With its product expansion in recent months, BharatPe is pulling into the fintech super app race with the likes of Paytm, PhonePe, CRED and Google Pay

CFO Nalin Negi claims BharatPe merchant-first approach will prove to be vital to fight off the competition, most of whom have adopted a consumer-first strategy

A sequence of steps have led to EBITDA profitability, not just in terms of strategies, but also on the governance front, says BharatPe board member and Peak XV Partners MD Harshjit Sethi

All roads lead to Rome, and for India’s fintech startups, Rome means owning every inch of the value chain. In the case of BharatPe, the past year has been all about joining the great Indian fintech convergence while also shedding a lot of baggage.

That baggage is of course the persistent controversy around former MD and cofounder Ashneer Grover, facing not only a BharatPe

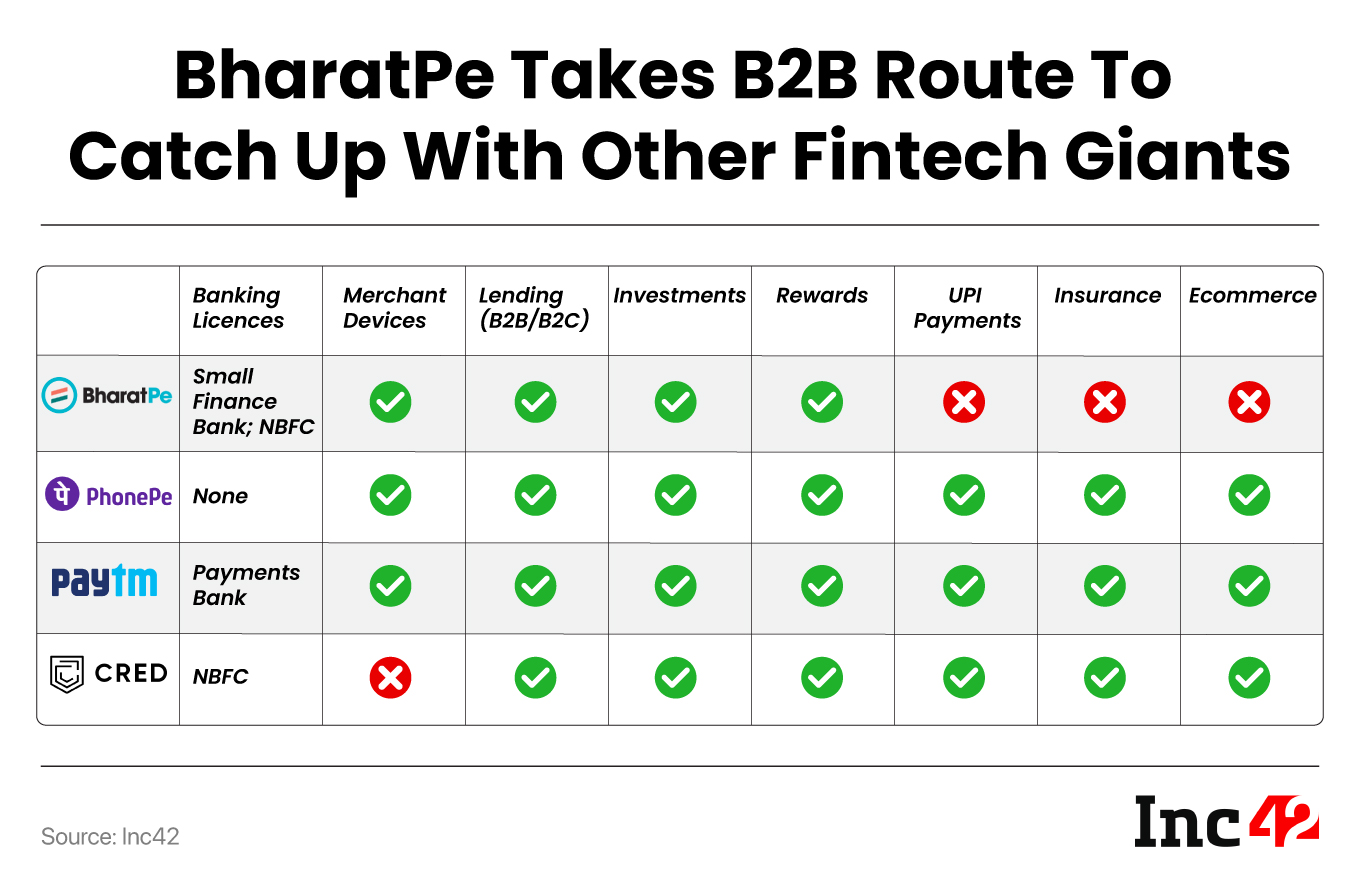

But looking to move on from that, the unicorn gave us a glimpse at its financial state earlier this week, and it’s becoming increasingly clear that the future for the company is similar to that of others such as Paytm, PhonePe, CRED and Google Pay. But instead of a consumer-first approach, BharatPe has stuck to its primary B2B strategy.

The current org structure sees former SBI Card CFO Nalin Negi at the top as the chief financial officer and interim chief executive officer.

Negi took over after the exit of Suhail Sameer in January this year, who quit the post just 16 months into the job. Negi himself only came on board in August 2022, and five months later, was handed the CEO role.

And since then, BharatPe has looked to go leaner on costs by getting the right lending partners for the capital, managing acquisition costs, servicing costs and generally bringing in efficiencies in the lending process, which is the biggest contributor to the profitability.

But the competition in the fintech sector is tough and BharatPe’s route to success crosses the likes of Paytm, PhonePe, CRED, Google Pay and others.

With a mix of merchant-focussed services and lending, as well as relatively new B2C verticals, BharatPe is looking more and more like a super app. And in doing so, it’s entering some uncharted territory. That’s the first complication.

At the same time, the problems of the past year mean that the company has not had a full-time CEO for nearly a year and lost several key personnel in the past year. And this is a company that is looking at a public listing in 2025 as per those close to the management, banking on the momentum of the past year.

Behind BharatPe’s Positive EBITDA

“Now our focus is on scaling the business by disbursing more through our partners and acquiring more merchants. There’s room for improvement in both revenue and costs, but this [positive EBITDA] is the first step and we have the right product mix to accelerate,” interim CEO Negi told us.

BharatPe said in a press statement this week that its annualised revenue crossed INR 1,500 Cr till October in FY24, a 31% increase from FY23. The startup claims to have significantly cut down its EBITDA burn which was averaging INR 60 Cr per month in FY23.

It must be noted that BharatPe’s audited financial statements have not yet been released.

Peak XV Partners’ managing director Harshjit Sethi and a BharatPe board member told Inc42 that the Indian fintech opportunity remains deep and underserved. Sethi said that was true five years ago when Peak XV (then Sequoia) invested in BharatPe and the thesis is relevant even today.

Millions of new merchants are coming under the financial services umbrella and a host of competition is targeting the merchants segment. But both Negi and Sethi are confident that there have been systemic changes in the company that will be key in the long run.

There is a sequence of steps that have led to this EBITDA profitability, which is not just in terms of the strategies, but also on the governance front in the past year, Sethi added. He pointed to the board appointments of former RBI deputy governor BP Kanungo and Thought Arbitrage Research Institute (TARI) founder Kaushik Dutta in September 2022.

He was also quick to remind us about the NBFC licence BharatPe acquired in a watchful regulatory environment in May 2023.

“I don’t think any other fintech company in India has a former deputy governor of the RBI on its board. We felt that this [the time after the Grover controversy] was an opportunity to truly improve and learn from mistakes. So as the board we ripped the band-aid and fixed as many things as we could and focussed on long-term sustainability.,” the Peak XV MD added.

B2B — BharatPe’s Trump Card

BharatPe is not the only fintech giant eyeing the merchant space — PhonePe, Google Pay, Paytm, Amazon Pay are all accelerating fast in this regard with the launch of ‘soundboxes’ and other PoS devices.

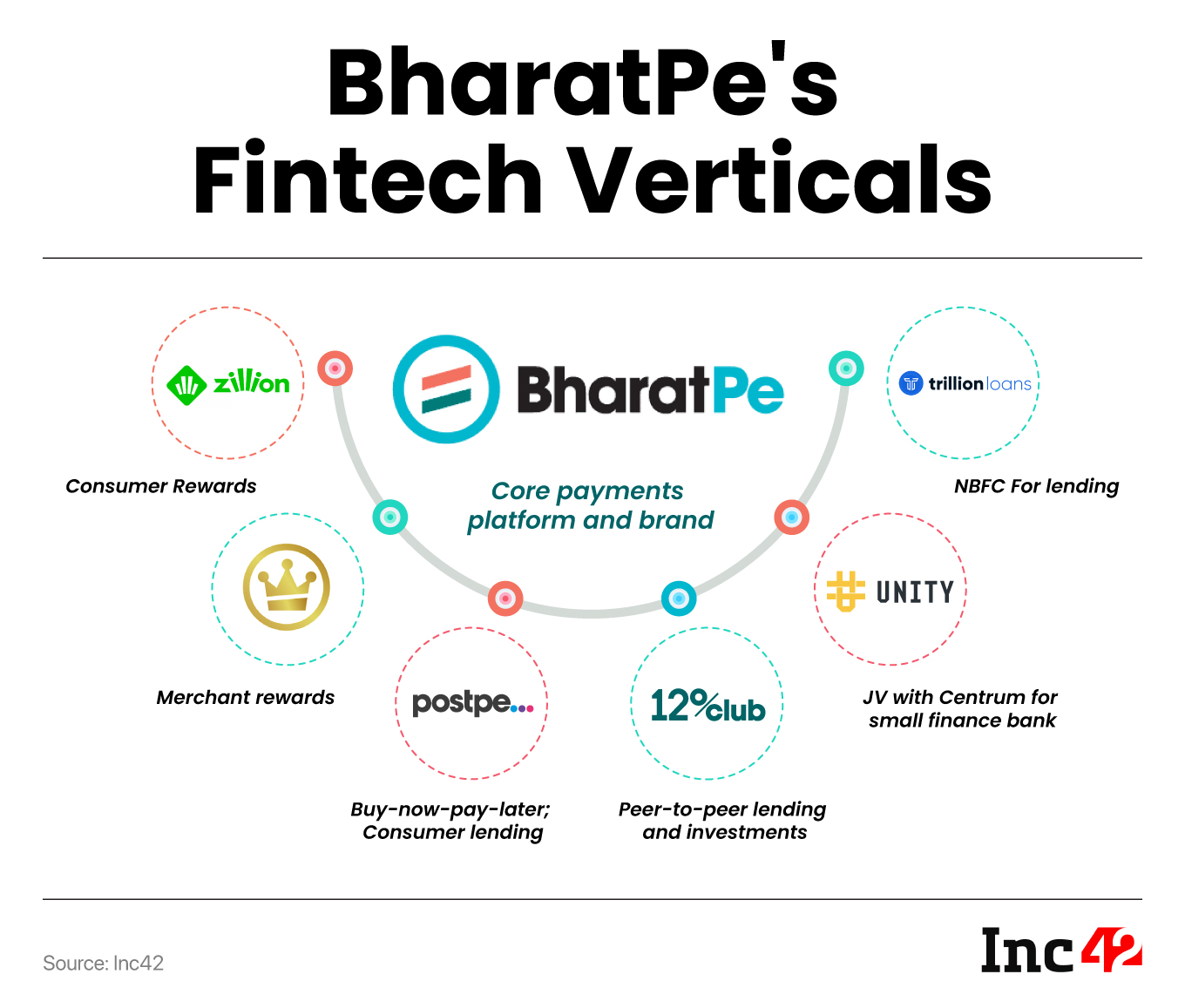

BharatPe’s merchant services include card swipe machines, soundboxes, simple QR codes and the BharatPe app that lets merchants track collections and settlements, available credit lines and payment status. The app also lets signed-up merchants lend through the 12% club P2P lending-investment platform.

Negi acknowledged the intense competition with the above players, but also felt that the market is growing and untapped at the same time. He said the recent momentum seen by BharatPe shows that despite heavyweight competition, there’s a lot of room for high volumes in India.

In October, BharatPe claimed to have reached a monthly total payments volume (TPV) of INR 14,000 Cr, after the launch of its revamped PoS device in August this year. PoS is the big focus for BharatPe in the next year, where Paytm has taken something of a lead, with 92 Lakh installed devices in Q2 FY24, nearly doubling since last year.

Much of the company’s confidence also comes from the fact that the lending vertical saw loans exceeding INR 640 Cr in October alone, 36% higher YoY. Just for comparison, Paytm disbursed loans worth INR 3,275 Cr in Q2 FY24.

The acquisition of TrillionLoans in April 2023 gives the company another revenue stream in the lending business going forward, where the NBFC can lend to other authorised lending channels.

Trillion Loans reported a profit of INR 74 Lakh in the financial year 2021-22 (FY22) while its revenue stood at INR 7 Cr. BharatPe would hope to widen the profit margin with its scale and distribution channels. Trillion is also a critical part of the personal lending plans for BharatPe, as we will see.

Peak XV’s Sethi believes that BharatPe’s USP is that it has always been a merchant-first business. “Every other company started off as a consumer company first and then decided to build a merchant business. We have always believed that focusing and building a product specifically tailored to the merchant can unlock greater value in the long run.”

Paytm launched UPI services for merchants in 2018, eight years after starting out as a recharge platform in 2010 and then branching out into Paytm Wallet in 2014. PhonePe also launched its merchant services in 2018, three years after incorporation.

He also believes that eventually everyone will decide to build similar things as BharatPe, but having seen the merchant evolution closely, BharatPe can keep pushing the ball forward. Of course, this is easier said than done, and competition is only going to get tougher with the entry of Reliance’s Jio Financial Services.

And it’s also why BharatPe also has to focus on the consumer vertical to remain in the race. In other words, BharatPe has to join the super app race, which has become heated this year, thanks to the changes at PhonePe and CRED, as we have noted in the past few months.

Playing The Super App Game

BharatPe’s route to success is pretty much the same as several of the most capitalised startups and listed fintech giants.

The product mix will be critical for BharatPe, which has also invested heavily in marketing its consumer-focussed verticals such as postpe (lending), 12% Club (P2P lending and investments) as well as Zillion, the rewards platform which was formerly known as PAYBACK India.

BharatPe acquired PAYBACK in 2021 for $27 Mn. Earlier this year, the platform was rebranded to Zillion, which is also BharatPe’s entry point towards ecommerce in some ways. Though this is largely limited to coupons and gift cards at the moment. Ecommerce will be a key vertical for BharatPe if it has to retain the maximum attention from users in the future.

Getting the NBFC licence has proven to be a key for the B2C fintech play for the personal loans segment, where BharatPe has a lot of catching up to do. To put things in context, Paytm processed 2.4 Lakh personal loans worth INR 3,927 Cr between July and October this year.

Among the fintech ‘super apps’, Paytm is the biggest lender thus far, but CRED is not far behind and is gunning for a bigger piece through a multi-product strategy, and CRED also has an NBFC licence like BharatPe.

Plus, the super app race also includes PhonePe, which is using the $1 Bn it raised this year to bulk up lending, insurance, investment tech and ecommerce plays. It is also eyeing the enterprise space with checkout and payment gateway products.

BharatPe is planning to launch co-branded credit cards in the near future for its merchant base, but the company is also experimenting with some more consumer-focused plans, details of which were not provided.

And Negi added “90% of the business comes from merchants, so that’s the DNA of the company and that will be the primary mission in the future too.”

The Hunt For A CEO

Speaking of the future, there’s talk of an IPO in two years, so one of the big tasks for Sethi and the rest of the BharatPe board is to find the next CEO who will lead this effort.

Two years is perhaps not enough time for a CEO to bed themselves into the company, let alone take to an IPO. Has the right time to get a new CEO has already passed?

“We are not as large as banks but we have size and scale. We have this blend of financial services and tech. We don’t have the many layers and bureaucracy of banks, but we want to be a highly governed company. So we have to find someone who can marry these things,” he added.

Sethi claimed there’s been “strong interest” in the market for the CEO role, and many are pleasantly surprised by the company’s financial state and are attracted to the mission of financial inclusion. He added that the bar is set high because the IPO is just one of the milestones for the new CEO, the full mission is the next five to ten years.

While BharatPe’s current leadership is bullish, the company’s future hinges on how it fares against the heavy competition and whether its next CEO proves to be the right leader for the stage where it is right now and where it hopes to go. Can the company sustain its current good run?

Ad-lite browsing experience

Ad-lite browsing experience