In a first, competition watchdog CCI imposed a cumulative penalty of INR 2,273 Cr on Google in two cases involving abuse of market dominance

The year 2022 saw Google undertaking multiple product launches in India such as Project Bindi, Project Vaani, UPI AutoPay and an LMS-based YouTube offering called Courses

The coming year can be a rough patch for Google as it tries to strike a balance between cutting-edge innovation and a crippling downturn

At the fag end of 2022, Alphabet’s (Google’s parent company) CEO Sundar Pichai landed in Delhi to attend the tech giant’s mega event, Google For India. He made a slew of India-centric announcements on that occasion, largely aimed to spur the country’s growing AI landscape.

But what stood out were the high-profile meetings that followed afterwards. He had a tête-à-tête with communications minister Ashwini Vaishnaw at the event, followed by a meeting with President Droupadi Murmu at Rashtrapati Bhavan. However, it was his meeting with Prime Minister Narendra Modi that grabbed national headlines.

Download Annual Funding Report 2022The meeting came after a tumultuous year for the tech giant, which had been under intense regulatory pressure in the country. In fact, Pichai’s meetings with high-profile Indian leaders pointed to somewhat of a thaw between the two sides, although Google topped the list of antitrust probes carried out by the Competition Commission of India (CCI) in 2022.

The year saw the CCI rap the tech giant’s knuckles after Google was found guilty of abusing its market dominance. The outcome appeared to repeat 2021, albeit with worse circumstances.

The antitrust investigations gathered steam this year and snowballed into hefty fines for Google, although the company continued to expand its offerings and scale its products in India.

Google’s Tumultuous 2022

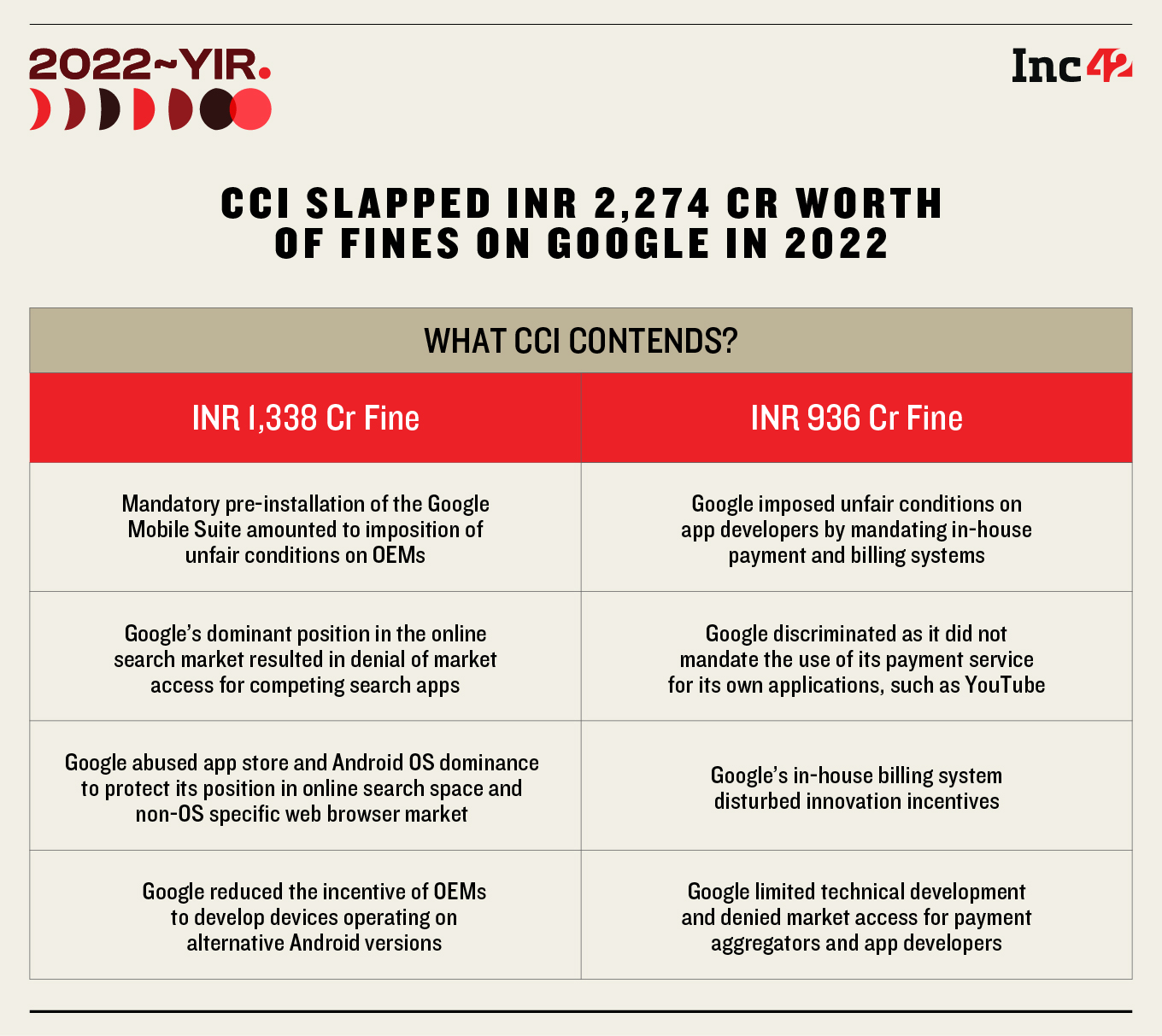

Regulatory scrutiny is a recurring occurrence as far as Google India operations are concerned. But things took a drastic turn after the competition watchdog found the tech giant guilty of abusing its market dominance in multiple arenas. In an industry-first, the CCI imposed two separate fines on the tech giant, totalling around INR 2,273 Cr after nearly four years of investigation.

To begin with, CCI imposed a penalty of INR 1,337.8 Cr on Google for abusing its market dominance in the Android devices ecosystem. According to the CCI order, the tech giant denied market access to competitors and disincentivised original equipment manufacturers (OEMs) for developing devices on alternative Android versions.

In a second ruling, the watchdog also slapped an INR 936 Cr fine on Google for abusing its dominant position with respect to its Play Store policies. In this order, CCI underlined how Google imposed unfair conditions on app developers by mandating in-house payment and billing systems.

In essence, Google Play Store charges app developers listed on the app marketplace 15%-30% for every in-app transaction. Developers using third-party payment systems, or billing systems that charge less, on their respective apps are barred from the Play Store.

Accordingly, the watchdog also found the tech giant guilty of limiting innovation and adopting different yardsticks when it came to payment systems involving its own products.

Google has now approached the National Company Law Appellate Tribunal (NCLAT), challenging CCI’s ruling on Android mobile devices.

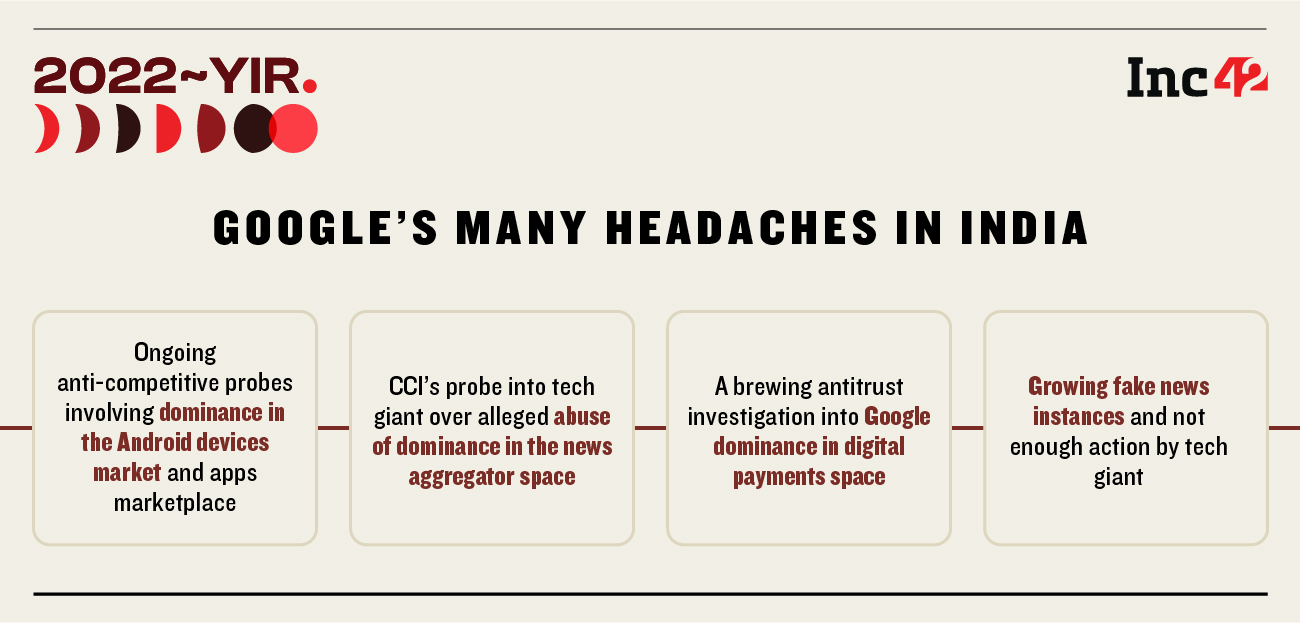

Meanwhile, the company continues to face a barrage of lawsuits, both groundbreaking and ‘frivolous’.

It is locked in a tussle with news publishers over its alleged abuse of dominance in the news aggregation space. The case is pending before CCI, while a clutch of media bodies such as the Digital News Publishers Association (DNPA), Indian Newspaper Society (INS) and News Broadcasters and Digital Association (NBDA) have filed cases with the watchdog seeking better payment terms.

The Indian antitrust agency is also probing the internet major to see whether the latter has abused its market power in digital payments. The tech giant-owned Google Pay is the country’s second-biggest UPI payments processing platform in terms of transaction number and volume.

Google is facing legal heat in a separate case related to its gaming policy piloted in 2022. Gaming platform WinZO is suing the company in Delhi High Court, citing the ‘unfair’ and ‘discriminatory’ nature of the updated norms.

On a lighter note, a petitioner dragged the tech giant to the Supreme Court, seeking compensation of INR 75 Lakh from the streaming platform YouTube for distracting him from his studies with explicit advertisements. The case was thrown out, and the petitioner was fined around INR 25K.

Cases continue to mount, perhaps not surprisingly, as the company’s compliance records leave much to be desired. But going by the global rulings against it, regulators must have realised by now that the tech giant has rarely shied away from hefty fines. For example, in three cases spanning more than a decade, the European Commission levied a penalty of €8.25 Bn ($8.7 Bn) on the search engine giant for antitrust violations. However, such penalties may not have served their purpose, given that authorities across nations still question Google’s operations.

Speaking to Inc42, Lavu Sri Krishna Devarayalu, a YSR Congress Party leader and the Member of Parliament from Narasaraopet (Andhra Pradesh), echoed a similar sentiment in the Indian context.

“Google will be happy to pay these fines. But if we have to build an ecosystem for tech startups and MSMEs to flourish, the country needs a long-term view, just like the EU and South Korea. We should not be happy with slapping fines and collecting them. Instead, there should be legislation to bring more transparency and benefit the ecosystem in the long term,” the MP said.

But at the center of these rulings are not just fines but the very structures that enable the company to mint money and abuse its ‘alleged’ dominance. If forced to comply, Google may land into uncharted waters where it may not be able to exert the influence it currently enjoys.

Indian Government Amps Up Regulatory Pressure

While legal issues have landed Google in deep trouble, the Indian government’s regulatory overdrive to govern the burgeoning digital ecosystem can make matters worse for tech companies.

For instance, the recently released draft Telecommunications Bill (2022) has brought internet-based and other over-the-top (OTT) communication services under its ambit. This may impact the tech giant’s offerings like Google Meet and Messages and bring it under a licensing regime.

Add to that the Digital Personal Data Protection Bill (2022) that specifies data localisation norms, cross-border data transfer guidelines, and responsibilities for significant data fiduciaries has invited criticisms of a compliance overload from a slew of organisations. All this has predictably resulted in many industry bodies opposing Bill’s provisions tooth and nail and seeking revisions in the draft Bill.

However, the IT (Intermediary Guidelines and Digital Media Ethics Code) Amendment Rules 2022 may pose the biggest regulatory hurdle for Google’s pure-play consumer-facing platforms such as YouTube and search. Given the broad jurisdiction and overarching censorship of Grievance Appellate Committee/s (GAC), the government is likely to exercise greater control over ‘opinions and expressions’ posted on those platforms, leading to further conflicts.

“Government has unveiled multiple laws that cover a gamut of domains. It is important that we have these non-specific forms of regulation as well because, in the past 10-20 years, the regulatory sphere has not evolved at the same pace as the digital markets. So, minute digital laws can complement these broad-based laws and cover large contours of the growing space,” a spokesperson for the Alliance of Digital India Foundation (ADIF) told Inc42.

Incidentally, the year has already seen government officials sparring with Google executives for inaction on fake news and non-compliance with takedown orders pertaining to YouTube and search pages. For context, the ministry of information and broadcasting issued a flurry of orders that barred 100+ YouTube channels and millions of videos for reasons ranging from national security to maintaining public order.

While concerns remain around censorship and lack of operational transparency, the new norms likely affect pure-play social media apps. The new norms will likely cover YouTube under its ambit and could also be extended to Google’s core offering which is the search engine business. Essentially, the new norms largely are expected to cover the consumer-facing businesses which account for a big chunk of Google’s revenues.

Is Google Playing It Smart?

Unlike Twitter, which dragged the Indian government to court over ‘innocuous block orders’, Google has mostly complied with the official norms. The two sides are also said to have sparred behind closed doors over matters related to inaction on fake news, but Google has always stayed away from a public confrontation with Indian authorities.

Although most of its self-regulatory measures address copyright infringements, the company has constantly strengthened its local grievance redressal mechanism and kept the authorities in the loop.

While the narrative around the new IT rules and the possible social media ‘censorship’ continues to pan out, the tech major has played it smart and partnered with the central government on a host of projects to promote itself as an India-focused brand.

Pursuing this strategy further, Google has partnered with MeitY Startup Hub and helped scale early-to-mid-stage Indian startups as part of its Appscale Academy programme. It recently collaborated on the government’s DigiLocker initiative, assisting users in storing their digital documents on Android devices.

It also works with state governments in areas like digital literacy and raising awareness about cyberfrauds. The company has signed an MoU with the Karnataka government to promote startups from Tier 2 and 3 locations and collaborates with the Assam government to promote digital growth and development.

Meanwhile, it is also pushing groups such as Asia Internet Coalition to uphold its interests and lobby on matters related to the upcoming DPDP Bill and the recently notified IT Rules.

Unwavering Focus On The Indian Market

In spite of a bumpy ride in 2022, Google’s strong India focus has continued.

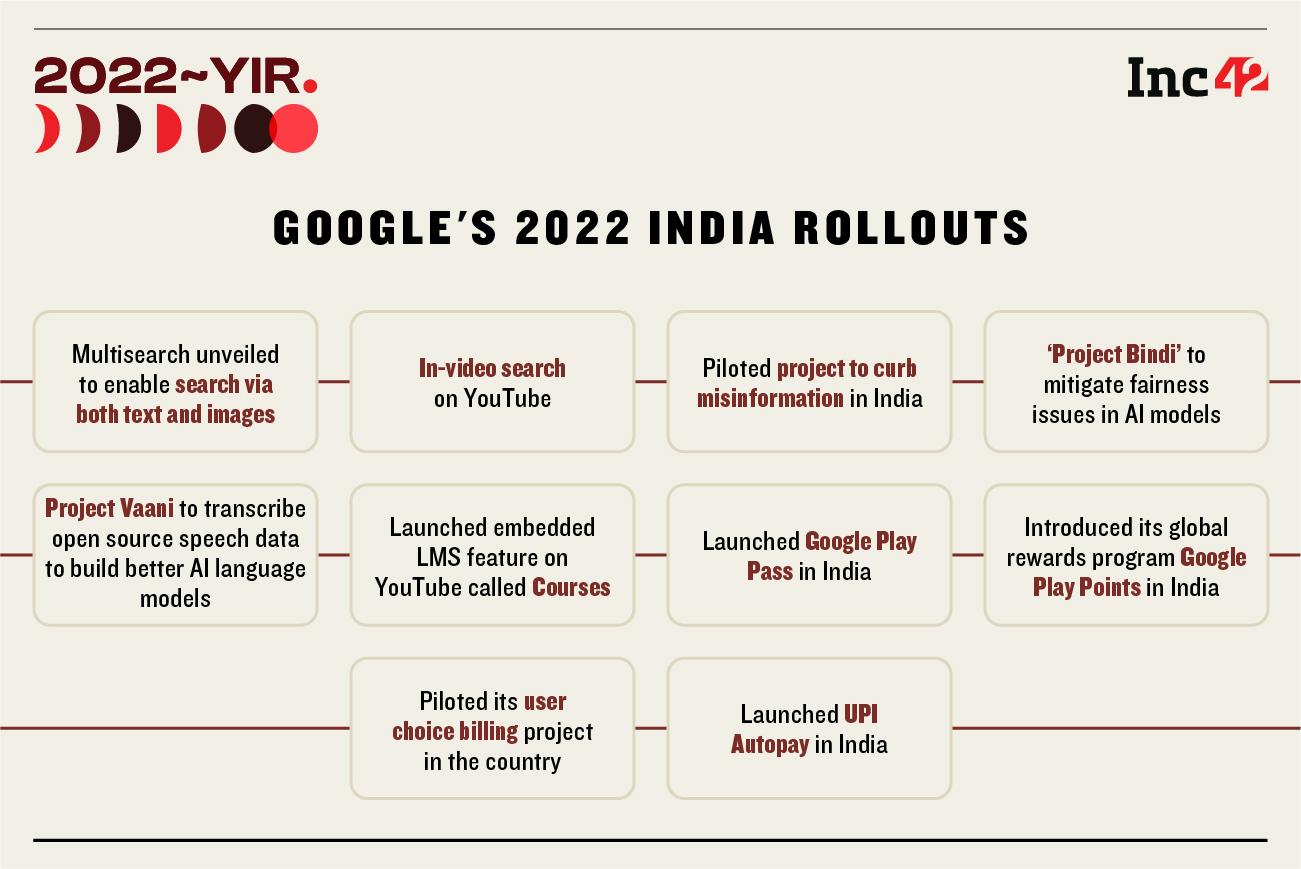

The year began on a cheerful note as the tech giant picked up a 1.28% stake in the telco major Airtel for $700 Mn and agreed to invest an additional $300 Mn in the next five years in areas such as devices, networks and cloud technologies.

The Mountain View company announced a host of new products at its recently concluded annual flagship event, Google For India. Its recent offerings include a pilot initiative that allows users to switch audio tracks of YouTube videos to multiple languages. The company is also bringing its multisearch module to India, allowing users to combine both text and image for search. It has also introduced an in-video search on the streaming platform and launched an embedded learning management system called Courses.

Google has debuted in India its much-touted pilot for curbing misinformation, launched Project Bindi for combating social biases in AI models and Project Vaani for developing inclusive AI language models. It has also launched UPI Autopay and Google Play Pass in the country.

A quick look at its existing businesses would not disappoint either. Google Pay remained the second biggest player (Walmart-backed PhonePe leads this space) in the UPI-based digital payments space, processing INR 113 Lakh Cr worth of transactions between January and November 2022. Its Android OS accounted for 90% of the market share in India. Its IT services, advertising and streaming also clocked substantial revenue, thanks to the increasing penetration of smartphones and the internet among the masses.

In terms of absolute numbers, Google India recorded INR 24,926.5 Cr in ad revenue in the fiscal year ended March 2022, up 79.4% compared to the same period in the previous financial year. Overall, the company’s India arm posted INR 9,286 Cr in net revenue from operations during FY22 against a net profit of INR 1,238.9 Cr during the period under review.

What’s On The Cards In 2023

Despite the continued India momentum, all is not well globally. Geopolitical tensions resulting in negative market sentiment, fluctuating exchange rates, tightening monetary norms and the fear of a long-lasting global recession are taking a heavy toll on the parent company.

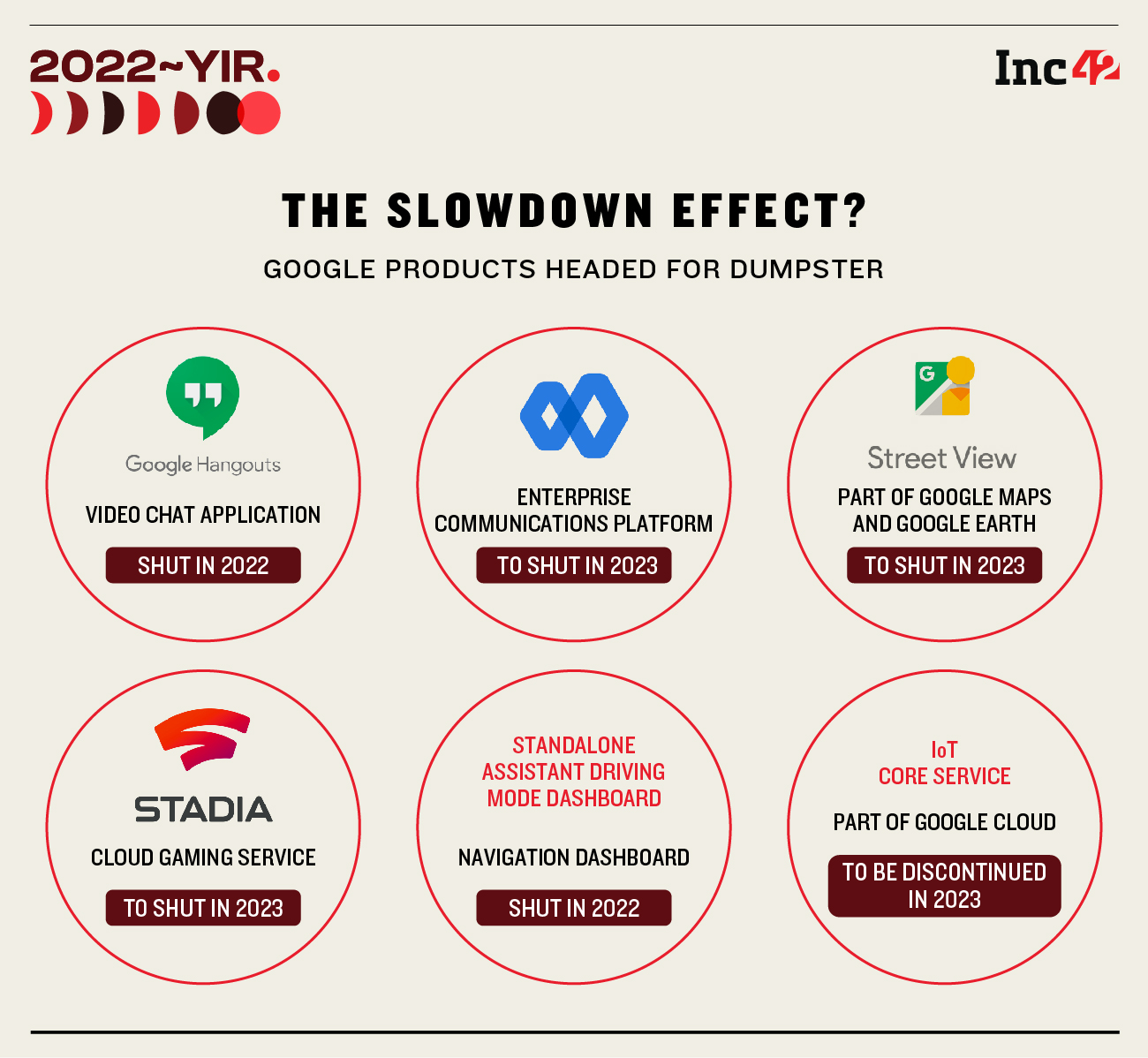

Google’s search offering, which forms its core business, is reportedly witnessing a slowdown, and the company is hell-bent on cutting costs to navigate the downturn. This year, it has shut down its video chat app Hangouts and Google Maps’ Standalone Assistant Driving Mode Dashboard. In 2023, it will close its enterprise communications platform Currents, popular navigation tool Street View and the cloud gaming service Stadia.

Google also plans to lay off more than 10K employees in the coming months. However, this is no longer surprising as it is raining pink slips across big tech, be it Twitter, Meta or Amazon.

With the global downturn expected to stretch for a few quarters, companies will be pummelled by a bear market, and bottom lines will be hurt. Layoffs will make headlines, and like its peers, Google will try to cut corners. The other way to save costs is to drive efficiency.

On the legal front, the tech major will continue to knock on courts’ doors to overturn CCI rulings and fight all pending cases. It remains to be seen whether Google will comply with the recommendations of the competition watchdog, which may threaten its purported dominance in multiple arenas.

As India joins a growing list of countries imposing fines on Google, it can set a precedent for other global regulatory bodies, which Google will want to avoid.

Going forward, Google will continue its focus on artificial intelligence (AI) in the country and will look to harness three specific focus areas namely linguistic diversity, agriculture and healthcare. It also plans to scale its offerings to other vernacular media to tap into the growing population that wants to access the internet in their own language.

Besides, the tech giant could also shell out more capital from its India Digitization Fund to make deeper inroads in the country and add more offerings to its kitty.

In spite of the legal quagmire and macroeconomic tailwinds, Google’s India arm has posted solid numbers and rolled out products to grow its user base and keep them engaged. With India’s digital ecosystem growing at a fast clip, the company is bound to benefit from the momentum if it continues to focus on this market.

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience