A 10-member expert committee on ‘Onshoring Innovations To GIFT IFSC’ has submitted its report, identifying key areas that will help Indian startups settled abroad to reverse flip to India

According to an analysis conducted by Inc42, approximately 65% (or 13) of Indian unicorns with headquarters abroad operate in the enterprise tech (SaaS) sector

To encourage startups to reverse flip, the expert panel is lobbying for a competitive tax regime, ESOP taxation reforms, more access to domestic capital and increased government-startup collaborations

It’s not often that a company uses its YouTube channel to talk about a major corporate restructuring decision. That’s what PhonePe did when its CEO Sameer Nigam spoke to CTO Rahul Chari in January this year.

The subject of their discussion: PhonePe’s decision to redomicile to India. Nigam, the cofounder and CEO, said that as many as 20 unicorns were willing to shift their bases to India if regulations were eased.

However, the company’s investors had to cough up INR 8,000 Cr ($966 Mn+) in taxes for PhonePe to redomicile to India. While it was manageable for a mammoth like Walmart-backed PhonePe — and the blow softened by subsequent fundraises — not every startup based outside of the country has the means or resources to relocate to India.

In PhonePe’s case, the costly move back was for its IPO plans, another reason why this is an exception.

U-turns such as PhonePe’s are rare due to India’s stiff laws and regulations related to startups coming back to India. The tax bill is one thing, but there are many compliance headwinds.

But PhonePe’s move has prompted the likes of Razorpay, Meesho and Groww to also consider the same. These are also large startups that have the deep pockets for such a move, but the same cannot be said for smaller, early-stage ventures.

Here, too, the sparks to ignite the spirit of ‘Desh Wapsi’ are now visible, but questions about how they can come back to India persist. Could the answer come from the GIFT IFSC?

A GIFT For Indian Startups

Envisioned as a virtual offshore destination for startups and investors, GIFT IFSC could be key to bringing back startups to India. That’s why a 10-member expert committee on ‘Onshoring Innovations To GIFT IFSC’ was set up in March this year, which has submitted its report, identifying key areas that will help Indian startups settled abroad to reverse flip to India.

Set up by India’s International Financial Services Central Authority (IFSCA), the expert committee is chaired by the RBI’s former executive director G Padmanabhan. Further, the GIFT IFSC’s expert committee counts Dipesh Shah, executive director, IFSCA; Sumeet Jarangal, director, DPIIT; Nishith Desai, founder, Nishith Desai Associates; Siddarth Pai, founding partner and CFO, 3one4 Capital; Nikhil Kamath, cofounder, Zerodha; Lalit Keshre, cofounder and CEO, Groww; Anjani Sharma, CA; Anjali Bansal, founding partner, Avaana Capital, and Sandip Shah, GM, GIFT City, as its members.

Speaking with Inc42, committee chairman Padmanabhan said, “This is one of the most important committees I have chaired in my career spanning over three and a half decades. The issue has far-reaching implications for the country looking to be the innovation hub of the world. It is a travesty that companies owned and controlled by Indians, employing Indians, and doing most of the work from India have holding companies set up and domiciled overseas on paper. This issue gets the attention of the Government of India, leading to IFSCA setting up this committee. In my view, it is a very timely step.”

He added that the committee has looked at the problem areas holistically, made recommendations and floated incentives to help companies reverse flip to India.

“I hope these recommendations are accepted for implementation, and we achieve what we have set out to achieve for the GIFT city — Onshoring the Offshore,” Padmanabhan said.

Understanding Why Startups Flip

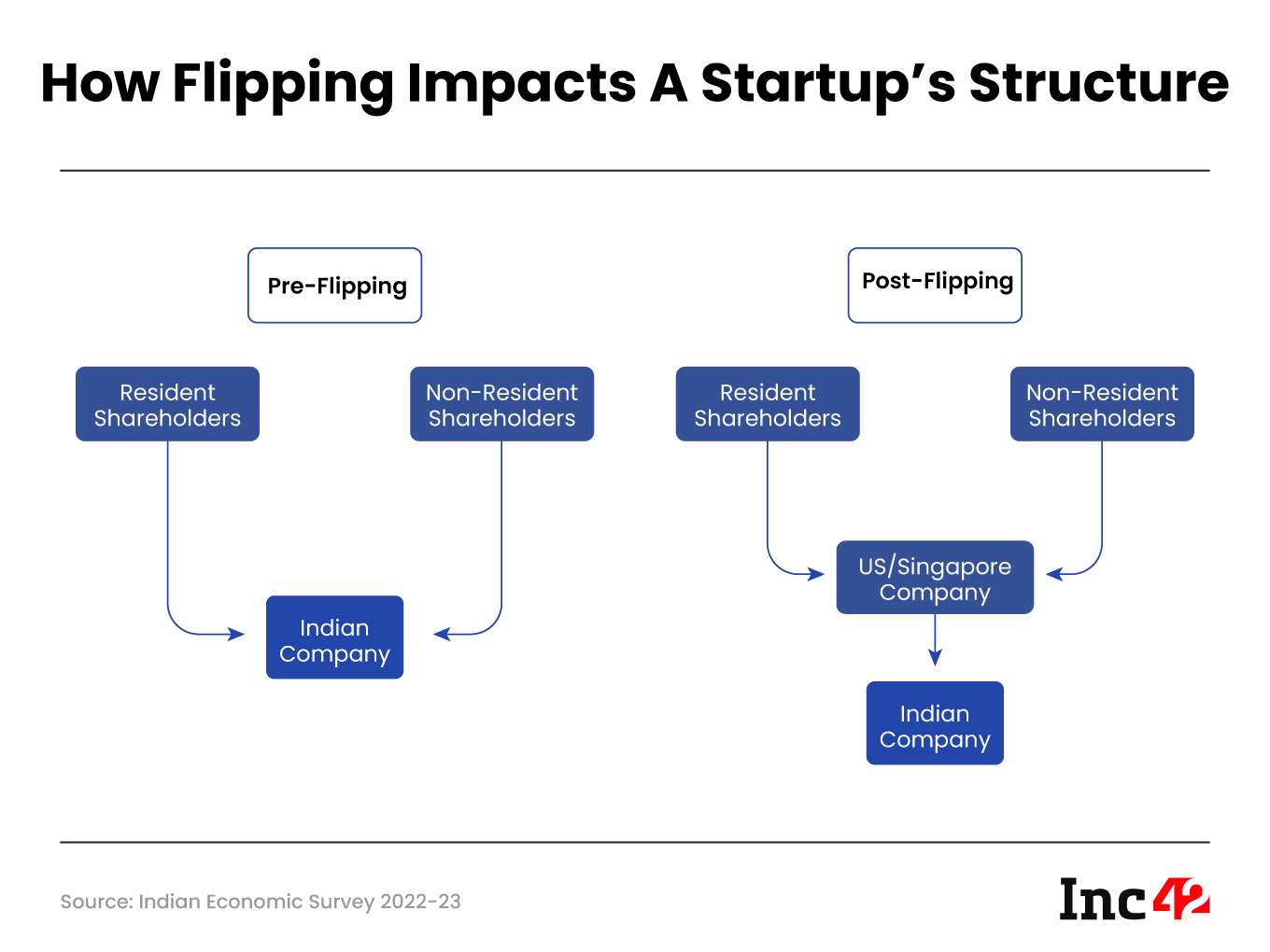

The Indian startup ecosystem has witnessed remarkable growth over the years, evolving through different waves of innovation and entrepreneurship. However, a concerning trend emerged, which is the increasing prevalence of startups flipping or essentially registering a holding company abroad with an Indian subsidiary.

This trend involves Indian startups moving their holding companies to foreign jurisdictions, potentially leading to significant economic and intellectual capital loss for India. This could also be understood by the fact that out of 111 unicorns, more than 20% are registered outside India.

3one4 Capital’s Pai said that when the committee began delving into the root causes that trigger the phenomenon of startup flipping, it found that the trend is predominantly driven by investor demands.

In particular, global early-stage programmes have made demands that startups shift their bases to specific geographies to avoid compliance issues in India. This investor demand is rooted in the familiarity with the legal frameworks of those specific jurisdictions, which are more often than not the US or Singapore.

“Pushing Indian startups to flip provides investors with a more convenient recourse in case of legal matters. For instance, jurisdictions like Delaware offer a robust corporate law framework that has gained significant traction due to its comprehensive and extensively practised business regulations. This familiarity makes it more convenient for investors to navigate legal complexities. Adding to the complexity of the issue, a significant portion of funding, approximately 85%, received by Indian startups originates from foreign sources,” Pai told Inc42.

Further, from an income tax standpoint, the tax rate on capital gains for non-residents is only half of what residents pay. This significant disparity creates a clear economic incentive for startups to consider moving their domicile overseas.

Alongside these tax considerations, operational challenges further complicate the situation. Many startups with global, recurring billing, such as SaaS companies, often do not generate traditional physical invoices. Instead, the billing process is typically directed towards their respective platforms or may involve direct debit mechanisms.

Unfortunately, as these are payments from non-residents, the current system requires these digital transactions to be processed through physical forms submitted to the bank in order to credit the foreign revenue to their account.

This operational hurdle adds an extra layer of complexity, adding more friction to the process, Pai noted.

Challenges Of Startups Shifting Their Headquarters Abroad:

- Brain Drain & Talent Flight: A direct consequence of startup flipping is the migration of founders and key talent to foreign countries. This results in a significant loss of entrepreneurial expertise and innovative capabilities within India, hampering its growth potential.

- Wealth Erosion: When holding companies are moved abroad, the wealth generated by Indian startups is often concentrated outside the country, benefiting foreign economies. This wealth erosion can impact domestic investments and economic stability.

- Intellectual Property Loss: Many Indian startups externalise due to stronger intellectual property protection laws in foreign jurisdictions. This leads to the loss of valuable intellectual property and technology that could otherwise contribute to India’s innovation landscape.

- Reduced Tax Revenue: Externalisation can result when Indian startups have an option to pay lower corporate taxes in foreign countries. However, due to this the Indian government loses revenue, which otherwise could have been used to spur development.

- Impact On The Nation’s Image: Startup flipping weakens India’s global position, especially concerning digital diplomacy and cross-border financial inclusion initiatives. It diminishes India’s ability to advocate for digital financial services and inclusive finance agendas worldwide.

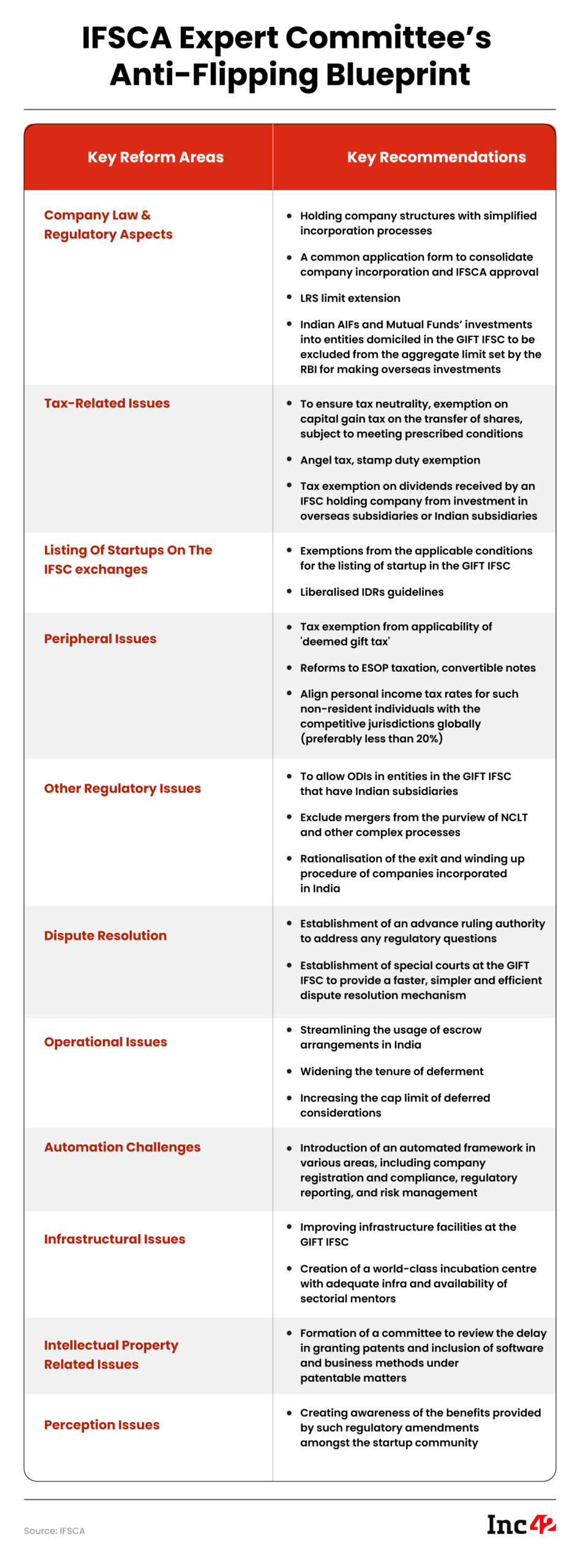

Luckily, taking cognisance of this, the executive committee has tabled recommendations in key areas like building a competitive tax regime, the need for enhanced IP protection, ESOP taxation reforms, access to domestic capital supporting companies’ global expansion plans and more government-startup collaborations, which will likely encourage startups to reverse flip.

Here’s a sneak peek into the recommendations made by the 10-member executive panel to boost reverse flipping among Indian startups.

Will GIFT IFSC Push Startups Towards ‘Desh Wapsi’?

The Indian government’s efforts to integrate the country’s economy with the global financial system have led to the establishment of the Gujarat International Finance Tech City (GIFT City) or GIFT IFSC.

This initiative aims to create a global financial hub within India to attract international businesses and capital. The IFSCA was established to regulate and develop IFSCs in India, assuming the powers of several domestic sector regulators. The GIFT IFSC has experienced substantial growth across various financial sectors, with over 530 registered entities as of June 2023, showcasing the remarkable progress of the initiative.

Speaking at Inc42’s MoneyX in July, Dipesh Shah, executive director (development), IFSCA, said that GIFT has triggered reverse flipping and countries like Singapore and Mauritius are asking private equity (PE) investors what needs to be done to stop them from moving to the IFSC.

“We have structured the GIFT IFSC to stop the trend of entrepreneurs moving abroad in search of better opportunities and simpler regulations. Whatever tax and other benefits PE investors would get (there), we are offering similar facilities here,” Shah had then said.

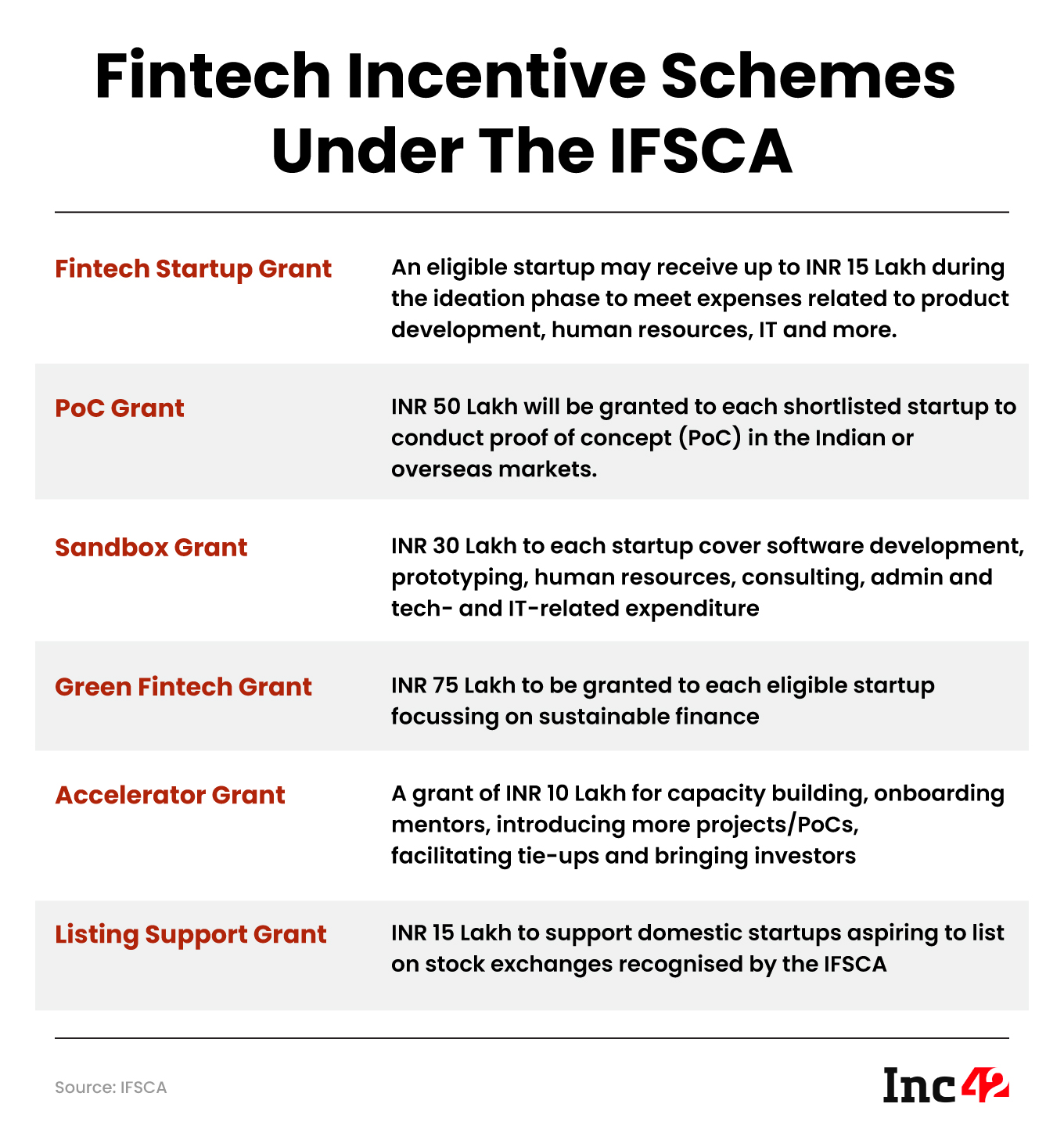

Meanwhile, a significant aspect of the GIFT IFSC’s development is its focus on fostering a world-class fintech ecosystem. The convergence of finance and technology has been a critical consideration since the inception of the GIFT City. The IFSCA also has the IFSCA FinTech Entity Framework in place for fintech activities.

Various sandboxes are also being established to encourage innovation and collaboration, with over 40 fintech companies approved under the framework. Further, the IFSCA’s FinTech Incentive Scheme supports fintech activities by offering grants and financial support to eligible entities.

The collapse of prominent US banks, including Silicon Valley Bank, in March 2023 had a direct impact on Indian startups that had deposits in these banks. This situation highlighted the GIFT IFSC’s potential to provide a secure alternative for these startups, given its offshore status, favourable regulatory framework, and competitive tax regime.

The crisis also underlined the GIFT IFSC’s role in positioning itself as a preferred jurisdiction for global and Indian startups, offering them stability and a conducive business environment.

The GIFT IFSC’s positioning as an ideal destination for reverse flipping Indian startups is rooted in its offshore jurisdiction within India, ease of doing business, competitive tax regime, access to a vibrant private equity and venture capital ecosystem, its status as a global fintech hub, and other key enablers like a skilled talent pool and advanced technological infrastructure.

The Reverse Flipping Road

According to an analysis conducted by Inc42, approximately 65% (or 13) of Indian unicorns with headquarters abroad operate in the enterprise tech (SaaS) sector. The remaining unicorns originate from diverse sectors, including ecommerce, media and entertainment, travel tech, and clean energy.

Last year, Inc42 reported that more than half a dozen Indian crypto startups had shifted their operations to destinations such as Dubai, Delaware, and the British Virgin Islands (BVI).

This shift can be attributed to several factors, including the challenges posed by the crypto winter, the Indian government’s introduction of TDS for crypto transactions, and an increasingly stringent regulatory environment within India. The rapidly evolving regulations in India have adversely affected not only crypto startups but also the broader fintech landscape.

According to 3one4 Capital’s Pai, the report acknowledges the reasons for flipping as taxation disparity, operational hurdles, tax issues, legal frameworks, etc. and makes suggestions based on market feedback on what is needed to allow such flipped startups to redomicile to India.

The report also hopes to drive dialogue and discussion on the matter and serve as a resource for easing the conditions that prompted such flips.

Even as the winds of change are yet to embrace startups settled abroad, the recommendations by the 10-member expert panel seem a move in the right direction.

The challenge now lies in getting the government to adopt these recommendations and present them to startups as a viable solution.

[Edited by Shishir Parasher]

Ad-lite browsing experience

Ad-lite browsing experience