Prosus’ representative Gunjan Shukla chaired the EGM. Sources close to the development claimed that 30 investors were present at the EGM

The validity of the EGM and the resolutions passed will now be decided by the NCLT and Karnataka High Court, and there won’t be any immediate implications of their resolve

Inc42 has access to a copy of the resolutions passed at the EGM on February 23, 2024

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

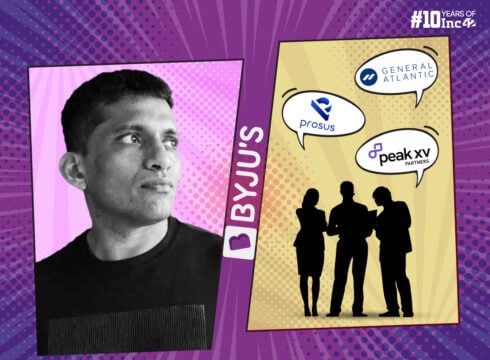

The promoters of BYJU’S and the investor group, comprising Prosus, PeakXV, General Atlantic, Sofina, Chan Zuckerberg Initiative, and Sands Capital, will now be locking horns in the NCLT and the Karnataka High Court over the control of the troubled edtech giant.

The crucial extraordinary general meeting (EGM), which was held on Friday (February 23), started on a turbulent note, with many company employees allegedly impersonating shareholders.

Amid the emotional appeals made by BYJU’S employees — “We want Byju sir. Byju Sir is the soul of the company…” — the meeting officially started with a roll call and reading of the resolutions.

Prosus’ representative Gunjan Shukla chaired the meeting. Sources claimed that 30 investors were present at the time. Inc42 could not independently verify the claim.

Even as the investor group stated that shareholders unanimously agreed to the ouster of Byju Raveendran as the company CEO, the edtech firm said in an official statement that the EGM did not have the required quorum as entailed in the Article of Association or shareholders’ agreement to carry out the EGM, therefore any resolution passed during the EGM remains ineffective.

BYJU’S statement added that the resolutions passed at the EGM had also been “invalidated” by the Karnataka High Court, which in its order stated that any resolutions passed would remain ineffective till March 13 — the next hearing date.

Meanwhile, sources claimed that the validity of the EGM and the resolutions passed will now be decided by the NCLT and Karnataka High Court, and there won’t be any immediate implementation of the resolutions.

The following resolutions were passed by the investor group at the EGM on February 23, 2024. Inc42 has accessed a copy of the resolutions passed, which reads:

The investors…

- Resolved that the approval of shareholders is hereby accorded for the Company and Board to consider changes to the current Board structure to ensure adequate representation by shareholders and approved independent input is taken into account so that adequate measures can be implemented within the Company to improve corporate governance and correct lack of compliance with respective agreements being undertaken by the Company.

- Resolved further that approval of the shareholders is hereby accorded to the Board of Directors to come to an agreement with the Observers (as defined in the SHA) to identify and recommend to the shareholders a new Board structure to include nine members (1 founder, 2 executives from within the group companies, 3 shareholders and 3 independents) to be appointed as directors on the Board of Directors of the Company, at a subsequent meeting of the shareholders, no more than thirty (30) days from the date of this EGM.

- Resolved further that the approval of shareholders is hereby accorded for the Company and Board to appoint, within a period of thirty (30) days from the date of this EGM, a forensic expert (from amongst the Big 4 Accounting Firms or any of the top 10 national law firms) to investigate various actions including with respect to acquisitions, alleged breaches, regulatory affairs, tax filings and any payments made by the Company and to record any requested recommendations for improvement.

- Resolved further that the approval of the shareholders is hereby accorded to the Board of Directors to consider immediate changes in the management of the Company to prevent further dilution of value to the shareholders by removing Byju Raveendran as CEO, and removal of both Divya Gokulnath and Riju Raveendran from their respective management roles and as directors and as signatories on any bank accounts, and to consider further changes in management leadership of the Company keeping in mind the exigencies of the business in view of the performance of the founders and current executive team.

- Resolved further that the approval of the shareholders is hereby accorded to the Board of Directors to agree with the Observers (as defined in the SHA) to identify an appropriate interim Chief Executive Officer or entity to manage the affairs of the Company, as well as a search firm to identify and consider potential candidates with experience in handling a group of this size and nature, for appointment as Chief Executive Officer of the Company, within 10 (ten) days from the date of the EGM and to consider further changes in management leadership of the Company keeping in mind the exigencies of the business in view of the performance of the founders and current executive team.

- Resolved further that until further notice, given the state of the Company’s affairs, continued breaches of its obligations and inability to properly resolve key issues facing the Company, no Founder (as defined under the SHA) of the Company should be permitted to undertake any direct or indirect transfers of any shares, rights, title or interest in any subsidiary, associate companies etc. including Aakash) without the approval of the shareholders of the Company.

- Resolved further that the executive members of the Board of Directors be authorized to take such further actions as may be necessary to implement the aforestated resolutions, in the best interests of the Company without prejudice to the interests of any stakeholders.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.