BYJU'S problems at the company are not about the leadership but about the lack of clarity on financials and its cash reserves. Is a new CEO enough to save the company?

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

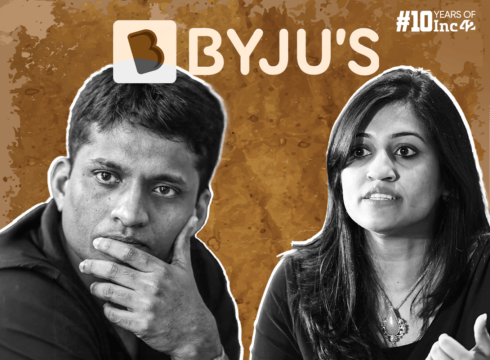

BYJU’S has lost the faith of its investors and BYJU’S has very likely also lost Byju Raveendran.

If the all-important Karnataka High Court order comes against BYJU’S, we could see sweeping changes at the edtech giant. And after all the drama and the media war of the past week, we wanted to see whether a change in guard could change things for the troubled company.

How does that change things for the edtech giant? Will it solve all the long-pending issues at the company? What else needs to be fixed before one can claim that everything is alright with BYJU’S?

These are the questions we are pondering this weekend. But as usual, first we will dive into the other big stories from this past week:

- Avaamo’s GenAI Bet: Enterprise tech startup Avaamo is making a big play for the GenAI world and debuting its product suite with Indian IT giant Wipro, the largest GenAI deployment globally. Here’s the Avaamo story

- Mumbai’s Startup Spirit: Can India’s financial capital pull itself up the startup charts to catch up with Bengaluru and Delhi? A group of unicorn founders from the city certainly think so, but here’s why it won’t be an easy path

- Spacetech Boost: The Indian government has fulfilled a long-standing demand of spacetech startups by allowing up to 100% FDI via the automatic route for certain sub-segments

The Battle Will Go On

Before we look at how BYJU’S might change, we must clarify that the resolutions passed at the company’s reportedly chaotic extraordinary general meeting (EGM) are not final yet. As we had reported earlier this week, the Karnataka High Court has the final say in the matter and the decision is likely to come on March 13.

In a letter to employees on Saturday (Feb 24), CEO and cofounder Byju Raveendran claimed, “I continue to remain CEO, the management remains unchanged, and the board remains the same. Put differently, it is “business as usual” at BYJU’S.”

The letter goes into detail about the illegalities of the EGM and that resolutions were passed in violation of the company’s Articles of Association and Shareholders Agreement (SHA). It ends in florid language that’s become typical of Raveendran’s communications in recent months. “To reemphasize, the rumours of my firing have been greatly exaggerated and highly inaccurate,” he claimed.

But let’s assume these are not exaggerations. Will BYJU’S bounce back simply with a new Group CEO or board?

New Leadership, Same Old Problems?

One of the curious things about the investor-led EGM is that it does not directly address the fundamental issues at BYJU’S. The problems at the company are not about the leadership but about the lack of clarity on audited financials and its cash reserves.

As Inc42 reported exclusively earlier this month, the edtech giant is expected to report total revenue of around INR 6,500 Cr in FY23, and it has touched a revenue of INR 3,500 Cr in the first six months of the ongoing fiscal year (H1 FY24).

But these are unaudited numbers. Given that we don’t have a clear picture of the FY23 and FY24 financials, is there a possibility that the company is in a worse position than what the investors believed ahead of the EGM?

The company is currently said to be seeing close to INR 200 Cr in monthly sales, but revenue collection challenges persist due to the discontinuation of partnerships with non-bank financial company (NBFC) lenders.

BYJU’S net loss surged 81% YoY to INR 8,245.2 Cr (close to $1 Bn) in FY22 as WhiteHat Jr and other loss-making acquisitions continued to weigh down the bottom line. In FY22, the startup’s total expenses nearly doubled to INR 13,668 Cr.

Whoever is in charge of the company first needs to fix this severe imbalance. A rights issue of $200 Mn or $300 Mn is not about to save the company as much as it would help keep it afloat for a few more months.

Another interesting point from a Bengaluru-based investor: What can BYJU’S do with $300 Mn that it couldn’t with more than $1.5 Bn in the past two years?

In comparison to the Term Loan B and the separate loan from Davidson Kempner, the rights issue is a drop in the bucket and might not be enough to even keep BYJU’S core online learning business ticking, let alone the offline business (BYJU’S Tuition Centres, Aakash) or higher learning (Great Learning), besides subsidiaries like WhiteHat Jr or US-based Epic.

Despite downsizing over multiple rounds since 2022, the company currently has over 35,000 employees. That itself will be a huge monthly expense for the company and $300 Mn will not go a long way with that employee base.

WhiteHat Jr in particular is bleeding heavily with its own losses; what is the plan to change this? BYJU’S lent INR 2,526.40 Cr to WhiteHat Jr in FY22, of which INR 1,735.05 Cr was due as of March 31, 2022.

In FY22, the coding edtech startup saw a 25%+ drop in revenue from INR 484 Cr to INR 356 Cr, and WhiteHat Jr’s standalone losses increased to INR 2,692 Cr from INR 1,690 Cr. The company’s losses themselves are INR 2690 Cr or over $300 Mn.

The WhiteHat acquisition has continued to underperform for BYJU’S despite being one of the biggest deals in the Indian startup ecosystem.

While the dispute between the management and investors is far from settled, how much can a potential new CEO do given this incredibly weak financial state? Plus, a new CEO will not solve the issues overnight; whoever takes charge of the company will need to get familiar with the operations, embed themselves within the company’s culture and perhaps even reshuffle some of the key managerial positions.

The company saw a new India CEO Arjun Mohan in September 2023, but the problems over the past few months, call for new leaders across all subsidiaries in the group.

Will BYJU’S Still Offload Assets?

Now let’s look at the potential sale of Great Learning, Aakash, Epic as reported in the past few months.

First, Aakash. Ranjan Pai, the chairman of the Manipal Education and Medical Group (MEMG), emerged as something of a white knight for BYJU’S when he infused $300 Mn as debt in the offline coaching entity last year, which was converted into 40% equity.

Reports indicate he is likely to infuse another $60 Mn over a period of time into the unit, where he is already the largest shareholder. Prosus, the lead external investor in BYJU’S parent Think & Learn, sent a legal notice to Pai over the latter’s conversion of debt into equity in Aakash.

Prosus is also part of the group of investors that moved the NCLT to sue Raveendran and cofounder Divya Gokulnath for mismanagement and suppression of facts, raising concerns about BYJU’S loss of control over Aakash.

Given his stake in the company, Pai and MEMG are in the pole position to take over Aakash, especially if BYJU’S efforts to raise funds fail. Given this context, a new CEO or board at BYJU’S is unlikely to have any influence on the course of events at Aakash.

The ownership of Great Learning, which BYJU’S acquired for $600 Mn in 2021, is also uncertain. As per the EGM notice, investors in BYJU’S are particularly aggrieved about the so-called failures of the management to disclose a notice of default from Great Learning in April 2022 and its consequences which had a material impact on the value of the group.

Given the default notice, it’s unclear if BYJU’S completed the transaction for Great Learning, just as questions were raised by Blackstone about the company not adhering to terms of the Aakash deal.

Neither BYJU’S nor its investors responded to questions about the default, but in October last year, reports indicated that Great Learning founders Arjun Nair, Hari Nair, and Mohan Lakhamraju held talks with investors to buy the company back from BYJU’S. The three founders are negotiating an additional equity stake with an investor consortium if the potential buyback goes through.

Epic, which is based in the US, is also on the chopping block, with BYJU’S looking to offload the company, but it is likely to have a problem selling the $400 Mn valuation it’s seeking for the deal.

Like we wrote ahead of the EGM, BYJU’S various acquisitions over the years have proved to be a costly and deadly gamble. Neither of these high-value acquisitions has proved to be anything but a burden on the company, and now given its weak financial state, it has also lost control over some of these assets, which were once quite promising.

Even if Byju Raveendran is cast away from the CEO role by the investors, these acquisitions will continue to be a big headache for the potential new management.

A Legacy Tarnished?

BYJU’S might survive the current malevolence, Raveendran may end up being just a shareholder and not the CEO, but there are questions about the legacy of the once-celebrated founder.

Let’s not forget the way dirty laundry got aired in the media over the last week. If the high court turns down the company’s petition, the battle is likely to continue, and will further tarnish the image of the company.

Even as the management battles with investors, no one is talking about the customers. Will the company have to refund more of its users in the next few weeks? And new customer acquisition is likely to become extremely hard for BYJU’S putting the survival of the company in further jeopardy.

Some might say that the founders need to step away to preserve their legacy, the positive trajectory of the Indian tech economy and the startup ecosystem.

The fact is that BYJU’S scaled the heights till 2022 because of Raveendran’s brand equity as well as his leadership. A new CEO might save the company, but does the fact that he was replaced tarnish the legacy of Raveendran?

As many investors have told us in the past two years — amid corporate governance scandals — founders need to realise they can only take a company so far before an external professional CEO has to step in. Especially, when the company has grown much beyond anyone imagined at the early stages.

Flipkart’s acquisition by Walmart saw founders Sachin Bansal and Binny Bansal step away, as Kalyan Krishnamurthy took over. BharatPe’s governance issues saw Ashneer Grover ousted as MD, and Suhail Sameer resigned in just a year as CEO, with professional management with relevant financial services experience stepping in.

We predicted in 2023 that the ecosystem-wide focus on sustainability and profitability will force scaled-up startups to go beyond founder vision and look for operational efficiency. Growth and late stage startups with monetisation or bottom line challenges need a change of guard, and corporate governance debacles required investors to curb founder influence on operations.

But this does not tarnish the legacy of the founder themselves. No one believes, for instance, that the Bansal duo did not create Flipkart to become an attractive target for Walmart. Similarly, BYJU’S is likely to survive and even thrive without Byju, but it does not diminish the legacy of Raveendran and Gokulnath.

Startup Spotlight: 30 Startup To Watch (January Edition)

As we usher in 2024, our drive to discover early-stage Indian startups is growing, as seen in the 43rd edition of 30 Startups To Watch. What sets this cohort apart is that more than 70% of the featured startups have secured funding below $2 Mn.

In this edition, we have selected startups from a broad array of sectors, going from the ‘traditional’ startup segments of fintech, ecommerce and enterprise tech to new disruptors such as GenAI, electric vehicles and cleantech.

In line with industry-wide trends, a significant portion of this cohort is bootstrapped, signalling in no uncertain terms that raising funding is secondary to driving innovation for a startup.

Sunday Roundup: Tech Stocks, Startup Funding & More

- A Trickle Of Funding: Indian startups collectively raised $110.4 Mn across 15 deals this past week, with Rentomojo leading the list as funding in February inches close to the $500 Mn mark

- Swiggy’s IPO Dreams: IPO-bound Swiggy is changing its registered name from Bundl Technologies Private Limited to Swiggy Private Limited ahead of its potential public listing this year

- Blinkit’s Big Run: Zomato-owned quick commerce platform Blinkit is on the verge of venturing into new categories as it aims to compete with ecommerce marketplaces Amazon and Flipkart

- Uber Backs ONDC: India is one of the toughest markets, claimed Uber CEO as the ride-hailing giant jumped on the ONDC bandwagon

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.