Grofers, which has survived the grocery delivery bloodbath, is planning to go public In 2021 after M&A talks with rivals failed to take off. The company however denies getting into talks for selling its business.

The pandemic push triggering the demand e-grocery platforms seem to have turned the tide in Grofers’ favour, and the startup is bullish on private labels for further growth

The Startup has been stepping up partnerships with kirana stores and has doubled down on private labels for better margins, but will investors buy this pitch?

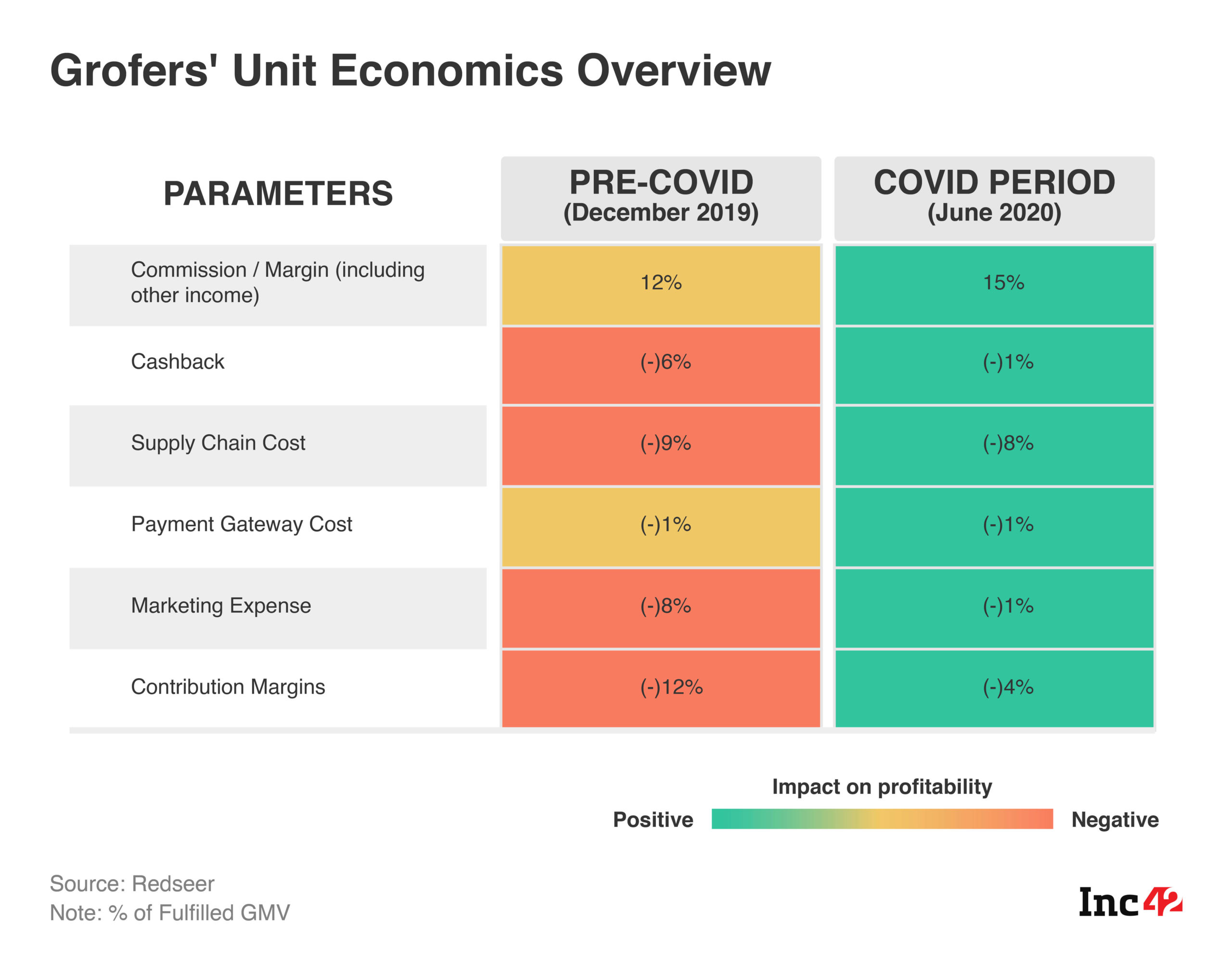

Gurugram-headquartered e-grocery startup Grofers has lately been in a PR overdrive, amplifying its ambitious targets, especially its grand plan to clock $4 Bn (Rs 30,000 Cr) in gross merchandise value (GMV) by the end of CY2021-22. According to several media reports, the company claims to be on track to touch $1.4 Bn (Rs 10,000 Cr) GMV by the end of the current financial year ended March 2021 (FY21). Besides, just a few months after the Covid-19 lockdowns ended in July 2020, Grofers’ cofounder and CEO Albinder Dhindsa told the media the company would bring forward its IPO date to the end of CY2021, from its earlier schedule of mid-2022. In an email response to Inc42, the company claimed that they had a lean, grocery-specific supply chain and were making profits on every order.

Going by these announcements, it seems business has never been so good for Grofers. However, some of these GMV targets do not add up when we look at the numbers from an overall online grocery perspective.

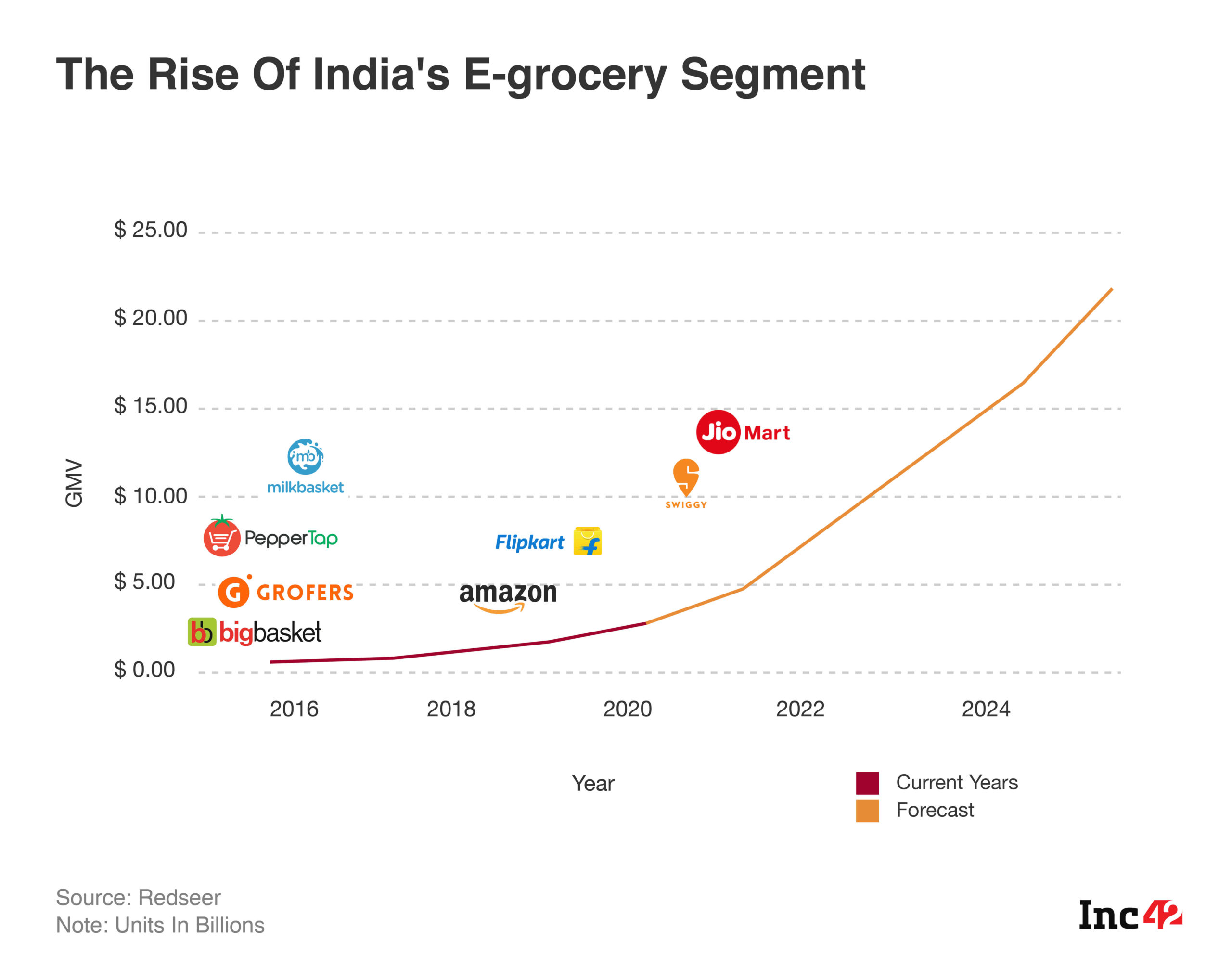

According to market research firm RedSeer, the entire online grocery market in India crossed $3 Bn in GMV as of December 2020, a sizable increase compared to $1.9Bn, reached by the overall segment in December 2019. If Grofers’ GMV figures are to be believed, it has already bagged around 50% share of the online grocery market.

Interestingly, Grofers’ closest rival BigBasket also claims to have reached $1 Bn in GMV run-rate in June 2020. To be precise, a ‘run-rate’ figure is considerably different from the total GMV figure that Grofers’ CEO Dhindsa quoted to the Press in January 2021. According to him, Grofers had already done $1.4 Bn in GMV sales while BigBasket was simply extrapolating monthly sales figures into an annual figure. On the other hand, BigBasket’s CEO Hari Menon told TOI in July 2020 that its monthly gross sales figure stood at around Rs 650 Cr ($90 Mn). Grofers did not indicate its monthly gross sales figure in any of its interviews.

If we take into account the numbers supplied by both BigBasket and Grofers, a surprising fact seems to emerge. Together, these two startups account for an astounding 80% of the current market. This leaves all other players like Amazon, Flipkart, JioMart and Milkbasket a meagre 20% of the market share at $600 Mn, going by RedSeer’s estimates which currently peg the value of the overall e-grocery industry at $3 Bn.

Experts like investment bankers and consultants who have spoken to Inc42 are baffled by these numbers. This is because the term GMV simply indicates the gross value of goods sold by a company in a given period. In the online grocery context, this value is extracted by adding up the total MRP of the goods sold. Hence, this does not correctly indicate the actual sales done by either Grofers or BigBasket. Experts, however, agree that the latter is the larger player in the market.

“It seems that Grofers is trying to portray itself as one of the larger players by quoting a vanity metric like the GMV. In the context of online grocery delivery, the $1.4 Bn GMV that Grofers claims to be making does not take into account the value of returned items, discounts and cancellations,” says an investment banker, with clients in the hyperlocal delivery space, asking not to be named.

He also points out that most of BigBasket’s sales come from its inventory present across its warehouses and dark stores. So, the Bengaluru-based startup is more likely to have higher margins and higher gross revenue than Grofers.

The ongoing GMV feud between the two startups invariably reminds one of the early e-commerce days in India when Flipkart and Amazon competed heavily on GMV figures and constantly amplified this in media coverage. The GMV fever has now caught up with online grocery.

A Journey From Marketplace To Inventory And Private Labels

Grofers has been playing catch up with BigBasket for some time now. After operating as a grocery marketplace for nearly three years until 2017 – the business model involved aggregation of inventory directly from stores and supermarkets – the company pivoted towards inventory-led play and scaled down its marketplace operations after careful planning. In contrast, BigBasket adopted a full-fledged inventory-led model prior to Grofers, and by 2018 it even claimed to have doubled its margins to reach 18% per order, according to a Mint report.

Grofers’ pivot towards a larger inventory model did not start until a funding crunch hit the grocery segment. In 2016, the company had to shut down its operations in nine cities to conserve cash. By 2018, Grofers started to invest heavily in its private labels and warehouses, which eventually helped improve economics and enabled it to raise more funding from existing investors like SoftBank in the following years.

A founder in the grocery delivery segment (the company currently handles more than 80K orders per day) told Inc42 that working with grocery stores and supermarkets for sourcing inventory proved to be unsustainable as several orders could go unfulfilled. The founder has spoken on condition of anonymity as he does not want to comment on his rival publicly.

“Everyone who tried a marketplace model in the grocery delivery segment had either shut down the business or pivoted completely. The problem with this model is that you have no real-time visibility into inventory. As grocery stores and supermarkets have no way of communicating real-time inventory updates to grocery apps, a customer who orders via an app will end up missing several items in the cart, and this eventually hurts loyalty and recurring orders,” he adds.

Grofers’ CEO Dhindsa agreed to this in an interview with online tech publication Entrackr in December 2017. “…They (supermarkets and kiranas) were not capable to cater to customers’ demand. In most of the orders, we tend to miss some items as they weren’t available at stores. It was taking a toll on overall consumer experience,” he told the publication. To fix this issue, Grofers buckled up and went all out with its private-label business, which was, again, a page borrowed from the playbook of BigBasket.

In 2020, Grofers set aside $15 Mn for expanding its private labels, which currently include a number of brands such as Happy Day, Happy Home, Grofers Fresh, Orange and Mothers Choice. These brands are spread across categories, including personal care, home care, staples, snacks, sanitary products and even home furnishing. The startup says its private labels may account for more than 60% of its business in the next two years, given the current surge. Consequently, it aims to invest up to $50 million to grow both its supply chain and private-label business during this period.

But investing in private labels is just one step towards Grofers’ plan to hit $4 Bn GMV by 2022. To achieve this goal, the e-grocery startup will have to burn a minimum of Rs 500 Cr every year until 2022, going by its own financials.

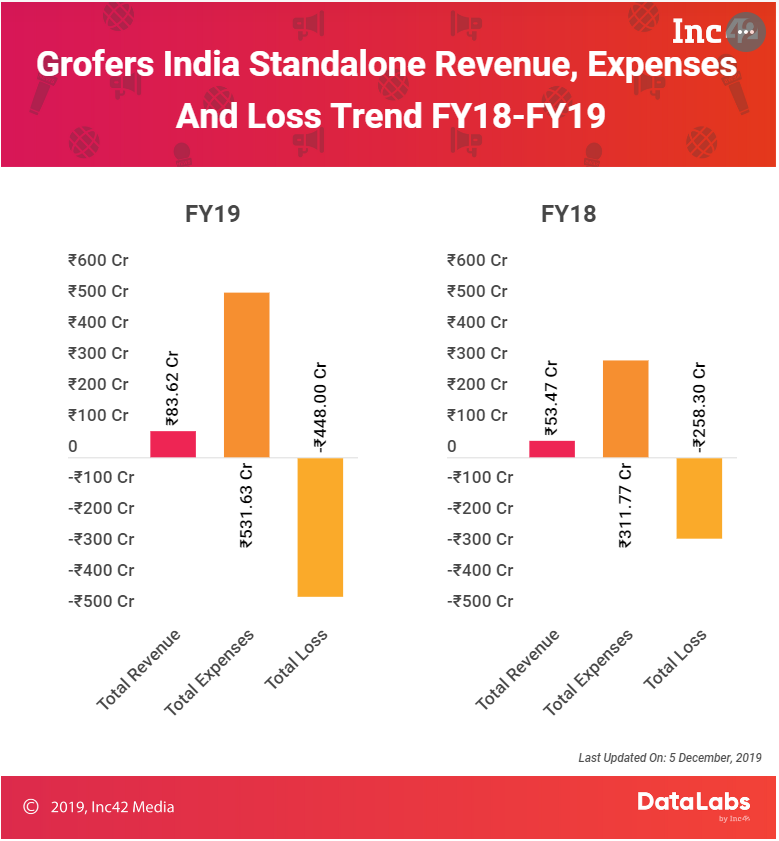

For the financial year ended in March 2019 (FY19), the company’s operating revenue grew 1.35x to reach INR 70.14 Cr for which it had to spend a whopping INR 531.63 Cr in expenses, a significant rise from INR 311 Cr in FY18. Grofers spent 24% of its total expenses on discounting, which stood at INR 128.32 Cr in FY19. It had also gone up 5.5x compared to FY18. Grofers is yet to file its financial statements for FY20.

Will An Asset-Light Network Of Discount Stores Become A Game Changer For Grofers?

Online grocery delivery is a tough space, riddled with low margins and wastage in the supply chain. Add to that full-blown attacks from deep-pocketed rivals like Amazon India, Walmart-owned Flipkart and homegrown retail giant Jio, and things are going to be more challenging for Grofers. However, a clear trend seems to be emerging among all major grocery delivery brands. The aggregation of kirana stores is now touted as an ‘asset-light’ model and almost all players in India’s grocery delivery segment are adopting it. Grofers, too, is closing in.

Inc42 reported in April 2020 that Grofers was looking to invest $50 Mn to strengthen its supply chain and private-label categories in the next two years. But in sync with the emerging trend mentioned above, the company is also upping its kirana aggregation play.

Since mid-2019, Grofers has been converting kirana stores and supermarket outlets into its branded discount stores in Delhi-NCR. In addition, it will help them with backend sourcing, inventory and technology support on a revenue-sharing basis. In fact, Grofers planned to convert around 1,000 such stores by the end of 2019.

Grofers’ playbook currently involves a mix of private labels, supported by a distribution chain that operates across its own warehouses and its network of kirana stores. But the startup has been heavily discounting even during an apparent spike in demand for online grocery. In August last year, Grofers offered steep discounts of 20-50% during a nine-day sale period, which was at least 15% higher than what it did during its previous sale. This is likely to push up marketing and promotional expenses even though the discounting happens once a year.

According to the founder in the grocery delivery segment who was quoted earlier in the article, the average margin per order ranges anywhere between 15 and 20%. The highest-margin products include fresh vegetables, fruits and other perishables, but the wastage in supply chains can affect final margins as well, he adds. Hence, the only way to shore up margins up to 20% is by ensuring that each customer cart has at least three-four products from the private label stack. This explains why Grofers is aggressively pushing its private label products online and also in kirana stores. In an emailed response to Inc42, a company spokesperson confirmed that Grofers would be looking at expanding its own labels via both channels (online and offline) and indicated that the startup would be expanding this further.

Ankur Pahwa, partner and national leader, eCommerce and consumer internet sector, at Ernst & Young (EY), says that the inventory-led model may help improve the overall unit economics of any grocery delivery firm through a mix of private-label brands, but startups (like Grofers) will still have to invest heavily in supply chain operations.

“It is still a cash-burn-heavy segment due to low margins and requires deep pockets to be sustainable. But considering that it is one of the largest retail segments and the traction it has seen in 2020, funding will continue to flow into existing players, along with strategic partnerships and buyouts by large conglomerates trying to gain a bigger footprint in the market,” he adds.

Will There Be Growth When Overambitious Targets Fade Beyond Tier-1?

Grofers’ biggest rival BigBasket has been struggling to cut down on losses even after raising multiple rounds of funding. It is currently in talks with the Tata Group to sell a majority stake in its business, a strategic buyout on the part of the conglomerate.

Therefore, the glaring questions remain. Even after juggling between marketplace and inventory play and then adopting a hybrid model, why couldn’t BigBasket or Grofers cut down on losses? Why does BigBasket want to exit even after holding a dominant position for a long time?

The answer: Clearly, users in Tier-2 locations and beyond are not convinced that they want their groceries to be delivered at their doorstep. Hence, the digitally savvy customers in Tier-1 cities are the only viable targets for all e-grocery companies.

According to Sreedhar Prasad, a former KPMG consultant who currently advises startups in the grocery delivery space, the demand for grocery delivery services level out beyond metros and Tier-1 cities even though a parallel food delivery market has proliferated in smaller cities. This trend has baffled investors and founders alike, and it is unlikely to change in the foreseeable future.

“The hyperlocal delivery segment, which includes both food and grocery delivery, has proliferated because of digitally savvy consumers in metros and also due to the availability of a large blue-collar workforce in those cities. But beyond Tier-2, there is a demand-supply problem both ways, especially in the grocery segment,” he adds.

The reason why grocery delivery is not growing at the same pace as food delivery is that the grocery supply chain has to deal with perishables on a daily basis. Besides that, building a supply chain that works for online grocery delivery in non-metro cities is going to be challenging, says Prasad.

Also, global investors are looking at how the next 400 Mn users in India can be served using online products and services. But grocery or food delivery is not a priority requirement for the next set of users residing in non-metro cities and beyond. Prasad says that Tier-2 and smaller towns already have alternative grocery delivery channels, including the government-subsidised public distribution system, self-help groups, mandis and small kirana stores which have loyal customers and who depend on those entities for home delivery. These alternative services in smaller towns are self-sufficient. Also, users there cannot afford to pay extra delivery charges for added convenience.

So, where does it leave Grofers and its $4 Bn GMV plans? Grofers’ rivals, industry experts and investors believe it will be an arduous sprint, with no scope for error, given the short time frame the company has given to itself. It is also possible that instead of trying to achieve these numbers, the company is selling a promise to attract potential buyers who can give the founders a much-needed exit.

Last Updated | 8:55 PM; 10th Feb, 2021

The story has been updated to reflect the company’s view on its unit economics. The updated article also reflects Grofers’ response to media reports claiming that the company was involved in M&A talks.

Ad-lite browsing experience

Ad-lite browsing experience