Wealth management is integrating digital investment at a fast pace

Customers prefer digital investing due to convenience and no-to-low cost

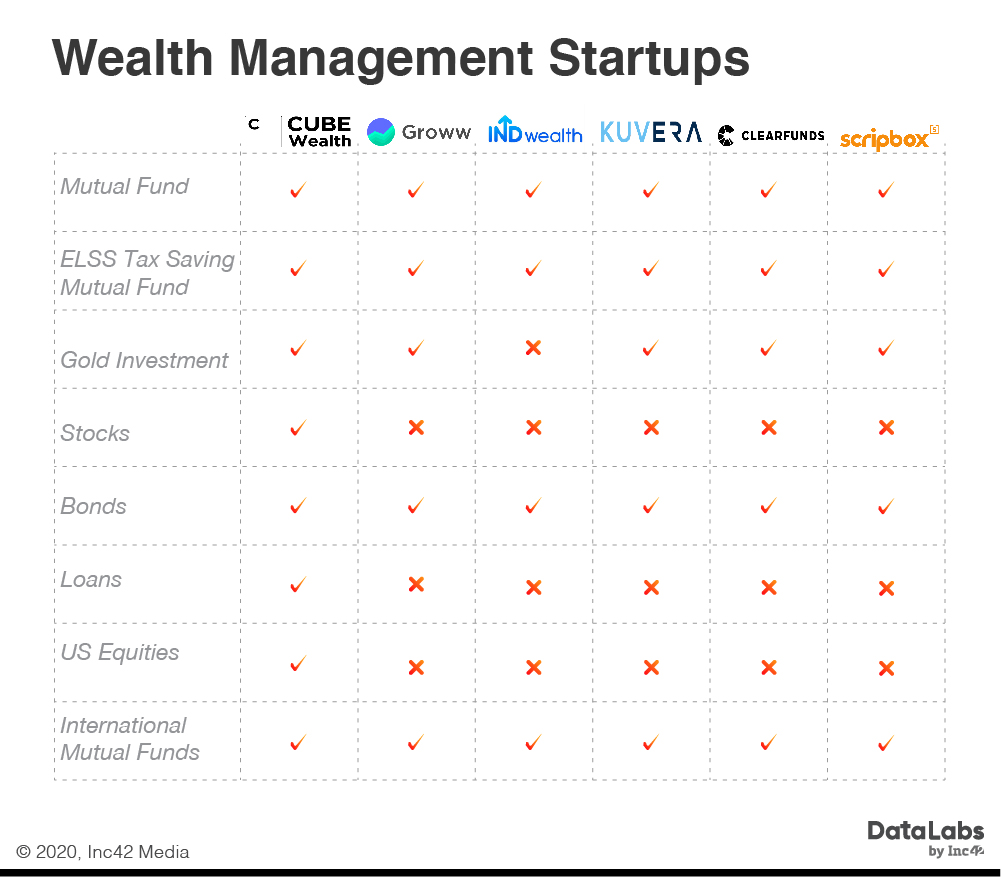

Inc42 presents a list of the 6 wealth management startups from India

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

With rising disposable incomes, Indians have changed how they invest their wealth and assets. No longer is it about trusting that one manager, but relying on data and a host of other indicators to make decisions. Often a computer running on numerous algorithms is taking these decisions for investors with the rise of automated wealth management.

A 2018 report by Confederation of Indian Industries (CII) estimates that Indian mutual fund market will grow at a CAGR of 18% to reach an asset under management (AUM) of INR 50 Lakh Cr by 2023.

Factors such as increased awareness about mutual funds, investor-friendly regulatory environment and rising digital and financial literacy are expected to be the major drivers of this growth.

Further, a report by Deloitte India predicts that Indian wealth management network is all set to boom and that by the end of 2020, 21 paise out of every rupee invested in mutual funds will likely be through online portals.

This major shift to digital investments can be attributed to the superior customer experience, less time, and the zero-to-low cost of trading in equities and mutual funds, which has especially attracted investments from the middle-class.

Moreover, the digital wealth management space also provides varied features like investment advisories, curated investment options, algo-trading, backtesting, and free access to research reports. All this is making wealth management and investments much frictionless for busy urban Indians. And many startups are making the most of this opportunity, thanks to the rise in adoption of fintech services.

Going From Gold To Wealth Management Startups

Cube Wealth

One of the latest investment products launched by Cube Wealth lets Indians invest in stocks listed in the US, Europe and other countries, which was earlier a complicated process for investors in India. This service was added to the platform launched last year in partnership with Stockal, a New York and Bengaluru-based platform that enables investments in a diverse set of global assets from a single account, from anywhere in the world.

The wealth management platform also provides a dedicated ‘wealth coach’, who provides personalised guidance for any investments. One of the interesting features of the platform is that it provides a free custom investment portfolio for users based on multiple factors such as monthly savings and expenses, goals, among others.

Founded in 2018 by Satyen Kothari, who had previously founded Citrus Pay, Cube Wealth also provides experienced investment managers to manage investments of high net worth individuals (HNIs).

With the data security experience gained at Citrus Pay, Kothari said Cube Wealth has been so far successful in securing investor data at the device, server, and database-level. It also performs due diligence of each investment manager to minimise investor risk.

Groww

Besides offering investors an objective evaluation of all the mutual funds available in the market, Groww is looking at educating investors about the various risks involved in each portfolio through Groww Assist. The company’s SmartSave product is an investment product fashioned like a bank account, where customers can withdraw their investments.

While Groww offers zero commission for investing in direct mutual fund plans, it is planning to monetise the next set of products which will be launched on the platform soon. The company said that it is planning to go multi-product, starting with stock investing which has been recently launched on the platform. As of now, Groww is also not charging any transaction fee for buying stocks.

Currently, Groww has over 4.5 Mn users on the platform. The Bengaluru-based startup has partnered with 40 asset management companies (AMCs) and claims to be offering mutual funds from all categories.

INDWealth

The startup empowers its clients with the right data to organise and track their wealth across investments, loans, expenses and taxes.

Based on data collected from clients, INDWealth’s platform provides machine learning-driven recommendations along with researched investment products to improve their financial future and cash flows. With the help of AI, the platform analyses investments and loans to provide clients with recommendations to switch portfolio or prepay for the existing ones.

Founded in 2018 by serial entrepreneur Ashish Kashyap, Pratiksha Dake and Varun Bhatia, INDWealth has also enrolled certified wealth advisors that get mapped to every user family.

Further, the company also launched a wealth advisor facing web application thereby curating communication and feedback loops between the customers and advisors. Besides wealth managers, INDWealth has also onboarded chartered accountants and compliance officers to help the clients with tax management.

As of now, Kuvera doesn’t charge any transaction fees to its users for making an investment in mutual funds through the online platform and mobile application. The company claims to be managing assets under advisory worth INR 7K Cr in mutual funds with more than 500K investors.

Kuvera claims that the first phase of its expansion came only through word-of-mouth growth. Following this, it added new features such as consolidating existing portfolios, facilitating easier switching to direct plans, allowing families to invest and plan together.

The startup also tailors financial advice based on the customer’s needs. The company allows users to switch from regular mutual funds to direct mutual funds, lowering the cost of investment. The company claims that about 35% of its users are first-time investors.

Kuvera was founded in 2016 by Gaurav Rastogi and Neelabh Sanyal. Before starting their entrepreneurship journey, Rastogi and Sanyal were investment bankers. Using their banking skills, and leveraging the tech opportunities around AI and algorithm-based investments, they created Kuvera.

Clearfunds

The company also offers a fully-automated investment advisory service ‘Smart Portfolio’, which has been designed to make investing easy for everyone. The platform uses algorithms to build, monitor and rebalance diversified mutual fund investment portfolios, which fulfil the customer’s checklist— stated goals, time horizon and risk tolerance.

There’s no fee involved when a user invests either a lump sum amount at once or goes for a monthly systematic investment plan (SIP). After its acquisition in 2018 by payments company MobiKwik, Clearfunds has also added investment in digital gold as one of the investment tools on the platform.

The statistical algorithm of Clearfunds which uses big-data tools to crunch millions of data points with one goal which is to recommend their customers with best performing funds according to their needs.

It provides access to over 3000 direct mutual fund schemes across all 36 mutual fund companies. The platform has partnered with fund analytics company Morningstar to provide their clients with information related to performance, ranking and star-ratings of all mutual funds available in India.

Scripbox

The startup selects the funds through a quantitative and qualitative algorithm, which helps to eliminate selection biases arising out of vague advice and a plethora of information available through varied sources.

Scripbox also doesn’t charge any fees to its customers. Instead, the startup earns a commission from the mutual fund companies over the life of the investment which covers the cost of providing its services.

Founded in 2012 by Ashok Kumar and Sanjiv Singhal, Scripbox claims to be managing over INR 1.1K Cr worth of investments from its customer base spread across 1.2K Indian cities and towns. According to the company, 70% of the investors on its platform are millennials, while 29% of the overall base is made up of women investors. It claims to be working with most major mutual funds in India.

In 2020 and beyond, the startup wants to continue to build on the foundation and expand the scope of its services to other consumer segments as well. It will also be adding more algorithms to the platform to make investments easier and simpler.

Key Highlights

Funding Highlights

Investment Highlights

Acquisition Highlights

Financial Highlights

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.