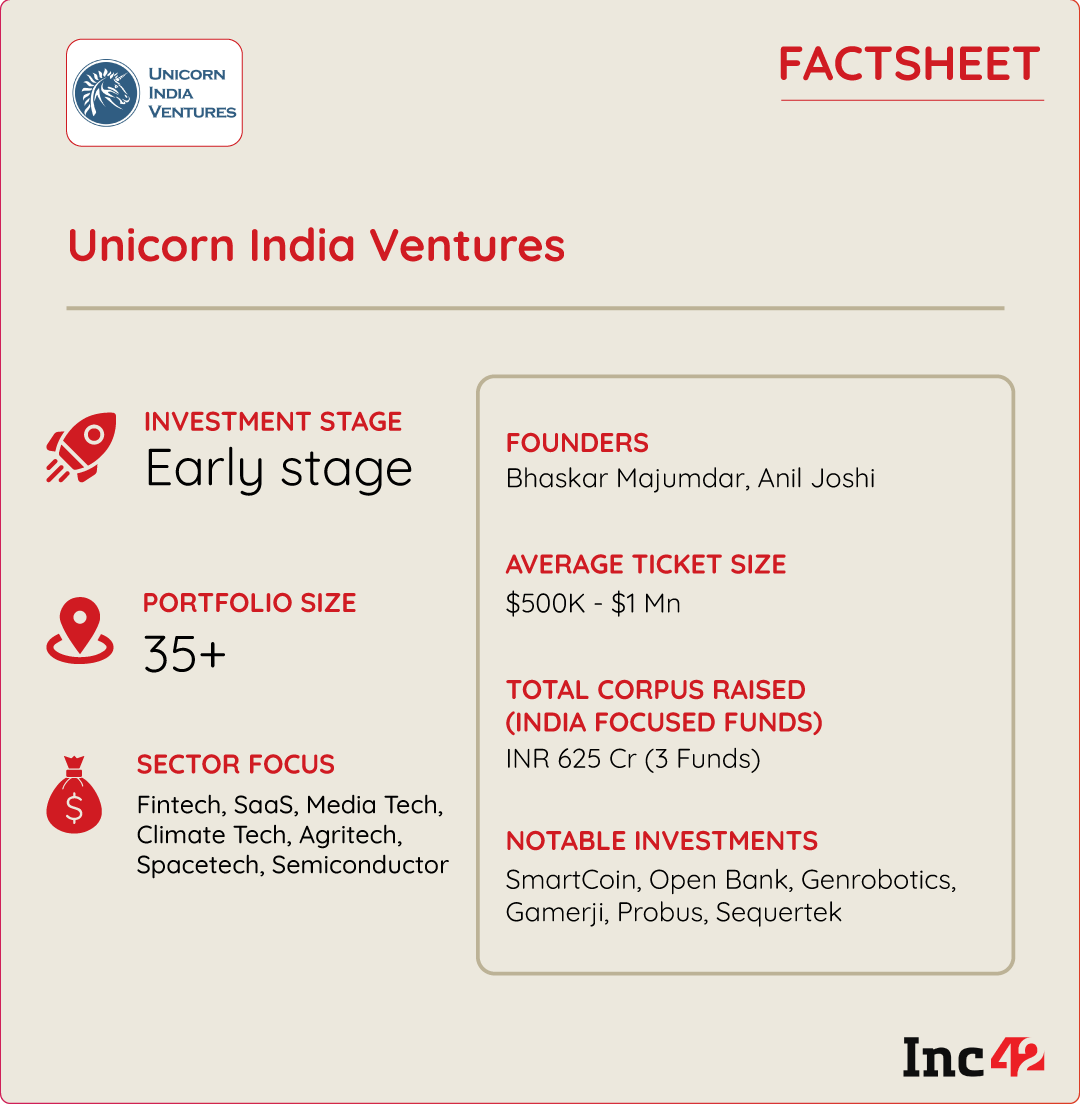

It is not every day that limited partners (LPs) get to cherish mind-boggling returns, and that too, before the maturity of the lifecycle of their investments. However, Bhaskar Majumdar and Anil Joshi of Unicorn India Ventures

At a time when exits have largely been a bone of contention between investors and founders in the world’s third-largest startup economy, let’s take you through the journey of the protagonists of our story who dared to walk the extra mile to deliver hefty returns to their investors with least portfolio dilution.

Armed with a wealth of experience and the intricacies of investment, Majumdar and Joshi incorporated their VC firm, UIV, in 2015. A year later the duo floated their Operating Fund I, with a fund size of INR 100 Cr.

At that time, little did they realise that a golden goose rests in their bucket of investments in the form of Open, an Indian neobanking startup.

What’s more interesting is that the founders had invested INR 7 Cr (about $854K) in the neobanking startup when only a handful of investors in India were willing to enter the emerging fintech realm due to little awareness, while investors in regions like the UK, Brazil, and the UAE were drenching in the perks of the segment.

Few years later, in 2022, the VCs partially exited Open at a valuation exceeding $650 Mn. The strategic exit resulted in a remarkable 85-90X blended return, doubling the initial value of Fund I for its Limited Partners (LPs) and yielding a substantial 60% internal rate of return (IRR).

While this is just the tip of the iceberg, the UIV founders still have a substantial asset portfolio in Fund I, which, according to Majumdar, is expected to give an overall portfolio return of 5.5X-6X on the initial investment at the end of the fund cycle.

Today, Majumdar, who is on a mission to churn hefty returns for his investors, boasts having ‘best-performing funds’ in his kitty. With only four write-offs so far, UIV’s Operating Fund I counts its investments in SmartCoin, Open Bank, Sequretek, Pharmarack, Genrobotics, Clootrack, FutureCure, amongst other startups.

Upping their game, the UIV founders on September 5, 2023, announced the first close of the INR 1,000 Cr Fund III at INR 225 Cr.

However, this time, the VC firm has its eyes set on startups focussed on global SaaS and digital platforms operating in sectors like climate tech, agritech, spacetech and the semiconductor ecosystem.

From giving exceptional returns to investors to now betting big on neo-sectors, where rests the key to the duo’s investment thesis, piggybacking on which they today claim to have one of India’s best-performing funds at their disposal?

Before decoding the answer to this, let’s first take a quick look at the VC firm’s lineup of funds, crafted with perfection to generate maximum returns.

Defying Trends To Generate Exceptional Returns

Speaking with Inc42, Joshi summed up his investment thesis in a single line — “Spotting exceptional opportunities involves defying trends and transcending conventions”.

Elaborating on this, the founder of UIV, Majumdar, said that every year he spends more than 100 days on the road, seeking opportunities in the farthest reaches of India. And in the process, the venture capital firm gets 300+ business pitches every week.

“We are anything but passive VCs casually sipping coffee at Starbucks, relying on referrals rather than hasty term sheet signings. With limited flight options in Tier II cities like Bhubeshwar, establishing initial contact with startup founders demands meticulous planning and proactive efforts,” Joshi said.

From backing the visionary college founders of GenRobotics in 2017 (later endorsed by Anand Mahindra) to making three pivotal funding announcements in Kerala in the same year, where no venture capitalist had ventured before at the time — the driving force behind UIV’s success lies in the profound expertise and the knack for seizing opportune deals at the right time, according to Majumdar.

“We have consistently allocated only 20% of our fund as the initial investment and supported winners in subsequent rounds with the remaining fund. This strategy has proven highly effective for us. Our inbound and outbound processes are no different from any other VCs except for the fact that we have a lot of more mature entrepreneurs reaching out to us and we are very deep within India,” Majumdar added.

In terms of sectors, UIV actively invests in areas that are regulated or have the potential for government intervention. According to Majumdar, only those sectors will grow in the country that are able to win the trust of the government.

Meanwhile, the fund follows a 10-point checklist before making a startup bet. These points include:

- Spending significant time (3-4 months) with founders

- Making founders understand that mentorship comes before funding

- Understanding areas where value can be added as a VC

- Gauging the vision of a founder

- Looking for adversity quotient and ability to improvise

- Understanding team structure and cofounder’s compatibility

- Identifying appropriate valuation with reasonable terms

- Predicting the viability of raising follow-on rounds

- Going deeper into regulated sectors or sectors having the potential to get regulated

- Giving preference to founders with corporate or entrepreneurship experience

“Anil and I are committed to this aspect in every deal. Despite my busy schedule and location, I ensure a one-on-one interaction with founders or the founding team. During this time, I gauge whether to proceed or not. This approach has often proven right. Future developments and market shifts are uncertain, making the person we support crucial,” Majumdar said.

Key Investment Strategies

When UIV launched its debut fund in 2016, the founders were determined to make a strong impact.

With a substantial infusion of Majumdar’s personal capital and almost entirely funded by Indian Limited Partners (LPs), the initial year focussed on investments in the burgeoning consumer internet sector, which was witnessing heightened investment activity.

However, a quick realisation led the founders to steer towards supporting B2B SaaS companies.

Despite the global prevalence of the term ‘B2B SaaS’, their reputation was built on investing in companies driving large-scale digitisation.

The key strategies that have bolstered UIV’s ability to secure promising deals are:

Expanding Into Tier II Cities & Beyond: Leveraging Joshi’s experience with Mumbai Angels since 2010, UIV ventures boldly into Tier II cities, becoming one of the first VCs to invest in founders from locales like Cochin, Trivandrum, Hyderabad, Jaipur, Pune, and Goa. Collaborating with state governments in Kerala and Maharashtra, known contributors to the fund, has enabled a portfolio where over 60% of 35-plus companies are based outside traditional hubs.

Immunity To FOMO: The founders of the VC firm believe that controlling entry prices in startups is more feasible than exit prices. This philosophy has shielded them from market sentiments. In 2021, they refrained from numerous deals that other investors pursued. Today, many of those startups are grappling with existential challenges.

In-Depth Due Diligence: The founders, who identify early stage investment as an art, employ an on-call CTO for technology due diligence, an unconventional practice among Indian VCs. They also conduct commercial due diligence, speaking to clients and consumers.

Smart Questioning: Sitting on the board of more than 30 portfolio companies, UIV’s active involvement in their growth allows them to ask probing questions to founders, preventing governance or execution problems.

“It is due to these factors that we believe, excluding a minority, every company will contribute, and there will be 2-3 extraordinary winners. In our first fund, barring four write-offs, every company yielded returns. At the fund level, even without a 100X winner, a mix of 10X, 3X, and 4X is attainable, ensuring a 4x to 6x return at the point level,” Joshi said.

Forging An Effective Exit Strategy

Getting an exit through an IPO is rare for early stage investors due to the shorter fund cycle of 7 to 8 years.

Additionally, not all startups yield the desired 80-90X returns for VCs. Typically, a fund cycle brings the highest 10X exit, with most startups reaching 2-3X.

To secure meaningful exits, especially with well-performing companies, UIV employs a three-pronged approach:

Firstly, they strive to avoid write-offs as much as possible. Even for struggling companies, the UIV team endeavours to recoup invested capital. An instance is Boxx.ai from Fund I, which offered AI-based analytics. Recognising the need for comprehensive features, UIV sold Boxx.ai to Netcore, obtaining a 1:1 cash return, a move that many VCs might not have pursued.

Secondly, if a write-off appears inevitable, UIV allows the company to survive autonomously. This approach increases the chance of an acquisition opportunity arising if market demands shift. Currently, two companies in the UIV portfolio are in acquisition discussions, potentially resulting in 4-5X returns on these investments.

Thirdly, UIV emphasises the importance of timing in exits. Deals that seem promising today can sour within six months. Moreover, full exits aren’t always necessary; partial exits allow for capital withdrawal and extra gains, according to Joshi.

For instance, in January 2022, when a billion-dollar round was happening at Open Bank, UIV’s investors questioned their exit timing. However, they exited only 20% of their holding. This strategic choice spared them the pressure faced by other funds scrambling to return capital to investors.

The key, as Majumdar highlighted, is that there’s never a ‘best’ time. When presented with a deal that aligns with their judgment, partial exits can be a prudent move.

What’s Next On The Cards

Unicorn India Ventures has always believed in the Bharat story as much as the India story. According to Joshi, the main advantage of Tier II cities and beyond is cost, which results in a longer runway and low attrition. But sometimes emerging infrastructure and the availability of high-end resources could be challenging. Irrespective of challenges, the startups are able to build decent businesses with profitability, which is definitely getting noticed by the investors.

“Our key differentiator is that we are present across India and believe that India’s startup landscape has changed immensely over the past couple of years. With this third fund, our commitment to nurture Indian startups will be unwavering, and we will keep scouting for highly innovative companies whose disruptive solutions can address real life problems of users by leveraging technology,” Joshi said.

Majumdar further emphasises that there is a pressing need for Indian VCs to build an international capital network, setting themselves apart from the multitude of existing funds.

Currently, the predominant challenge in India is the limited scope beyond Series C funding. A consistent group of 10-12 funds are familiar players at these stages.

Likewise, Indian family offices are reached out to by every fund, private banker, and wealth manager, resulting in a pool of about 50-60 offices.

Majumdar stresses the necessity of forging alternative resource networks and exit avenues beyond India. The focus is on creating opportunities for portfolio companies to secure exits, concurrently establishing a robust advisory network.

The envisioned network could comprise LPs, co-investors in deals, and participants in secondary transactions. The ultimate goal is to facilitate the exit process for portfolio companies while fostering growth through added investments and strong advisory connections.

Majumdar concludes that while the potential for larger funds exists, cultivating such a resource pool is essential for a fund’s successful performance. It is because of this that Majumdar is spending a lot of time in the US and Europe and creating these alternative sources of capital.

[Edited by Shishir Parasher]

Ad-lite browsing experience

Ad-lite browsing experience