A report by BCG and B Capital suggests smaller hospitals experience lower occupancy rates at 25-30%, compared to larger hospital chains (60-70%)

Without a consistent patient inflow, these hospitals face financial constraints that hinder their ability to invest in infrastructure, says Mykare Health cofounder Senu Sam

The startup claims around 40% of its partner hospitals have seen a significant rise in patient footfall, caseloads and revenues

India’s healthcare grapples with inherent challenges, particularly for small-to-midsized hospitals situated in non metro areas and in Tier 2 and 3 cities. Despite these areas catering to approximately 86% of medical visits in India, patients often embark on arduous journeys to larger branded hospital chains due to a lack of trust in local or small/medium facilities and the perceived necessity of advanced diagnostic and treatment capabilities.

Many times, patients struggle to cope with hefty bills and out-of-pocket expenses at these large facilities even if they have insurance or PMJAY (the coverage may not be sufficient for them in many cases). In fact, two-third of patients seek treatment in the costlier private sector, observed a 2021 NITI Aayog report.

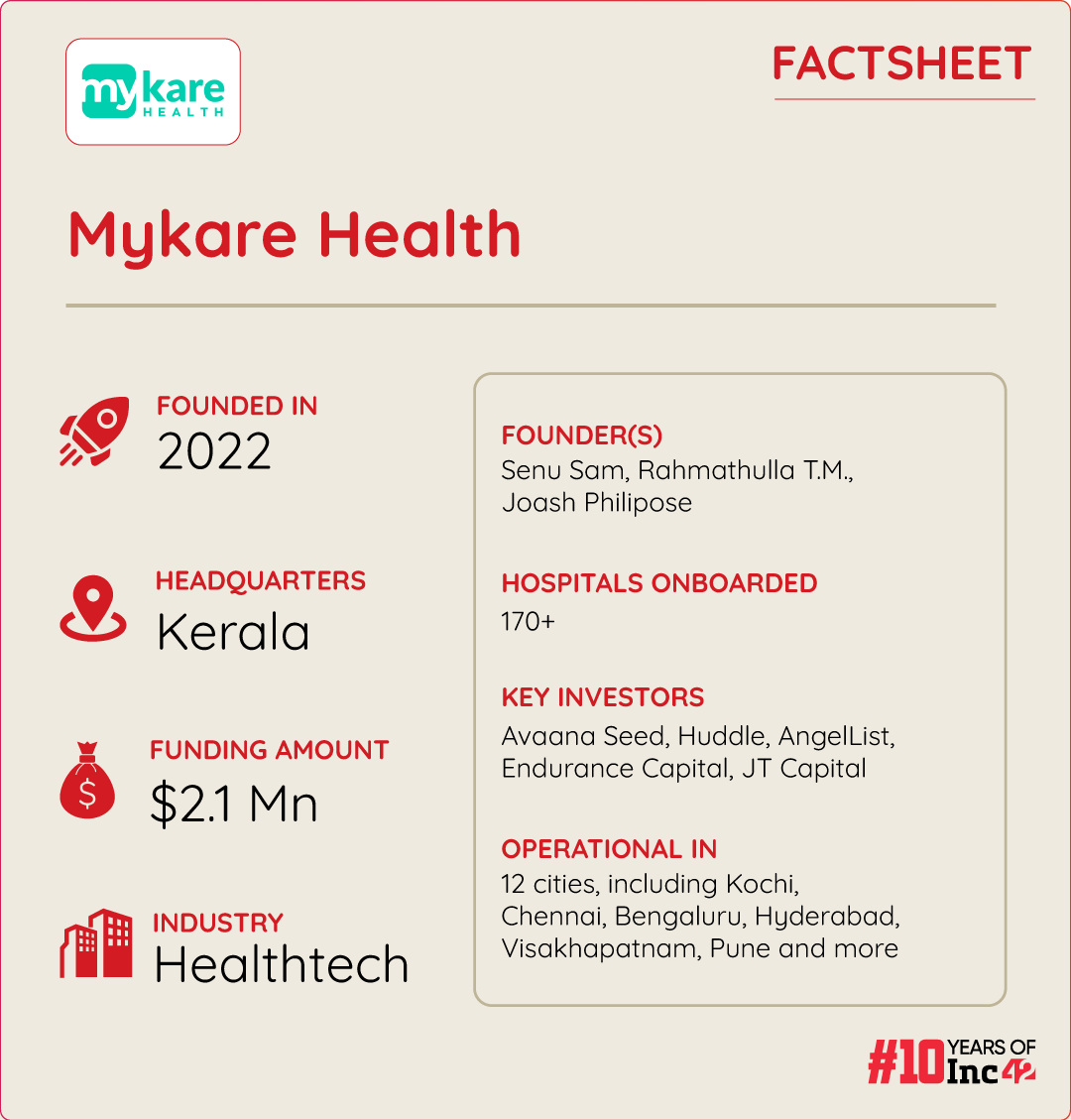

“The majority of healthcare facilities in India (almost 90%) are small and medium unbranded establishments. The middle class is only aware of large branded facilities,” said Senu Sam, the cofounder of healthtech startup Mykare Health.

He further added that many small and medium facilities have experienced doctors, equipment and trained resources but struggle to build awareness and trust among patients.

Patients often have a few fundamental questions: Who is my doctor, and what is their expertise? How good is the facility? Who will guide me through the treatment process? And what are the costs involved?

A new crop of asset-light aggregators like Mykare Health is helping patients find these answers, while helping smaller hospitals with a steady patient footfall. They aim to build extensive provider networks and offer value-added services to make patient care more affordable and accessible. Essentially, these new-age healthcare startups are partnering with medical facilities (hospitals, clinics, labs/diagnostic centres and more) and networks of surgeons to bring quality and scale to the value chain for a patient-centric approach.

When Sam and other two founders built Mykare Health to help people looking for treatment, they had two clear goals in mind. First, patients, especially those from the middle income class, should have access and be aware of the experience and expertise of their doctors. Second, helping the hospital owners to unlock the chicken and egg scenario (patients want experienced doctors and doctors need footfalls).

However, the interconnected nature of these issues involving healthcare infra, cost and staffing critical components for handling short stay surgeries (or elective surgeries that are planned non-emergency procedures) requires a deeper plug-in rather than a simple fix. So, the healthcare startup zeroed in on a two-pronged strategy to make it a win-win for healthcare providers and consumers.

Although small and midsized hospitals typically experience lower patient traffic and occupancy rates, they have been urged to optimise their offerings to attract more patients and drive revenue majorly due to the awareness. On the other hand, Mykare Health connects patients with its network hospitals that offer affordable procedures compared to branded large chains.

This approach has paid rich dividends by addressing the consumer pain points for elective surgery (quick access and affordable quality care) and driving network hospitals’ revenues. By February 2024, Mykare Health partnered with 170+ hospitals in 12 Indian cities and claimed a 20% monthly rise in surgical enquiries, reaching 5K+ since its inception.

The business is now running at operational positive (CM2), indicating a firm stride towards profitability. For context, CM2 covers everything apart from admin cost.

Mykare’s USP: Balancing Demand-Supply, Revving Up Revenue Via Capacity Utilisation

While people struggle to schedule elective procedures in big hospitals across big cities, Mykare Health has strategically leveraged the existing healthcare infrastructure by partnering with underutilised and budget-friendly small and medium private hospitals.

According to a report by BCG and B Capital titled A Digital Pill For Revolutionizing Healthcare, smaller hospitals find it difficult to cope with low footfall, witnessing 25-30% occupancy rates compared to large hospital chains (60-70%) in the top 60 Indian cities.

In contrast, public healthcare units are mostly understaffed, under-equipped and flooded with more patients than they can handle. According to KPMG, as of May 2021, India had 1.4 beds per 1,000 people and 0.5 beds in public hospitals, falling significantly short of WHO’s recommended 2.9 beds per 1,000. Therefore, it is imperative to utilise the existing infrastructure in the private healthcare space and bring cost-effective medical services to the masses via asset-light aggregators.

“It would be an oversimplification if we attribute the current scenario to mere underutilisation of small and midsized hospitals,” said Sam. “The crux of the matter lies in the limited recognition of these hospitals by potential patients. Without a consistent patient inflow, these hospitals face financial constraints that hinder their ability to invest in and optimise the necessary infrastructure,” he pointed out.

It reminds us of the proverbial chicken-and-egg situation, as the lack of footfall hinders timely upgrades, and talented doctors hesitate to enrol in facilities minus the modern-day adaptations required for a high volume.

Mykare Health aims to break this cycle by providing a comprehensive suite of services, starting with surgeries, from assessing surgery needs to finding providers, managing appointments, helping settle insurance claims and offering follow-up consultations post-surgery. This end-to-end and hassle free approach streamlines the entire process, cutting down on lengthy paperwork and the endless running around to reach the right people for medical and insurance requirements. Plus, there’s the cherry on the cake – an average cost-benefit of 30% or more and zero hidden costs.

Smaller hospitals also gain awareness about their experienced doctors and a steady stream of patients. According to Sam, around 40% of Mykare’s partner hospitals have seen a significant rise in patient footfall, caseload and revenues. Moreover, when hospitals have steady revenue streams, state-of-the-art healthcare infrastructure can be easily rolled in, and elective surgery in these locations would be as advanced as in speciality centres.

How Healthcare Aggregators Are Transforming Elective Surgery

Forget Covid-related delays; a survey by healthtech startup Navia Life Care reveals a more critical concern. Around 60% of elective procedures in India remain on hold due to financial issues.

Consequently, Mykare Health and its ilk are trying to fix the healthcare financing part, keep costs transparent and ensure that the service offerings are as inclusive as possible to help people access secondary or even tertiary care (if the occasion calls for it) in the face of skyrocketing healthcare costs and not-so-sturdy public finances.

Sam says that with Mykare Health, patients pay almost 30% less compared to the traditional route.

For instance, Mykare Health focusses on coordinating and overseeing elective procedures in several areas such as laparoscopy procedures (for hernia and gallstone), proctology (piles and fissures), gynaecology (hysterectomy, vaginal cyst), urology (kidney stones & prostate), vascular (varicose veins), ophthalmology (cataract & LASIK) and cosmetic surgery.

Sam related a case to illustrate his startup’s impact on people’s lives. A delivery agent suffering from piles faced an unexpected hurdle as his health insurer refused to cover the treatment due to a draconian clause. The claim was declined as the agent was not working on the day when he fell ill.

The patient sought Mykare’s help and the startup intervened on his behalf. All ‘issues’ were quickly ironed out with the patient undergoing the surgery and his medical bills getting settled. The year was 2023, but such irregularities within the healthcare ecosystem continue to raise their ugly heads, leaving the insured in the lurch.

“This will tell you how our platform acts as a catalyst in navigating and resolving complexities within the healthcare system, ultimately benefiting the patients we serve,” said Sam.

In the next six to nine months, the startup aims to tie up with more hospitals and help partner hospitals grow their patient base.

What The Future Holds

According to a report by healthcare-focussed market research firm Insights 10, the digital healthcare market in India is projected to soar from $3.8 Bn in 2022 to $18.3 Bn by 2030, growing at a CAGR of 21.6%.

These forecasts highlight a clear opportunity for platforms like Mykare Health, which go beyond traditional digital healthcare services like online consultations. Instead, it focuses on delivering a comprehensive patient experience tailored for elective surgery to start with. As discussed, this strategic approach benefits patients and addresses a significant challenge within the industry: The underutilisation of small and medium hospital capacities.

“In the next two to three years, the elective surgery landscape is poised for a convergence of digital advancements, collaborative healthcare networks, technological empowerment for hospitals and diversification of healthcare offerings,” observed Sam.

For instance, after a significant demand utilising the beds and equipment, these facilities need technology tools to manage certain processes.

However, there’s more to come. Sam envisions this asset-light healthcare service model extending beyond the elective surgery landscape. “We have started with elective surgery, however our goal is to increase footfalls. We are focusing on demand and help underutilised facilities in areas like utilising radiology equipment and resources,” he said.

Saying that, the founders of Mykare Health want to build the largest asset light affordable and trusted hospital chain.

In recent years, digital healthcare startups have proven how to bridge the gap between affordability and accessibility. The BCG report further suggests that healthcare providers must explore new models such as remote health management, eICU and care coordination across homes and hospitals through strategic partnerships with innovative healthtech platforms. This innovative shift will be crucial for improving the healthcare system in India, and digital-age players like Mykare Health are likely to play a pivotal role in bringing about that change.

Ad-lite browsing experience

Ad-lite browsing experience