The overall Indian real estate market is expected to reach a size of $1 Tn by 2030, presenting ample opportunity for proptech startups

This new wave of proptech startups have brought a larger degree of transparency, streamlined transactions and ease of experience to the real estate sector

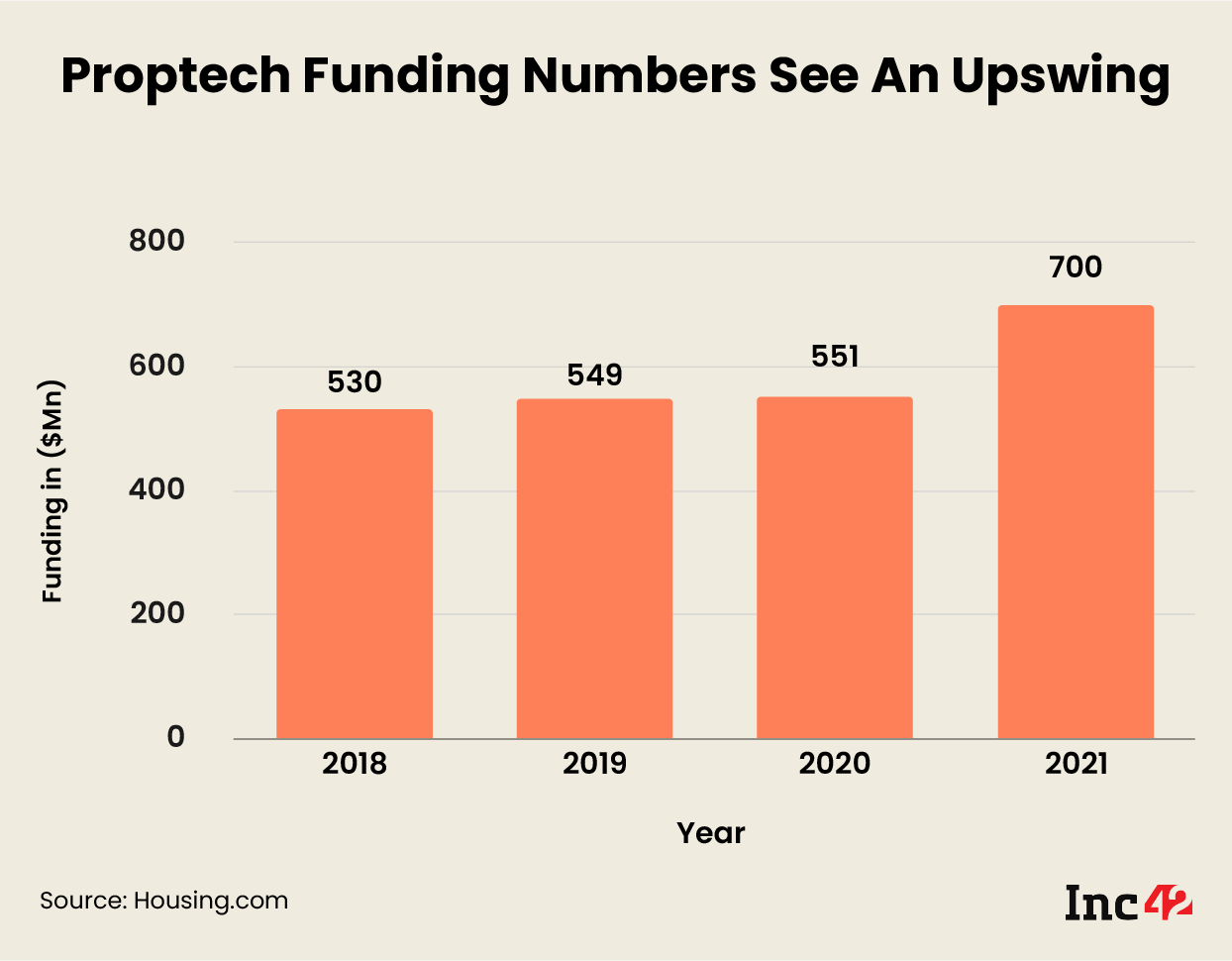

According to a report, Indian proptech startups garnered more than $3.2 Bn in funding across 255 deals between 2009 and 2021

The current age of consumer internet has rejigged the quintessential basic Indian needs of ‘roti kapada, aur makaan’ (food, clothing and shelter), with convenience becoming of utmost important. While online apparel stores and foodtech giants have captured the imagination of the country, real estate still appears to be waiting for its major revolution.

Buying their own home is a dream for almost every family. The real estate sector is also seen as a means of ensuring financial security. Be it buying, selling, leasing or even renting, the space touches almost every aspect of an individual’s life. However, real estate management continues to be the playground of a select few brokers and agents.

Many have noted that the presence of these intermediaries makes the entire process of owning or renting a property ‘tedious’. These issues led to the emergence of the proptech sector in the country over the last few years. Fueled largely by the rapid urbanisation and the need for convenience, the first wave of proptech startups in India consisted largely of real estate aggregators or discovery platforms.

Most of them offered properties for sale or rent. Based on the premise of reducing intermediaries and offering more choices, platforms such as 99acres, Housing, Makaan and NoBroker caught the fancy of many users early on. The convenience factor especially became more pronounced in metros such as Mumbai where long hours of house hunting and high brokerage charges were the norm earlier.

These early players addressed the information asymmetry in the market and brought both buyers and sellers on a common platform. While buyers saved money which they would have paid to brokers, sellers found better deals and hassle-free accommodations.

This new era also brought with it a greater degree of transparency, streamlined transactions, and provided better access to data, something which was previously not the hallmark of the industry.

Discovery platforms, which formed the bedrock of the first phase of proptech evolution, allowed buyers, sellers, channel partners and developers to discover each other. As more and more users adopted these discovery platforms, more and more clean real-estate data flowed into the databases of these legacy proptech players.

Realising the value of this and the need for an organised market information and data analytics, many startups scaled up their offerings to include real estate market data services.

New entrants such as PropTiger built data-centric full stack platforms that leverage the element of ‘customer delight’. The result was customer-focused platforms that flipped the entire sector on its head with a tailored model catering to every specific user.

Since then, these players have ventured into new arenas, offering embedded insurance, financing and even instant liquidity to homebuyers. Essentially, these new-age companies have built a new line of portfolio to offer a plethora of new services in the sector.

This appears to have paved the way for the next phase of proptech evolution which will largely disrupt the actual transaction space and the services around the property market.

According to Homexchange CEO and cofounder Jesal Sanghavi, the next phase of proptech disruption will drive faster and sustainable growth in the real estate sector in the medium to long-run.

However, Landeed CEO and cofounder Sanjay Mandava believes that not much transformation has happened in the Indian proptech space. Noting that the country is merely at the beginning of proptech development, he said that the focus has largely been on building advanced tools for brokers or rentals and purchases of residential real estate.

The Pandemic Push

As COVID-19 pandemic swept the country, a peculiar situation emerged for the sector. Many labourers left cities in droves, while approvals for real estate projects saw multiple delays. The problem was compounded by reduced walk-ins and customers putting off sales owing to financial uncertainty.

The pain points continued to grow over successive Covid waves as sales dwindled and costs rose. This provided an opportunity to proptech players to address some of the issues. Leveraging digital penetration, many of these startups came up with products which optimised processes, enhanced outreach and improved consumer experience.

The digital transition saw many startups also deploying augmented reality and Metaverse to give remote tours of the properties. The ensuing transformation also saw some of these startups using emerging technologies such as artificial intelligence (AI), machine learning (ML) and blockchain to open up new avenues within the overarching real estate sector.

However, real estate is the biggest investment in their life for most of the customers and they prefer physically visiting multiple sites before making a final purchase decision.

Talking about the role of the proptech platforms in this situation, Sanghavi said, “Most customers, especially end users, will always visit properties. However, it’s the entire engagement with the customer and the forward and backward processes to complete a transaction, including discovery, initial assessment, shortlisting and closing that will quickly move onto tech platforms, thus, making the consumer journey short, transparent and hasslefree. In the years to come, smarter technologies that capture real time product and market environments will further dilute the tangibility issue.”

Other founders also told Inc42 that a digital approach would improve visit conversion ratio and could improve lifecycle of a real estate transaction.

Regulatory Issues

Regulatory red tape still appears to be a major hurdle when it comes to the real estate sector. From cumbersome zoning regulations to RERA norms, the space continues to be weighed down by heavy regulatory oversight. This also appears to have bogged down the proptech players.

Speaking to Inc42, proptech major Housing’s group CFO Vikas Wadhawan said that there is a need for a single-window clearance system for the space. He added that such a mechanism would not only reduce the compliance burden, cost and speed of construction but also improve transparency and consumer confidence significantly.

A proptech startup cofounder told Inc42, on the condition of anonymity, that the regulatory environment is improving from a consumer perspective. Another cofounder said that blaming the regulatory environment for the lack of progress is “not much of a benefit to anyone” as the government itself is one of the stakeholders in the sector.

In response to a question, Wadhawan further added that the government can intervene and offer certain incentives to proptech startups during their early years.

“In the earlier two or three years when startups are bootstrapped and have limited capital, it would really help these new players to have lesser compliance burden or less stringent labour laws or to have rebates in terms of GST or income tax,” he said.

Despite the so-called scale, the proptech startups still operate in a space largely dominated by some of the biggest conglomerates in the country. Many real estate companies are decades old and bring with them considerable clout in terms of size and market insight, and the proptech players are dependent on these companies for success.

A close parallel could be the financial space. While fintech startups have aced the digital landscape, it is the banks that have provided the foundation for the emergence of these players.

Retorting to this situation in real estate, Sanghavi said, “Digital trends during Covid times have forced real estate companies to reach customers through digital channels, which is a hard trend to reverse. Therefore, most developers and construction companies have welcomed synergies with proptech players which will continue to grow the avenues and manner through which they engage with consumers and manage their own businesses.”

The Trillion Dollar Opportunity

The overall Indian real estate market is expected to reach a size of $1 Tn by 2030, presenting a huge opportunity for proptech startups disrupting the space.

According to a Housing.com report, Indian proptech startups garnered more than $3.2 Bn in funding across 255 deals between 2009 and 2021. The year 2021 turned out to be the best year on record, accounting for $700 Mn in capital inflow into the proptech sector.

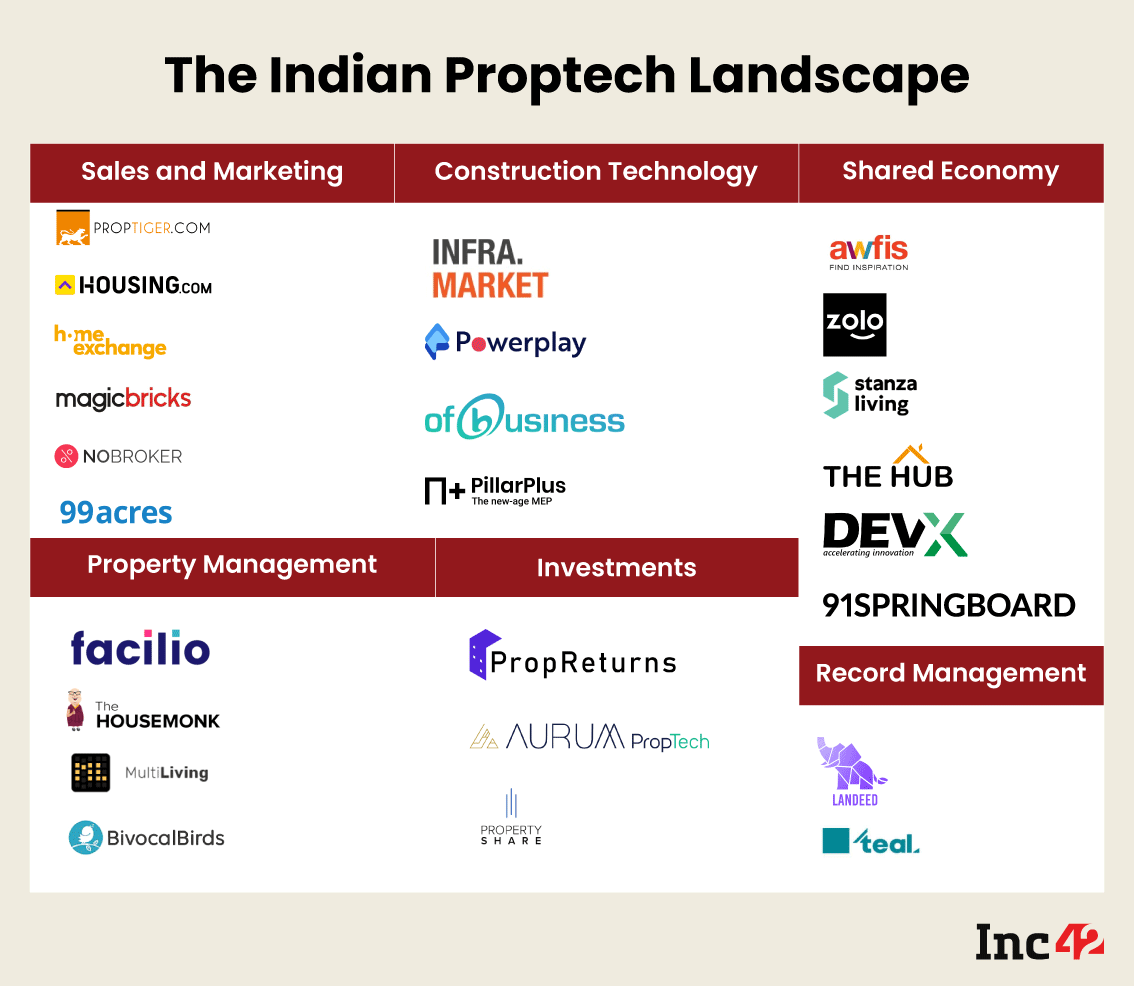

Within the larger proptech segment, sales and marketing as well as construction technology firms continued their stranglehold over the market. Private equity (PE) investments worth $742 Mn poured into the construction technology startups in 2021, while property management startups recorded a five-fold year-on-year (YoY) increase in PE funding numbers to $98 Mn.

Such was the growth last year that the proptech sector minted its first unicorn in the form of NoBroker after it raised $210 Mn in funding from Tiger Global and other investors.

However, the $700 Mn raised by the proptech startups last year was just a fraction of over $44 Bn pumped into the overall Indian startup ecosystem in 2021. While the investment in proptech has been increasing gradually over the years, many blame the lack of interest in the sector for the lower funding numbers.

“Often, most domestic investors view the proptech industry as a subset of fintech versus an industry on its own. This idea is a crucial reason why promising founders in the sector look at global partners, not domestic, when meeting their funding requirements. In India, there aren’t even a handful of proptech-focused investors that can support the scale in the country and the amount of funding flowing into this space compared to the market size is negligible,” said Mandava.

Amidst all this, the year 2022 saw proptech emerge from the shadows and clinch some of the major big-ticket deals. Earlier this year, Delhi-based coliving startup Stanza Living bagged $57 Mn in a debt funding round led by Kotak Mahindra Bank and RBL Bank.

Housing.com founder Rahul Yadav’s new venture Broker Network also raised nearly INR 90 Cr in funding from Info Edge. In February, Chennai-based Facilio secured $35 Mn in a Series B funding round led by Dragoneer Investment Group. Bengaluru-based real estate investment startup PropShare also bagged $47 Mn in funding from WestBridge Capital and Pravega Ventures.

A slew of major players have made a beeline for the sector. Recently, HDFC Capital’s tech platform (Housing and Affordable Real Estate and Technology) H@ART said that it has so far committed investments in 15 proptech startups.

This came close on the heels of the Confederation of Real Estate Developers’ Associations of India (CREDAI) and startup incubator Venture Catalysts announcing a $100 Mn proptech fund. Apart from this, Zerodha cofounder Nikhil Kamath-backed proptech accelerator Gruhas ASPIRE also picked up seven startups as part of its maiden cohort.

Overall, the Indian proptech arena has grown slowly and steadily despite the challenges. While the space has been seeing an increase in funding in recent times, it remains to be seen how it faces the challenges such as the ongoing funding winter, and apprehensions of an upcoming recession, among others. However, as internet penetration continues to grow higher, the ride forward appears to be about time-tested parameters such as sustainability and innovation.

As construction management platform Powerplay’s CEO and cofounder Iesh Dixit said, “India’s construction market is booming. As internet usage grows and more investment flows in, the main challenge now has shifted from demand side to supply side. How we offer the right product to the customer at the right price.”

While the future seems to be bright for the sector, only time will tell if the Indian proptech startups are able to make the most of the $1 Tn opportunity.

Ad-lite browsing experience

Ad-lite browsing experience