Within a month, the real money gaming industry is feeling the impact of the new GST regime on revenue as well as user spending

Online poker platforms are the worst affected by the changes, followed by rummy platforms

While well-funded platforms are absorbing the increase in tax for now, it seems to be only a matter of time before they too start feeling the heat

The Indian online real money gaming industry is used to being in the eye of the storm. From periodic bans by various state governments to uproar from a section of society, the homegrown online gaming industry has somehow always endured and made its way through choppy waters.

While the regulatory shenanigans are nothing new, what came as a bolt from the blue was the GST Council’s decision to impose 28% Goods and Services Tax (GST) on the sector, sending all stakeholders in a tizzy.

The move thrusted the entire online real money gaming ecosystem in a state of flux as the focus suddenly turned from fearing adverse regulations to a long bill of tax evasion. What followed was a bloodbath that left many jobless and brought down the shutters on many gaming companies.

The aftermath was largely in line with what industry stakeholders predicted as the looming taxation challenges and a flurry of notices took the sheen away from a sector that once basked in glory. And all of this happened in a span of a few months, courtesy a single order from the GST Council.

The Council, in July this year, announced its decision to impose a 28% GST on the amount being paid at the entry level for online gaming. In August, amendments to the Central Goods and Services Tax (Amendment) Bill, 2023 and the Integrated Goods and Services Tax (Amendment) Bill, 2023 were approved by the GST Council. Later, the Parliament approved these amendments.

Finally, real money gaming platforms entered the new tax regime on October 1. While some states are yet to amend the GST law, they would apply the amendment retrospectively from October 1.

In line with the predictions, the increase in taxation seems to have an immediate impact on the online real money gaming industry and startups in the sector are reeling due to squeezed margins, decline in user spending, and no clarity about the future path.

Poker Bears The Brunt – Most Impacted Sub-Segment

While at least a full quarter is needed to understand the complete impact of the changes in GST law, its effects are visible in the revenue margins and user spending of gaming platforms within a month of the changes coming into effect, according to industry stakeholders.

Platforms that offer online poker games are the most impacted by the changes in taxation, as per industry sources. The reason behind this is that the platform fee for poker used to be lower, at around 3-4%, as against 10%-15% for rummy and above 15% for many fantasy gaming leagues.

While poker platforms are absorbing some of the impact of the increase in GST rate for now, they have started passing on some of the increase to the users by charging 4%-5% higher platform fee. As a result, many of the platforms have not only seen a 10%-20% decline in their user base but also a 20% fall in their user margins.

It must be noted that online poker platform Spartan Poker fired 125 employees or 40% of its total workforce after the new tax regime kicked in. It was not immediately clear which departments were impacted by the company’s retrenchment move.

Rummy is the second most affected segment in real money gaming, as per the industry sources.

Meanwhile, the ongoing men’s cricket World Cup seems to be acting as a shield for fantasy gaming platforms, as they have not seen any impact of the new tax regime so far. However, it seems it is only a matter of time before these platforms too begin to feel the heat. For now, the prominent fantasy platforms, many of which are well funded, are absorbing the increase in cost, but this is, of course, not a long-term solution.

Disappearing Offers & Bonuses Impact User Sentiment

An official of an online rummy platform pointed out that the current practice of absorbing the increase in costs is not a sustainable solution.

The decision to tax online real money gaming platforms at 28% on full face value will hit the bottom line of all the players in the industry, no matter how well funded they are, he explained. He added that the impact of the new tax regime is already visible as not only has the number of users depositing money on these platforms decreased but also the quantum of deposits for the platform he works with.

To recap, under the new regulations, a flat 28% tax applies to the total value of bets for online games, irrespective of whether they are games of skill or chance. Previously, a lower 18% GST was levied, specifically on the platform fee for skill-based games. For instance, with a platform fee of 20% on a INR 100 bet, the GST under the previous tax regime would be INR 3.6 (18% of INR 20), which has now shot up to INR 28.

“There is a percentage of users out there who are just not happy with this new regime. If we are subsidising this 28% tax, the kind of offers and bonuses that the industry used to provide players cannot be provided any more. Users are not happy with this and there is a clear drop there,” the aforementioned official said.

Revenue Estimates Revised Downwards

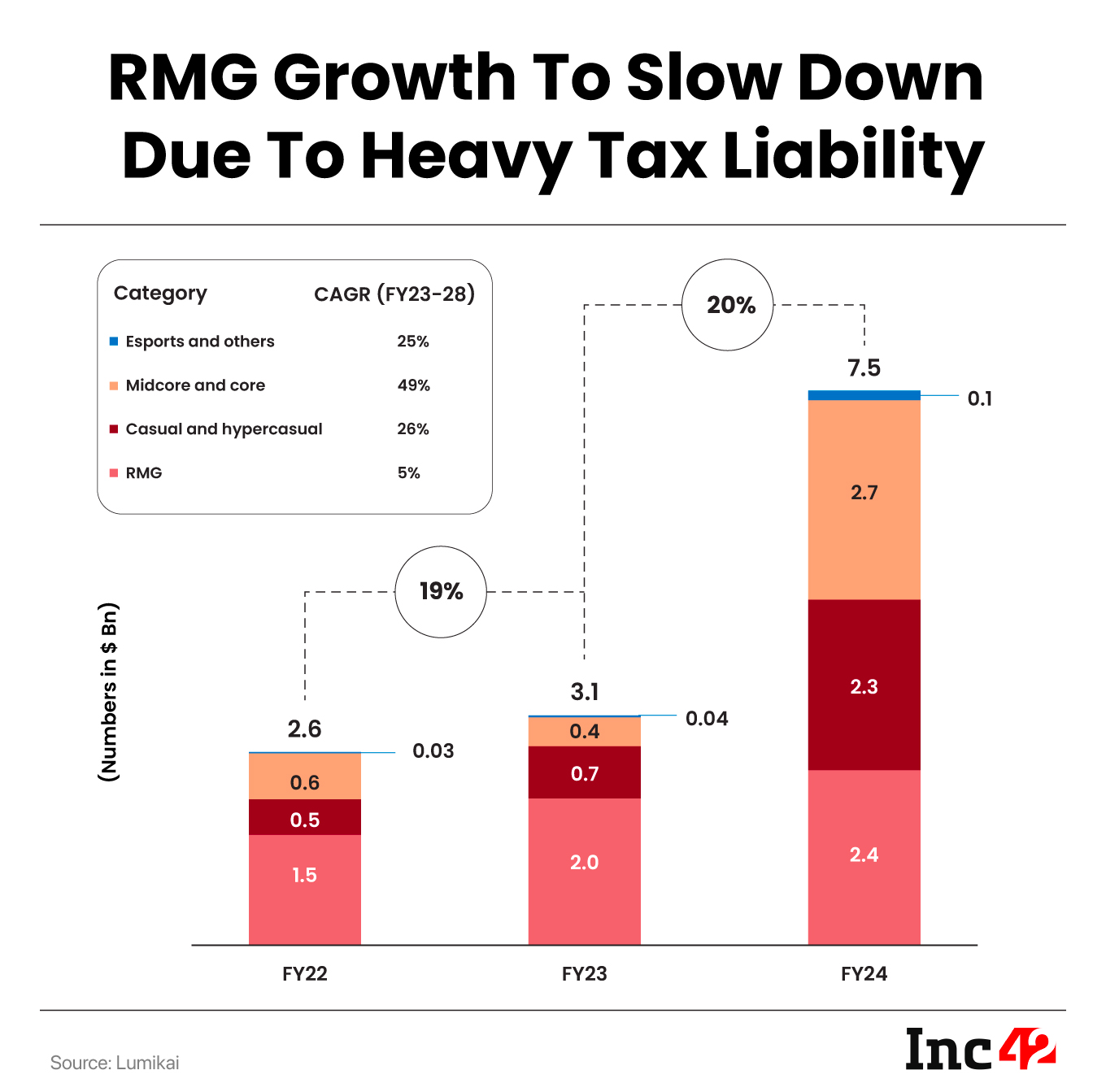

The real money gaming sector has been a key revenue driver for the overall Indian gaming industry. However, as the new GST regime begins showing its impact on the online real money gaming sector, the overall growth projections for the Indian gaming industry are being revised downwards.

In a recent report, Lumikai, a gaming-focused venture capital fund, which last year said the Indian gaming industry would have a revenue of $8.6 Bn by the end of FY27, said it now expects this number to be at $7.5 Bn by the end of FY28.

The Indian online real money gaming industry, which generated a revenue of $3.1 Bn in FY23 and grew at a robust 33% during the year, is likely to see a sharp slowdown in growth as recent taxation policies are anticipated to impede further expansion, it said.

The Indian online real money gaming industry, which generated a revenue of $3.1 Bn in FY23 and grew at a robust 33% during the year, is likely to see a sharp slowdown in growth as recent taxation policies are anticipated to impede further expansion, it said.

“Growth in RMG over the coming years is expected to be muted due to recent tax policies and industry consolidation,” the report added.

Inc42 earlier reported that a consolidation wave in the online gaming industry is expected due to the new tax regime. However, the landscape has shifted, with major industry players now facing show-cause notices for alleged tax evasions.

Such has been the impact of the move that Dream Sports, which runs fantasy gaming platform Dream11 and is among the few profitable players in the segment, is also considering diversifying into sectors like sports commerce, content, fitness, among others.

Additionally, there has been no update on the regulatory front so far despite the industry filing applications for self-regulatory organisations (SROs) in July. As such, the future of the sector seems to be hanging in balance.

Ad-lite browsing experience

Ad-lite browsing experience